Leapmotor: Does a hero's origin matter?

![]() 12/06 2024

12/06 2024

![]() 597

597

Results matter most, not attitudes. Leapmotor has truly embodied this saying to the fullest.

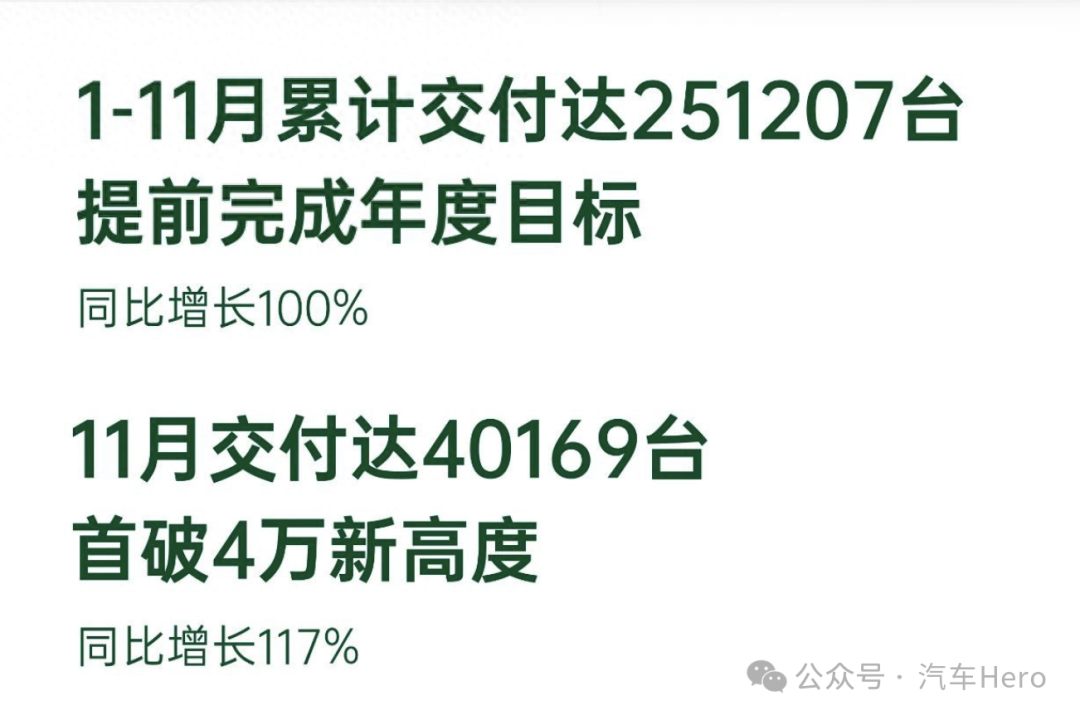

In November this year, Leapmotor sold over 40,000 vehicles for the first time in a single month, with a total terminal sales volume of 40,200 units, marking a year-on-year increase of 117%. Such sales performance has also allowed Leapmotor to be the first to achieve its 2024 sales target.

If you ask how Leapmotor achieved this,

I can only ask you what you want to hear: 'Full-stack self-development + cost control' or 'Ideal alternative, comprehensively learning from Li Auto.'

In March this year, the Leapmotor C10 was launched, and Leapmotor boldly proclaimed it as 'The ideal home for young people.' As we all know, Li Auto's slogan is 'Creating a mobile home, a happy home.' This is not just bold, it's almost arrogant.

As for the upcoming Leapmotor C16, it can be said to be a complete copy of Li Auto, having everything except the refrigerator, yet priced at only half of Li Auto's L8.

Looking back at Leapmotor's growth history, it is not difficult to find that almost since its inception, the company has been trying to replicate popular models of the time. It's hard to say if this is a shortcut for Leapmotor.

In 2019, Leapmotor's first mass-produced car, the S01, was introduced, officially dubbed the 'People's Tesla';

In 2020, the Leapmotor T03, resembling the Wuling Hongguang MINI EV;

In 2021, the Leapmotor C11 was officially launched, with average sales;

In 2023, the extended-range version of the Leapmotor C11 was launched, fully targeting Li Auto;

In 2024, the Leapmotor C10, targeting Li Auto's L7;

In 2024, the Leapmotor C16, targeting Li Auto's L8;

...

As we can see, Leapmotor has been riding the wave of success with its 'ideal alternative' strategy. So, for automakers, does the result really matter most, and not the attitude?

On the other hand, Leapmotor has been dubbed as 'riding the wave of extended-range and consumption downgrade.' As more automakers enter the extended-range market in the future, including powerful ones that may penetrate Leapmotor's core business, it remains to be seen whether Leapmotor can withstand the competition.

Conclusion

Admittedly, a hero's origin does not matter, but there is no answer to how long Leapmotor can sustain its current success, having benefited from the trend. Additionally, Leapmotor's three major expenses (R&D, sales, and administration) have consistently been higher than market expectations, which is a dangerous sign for the company. Therefore, it is still too early to celebrate Leapmotor's success with champagne.