Car companies "clinging to the powerful", leveraging for success

![]() 12/09 2024

12/09 2024

![]() 654

654

Author | Zhen Yao

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

"GAC Group will create a brand-new high-end intelligent new energy vehicle brand beyond Trumpchi, Aion, and Hyper... Using the new brand as a platform, we will leverage our respective advantages with Huawei to cooperate in product development, marketing, and ecological services."

After seven years of twists and turns, GAC finally returned to Huawei's embrace. On the last day of November 2024, GAC Group and Huawei held a strategic cooperation signing ceremony for smart vehicles, and both parties signed a cooperation agreement for further deepening. Subsequently, GAC Group's A-share price rose for three consecutive trading days, with consecutive daily limits on December 2nd and 3rd. As of December 3rd, the cumulative increase in share price reached 20.93%, and the total market value returned to 100 billion yuan.

The cooperation between GAC Group and Huawei began in 2017, when the two parties initially established a strategic cooperation relationship on the development of intelligent connected electric vehicles.

About four years later, on July 9, 2021, GAC Aion took a significant step forward in its cooperation with Huawei, jointly launching the first jointly developed model, the AH8 project. According to the announcement, the AH8 is a medium to large pure electric SUV planned for mass production by the end of 2023, with a total investment of 788 million yuan and will be equipped with Huawei's intelligent driving system and intelligent cockpit technology.

However, on March 27, 2023, an announcement shocked the industry - GAC Group announced that the AH8 project would be transitioned from joint development to independent development, and Huawei's role would shift from the Huawei Inside model to that of a key supplier. But by November 2024, both parties resumed cooperation and signed an agreement to promote strategic cooperation in smart vehicles.

The reversal in the cooperation mode between GAC and Huawei is against the backdrop of tremendous changes in the landscape of the Chinese automotive market, especially the strong rise of Huawei's HarmonyOS Intelligent Drive.

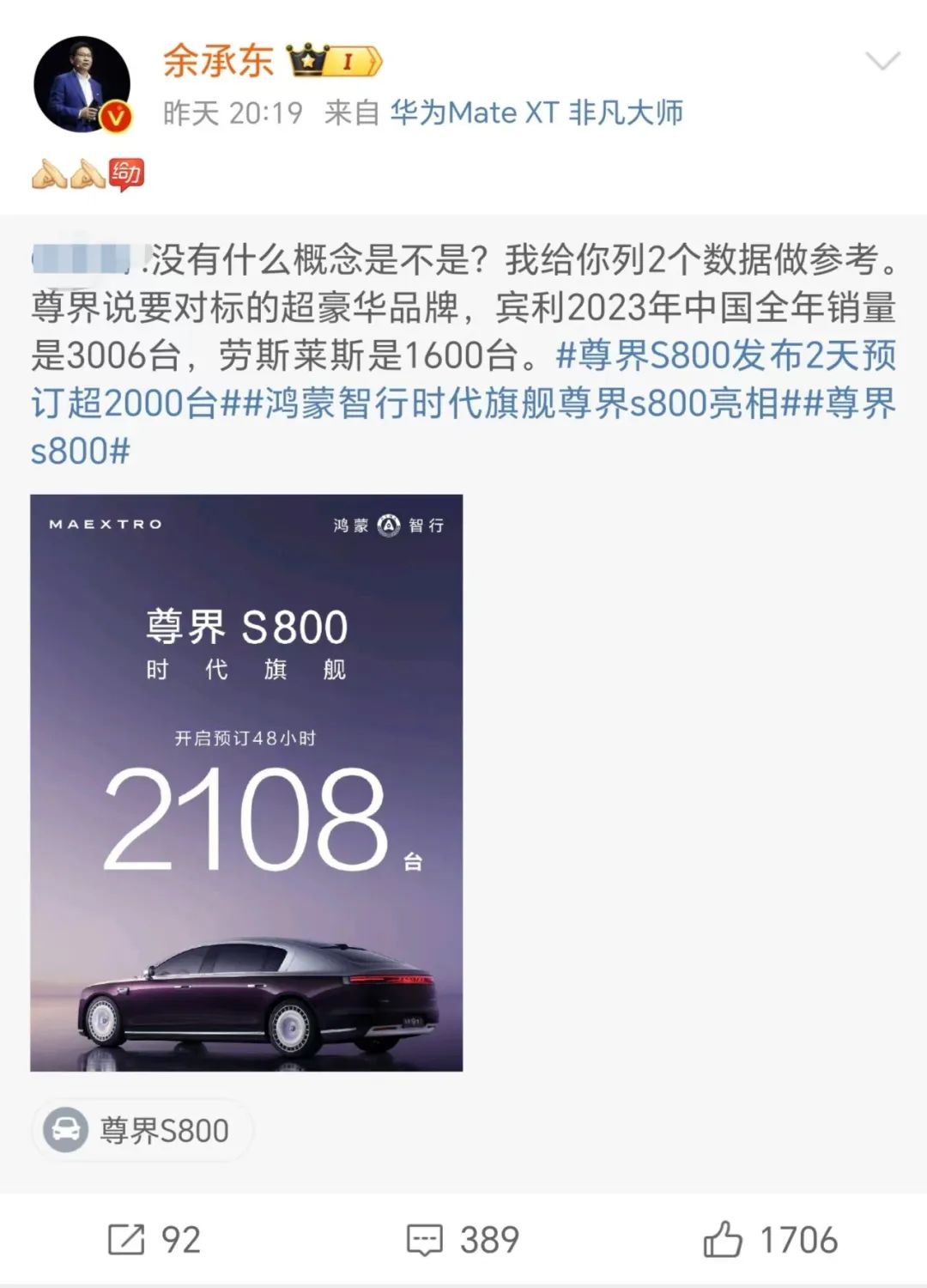

On November 28, Huawei's HarmonyOS Intelligent Drive delivered good news: Zenjie S800 received 2,108 orders within 48 hours of opening for reservations.

"Isn't it incredible? Let me give you two data points for reference. Zenjie aims to compete with ultra-luxury brands, and Bentley sold 3,006 vehicles in China in 2023, while Rolls-Royce sold 1,600 vehicles." A netizen commented on Weibo.

"Impressive." Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Automotive Solutions BU, responded to this Weibo post with just two words.

On November 26, at the Huawei Mate brand ceremony, the ultra-luxury brand Zenjie, jointly created by Huawei and JAC Motors, made its debut, with the Zenjie S800 as its first model. The car has a pre-sale price range of 1 million to 1.5 million yuan, with a reservation deposit of 20,000 yuan. If estimated at the mid-point of the pre-sale price range of 1.25 million yuan, JAC Motors achieved a "small goal" of earning 2.6 billion yuan within 48 hours.

As early as two months ago, JAC Motors' share price had already surged, from 22 yuan per share to a high of 47.28 yuan, with its total market value soaring to 100 billion yuan at one point during the year. NIO, a former partner and leading new force in the industry, could only aspire to such heights.

While many automakers are still struggling to survive, JAC, founded 60 years ago, has secured a ticket to success. The key to changing JAC's fate has been its cooperation with Huawei.

Looking across the industry, there are many examples of Chinese automakers achieving a stunning transformation through cooperation.

14 years ago, Geely Automobile acquired the luxury brand Volvo for 1.8 billion dollars. The union of the "poor boy" and the "distressed princess" in the past has contributed to Geely's current glory.

THALYS started as a small spring factory and later partnered with Dongfeng to launch Xiaokang. In the past three years, it has collaborated with Huawei in the field of new energy to create the AITO brand, now competing fiercely with BBA (BMW, Benz, and Audi) and NIO.

Xiaopeng Motors, which almost failed, is now leading the race after a two-way empowerment partnership with Volkswagen. Collaborating with the global automotive giant Stellantis has prevented Leap Motor from becoming a shaky NIO.

"With a good wind, I can ascend to the sky." For automakers, star companies like Huawei are as popular as the Chinese yuan, and cooperation with them is a shortcut for automakers seeking rapid growth.

Choice is more important than effort.

If Li Shufu had not acquired Volvo and Zhang Xinghai had not cooperated with Huawei, would there be today's Geely and THALYS? The answer is questionable.

Volvo was founded in 1927 with its headquarters in Gothenburg, Sweden. For a long time, the Volvo brand has been renowned for its top-notch safety performance, making it a leader among luxury automakers in Europe and America.

Seventy years later, in 1997, Li Shufu, with the dream of "making good cars affordable for ordinary people," founded China's first private automaker, Geely Automobile. The next year, the first Geely car rolled off the production line in Linhai, Zhejiang Province. From 1999 to 2009, Geely Automobile was considered a small automaker, but its technological innovation and market expansion during these 10 years laid the foundation for its subsequent development.

The turning point came on March 28, 2010, when Li Shufu personally led a team overseas to acquire the struggling Volvo Cars from Ford for 1.8 billion dollars. "I've bet my life savings on this," he said.

This "snake swallowing an elephant" acquisition shocked the entire automotive industry and became a crucial step in Geely Automobile's growth and prosperity. This investment not only revitalized Volvo Cars but also helped Geely go global from China.

"If an automaker wants to participate in global competition, it must emphasize innovation and form a systematic capability," Li Shufu summarized 10 years later, highlighting the core insight gained from the Volvo acquisition.

In the early years, a Volvo executive saw Geely's models as chaotic and disorganized, "like a zoo."

Today, Geely Holdings has a full range of brands, from supercars to luxury brands, joint ventures, and mass-market brands.

Behind the systematic approach to multi-brand vehicle manufacturing lies a technological platform, with the core of the Geely and Volvo technological system being the modular architecture.

Modular architecture, referred to by Li Shufu as a development framework that "will not be overturned by the automotive industry in the future and can be continuously iterated and upgraded," represents the future of Geely's vehicle manufacturing.

For example, Volvo and Geely jointly developed the CMA architecture, based on which Geely Holdings has successively launched the Volvo XC40, Lynk & Co 01, Geely Xingyue, and Polestar 2 since 2017, covering multiple brand segments such as luxury, joint ventures, and mass market brands, as well as different categories like sports SUVs and pure electric coupes.

While developing the CMA architecture, the Geely Research Institute also initiated the development of a smaller modular architecture, the BMA architecture.

According to data, approximately 2,000 engineers were mobilized during the development of CMA. Over 500 engineers were involved in the development of the BMA architecture, which began in 2014 and was largely completed by 2018.

During these years, benchmark models such as Geely Borui and Boyue were successively launched. Volvo provided significant assistance to Geely in active and passive safety, in-car air quality, and other technologies. However, Geely's most core and systematic R&D experience stems from its modular architecture.

Although Zhang Xinghai did not have the same opportunities as Li Shufu, he also had remarkable luck.

In 2019, Dongfeng Xiaokang (predecessor of THALYS) launched its self-developed new energy passenger car, the SF5, but the market response was lukewarm. In 2020, total sales of the SF5 were only 791 units.

It's easy to go from prosperity to decline but difficult to reverse the trend. Fortunately, Zhang Xinghai waited for the turnaround hero - Yu Chengdong.

"At that time, many state-owned enterprises and other companies didn't understand the AITO model, and Huawei didn't have experience in manufacturing complete vehicles either. However, as a private entrepreneur, Mr. Zhang made a decisive choice to cooperate deeply with Huawei and go all in without any hesitation," Yu Chengdong said during his first meeting with Zhang Xinghai, who made a deep impression on him. Yu felt that although Zhang Xinghai might not be eloquent, he had keen business acumen and judgment.

Huawei, which does not manufacture vehicles, needed a brand to demonstrate its technology. On the other hand, Xiaokang, with poor sales, desperately needed a turnaround.

"I must work with Huawei. Cooperation between automakers is a physical reaction. Only cross-business collaboration can produce a chemical reaction. Huawei is a world-class ICT company with unparalleled understanding of consumer products and users, which automakers cannot match," Zhang Xinghai said regarding his cooperation with Huawei.

Facts have shown that Zhang Xinghai made the right bet. On October 30, THALYS released its third-quarter report for 2024, showing revenue of 106.627 billion yuan for the first three quarters, a year-on-year increase of 539.24%, with a net profit attributable to shareholders of listed companies of 4.038 billion yuan.

This not only relieved shareholders but also garnered envy from countless peers.

The surge in performance stems from an explosion in sales. In October this year, AITO M9 delivered 16,004 units, and in the 10 months since its launch, cumulative orders have exceeded 160,000 units, making it the monthly sales champion in the Chinese market for vehicles priced above 500,000 yuan for consecutive months. The M7 series delivered 15,836 units, with over 20,000 orders in the same month. This year, AITO's new M7 has delivered over 170,000 units, maintaining its position as the monthly sales champion among new force automakers in China for 10 consecutive months.

Focusing only on the high-end market is Huawei's consistent approach, from high-end smartphones to automobiles, and it dares to compete head-on with BBA (BMW, Benz, and Audi), Rolls-Royce, and Maybach.

In addition to THALYS, JAC, Chery, and BAIC have also cooperated deeply with Huawei, and these mid-to-low-end automakers are expected to excel in the high-end market.

"The powerful" reversal

Over the past decade, new energy vehicle companies have undergone fierce competition and elimination.

Bankrupt automakers include Aichi, Byton, Bojun, Guoji Zhijun, Hengchi, GreenTech, Singulato, Qiantu, Changjiang EV, Tianji, WM Motor, Xiaowei, and HiPhi... Currently, NIO is on shaky ground, and Yuhang Automobile is in deep crisis.

"The reason these automakers were eliminated is not only due to insufficient financial and technical support and poor management but also, more crucially, the lack of a strong brand endorsement," said an industry insider.

In the new energy market, brand influence and consumer trust are crucial. Some automakers lag behind in brand building, lacking sufficient market recognition and a good reputation, making it difficult to establish a trustworthy image in the minds of consumers, severely restricting their market competitiveness.

Compared to established traditional automakers, new force brands are even more urgently in need of "clinging to the powerful."

On the evening of July 26, 2023, the Volkswagen Group announced two partnerships with Chinese automakers in the field of electric vehicles in China.

One was a technical cooperation agreement between the Volkswagen brand and Xiaopeng Motors, where the Volkswagen Group will invest approximately 700 million dollars in Xiaopeng Motors, acquiring approximately 4.99% equity at a price of 15 dollars per share, upon completion of the transaction. The other was a memorandum of understanding signed between Audi and SAIC Motor to further deepen their existing cooperation.

Three months later, the Stellantis Group invested approximately 1.5 billion euros to acquire approximately 20% equity in Leap Motor, becoming a significant shareholder.

The entry of Volkswagen and the Stellantis Group has undoubtedly given Xiaopeng Motors and Leap Motor a boost of confidence.

On November 11 this year, Leap Motor released its third-quarter financial report for 2024, with all indicators on an upward trajectory:

Sales in the third quarter were 86,165 units, a quarter-on-quarter increase of 61.7%, ranking among the top three among new force brands; revenue was 9.86 billion yuan, a year-on-year increase of 74.3%; gross margin was 8.1%, an increase of 5.3 percentage points from the second quarter; net loss was significantly narrowed to 690 million yuan; in addition, funds on hand were abundant, totaling 18.7 billion yuan...

Xiaopeng Motors delivered its strongest third-quarter report ever: revenue was 10.1 billion yuan, a year-on-year increase of 18.4%, net loss was narrowed to 1.81 billion yuan, and gross margin was increased to 15.3%. "Our systemic capabilities have been comprehensively improved after the transformation. The successful launch of the M03 and P7+ marks the beginning of our positive growth cycle for major product cycles," said He Xiaopeng, Chairman of Xiaopeng Motors.

This shows that the two new forces are basically far from the risk of bankruptcy or operational difficulties.

What are the benefits of these car companies 'hugging the big leg'?

First, it enhances brand influence, market recognition, and consumer confidence.

"As one of the leaders in the automotive industry, Volkswagen's support undoubtedly highlights Xpeng's leading position in electric drive, intelligent driving, and intelligent cockpit technology." An Xpeng G6 owner admitted that it was Volkswagen's investment in Xpeng that led him to decide to purchase an Xpeng car.

Similarly, in related forums, users who purchased Thalys products admitted that they were attracted by Huawei and believed that Huawei's support could enhance Thalys' brand influence. In fact, after Huawei's empowerment, Thalys' share price surged significantly.

Geely Automobile and Volvo jointly created the Lynk & Co brand, becoming one of the pioneers among Chinese brands that dared to break the 200,000 yuan price ceiling.

Second, it enhances core technology.

The aforementioned collaborations all bring complementary advantages and technological upgrades. Geely's acquisition of Volvo allowed it to acquire deep accumulation in automotive safety and technology, utilizing Volvo's technology to improve the quality and safety of its own models; while Volvo leveraged Geely's cost control and market development capabilities to achieve better development.

Similarly, Thalys' collaboration with Huawei is also based on complementary advantages. Thalys has certain vehicle manufacturing capabilities, while Huawei has strong capabilities in the field of intelligent technology. When Thalys' models incorporate Huawei's intelligent driving and intelligent cockpit technology, their technological competitiveness is greatly enhanced.

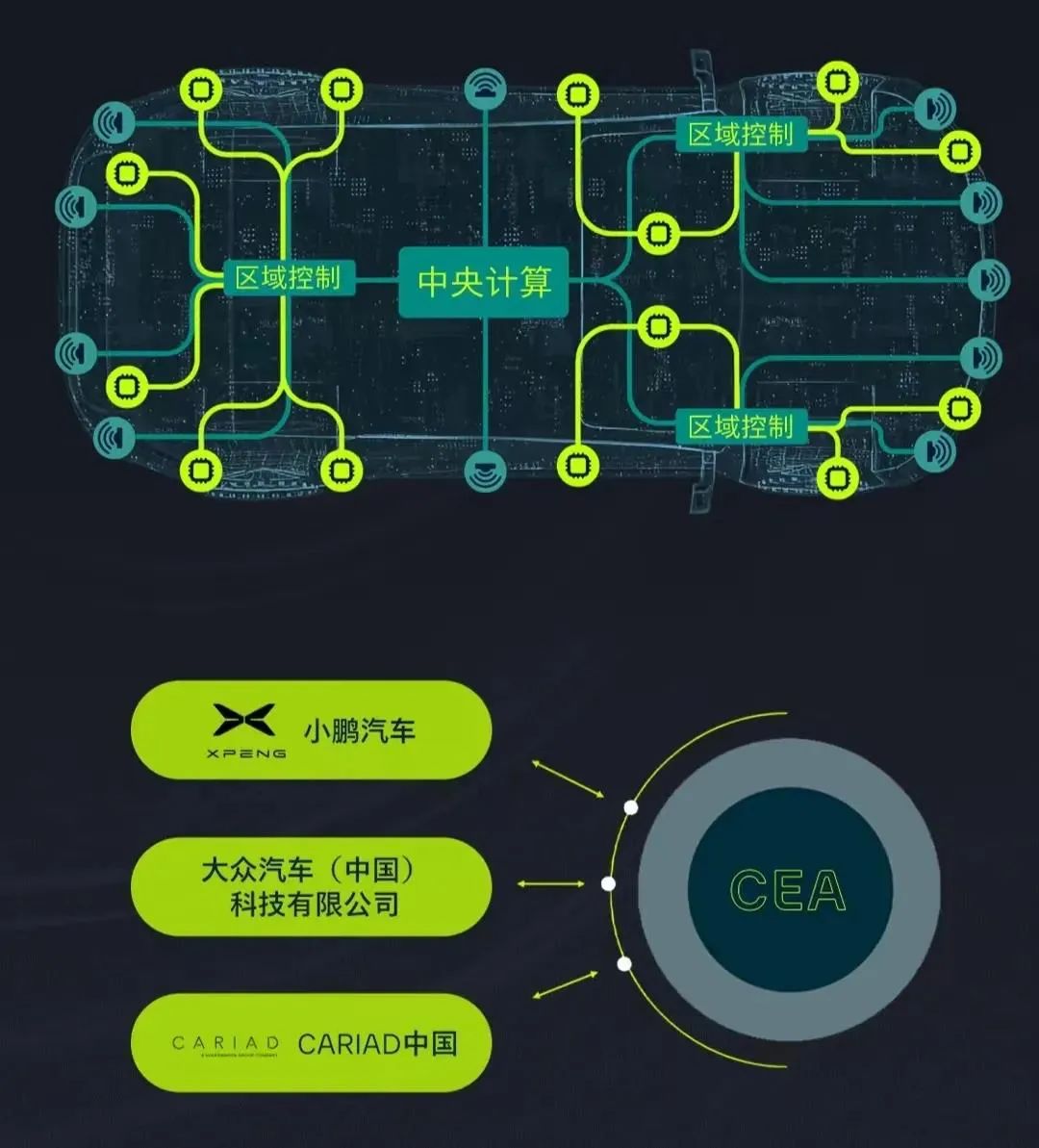

"Our collaboration is a win-win situation. Xpeng will bring a series of changes in localization and intelligence to Volkswagen. Xpeng, in turn, learns automotive engineering technology, production and quality management systems, and supply chain optimization to reduce costs from Volkswagen," said He Xiaopeng.

Third, it adapts to industry development trends.

The current automotive industry is undergoing changes in the era of electrification and intelligence, marking a crucial moment for Chinese automakers to reverse-export technology.

In the past, Chinese automakers sought development through the strategy of "exchanging markets for technology"; today, Chinese automakers lead trends in many niche areas, teaching overseas automakers the "way of car manufacturing."

In April this year, Xpeng and Volkswagen Group jointly announced that they would jointly develop a new generation of electronic and electrical architecture based on Xpeng's technology and integrate it into Volkswagen's CMP platform. The jointly developed electronic and electrical architecture is expected to be applied to Volkswagen's electric vehicle models produced in China from 2026.

Another new force in Chinese automaking is also sharing its experience in building electric vehicles with the international giant Stellantis Group.

The collaboration between the Stellantis Group and Leap Motor currently utilizes China's mature new energy vehicle industry chain and Leap Motor's technological advantages to achieve low-cost vehicle production and expand exports to the global market. This collaboration model gives Leap Motor a high cost-performance advantage in the global market, especially in the European market.

With successful precedents set by Volkswagen Group and Stellantis, perhaps more overseas automakers will adopt the reverse joint venture model. However, the Chinese automakers favored by traditional giants must possess genuine capabilities.

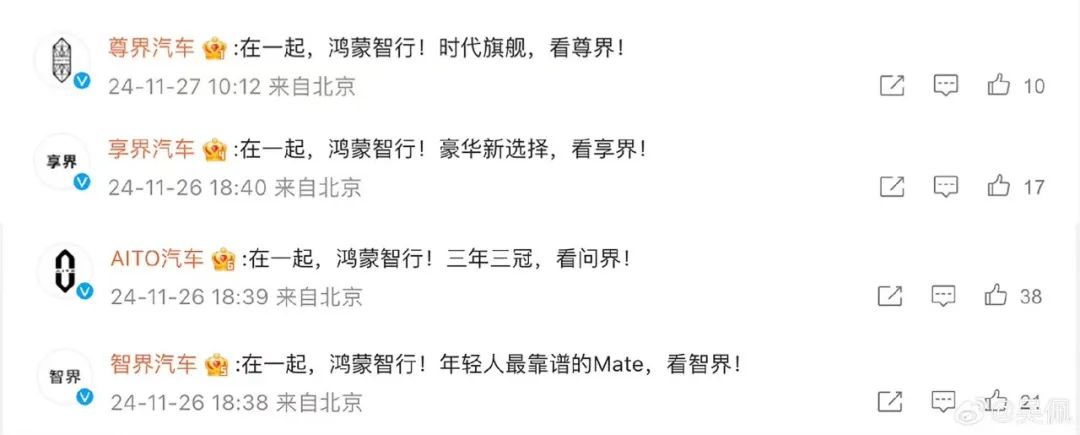

With the unveiling of the ZunJie S800, HarmonyOS Intelligent Drive has gathered the 'Four Realms.' Aiming to lead the times, regardless of steep challenges, in December, relevant leaders from Huawei will join hands with leaders from Thalys, Chery, BAIC, JAC, and other automakers to gather in CCTV's live broadcast room. Upon the announcement, the official Weibo accounts of ZunJie Automobile, XiangJie Automobile, AITO Automobile, and ZhiJie Automobile all interacted and echoed each other.

Through these in-depth collaboration cases, we can see that self-effort and external assistance complement each other, and that luck and courage are indispensable. Courage and persistence are equally important. Automakers who wish to 'hug the big leg' need genuine strength. Taking the top brand ZunJie as an example, if JAC Motors did not have 60 years of experience in car manufacturing and collaboration with NIO and Volkswagen, would Huawei have chosen it?