A 'Hidden Champion' Rises from Han's Laser's Birthplace: Sitech Optics Embarks on Its IPO Odyssey

![]() 02/04 2026

02/04 2026

![]() 539

539

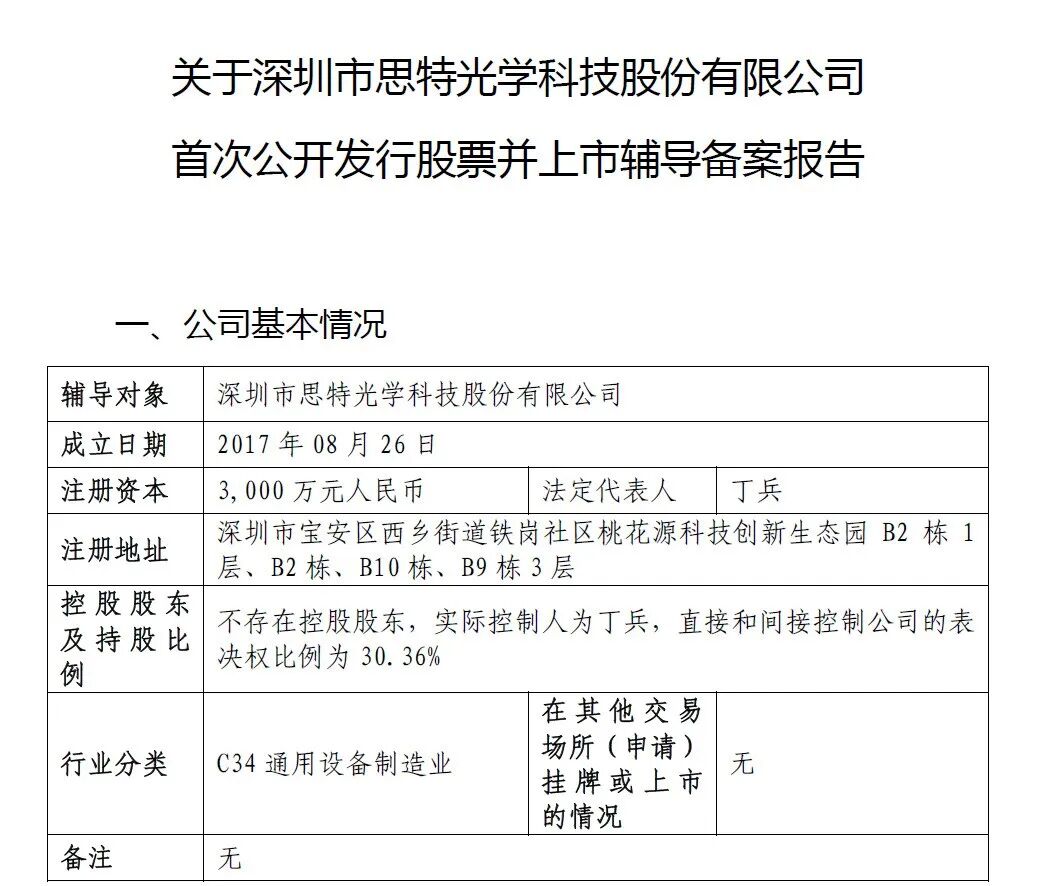

Recently, Shenzhen Sitech Optics Technology Co., Ltd. (hereinafter referred to as 'Sitech Optics') has filed its listing counseling registration with the Shenzhen Securities Regulatory Bureau, officially setting foot on its IPO journey.

The IPO counseling agencies for this significant undertaking are China International Capital Corporation Limited and Guojin Securities Co., Ltd. Guangdong Shanda Law Firm is providing legal counsel, while Rongcheng Certified Public Accountants (Special General Partnership) is handling the accounting affairs.

Sitech Optics is endowed with a profound technological legacy and a solid industrial foundation. Its business origins can be traced back to 2009 when it emerged from the micro-special motor product line of Han's Motor, a subsidiary of Han's Laser. Since then, the team has embarked on a journey of research and development in laser galvanometer technology, initially focusing on galvanometer motors and drivers. From 2009 to 2018, serving as a core supporting unit within the group, the company dedicated itself to supplying galvanometer products and comprehensive solutions to various business divisions and product lines within the Han's Laser system. Through this process, it gradually amassed complete technological capabilities and extensive process experience, spanning from optical lenses and control cards to software systems. In 2018, the company officially separated from Han's Motor and became an independently operated subsidiary of Han's Laser.

Since gaining independent operational status in 2018, Sitech Optics has delved deeply into the realm of optical technology, concentrating on the research and development, production, and provision of solutions for products such as field lenses, grating rulers, and galvanometer scanning systems. The company boasts a diverse product portfolio, encompassing multiple series of galvanometer motors, scanning galvanometer systems, dynamic focusing systems, multi-axis laser processing systems, and medical optical systems. These products find widespread applications in key industrial sectors, including 3C electronics, precision machining, PCB manufacturing, lithium batteries, automotive welding, and photovoltaic new energy.

In terms of technological research and development, the company has assembled a multidisciplinary R&D team with expertise spanning optics, mechanics, electronics, software, and other fields. R&D personnel constitute 30% of the workforce, and over 50% of employees hold a bachelor's degree or higher. Continuous investments in innovation have yielded bountiful results. As of September 2025, the company has accumulated 71 invention patents and 70 software copyrights, boasting a total of over a hundred intellectual property rights.

With a robust technological foundation and outstanding product performance, Sitech Optics can produce up to 100,000 sets of scanning galvanometer systems annually, establishing itself as a leading enterprise in China's laser galvanometer motor sector. It enjoys significant advantages in system stability and batch manufacturing capabilities and has established a nationwide service network.

The company's industry standing and growth potential have garnered numerous accolades. In 2024, Sitech Optics was honored as a provincial-level 'Specialized, Refined, Distinctive, and Innovative' small and medium-sized enterprise and a provincial-level manufacturing single champion enterprise. In 2025, the company successfully obtained national high-tech enterprise certification.

At the capital level, Sitech Optics has previously completed multiple rounds of financing, attracting a host of well-known institutional investors, including Shenzhen Capital Group, CICC Capital, Qianhai Mother Fund, Matrix Partners China, Vision Knight Capital, NIO Capital, Yuanhe Capital, and Dongke Venture Capital. Existing shareholders have also repeatedly increased their investments during the company's development, demonstrating their unwavering optimism.

According to the IPO counseling registration report, the company's actual controller is Ding Bing, who collectively controls 30.36% of the company's voting rights through direct and indirect means. Currently, the company's shareholding structure is relatively decentralized, with no single controlling shareholder.

From the vantage point of optical industry observation, Sitech Optics' initiation of the IPO represents far more than just a capital market endeavor for an outstanding enterprise; it also marks a pivotal turning point where China's high-end optical core component sector is transitioning from long-term following to independent innovation and leadership. We eagerly anticipate its subsequent market developments.