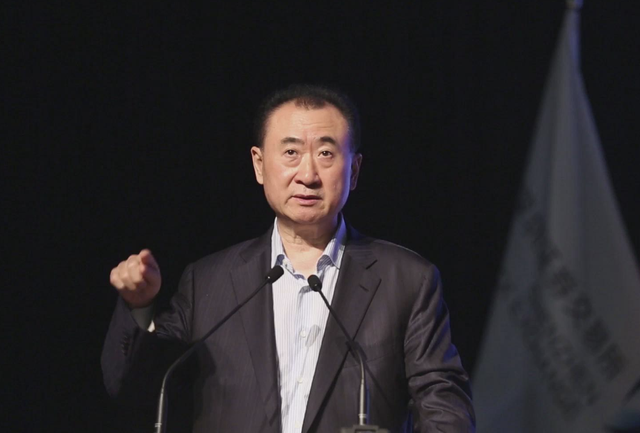

Back to a net worth of 140 billion! Why is Wang Jianlin still "selling off madly"

![]() 07/08 2024

07/08 2024

![]() 786

786

Only by dispelling the fog of wealth can we see some of the essence clearly.

Although Wang Jianlin has overcome his difficulties, Wanda Group's "selling off" spree continues.

According to relevant information from Tianyancha, recently, there have been changes in the shareholders, legal representatives, and senior management team of Hefei Wanda. According to the data, Wanda Commercial Management, the original shareholder of Hefei Wanda, has exited, and a new wholly-owned shareholder, Lianshang Yihao, has been added.

From the perspective of equity penetration, the controlling shareholder of Lianshang Yihao is Sunshine Life Insurance. It is worth noting that Wang Jianlin has sold multiple Wanda Plaza properties, and most of the buyers are domestic insurance funds.

Among the multifaceted Wanda Group, what is the ultimate essence?

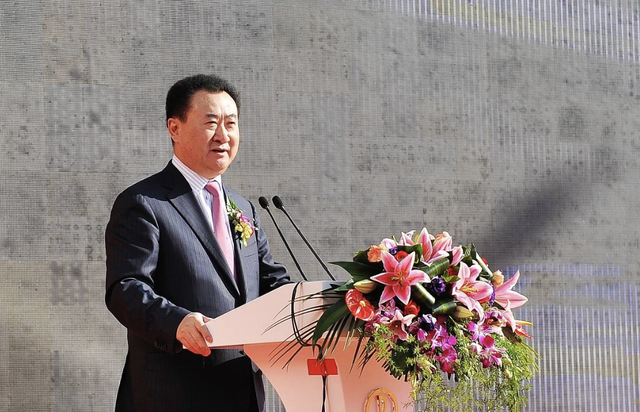

A month ago, New Fortune released the "2024 New Fortune 500 Wealth Creation List." According to the list, Wang Jianlin and his son have regained the ninth place among domestic billionaires with a total net worth of 140.6 billion yuan.

According to New Fortune, Wang Jianlin still holds 46% of the equity in Dalian Wanda Commercial Management Group, which still issued bonds normally in 2023. Based on its net assets of 300 billion yuan, coupled with its stake in Wanda Films, the net worth of Wang Jianlin and his son reached 140.6 billion yuan.

However, Wanda Films had already changed hands as early as December 2023.

In other words, in this ranking of wealth, the truth is difficult to truly reflect in reality, and a recent trending topic involving Wang Sicong seems to provide some answers to the market.

According to the trending topic "#Wang Sicong Will Have Money for You Next Year#" related content shows that Huang Yiming, who claimed to have given birth to Wang Sicong's son, shared their chat records from 2023 where he asked Wang Sicong for baby formula money but did not receive it.

According to the chat content, Huang Yiming asked Wang Sicong to send money quickly, and Wang Sicong replied that he had no money. Then, Wang Sicong said, "Just bear with it for now. You'll have money next year."

It can be seen that although Wang Jianlin no longer needs to worry about the gambling issue, the problems within Wanda Group may still exist. In the future, only when Wanda Group is relisted can these crises be completely resolved.

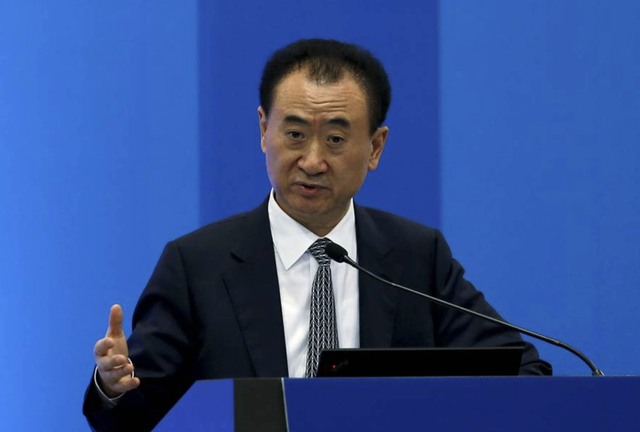

Decisive Action

In 2023, Wanda Group's gambling agreement had reached a point where it had to be resolved.

Actually, starting from the beginning of the year, Wang Jianlin had already begun to address the potential failure of the gambling agreement. To increase the company's cash flow and pave the way for Wanda Commercial Management's listing, Wang Jianlin began selling Wanda Films' equity.

As everyone knows, Wanda Films is an absolutely high-quality asset in Wang Jianlin's hands. If it were not for the fact that Wanda Commercial Management was really in a very difficult situation, it is believed that Wang Jianlin would never have sold Wanda Films' equity.

From Wang Jianlin selling cultural tourism projects to selling Wanda Films' equity, these transactions have presented a three-dimensional Wang Jianlin to the outside world and also won him a good reputation in the capital market.

Even ordinary people, once mentioning Wang Jianlin and his son, are generally full of praise.

Market trends are difficult for individuals to reverse. Even the once richest man in China, Wang Jianlin, after a series of efforts, did not completely resolve the困境 by selling Wanda's equity for cash flow. Therefore, Wang Jianlin chose to continue selling.

It has to be said that in the face of difficulties, Wang Jianlin's decisiveness really played a decisive role.

In December 2023, the gambling agreement of Wanda Commercial Management finally came to a conclusion, but the outside world did not expect it to be resolved in such a way. According to a message released on the Wanda official website, PAG Investment Group and Dalian Wanda Commercial Management Group jointly signed a new investment agreement. According to the new investment agreement, PAG Investment will jointly invest in Zhuhai Wanda Commercial Management with other investors after the previous investment redemption period expires and after being redeemed by Dalian Wanda Commercial Management Group. Among them, Dalian Wanda Commercial Management holds a 40% stake, making it the single largest shareholder, with PAG Investment and several other existing and new investors participating in the investment, holding a total of 60% of the shares.

And three months later, this capital had already been put into place.

Dalian Wanda New Alliance Commercial Management, held by Wang Jianlin, received investments totaling 60 billion yuan from 5 institutions. The price was that Wang Jianlin temporarily lost absolute control of Wanda Commercial Management.

Looking back, in fact, since the sale of Wanda Cultural Tourism in 2017, Wang Jianlin's "retrograde Mercury" has begun. Fortunately, due to this crisis of Wanda Group, Wang Jianlin took an early step in the real estate market, avoiding an even greater crisis later.

In addition, the reason why Wanda Group can turn crisis into safety every time is closely related to Wang Jianlin's personality. His decisive handling and grasping of the core issues are the fundamental factors for Wanda Group to land safely. However, under the current market background, Wanda Commercial Management will still be affected. As long as Wanda Commercial Management fails to go public, Wang Jianlin's situation will not improve significantly.

Selling Off Continues

After the gambling crisis was resolved, Wang Jianlin still did not slow down the pace of selling.

According to relevant data, Wanda Commercial Management has 12 existing domestic and foreign bonds with a total scale of approximately 15.9 billion yuan, of which nearly 8.7 billion yuan will mature within one year. Among them, at the end of 2023, Wanda Commercial Management extended a 600 million US dollar bond issued to its subsidiaries. At that time, Wanda announced, "Due to the continued downturn in the real estate industry and rising interest rates in the overseas capital market, the company faces certain difficulties in refinancing, and there is some uncertainty in the approval of Zhuhai Commercial Management's listing before the end of the year."

Relevant personnel said, "Even with 60 billion yuan of investment, the relentless asset selling means that Wanda has not yet reached a truly safe zone."

This also indicates that Wanda Group still faces considerable short-term debt pressure.

Relevant statistics also show that Wang Jianlin has sold more than a dozen Wanda Plaza properties. Among them, at the end of December 2023, Wang Jianlin sold four Wanda Plaza properties in Suzhou, Huzhou, Guangzhou, and Shanghai within five days. Coupled with the Wanda Plaza properties sold during the year, it has recovered funds of over 8 billion yuan.

However, it is worth noting that the frequency of Wang Jianlin selling Wanda Plaza properties is slowing down. This is a positive signal for Wang Jianlin and Wanda.

Some analysts also pointed out that the sale of Wanda Plaza properties is likely to continue. On the one hand, it is for "self-rescue"; on the other hand, from Wanda's long-term plan to transition to light assets, selling assets can raise cash to repay debts and reduce leverage.

It is reported that Wanda owns nearly 500 Wanda Plaza properties nationwide, and projects located in first-tier cities and provincial capital cities may be more conducive to transfer. The ultimate goal is still to implement Wanda Group's light asset strategy.

According to a report by China Fund News, as of November 2023, Zhuhai Wanda Commercial Management operated 494 large commercial centers, of which 290 were Wanda Commercial Management's commercial centers, and 204 were third-party light asset commercial centers.

It can be seen that although Wang Jianlin and Wanda still face debt pressure in the short term, the liquidity crisis has been resolved. Relevant personnel from Wanda revealed that one of Wang Jianlin's tasks mentioned at the annual meeting in 2024 is to reduce costs and increase efficiency.

Judging from the current overall situation of Wanda Group, although cash flow and listing issues have plagued Wang Jianlin in the past two years, its fundamental position remains solid. Although some Wanda Plaza properties have been sold, its foundation is still substantial.

Currently, Wang Jianlin and Wanda still need to reserve funds to pave the way for listing, which explains why Wang Jianlin continues to sell Wanda Plaza properties under the current circumstances.