Industry giants are actively deploying. What opportunities does AI accelerate the wave of device replacement?

![]() 06/04 2024

06/04 2024

![]() 945

945

In May 2024, Apple's M4 chip uses a second-generation 3nm process. Compared to the M2, its professional rendering performance has been improved by 4 times, its central processor performance has been improved by 1.5 times, and its neural network engine can accelerate various AI tasks, achieving 38 trillion operations per second.

Generally speaking, each round of consumer electronics boom cycles is driven by new demand triggered by technological progress. With the arrival of the AI wave, a new round of consumer electronics innovation cycles is expected to open, potentially igniting the next wave of "device replacement." In addition, the future application of AI large models on mobile phones will first drive upstream hardware demand, enhancing the value of SoC, storage, and power management chips.

01

Collective action by technology giants

2024 undoubtedly marked the first year of the AI hardware era. Whether it's Intel announcing AI features for 1 million PCs by 2025, AMD pioneering APU desktop processors with AI engines, Qualcomm's efforts to break through, or Apple using the Arm architecture to establish a foothold, major companies have released or disclosed PC platform products centered around AI concepts during this period.

In the mobile phone sector, Huawei's Mate 60 series phones released in August 2023 were equipped with the Pangu large model, while Samsung's S24 series phones featured AI functionality as their main selling point. In October 2023, Google's Pixel 8 series was able to directly run Google AI models on mobile phones. Subsequently, AI phones from Xiaomi, Honor, OPPO, and others equipped with high-performance processors were also launched.

02

AI devices are blooming

Starting a new wave of device replacement

AI technology is revolutionizing our interactive experiences, meeting the needs of combining virtual and reality. In addition to AI phones, headphones, speakers, and smart security devices are also embracing AI+.

AI headphones: Personal secretary + better sound quality

AI technology has given headphones more functions, making them users' personal secretaries. Human-computer interaction and algorithm recommendations allow headphones to optimize audio and recommend playlists, significantly improving sound quality.

AI speakers: Convenient interaction + home assistant

AI speakers can not only play music but also engage in natural language dialogue with users, connect to smart home devices, control lights, sockets, air conditioners, and more, enabling voice control throughout the home.

AI smart security: Comprehensively enhancing the security experience

AI technology also plays an essential role in the field of smart security. AI-enhanced smart security systems can capture static and dynamic data of people, vehicles, and devices in scenarios such as campuses and hospitals, enabling functions like quick registration, closed-loop management of people and vehicles, and campus attendance.

MR devices: Revolutionary interactive experiences

The combination of MR (mixed reality) devices and AI is still in its early stages but has shown tremendous potential. MR devices integrate virtual and reality, naturally requiring AI technology to enhance their technological feel and interaction modes. With the advancement of MR and AI technology, such devices will provide more realistic and immersive experiences, and AI will help MR devices understand user intentions and provide context-aware assistance.

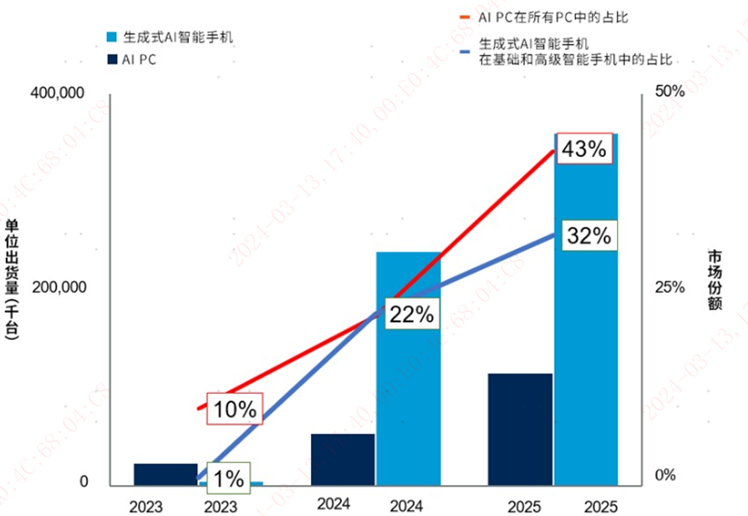

According to Gartner's forecast data, the global shipments of AI-driven PCs and smartphones alone are expected to reach 295 million units in 2024, an increase of over ten times compared to the 29 million units in 2023. Furthermore, by 2025, the market share of AIPC and AI phones is expected to rise to 43% and 32%, respectively. This not only reflects the increasing demand for intelligent and personalized devices among consumers but also highlights the core role of AI technology in driving electronic device innovation and market expansion.

Data source: Gartner

03

Increased prosperity of related industry chains

The gradual popularization of AIPC and AI phones has driven the upgrading and maturation of the entire industry chain, from CPUs to operating systems to brand and component ecosystems, urging major application manufacturers to enhance their technology across the board.

Advancement in thermal dissipation technology

The improved computing power of AI places higher demands on thermal dissipation performance. Compared to traditional heat pipes, vapor chambers have become a new trend. They can directly contact the cooling medium, improving thermal dissipation efficiency. Graphite materials, with their unique crystal structure, achieve strong planar thermal conductivity, and their penetration rate in heat dissipation modules is expected to further increase in the context of high computing power.

Increased demand for structural and appearance parts

Due to the high prices of early AIPC and AI phones, market penetration has mainly focused on high-end business laptops and phones. This has driven demand for lighter, more textured high-end structural and appearance parts, such as an increase in the use of magnesium-aluminum alloys and carbon fiber materials.

Upgrades in storage technology

The improved computing power of AI places higher demands on storage capacity and speed. To handle the massive amounts of data and complex instructions generated by AI, especially when running applications like large language models, storage performance and capacity must be upgraded simultaneously.

Development of AI chips

The main difference between AIPC and traditional PCs lies in the need to equip NPU (neural network processing unit) and other modules to provide AI computing power support. Processor giants like Intel, AMD, and Qualcomm have launched AIPC processors that support local AI large model operations, emphasizing NPU performance.

04

Artificial intelligence leads industrial transformation

The value of index allocation is prominent

The driving role of artificial intelligence on the industry is becoming increasingly apparent, and the allocation value of related indices is gradually gaining market attention. The CSI AI Theme Index focuses on various segments of the industry chain, covering 50 leading listed companies whose businesses involve AI-based resources, technologies, and application support. Meanwhile, the CSI Consumer Electronics Theme Index focuses on the industry chain of consumer electronics products such as smartphones, headphones, and wearable devices, consisting of 50 listed companies whose businesses involve component production, brand design and production of complete machines, and other consumer electronics-related areas. These two indices provide investors with convenient channels to seize industrial development opportunities driven by AI.

Currently, there are already relevant ETF products on the market, such as AI ETF (159819) and Consumer Electronics 50 ETF (562950), which track the above indices, providing investors with convenient tools to deploy in the fields of artificial intelligence and consumer electronics.