Strategic Leap or Blind Diversification? Can Meituan's 690 Million Users Sustain Its Automotive Ecosystem?

![]() 01/21 2026

01/21 2026

![]() 453

453

Venturing into the high-value auto sales sector is poised to unlock fresh growth opportunities for Meituan.

On January 15, 2026, Shanghai Xiche Future Intelligent Technology Co., Ltd. and Meituan inked a strategic cooperation agreement in Shanghai. This seemingly routine business partnership has sparked waves of interest across the industry. Picture a future where, upon opening the Meituan app, you can not only order food and book hotels but also compare 4S dealerships akin to restaurant reviews and even purchase cars directly online. This is no longer a figment of science fiction but a tangible transformation underway in the industry.

Significantly, Meituan's founder, Wang Xing, has long harbored a keen interest in the mobility sector. As early as 2019, Wang personally invested $285 million, with Meituan's Longzu Capital contributing an additional $15 million, totaling $300 million in Ideal Auto's Series C funding round. Wang remarked, "The future belongs to electric vehicles, and Meituan aims to be at the forefront."

In recent years, amid intensifying competition in the local lifestyle services sector, Meituan's profit margins have faced pressure despite sustained investment. Venturing into the high-value auto sales sector presents a promising new avenue for growth.

Automotive Industry's 'Inventory Anxiety' and Meituan's Opportunity

China's automotive market has transitioned into a 'stock competition' phase, characterized by significantly slower growth. In this 'supply exceeds demand' market, traditional 4S dealership models have revealed numerous pain points: opaque information complicates consumer decision-making, fragmented channels lead to resource wastage, and inconsistent service experiences tarnish brand reputation.

Jiang Shunyu, CEO of Xiche Technology, bluntly stated, "After entering stock competition, service experience has become paramount. The traditional model's issues of opaque information and fragmented channels are precisely what we aim to resolve."

"The automotive industry has entered a 'service-first' era," he added.

Industry insiders highlight, "While passenger vehicle sales growth slowed in 2025, the luxury car market expanded by 12% against the trend. This clearly indicates that in stock markets, service experience has become the pivotal factor influencing consumer choices. The traditional 4S model suffers from three major pain points: opaque information increases consumer decision costs, fragmented channels waste resources, and inconsistent service standards harm brand reputation."

Meituan's platform evaluation system offers a targeted solution to these pain points. Industry experts believe, "Meituan's rating mechanism will compel dealers to enhance service quality, akin to the 'Dianping effect' in the catering industry, ultimately benefiting consumers."

So, what calculations underpin Meituan's foray into the automotive industry?

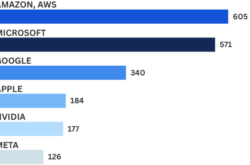

Currently, Meituan boasts 690 million annual transaction users and 9.2 million merchants, creating a local lifestyle services network that encompasses high-frequency scenarios such as dining, food delivery, hotels, and tourism. This 'high-frequency driving low-frequency' business model provides inherent advantages for entering the auto sales sector.

"We're not building cars but redefining the automotive consumption experience," revealed a Meituan insider. The platform views auto sales as a 'natural extension of local lifestyle services,' aiming to construct a one-stop platform that integrates 'car buying/usage + local services' through industry integration.

An auto dealer lamented, "This collaboration not only signifies Meituan's formal entry into auto sales but also foreshadows disruptive changes in automotive consumption ecosystems."

Future consumers on Meituan's platform will browse and compare different 4S dealerships akin to selecting restaurants, completing online purchases and evaluations seamlessly.

This 'a la carte car buying' experience introduces three innovations: immersive vehicle displays through 3D modeling and VR technology, enabling 360-degree views and simulated driving; transparent service processes, pricing, and user reviews, facilitating restaurant-rating-style dealer selection; and 'intermediate number' technology, which conceals real contact information during dealer communications to mitigate information leakage risks.

Simultaneously, Meituan may empower 4S dealerships through three key areas: providing online showroom construction, customer management systems, and data analysis tools to accelerate digital transformation; matching car buyers with suitable dealers through precise recommendation algorithms to reduce customer acquisition costs; and introducing Meituan's mature evaluation system to compel service quality improvements, fostering a virtuous cycle of 'better service → higher ratings → more traffic.'

Meituan plans to launch over 30 automotive brands and tens of thousands of dealer stores by the end of 2026, constructing a nationwide online automotive service ecosystem.

Strategic Gaming Through Diversified Approaches

Cross-border forays by internet companies into the automotive sector have become an irreversible industry trend, albeit with distinct entry paths that reveal differentiation in resource allocation, strategic positioning, technological routes, and business models.

Xiaomi Auto has opted for a capital-intensive model of independent R&D and manufacturing.

This strategic decision stems from Xiaomi's unique perspective on smart vehicles as 'mobile intelligent terminals' rather than mere transportation tools. The capital-intensive model enables high product customization and quality control but also brings substantial financial pressure and operational risks.

Huawei has taken a fundamentally different technology empowerment path.

As a global leader in communications technology, Huawei positions its automotive business as an 'incremental component supplier,' providing intelligent driving solutions through HI mode. The core of this model is Huawei's commitment to not build cars but to focus on constructing intelligent automotive digital platforms.

Huawei has forged partnerships with multiple mainstream automakers, with its technology solutions applied to brands like Seres and Avita. This technology empowerment model enables rapid technological implementation while avoiding capital-intensive risks.

JD.com, which announced its automotive entry late last year, demonstrates another innovative model - asset-light cooperative branding.

JD partnered with GAC Group and CATL to create the 'National Good Car' brand Aion UT Super, with a clear division of responsibilities: GAC handles vehicle manufacturing, CATL provides battery support, and JD dominates sales operations, with GAC Aion fully guaranteeing vehicle quality.

This model's innovation lies in: first, leveraging JD's e-commerce platform advantages to integrate car sales into the existing ecosystem, enabling full-process car selection and purchase within the JD app; second, ensuring battery technology leadership through CATL cooperation; and third, eliminating consumer quality concerns about internet company-manufactured cars through GAC Aion's quality assurance.

JD's automotive business leader stated, "We're not car manufacturers but 'new retail service providers' for the automotive industry."

In comparison, Meituan has chosen a platform model focusing on automotive circulation and service sectors, leveraging its local lifestyle domain traffic advantages and digital operation capabilities.

In fact, Meituan's automotive layout has quietly commenced. It previously partnered with SAIC Motor, with some SAIC Roewe 4S stores joining the Meituan platform. Users can intuitively understand models through online showrooms, view group purchase discounts, and even directly connect with sales personnel for one-stop car buying consultations. This pilot provided valuable experience for the current comprehensive layout.

However, Meituan's automotive challenges extend far beyond 'online car sales.'

A general manager at a Beijing joint-venture brand 4S dealership noted, "Our first 10 stores on Meituan saw significant online inquiry increases, but the 15% conversion rate fell far short of expectations. This isn't something simply resolved by 'going online' - it requires tripartite collaboration among dealers, platforms, and OEMs."

Industry experts also point out, "Whether consumers will develop the habit of buying cars through food delivery apps will require prolonged user mindset cultivation." Surveys show only 12% of consumers currently willing to complete car purchases via Meituan.

"Cars are high-value, low-frequency purchases requiring more offline experiences," industry insiders suggest. "Meituan should design an integrated online-offline service process, such as a closed loop of online appointment → offline experience → online payment → offline delivery."

Nevertheless, some experts view Meituan's cross-border auto sales as a strategically significant innovation attempt. This represents not just Meituan's business expansion but a reconstruction of the automotive consumption ecosystem. In a stock competition market environment, service experience will become the decisive factor.

In summary, Meituan's cross-border auto sales endeavor to reconstruct industry service processes through traffic and digital capabilities. The key to success lies in transforming 'convenient' online experiences into 'professional' and 'trustworthy' complete car buying and ownership services. This transformation concerns not only Meituan's strategic layout but also how the entire automotive industry adapts to digital era demands.

Note: Image sources from the internet. Contact for removal if infringement occurs. -END-