AI Race in the Automotive Sector Heats Up in 2026: How Will Global Automakers Strategize?

![]() 01/21 2026

01/21 2026

![]() 410

410

Lead | Introduction

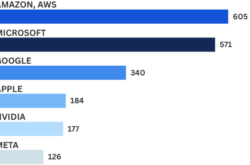

At this year's CES, Geely, Great Wall, BYD, and Leapmotor unveiled their strategic AI blueprints. Geely's 'Omnidirectional AI 2.0' strategy will encompass its architecture, powertrains, chassis, cockpits, and intelligent driving across the board. By 2026, the company plans to roll out high-speed L3 and low-speed L4 autonomous driving capabilities, along with support for Robotaxi services. Chery hosted its 'Technology Meets AI' Chery AI Night on January 17, marking a clear transition from 'Technical Chery' to a 'Global AI Technology Company.' As multinational automakers trail behind Chinese counterparts in their new energy strategies, what path will they take in the AI arena?

Published by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Full text: 2,363 characters

Reading time: 4 minutes

Currently, both domestic and international automakers are placing AI at the forefront of their strategic future development. AI's role in empowering automakers extends beyond internal management and efficiency enhancements; it directly influences intelligent driving, connected vehicle technologies, and the performance of the vehicle's electronic and electrical architecture, thereby determining a model's competitiveness and subsequent sales.

△Major automakers are fully embracing AI.

How Does AI Empower Automakers?

AI is revolutionizing vehicle architecture, intelligent driving, and smart cockpits.

In terms of vehicle architecture, Software-Defined Vehicles (SDV) have emerged as the strategic core for major multinational automaker groups. Volkswagen's CARIAD, Mercedes-Benz's MB.OS, Toyota's Woven City, and BMW's Neue Klasse are all in various stages of implementation. Automakers are now focusing more on software than hardware architecture, reducing vehicle development cycles from the traditional 48-60 months to 24-36 months. Continuously updating vehicle software and releasing new features through OTA (Over-the-Air) updates throughout the vehicle's lifecycle has become a top priority. Alongside new platform design, automakers are centralizing hardware resources and computing power, reducing the number of domain controllers to lower the complexity and cost of the vehicle's electrical architecture while enhancing OTA capabilities.

△The new generation of software platforms from multinational automakers is being continuously rolled out.

In intelligent driving, AI-driven end-to-end architectures have become the norm. NVIDIA introduced the Alpamayo autonomous driving world model at CES 2026, featuring causal reasoning capabilities to handle more complex traffic scenarios. This model is poised to become a coveted asset for many multinational automaker giants. On the other hand, Tesla's FSD, based on an end-to-end neural network, continues to evolve and upgrade using vast amounts of real-world road scene data. Data indicates that its testing mileage reached 700 million miles in 2025. In 2026, the latest FSD will be launched in Europe and China, marking a further enhancement in Tesla's intelligent driving capabilities.

△AI's empowerment of intelligent driving has become an irreversible trend.

In terms of cockpits, automakers are transitioning from smart cockpits to AI cockpits. The latest generation of cockpit products, powered by AI engines, are entering a phase of 'emotional understanding + memory + proactive service,' truly becoming users' travel assistants. Meanwhile, edge-cloud collaboration is becoming a mainstream trend for cockpits. Future cockpits will reduce reliance on the cloud by deploying large models on the vehicle side while completing complex reasoning on the cloud.

△Cockpit products, powered by AI engines, are entering a phase of 'emotional understanding + memory + proactive service.'

What Are the Highlights of Multinational Automakers' AI Strategies?

Compared to their previous hesitation regarding new energy strategies, multinational automaker groups are now resolute in their AI strategies. However, traditional automakers face significant challenges and resistance during the overall transformation process due to their past lack of accumulation in AI-related software and hardware. Nevertheless, whether through self-research or collaboration with third parties, major multinational automakers are striving to address their shortcomings in the AI field and gain a competitive edge.

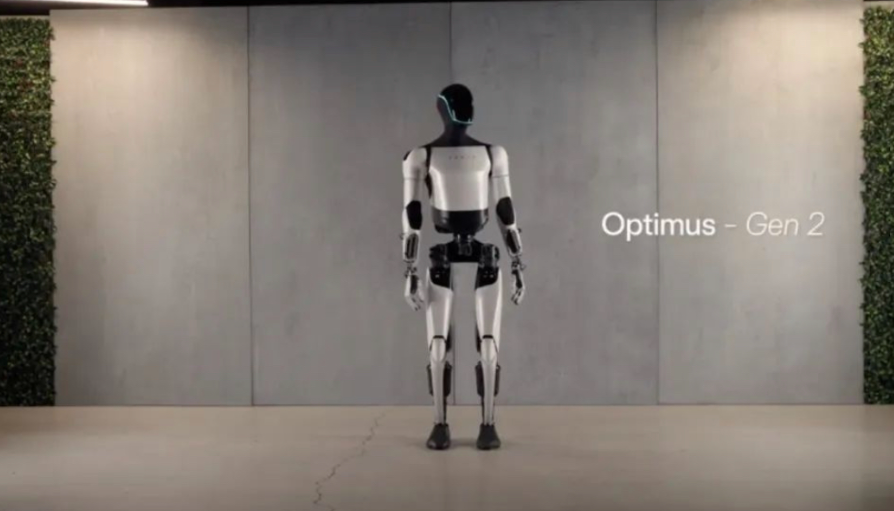

Among the multinational automaker giants, Tesla undoubtedly leads in AI combat effectiveness. Tesla has completed a comprehensive layout encompassing end-to-end FSD, self-developed chips, Robotaxi, and humanoid robots, covering all bases in the AI era. Notably, its latest version of the autonomous driving technology solution, FSD, offers an exceptional user experience through its end-to-end large model and cost advantages brought by its pure vision solution, placing Tesla in a favorable position in the intelligent driving competition. Additionally, the upcoming mass production of the humanoid robot Optimus and the large-scale deployment of Robotaxi will further expand Tesla's leading advantage in the AI field.

△Tesla has completed a comprehensive layout encompassing end-to-end FSD, self-developed chips, Robotaxi, and humanoid robots.

Mercedes-Benz focuses on its internal capabilities while introducing third-party technologies to launch new-generation products. In the field of intelligent driving, Mercedes-Benz will collaborate with NVIDIA, using the Alpamayo autonomous driving reasoning model as the core to develop and implement its L3/L4 intelligent driving technology. Considering Mercedes-Benz's recent announcement to suspend the promotion of Drive Pilot and instead advance the L2++ driving assistance system, Drive Pilot Assist, it can be inferred that Mercedes-Benz's high-level intelligent driving will undergo a significant transformation. In terms of cockpits, the 2026 new CLA model will be equipped with dual AI engines from Microsoft Azure OpenAI and Google, enabling the cockpit to understand complex requests, provide cross-domain answers, and execute tasks in a multimodal full-scene capability. Additionally, Mercedes-Benz plans to begin testing Robotaxi services in 2027, gradually entering the field of unmanned commercial operations.

△The 2026 new CLA model will be equipped with dual AI engines from Microsoft Azure OpenAI and Google.

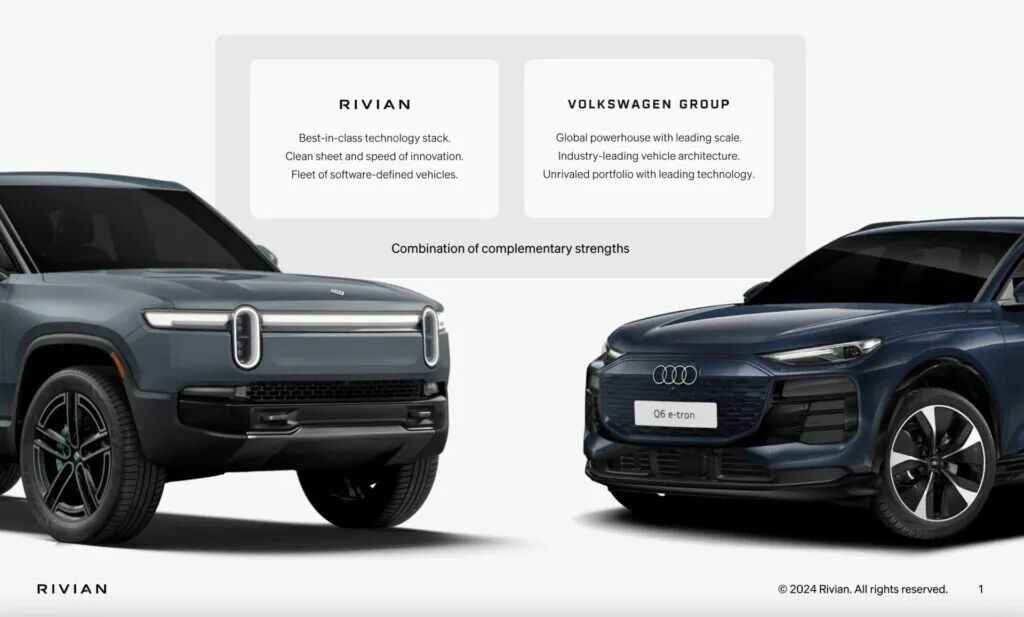

Volkswagen's AI strategy emphasizes localization. In China, Volkswagen has taken a stake in XPeng Motors and introduced XPeng's architecture into its VCTC R&D center in Hefei, helping Volkswagen achieve a complete closed loop from 'early R&D to mass production' overseas for the first time. In the United States, Volkswagen has also taken a stake in Rivian to enhance its competitiveness in the North American market. In 2026, Volkswagen will continue to deepen its collaboration with XPeng/Rivian, promoting more related vehicle projects. Meanwhile, considering Volkswagen's current sales focus remains on fuel vehicles, its intelligent strategy adheres to 'simultaneous advancement of fuel and electric vehicles,' meaning Volkswagen will still invest significant resources to enhance the intelligence levels of fuel and hybrid vehicles.

△Localization is one of the most important features of Volkswagen's AI strategy.

Toyota's AI strategy emphasizes human-machine collaboration. The core of this philosophy is not to replace humans with AI but to enhance human capabilities. This makes Toyota's autonomous driving platform, 'Guardian,' not aim for L4 autonomy in one step but rather embed autonomous driving technology into ADAS, striving to prevent accidents. Additionally, in 2026, Toyota announced the creation of a unified data and AI platform, 'vista.' This platform will unify data from enterprises, customers, connected vehicles, etc.; establish an AI-ready data environment; support natural language analysis with Genie and Databricks Apps; and plan to integrate Agent Bricks in the future to achieve large-scale deployment of agentic AI. Toyota's core focus is on ensuring high-quality data and consistent governance, serving as the foundation for future large-scale AI. In Toyota's renowned lean production, AI will also be extensively used for intelligent quality inspection and sustainable production at the production end, further enhancing efficiency and environmental sustainability.

△Toyota embeds autonomous driving technology into ADAS, striving to prevent accidents.

Commentary

The AI transformation poses a significant challenge for every traditional automaker. The dilemma of whether to persist with full-stack self-research or collaborate more with leading industry suppliers is a considerable one. Whoever can achieve maximum user perception with minimal resource investment will gain a first-mover advantage in this century-long transformation of the automotive industry. If they fail to keep pace with the times, new energy automakers like Tesla, Rivian, XPeng, and Xiaomi will quickly carve up the market share of their predecessors. Ultimately, in the hard battle of AI, no one can afford to lose.

(This article is original to 'Heyan Yueche' and may not be reproduced without authorization.)