BMW, Going Backward for a Decade?

![]() 01/21 2026

01/21 2026

![]() 545

545

"The battle is fierce, but the best is yet to come." The first half of the sentence is for others, the latter half belongs to BMW.

"Declining sales and brand reputation—where did the problems arise?"

This is a question BMW is still answering.

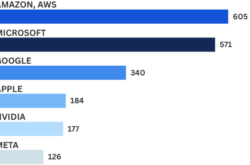

For BMW, the year 2025 could be described as more than just 'difficult.' Full-year data shows BMW sold 625,500 units in China, a 12.5% year-on-year decline. This marks the second consecutive year of sales decline in the Chinese market.

Among them, sales of the flagship model BMW X3 plummeted by 30% to 76,900 units, hitting a five-year low. While Xiaomi's YU7 sold over 153,000 units annually and Tesla's Model Y led with 425,000 units, the scenario BMW hoped to avoid became reality: 'Luxury is rewritten by technology.'

The current automotive market landscape is an unexpected eight-word reality for BMW: 'The battle is fierce, but the best is yet to come.' The first half applies to others, the latter half to BMW.

The Moat, Cracked

"A throwback to a decade ago."

Some use this phrase to describe BMW's sales trend, but it's not quite accurate.

A decade ago, BMW was on an upward sales trajectory, consistently surpassing 500,000 and then 600,000 units—a path of ascension. In the film Crazy Stone, BMW was jokingly referred to as 'Bi Mo Wo' (Don't Touch Me), exuding luxury.

Not just a decade ago, but for the past thirty years, BMW enjoyed a splendid journey and hoped to continue doing so. However, stories brewing amidst transformative winds and waves have converged into the current vibrant yet chaotic era.

Now, falling back to 600,000 units, with eroded brand advantages, declining sales of main models, and ever-dropping terminal prices, the electric transformation has been a bumpy ride—a standard 'downhill' path.

"Those without money buy BBA" is no longer just a jest in the electric era.

In 2025, local premium brands like Hongmeng Zhixing and Zeekr each surpassed 500,000 units in sales. Domestic brands have formed a Encirclement momentum (encircling trend) in the core luxury market of 300,000-500,000 yuan, continuously squeezing the survival space of traditional luxury brands like BMW.

Under this pressure, the luxury attribute once epitomized by 'preferring to cry in a BMW' has been diluted by 'plunging' price cuts, with each model seeing at least a 100,000 yuan reduction, some even over 200,000 yuan. As 'BMW price cuts' become commonplace, trading price for volume loses its direct stimulating effect.

Some owners complain, 'A car that cost 520,000 yuan last year is now worth only 320,000 yuan in the second-hand market. This isn't consumption upgrade but asset depreciation.' Fluctuating pricing strategies have left BMW in an Embarrassing situation (awkward position), losing both brand premium and sales volume.

A glimpse into BMW's main models reveals the trend. In 2024, BMW X3 sold over 110,000 units in China, dropping to 76,900 units in 2025, a 30% year-on-year decline. BMW X5 sales also fell nearly 20% year-on-year.

"It's not that we can't afford the 210,000 yuan Xiaomi SU7, but the 170,000 yuan BMW i3 offers better value." As 'BMW i3 at a Fracture price (bargain price)' trends online, the joke 'If you don't try harder, you'll only be driving BBA' becomes reality.

Cui Shudong, Secretary-General of the China Passenger Car Association, previously commented on Mercedes' price cuts, saying, 'Even with price reductions, Mercedes' electric vehicles struggle to capture market share from NIO, XPeng, and Li Auto because they operate on different tracks.' This logic applies to BMW as well.

Yes, two different tracks.

However, 'NIO, XPeng, and Li Auto' can take market share from BMW.

Earlier, NIO's Li Bin made a bold claim that was criticized: 'I can't understand why anyone still buys fuel vehicles now. How nostalgic must one be to buy a fuel car?' He even emphasized that NIO's true competitors are not Tesla, Li Auto, or other new energy brands but traditional fuel vehicles.

From NIO's product positioning, traditional fuel vehicles imply competitors like Mercedes, BMW, and Audi. Li Bin once dreamed of rewriting 'BBA' to 'NBA,' with NIO aiming to 'replace' BMW.

Though the road is long and arduous, BMW's moat has indeed been breached by new forces like NIO, armed with technological genes and a The momentum of encirclement and suppression (encircling offensive), creating multiple cracks.

Sales data is the most telling.

BMW sold 825,000 units in China in 2023, a 4.2% year-on-year increase, but sales fell 13.4% to 714,500 units in 2024 and further to 625,500 units in 2025. Over two years, nearly 200,000 units of market share have evaporated, gobbled up by new forces.

"Now, luxury brands selling high-volume models can consider zero-profit sales as decent," said a salesperson. Not losing money is already good; don't expect more.

Becoming a Follower

On the left, the glory of the luxury fuel era fades; on the right, the pressure of electric transformation looms. How to choose? Is BMW prepared for the 'downhill' path?

From BMW's urgent official price cuts in 2026, it seems they lack a comprehensive strategy for this chaotic period.

Starting January 1, BMW lowered the official suggested price (recommended prices) for 31 main models, covering fuel, new energy, and high-performance segments, with 24 models seeing over 10% reductions and five over 20%, lowering the brand's entry threshold to a historic low.

From the flagship 7 Series to the X1, dubbed 'young people's first BMW,' no model was spared. Industry insiders believe BMW's primary goal in lowering prices is to ease dealer cash flow pressures and stabilize pricing.

Behind this aggressive price cut lies BMW's tacit admission of its 'downhill' status.

Though emphasizing it's not a 'price war,' BMW knows this is merely a temporary fix and must align with user preferences. What are the mainstream preferences of Chinese market users now? Intelligence and electrification.

However, BMW has yet to step onto the electric track. Despite having an early advantage in electric vehicles, BMW remains 'unfamiliar' with the electric transformation path.

In 2012, Tesla launched the fully self-designed Model S. Soon after, in 2013, BMW introduced its first mass-produced electric model, the i3. Back then, these were the only two global automakers actively producing electric vehicles in the 2010s.

With an early advantage in electrification, BMW once leaned toward developing a dedicated platform for the i3 and i8. However, unable to predict whether fuel or electric vehicles would dominate, and with electric vehicle profits lower than fuel vehicles, BMW slowed its exploration to ensure profitability, becoming conservative and failing to capitalize on its advantage.

Comfortable times led to hesitant transformation. BMW didn't realize that 'new forces' still in the PPT stage would soon create new opportunities and challenges.

LifeDrive, a costly platform developed to 'dare to be first,' only produced two models—the pure electric i3 and hybrid i8—before quietly ending its lifecycle. After LifeDrive's failure, BMW became cautious, opting to retrofit existing fuel platforms rather than rush into a new electric platform.

Then, events unfolded unexpectedly. A series of concerns, coupled with an inability to let go of past successes, and a sudden surge, left BMW facing its current 'chaos.'

In electric transformation, BMW missed all early opportunities, with slow product refreshes and criticism for 'converting fuel models to electric.' Currently, pure electric models account for only 15% of BMW's sales in China, with main models like iX3 and i3 based on fuel platforms, lagging behind leaders in range and smart cabin performance.

After all, the underlying architecture remains rooted in fuel-era thinking, struggling to deliver top-tier OTA updates or cutting-edge autonomous driving.

Thus, a harsh reality emerges: inferior range, limited autonomous driving, and no price advantage. 'Why buy a BMW electric vehicle?' Similar doubts surround Mercedes and Audi.

A BMW salesperson lamented that due to the fuel-to-electric platform conversion, spatial layout and charging efficiency lag behind local pure electric models. 'Customers ask if we offer battery swaps. When I say no, they leave for NIO without negotiating price.'

McKinsey's 2025 China Automotive Consumer Insight Report shows 50% of consumers refuse to pay extra for Multinational brand (multinational brand) electric vehicles, with a sharp decline in willingness to pay a premium for German luxury electric brands.

AITO M8 has been the 400,000 yuan segment sales champion for months, while AITO M9 has dominated the 500,000 yuan segment for 20 months. As NIO ET5T alleviates range anxiety through its battery swap network, BMW's pure electric i5 and i7 remain fuel conversions. In 2025, BMW launched no new electric models in China...

In this electric and intelligent reshaped industry chain, BMW has become a follower—unwilling but helpless.

A Critical Year for 'Self-Rescue'

A century of technical moats in 'handling, chassis, engines' have been torn apart, forcing the once-dominant BBA to retreat for years. The pain BMW feels now is far more intense than in previous years.

In China, BMW faces pressure on sales, profits, and transformation pace—issues that won't resolve with a single price adjustment.

BMW must save itself.

Self-rescue requires identifying root causes. Surface-level reasons for BMW's sales decline include lagging electric transformation and price competition, but the deeper issue lies in balancing global standardization with Chinese localization in decision-making.

BMW has traditionally used a globally unified model development process, but China's new energy vehicle market completes iterations in '18 months,' highlighting an increasing adaptation gap.

Thus, CEO Oliver Zipse has repeatedly crossed oceans to China to find the root of 'BMW's decline.' In other words, BMW now doesn't know 'what users want.'

"China is a leading market for BMW, second only to our German headquarters in Munich," Zipse said, visiting China three times in thirty days, discussing technological changes.

"China is the country I've visited most this year, highlighting its importance in BMW's global strategy," he said on his fourth visit, reiterating, "China is the final arena for industry technology competition."

Like successful fuel vehicle era experiences, any automaker seeking success needs strong R&D capabilities in China, including BMW. 'We not only have the largest production scale outside Germany in China but also the largest R&D team, with over 3,000 researchers.'

BMW views the over 10 billion euro Neue Klasse platform as its technological breakthrough. With the debut of the iX3, the transformation truly begins.

BMW has designated 2026 as a critical year for 'self-rescue,' launching a series of localization initiatives, including upgrading the Shenyang production base and advancing the local launch of the new-era iX3.

Additionally, BMW announced deeper cooperation with partners like CATL, Momenta, Alibaba, and Huawei to accelerate its smart electric vehicle transformation.

"Drawing on collective strengths to achieve mastery." As a highly innovative enterprise, BMW refuses to be swept along by the times. In BMW's global strategy, China has shifted from a mere 'sales market' to a 'crucial pivot for R&D and innovation.'

BMW's first new-era model in China is set to roll off the Shenyang production line in 2026. Zipse called it the most 'China-ized' BMW model yet, 'not only responding to Chinese consumer demands but also signaling BMW's long-term commitment to the Chinese market.'

From Munich to China, 7,980 kilometers apart, this strategic innovation from fuel conversion to pure electric platforms connects BMW's future.

However, BMW faces two urgent challenges.

The new-era iX3, BMW's 'comprehensive innovation' electric model in China, still requires time. Meanwhile, balancing 'offense and defense' remains a test.

Another core challenge lies in understanding electric vehicles. Even Li Auto, which thrived earlier, stumbled with its MEGA electric model, temporarily slowing its electric push.

Li Xiang complained to Li Bin, 'Building pure electric vehicles is too hard.' Li Bin responded, 'So we're doing okay, right?' The new-era iX3 also tests whether BMW truly understands 'what users want.'

Understanding ensures a future. Without it, the downhill path will continue.

Note: Image sources from the internet. Contact for removal if infringing.

-END-