Sequoia's "Act of Disloyalty" and AI's "Rise of a New Deity": The Demise of Silicon Valley's Investment Discipline in 2026

![]() 01/28 2026

01/28 2026

![]() 431

431

01┃The End of the Classical Era: Finix's Loyalty Test

In the early months of 2020, Silicon Valley's venture capital landscape was still governed by a set of unspoken rules that had been in place for decades. Within this framework, a feudal-like allegiance existed between capital providers and startups: once a premier venture capital firm identified a "champion" within a specific sector (or "field"), it would commit its resources, connections, and credibility, forging a deep and enduring bond. In return, these firms vowed not to finance direct competitors of their chosen company—a rigid code of loyalty and territoriality.

At that juncture, Sequoia Capital stood as the quintessential representative of this classical order. As Silicon Valley's most storied venture capital firm, its influence stemmed not only from its uncanny ability to pick winners but also from its strict adherence to this ethical code. In Sequoia's philosophy, clear boundaries were the bedrock of long-term trust, while ambiguity was the most perilous toxin in relationship networks.

Against this backdrop, Sequoia faced a pivotal test. A startup named Finix emerged on its radar. Finix specialized in "payment infrastructure as a service," enabling businesses to swiftly integrate payment processing into their offerings. The crux of the matter was that this directly overlapped with the core domain of payments behemoth Stripe—and Sequoia was one of Stripe's earliest and most pivotal investors. According to the prevailing rules of Silicon Valley at the time, investing in Finix would be tantamount to a direct betrayal of Stripe. Media reports disclosed Sequoia's ultimate decision: it gracefully withdrew from negotiations, relinquishing potential board seats and financial gains. This was not merely an abandonment of a transaction but a public declaration of loyalty. Back then, Sequoia resembled a feudal lord, acutely aware of its territorial limits, understanding that safeguarding existing relationships was far more crucial than seizing new opportunities. This restraint was not a sign of weakness but a strength rooted in long-term strategic foresight.

02┃The Fracture of Rules: Sequoia's AI Trifecta

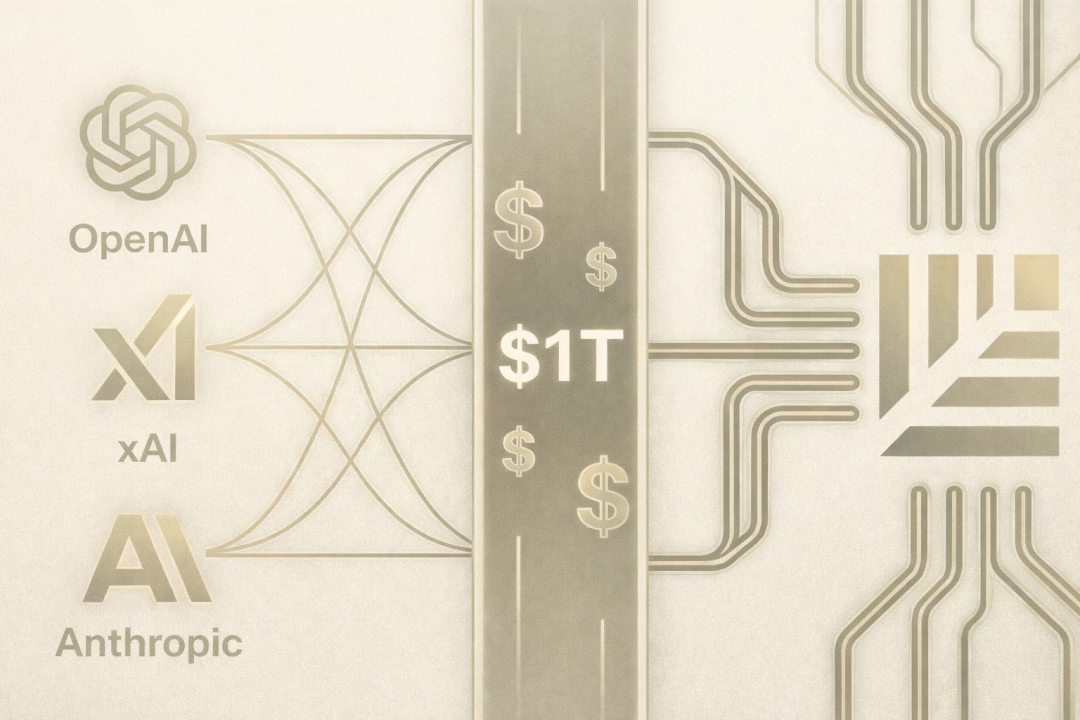

Four years can be enough to reshape entire eras in the tech industry. By 2026, when Sequoia found itself simultaneously negotiating with OpenAI, Anthropic, and Elon Musk's xAI, the Sequoia that had spurned Finix in 2020 over "potential competition" seemed like a distant memory.

According to reports from authoritative media outlets such as the Financial Times, Sequoia was deeply enmeshed in a capital strategy that had the potential to reshape the global AI landscape: having already made substantial investments in OpenAI and xAI, Sequoia was on the verge of joining a new funding round for Anthropic. This round targeted a valuation of $350 billion—just four months prior, the company's valuation stood at a "mere" $170 billion. Even more striking was the lineup of investors: Singapore's sovereign wealth fund GIC and U.S. hedge fund Coatue each led $1.5 billion investments, while Microsoft and NVIDIA committed up to $15 billion, creating a grand tableau of industrial and financial capital jointly placing their bets.

Sequoia, this seasoned veteran of Silicon Valley venture capital, no longer shied away from conflicts but systematically positioned itself among all major AI players; it no longer chose sides in competition but sought to become the holder of all cards. That once-clear red line—"not collaborating with direct competitors of existing portfolio companies"—was thoroughly erased and redrawn in the AI era. This transformation, while seemingly abrupt, was a rational choice when faced with the unique challenges of the AI field. The core competency of traditional venture capital lies in "identifying patterns amid uncertainty," but in the great model competition, old evaluation frameworks nearly collapsed. AI competition is a multidimensional, multi-stage composite war: vying for underlying computing power, innovating algorithmic architectures, building data ecosystems, navigating security ethics, and adapting to regulatory policies... When uncertainty reaches this level, the optimal strategy shifts from "picking winners" to "covering all possible nodes." Sequoia's AI strategy logic is no longer traditional venture capital's "horse racing" but more akin to "buying a permanent seat in the casino"—it recognizes that as intelligence becomes infrastructure like electricity, what matters is not which company wins but ensuring it remains at the table regardless.

03┃Managing Conflicts: Sequoia's New AI Rulebook

Anthropic's valuation doubling in four months reveals a profound transformation in how capital markets evaluate AI companies. On the surface, the valuation surge directly correlates with revenue growth—the company's annualized revenue soared from $1 billion to $10 billion. But a deeper driver lies in an asset being revalued: systemic trust. Against a backdrop of rapidly converging technologies, core capability gaps among major models are shrinking by the month. When technological advantage windows grow shorter, competition shifts from "performance races" in labs to "adoption races" in the real world. The decisive factor is no longer "whose technology is stronger" but "who can be adopted more safely, reliably, and compliantly by governments, banks, hospitals, and multinational corporations."

Anthropic's proposed "Constitutional AI" framework—a method for aligning AI systems' values through human feedback and principle-based self-correction—while technically complex, sends a clear political signal: this is a company prioritizing safety, transparency, and controllability. This positioning directly addresses the deepest concerns of enterprise clients, government regulators, and the public. Microsoft's, NVIDIA's, and other industrial giants' massive investments are essentially votes for this "collaborability." They seek not just financial returns but assurance of a reliable, stable, and ethically compliant partner in future AI infrastructure. Sequoia's participation adds financial capital's endorsement, forming a complete chain of legitimacy certification.

This implies that top venture capital's core competency has been redefined. In the classical era, avoiding conflicts of interest was a professional virtue; in the AI era, precisely managing multiple conflicts has become a rarer, more fundamental expertise. Sequoia's actions extend far beyond merely backing several competitors—it is completing a paradigm revolution in venture capital operations: shifting from seeking single battlefields to maintaining exquisite balance across all fronts of a global war.

04┃Building a New Pantheon on the Ruins of Old Gods

Sequoia's pivot is a rational usurpation of capital's power. It has dismantled the classical order built on loyalty, instead constructing a capital empire with itself as the hub.

This seemingly rational choice is birthing the most irrational future. When all top capital adopts the same multi-sided betting logic, the result will be structural innovation monopolies—a few institutions, through cross-shareholdings, substantially control resource channels for all technological routes. Disruptive ideas excluded from the capital map face "resource death sentences" from birth. Deeper still lies a transformation in the nature of power. When Sequoia sits simultaneously at OpenAI's, Anthropic's, and xAI's tables, it has mutated from a "field coach" into a "league manager mastering all teams' tactics." Competition persists, but the rules have been rewritten.

Top capital no longer predicts the future but, through precision strategy, becomes the structural foundation for the future itself. As we marvel at sky-high valuations, we must remain vigilant—the power to decide what deserves value is concentrating at the table's center at an unprecedented pace.