Tencent, ByteDance, and Alibaba All Seize AI Opportunities During the Spring Festival: The First All-Round Showdown for AI Entry Points

![]() 01/28 2026

01/28 2026

![]() 396

396

Every Spring Festival Gala serves as an ultimate test of national attention.

The true star of the show is often not the program itself, but the entity that can capture the most intense and valuable attention of the Chinese populace within a few hours.

As the 2026 Spring Festival approaches, Chinese internet giants are taking strategic actions: ByteDance is set to showcase its Volcano Engine at the Spring Festival Gala, aiming to directly promote its AI capabilities to the public; Alibaba has secured exclusive sponsorships for multiple TV stations' 2026 Spring Festival Galas, propelling Tongyi Qianwen into the consumer market at an accelerated pace; Tencent is investing a hefty 1 billion yuan to pave the way for Yuanbao, expanding into new territories while hastening the integration of AI with emerging social formats.

Indeed, such highly synchronized, platform-wide, and irreversible collective maneuvers all point to one conclusion: the race for the next-generation super entry point has officially commenced.

Looking back years from now, this new competition may signify the most significant transformation in China's internet landscape in two decades, potentially reshaping the digital life order for the next ten years. The harsh truth is that in the competition for entry points, there is no 'safe haven' for runners-up.

AI's First Leap Towards True Mass Adoption

For the tech community, a unique feature of the 2026 Spring Festival is that AI is being simultaneously propelled to the forefront of the consumer market through highly coordinated platform-level initiatives.

Unlike the sporadic and experimental dissemination of the past two years, nearly all leading platforms have chosen this timeframe to leverage their resources and highest-profile exposure to introduce AI to everyday users.

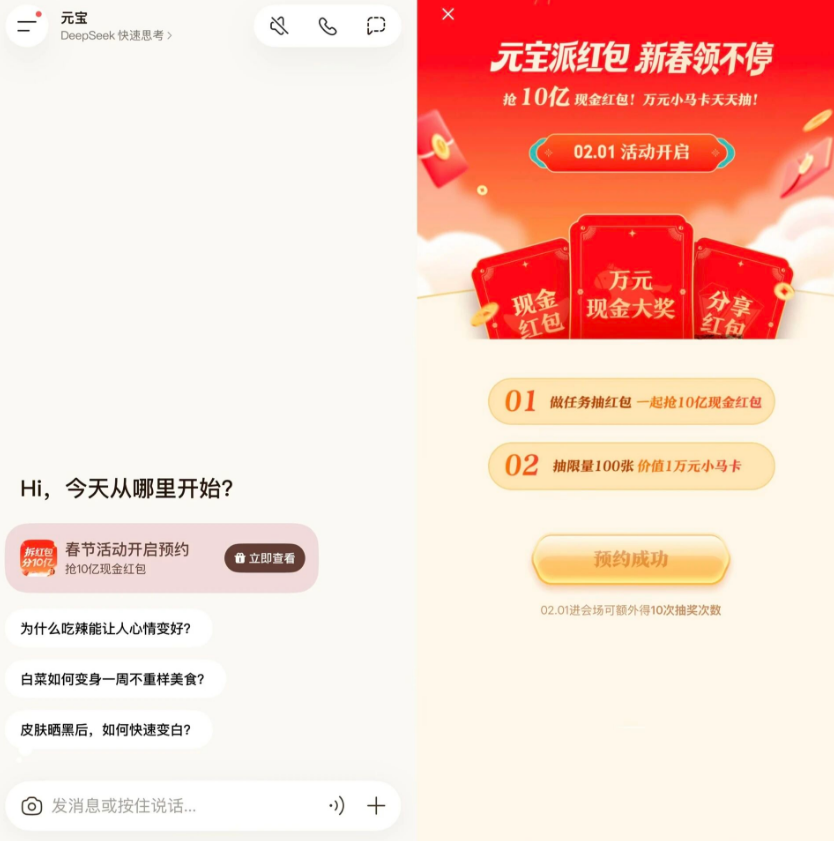

Specifically, Tencent has opted for a familiar and 'Tencent-esque' approach, directly utilizing cash incentives and social network effects. Yuanbao is set to launch a New Year promotion with 1 billion yuan in cash subsidies on February 1st, echoing WeChat's classic red envelope strategy. The objective is clear: first attract users, then delve into usage depth, ultimately integrating AI Yuanbao into the social infrastructure of the next decade.

ByteDance's strategy is more aggressive in terms of traffic generation. Volcano Engine becomes the exclusive AI cloud partner for the 2026 Spring Festival Gala, with Doubao simultaneously introducing a series of AI-powered features such as search, companion viewing, interaction, and Spring Festival couplet customization, all seamlessly integrated into the Spring Festival atmosphere. The ultimate goal is to enable non-tech-savvy users to continuously engage with AI without any learning curve.

This marks Douyin's third deep involvement in the Spring Festival Gala, but the first time it has showcased its own AI capabilities. Following Douyin's promotional path, ByteDance attempts to once again embed AI into the public consciousness through the most attention-grabbing medium—the Spring Festival Gala.

Alibaba has refrained from joining the red envelope war, but its path is equally strategic. Tongyi Qianwen has secured exclusive sponsorships for multiple TV stations' Spring Festival Galas, including Jiangsu, Henan, and Dragon TV, aiming to accelerate the integration of AI into users' transaction and decision-making processes on Taobao, Tmall, Fliggy, and DingTalk. Its rationale is that the true super entry point may not be the most frequently used but must be closest to transactions and value, leaving users with no alternative but to use it.

Even Baidu, which has lagged behind the former BAT trio, has joined the fray. Wenxin Assistant has launched a 500 million yuan red envelope promotion with rewards up to 10,000 yuan, while Baidu APP has secured the AI cooperation status for Beijing TV's Spring Festival Gala, attempting to regain a foothold in the discussion.

While specific strategies vary, the giants' assessments are remarkably consistent: AI is no longer viewed as a frontier technology awaiting validation but as the next-generation infrastructure to be actively promoted to the public, striving to make 'conversing with AI' a new daily norm.

Path Divergence: Three Giants Define AI Super Entry Points Differently

At the competitive level, amidst the Spring Festival hustle, Tencent, Alibaba, and ByteDance are actually vying for not entirely identical AI entry point forms based on their inherent strengths. This also offers three distinct directions for the evolution of AI entry points.

Data indicates that Yuanbao is in a catching-up position. As of the latest public data before press time, Doubao has surpassed 100 million daily active users and approximately 155 million monthly active users; Tongyi Qianwen's consumer-side monthly active users have exceeded 100 million. In comparison, Yuanbao still has a way to go to reach the 100 million mark.

Amidst this visible gap, Tencent may feel some anxiety but is generally not rushing to win based on standalone app metrics. The reason is straightforward: the super national-level social entry points, WeChat and QQ, are Tencent's true strengths.

According to Tencent's latest strategy, Yuanbao is not an isolated AI product but is designed as a capability layer that can be embedded into social networks. By supporting WeChat and QQ red envelope forwarding and launching the 'Yuanbao Pai' multiplayer social space feature in beta testing, it attempts to integrate into high-frequency social scenarios and even begins to explore the possibilities of AI in social interaction.

What Tencent truly aims to achieve is not necessarily creating another blockbuster AI app but making AI a default presence in chatting, interaction, and collaboration. Its AI ambitions still lie within the social network.

Alibaba's path should be the most commercially viable. Based on its vast and diverse business landscape and the robust support from Alibaba Cloud, Alibaba believes that the core value of AI should lie in effectively enhancing efficiency and facilitating transactions.

Tongyi Qianwen is systematically embedded into DingTalk, Taobao, Tmall, merchant backends, and enterprise systems, with a core keyword: productivity. Through DingTalk for enterprises and Taobao, Tmall, and Fliggy for consumers, Tongyi Qianwen ultimately aims to become the 'intelligent engine' of the digital economy.

In Alibaba's logic, an entry point is not just a traffic pool but a value amplifier. The amplification potential is evident from Tongyi Qianwen Chinese Version becoming the third AI app with over 100 million monthly active users just two months after its launch.

As for ByteDance, its strength still lies in maximizing user engagement time. Leveraging the Douyin ecosystem to efficiently convert entertainment and social traffic, Doubao is deeply integrated into Douyin's content creation, daily conversation search, and recommendation systems, forming a concise short path from curiosity to inquiry, recommendation, and direct conversion. Consequently, Doubao has become the fastest-growing.

In other words, ByteDance's AI entry point acts as an intelligent accelerator in the content consumption and creation process, aiming to keep users engaged longer and consuming more.

Three companies, three paradigms: Tencent focuses on the social environment, Alibaba on production tools, and ByteDance on the time system. This is not a homogeneous competition among the top players but the starting point of three parallel tracks. Regardless of the outcome, at least it aligns with their inherent logic.

The Competition for AI Super Entry Points: Will 'Observation Seats' Soon Be Unavailable?

An industry-level assessment behind this Spring Festival battle is that as AI begins to undergo systematic user acquisition, subsidies, and social network effects akin to past food delivery and ride-hailing services, the pioneer dividend period for technology has ended, and a market-driven, intense product elimination round has begun. Especially in the fiercely competitive arena for AI super entry points with very few winning seats, the competition has officially entered a critical positioning stage from mutual probing among the giants.

The essence of this stage is who can embed AI into users' high-frequency paths in the shortest time and form stable, repeatable usage habits. Once the path is locked, latecomers can only wander in the marginal market unless they present a new solution with sufficient disruptive power.

It is precisely in this sense that the significance of the Spring Festival is truly amplified. Among them, three almost irreversible industry rules are taking shape, worthy of in-depth exploration.

Rule 1: The competition for AI entry points is not just about simple performance but usage habits. After AI products begin to participate in continuous behaviors such as chatting, searching, creating, and decision-making, what users accumulate is not just preference settings but an entire set of implicit workflows. Once this path dependency is formed, the cost of user migration no longer grows linearly but jumps exponentially, with subsequent switching costs far higher than traditional app migrations.

Therefore, AI entry points naturally possess strong exclusivity. They may not be the best but are the first to be habitually used. History has repeatedly proven that in this competitive structure, latecomers often quickly lose even the chance to challenge.

Rule 2: Super entry points belong only to platforms, and vertical AI is destined to diversify and survive. Besides the existing internet giant forces, the rapidly emerging vertical AI forces and new-generation model startups are also indispensable new forces in this future massive market.

Therefore, the industry will not ultimately converge into a single omnipotent AI. The true structure will be a coexistence of a few platform-level entry points and a large number of specific, highly sticky vertical nodes. For general-purpose AI giants accelerating their platformization, losing the entry point means a high probability of being marginalized; for vertical players, not participating in the entry point competition is, instead, a rational survival strategy.

Rule 3: Once entry points are solidified, technological discourse power will be reversely defined. Once platform companies solidify their entry points, they will not just distribute AI capabilities but begin to reversely define the form of AI, further marginalizing latecomers. AI products without an ecosystem, distribution, or scenario binding will find it difficult to obtain hyper-scale opportunities.

The urgency of this competition is evident from the accelerated capitalization moves of new-generation AI model startups. Companies like Zhipu and MiniMax are replenishing their computational power, talent, and engineering capabilities through IPOs or capital infusions, vying not just for short-term traffic but to secure a position on the mainstream evolutionary path before entry points are solidified.

After all, while there may not be just one AI super entry point, the number of companies remaining on the table will certainly be limited. And time and user habits tend to favor those who solidify their entry points first.

Source: Hong Kong Stocks Research Society