L3 Autonomous Driving “Breaks the Ice” and Hits the Road: Who Will Be at the Helm?

![]() 01/28 2026

01/28 2026

![]() 343

343

Introduction | Lead

Recently, China granted conditional approval to its first batch of L3-level conditionally autonomous driving models, allowing them to conduct “road trial operations” in designated areas. This marks a new phase in which China’s autonomous driving systems can undertake driving tasks under specific conditions and bear primary responsibility. As L3 autonomous driving approaches, is China prepared for smarter travel options?

Authored by | Heyan Yueche Studio

Written by | Cai Yan

Edited by | He Zi

Full text: 1,874 characters

Reading time: 3 minutes

Towards the end of last year, the Ministry of Industry and Information Technology officially announced the approval of China’s first batch of L3-level conditionally autonomous driving models, with two models—Chang’an Deepal SL03 and ARCFOX Alpha S—receiving permission to conduct “road trial operations” in designated areas. This heralds the dawn of a new era.

The key breakthrough of L3 autonomous driving is that when the vehicle is activated and operating on limited highways or in urban congested areas, the primary responsibility for accidents caused by misjudgment of the perception system, algorithmic flaws, or hardware failures will clearly rest with the automotive manufacturer. This represents a dual legal and technological leap for autonomous driving technology, transitioning from “assisted driving” to “autonomous driving.”

2026 will be a crucial year for automakers to compete in the L3 arena and expedite commercialization.

△ ARCFOX Alpha S Receives Approval for “Road Trial Operations” in Designated Areas

L3 Autonomous Driving: A Major Transformation

In September 2025, a “Work Plan for Stable Growth in the Automotive Industry (2025–2026)” jointly issued by eight departments, including the Ministry of Industry and Information Technology, brought about a historic shift in the entire automotive industry. The explicit statement to “conditionally approve the production entry of L3-level models” marks a long-awaited breakthrough in the commercialization of autonomous driving in China. The deeper significance of this policy extends far beyond a production license—it represents the first systematic national-level refactoring (reconstruction) of driving responsibility allocation: when the L3-level conditionally autonomous driving system is activated within its designed operational scope, the primary responsibility for accidents shifts from the driver to the automotive manufacturer and system provider for the first time.

This fundamental shift completely breaks the long-standing impasse where “technology can be developed, but products struggle to enter the market,” compelling automakers to prioritize absolute system safety and reliability above all else. This drives the industry’s competitive logic from past “marketing battles” to genuine “technological showdowns.”

△ Policy Rollout to Accelerate L3 Autonomous Driving Deployment

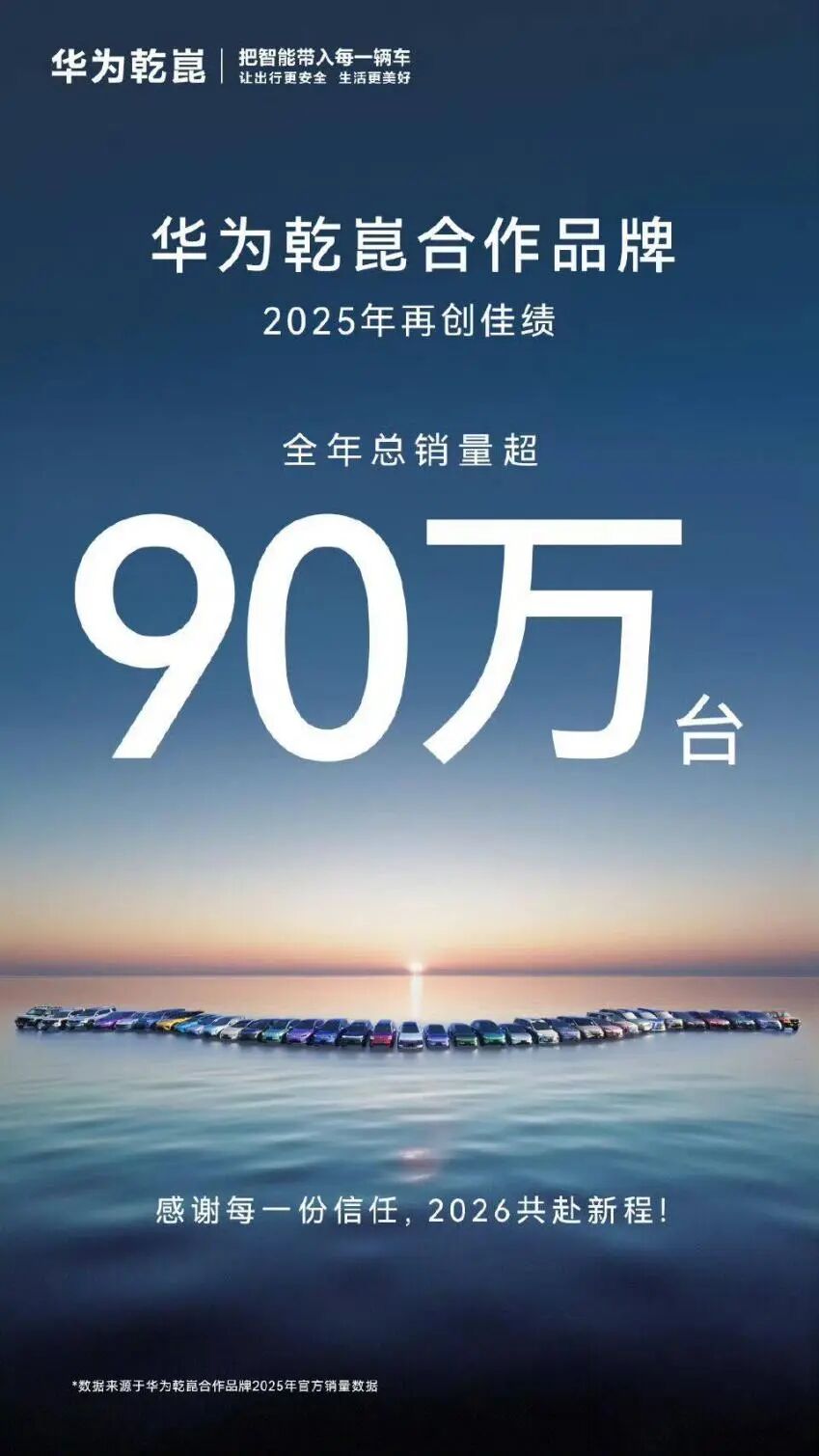

In terms of technical routes, the industry also displays a diversified landscape. The first batch of pilot models, represented by Chang’an Deepal SL03 and BAIC ARCFOX Alpha S, exhibit two distinct development paths: one pursues cost-effective, large-scale deployment through pure vision-based solutions and advanced algorithms, aiming to bring L3 autonomous driving functions to the mainstream market in the future. The other adopts a multi-LiDAR-dominated fused perception approach, investing heavily in hardware redundancy to pursue ultimate safety and reliability. This divergence reflects not only technological choices but also market strategies, indicating that future L3 autonomous driving functions will follow a “premium-first, gradual penetration” adoption path. At the market structure level, automakers like Chang’an and Seres (representing Huawei’s intelligent driving ecosystem) have secured advantageous positions in the first round of approval pilots due to their early-mover advantages.

However, the competition is far from over. Leading solution providers like Huawei, with their extensive road test data, rapidly iterating algorithms, and open collaboration models, are becoming the “technological bridges” for many automakers embracing L3 autonomous driving. It is foreseeable that future market competition will be a comprehensive contest of core technology self-research capabilities, cross-border ecosystem integration efficiency, and safety performance.

△ Different Automakers Will Adopt Distinct Paths to Advance L3 Autonomous Driving

L3 Autonomous Driving Enters the Deep Waters

The deployment of L3 autonomous driving is reshaping the landscape and ecosystem of the entire automotive industry. First, it will extend to the vast upstream of the industrial chain, spawning a new ecosystem encompassing perception, decision-making, and execution. The cost of key sensors like LiDAR is rapidly declining to the thousand-yuan level, while the maturity of third-party solutions such as Huawei ADS and Momenta has shifted the competitive focus from mere hardware stacking to algorithmic and software ecosystem capabilities, providing diversified technological path options for different types of automakers.

With the issuance of the first batch of L3-level autonomous driving test licenses in Beijing, Chongqing, and other regions by the end of 2025, the technology is officially transitioning from closed test sites to complex real-world road testing. The core task at this stage is to accumulate massive long-tail data in limited scenarios such as actual highways and expressways, driving continuous system iteration and laying a solid safety foundation for broader future applications.

△ Core Technology Suppliers Like Huawei ADS Will Step into the Spotlight

However, more revolutionary than technological deployment is the reconstruction of responsibility allocation. As reports of intelligent vehicle accidents increasingly come to users’ attention, there is widespread skepticism about the deployment of L3 autonomous driving. Only when automakers stop “shifting the blame” can users truly accept and trust autonomous driving. Now, policies clearly assign primary responsibility for accidents occurring when the L3 system is activated to the automotive manufacturers. This regulation, akin to a “Damocles’ Sword,” forces automakers to place safety and reliability at an unprecedented strategic height. Data recorded by onboard “black boxes” will become crucial evidence for clarifying responsibility, compelling the entire industry to establish a new safety framework covering R&D, testing, validation, and insurance.

Against this backdrop, the logic of market competition is undergoing profound evolution. For some automakers, relying solely on their in-house R&D capabilities to achieve a short-term breakthrough in L3 autonomous driving technology may prove challenging. In the future, a pragmatic shift from full-stack self-research to collaboration with top-tier solution providers will be a viable choice, potentially leading to a tightly allied “automaker + core technology supplier” industry landscape.

Commentary

The deployment of L3 autonomous driving technology represents not just a technological leap from assistance to delegation but also a complete shift of driving responsibility from humans to vehicles. When automakers must assume full responsibility for every system judgment, the ultimate competition in autonomous driving technology truly begins. What we witness is not just smarter vehicles but a revolution in travel paradigms.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)