Eliminating Game Stocks: Does Google's "Thanos Snap" Deliver a Critical Hit?

![]() 02/03 2026

02/03 2026

![]() 354

354

On the previous Friday, the stock prices of three companies with a strong connection to the gaming industry—Unity, Applovin, and Roblox—took a significant nosedive. This decline was largely attributed to the disruptive influence of Google's newly launched world model, Genie, on the gaming sector.

Dolphin Research acknowledges that while Genie has the potential to bring about substantial changes in the gaming industry through ongoing enhancements, at present, it falls short of being truly revolutionary in terms of both 'playability' and 'cost efficiency'. The approximately 20% drop in Unity and Applovin's stock prices that day was also influenced by other factors.

So, the pressing question is: Were these three companies unfairly penalized? Do they possess robust fundamentals to weather the negative impact of the 'AI narrative' as their earnings reports loom? Let's engage in a thorough discussion with Dolphin Research.

Here's a comprehensive analysis:

I. Genie as a Disruptive Force in the Present

Firstly, the conclusion: The Genie world model is undeniably a disruptive technology poised to have a profound impact on multiple industries in the long run. However, from the perspectives of practicality and cost efficiency, Genie is better suited for short-term development in conjunction with traditional engines. This strategy can help reduce high labor costs while preserving the original product's precision and stability:

The world model has the potential to inspire more non-professionals to participate in game creation. Genie can handle foundational tasks (such as conceptual prototype research, rendering of basic non-critical scenes, physical simulations, and the production of promotional CG), while Unity, Applovin, and Roblox continue to excel in more precise animation rendering, long-term stable interactions, game promotion and monetization, as well as the construction of the entire ecosystem economy and user operations.

1. Why Did Genie 'Take Off' This Time?

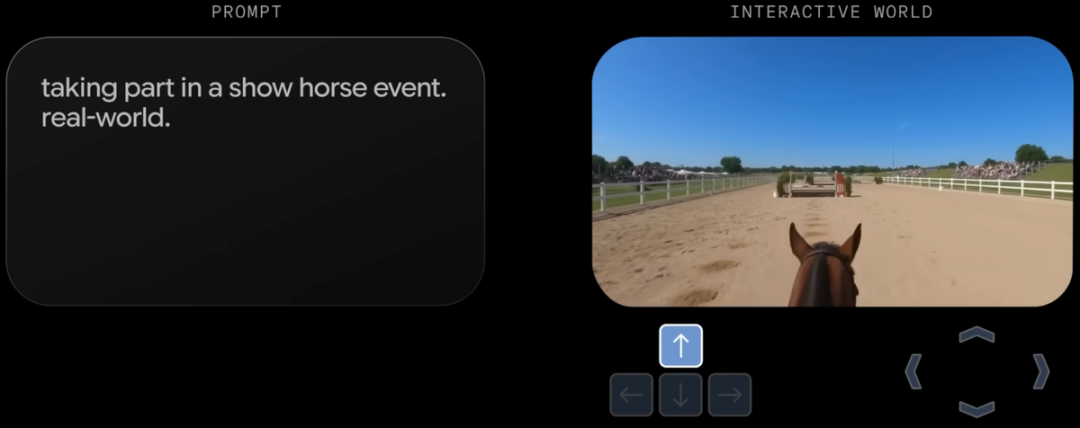

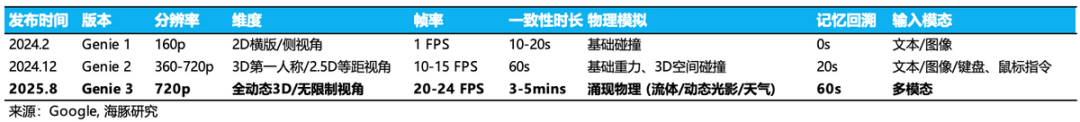

Google's Genie is a generative interactive environment world model, first unveiled in February 2024. Its primary function is to instantly generate a virtually operable, logically coherent world from a single image or text description.

The initial version of Genie had limited practical applications, with drawbacks such as low resolution, single interactive scenes, a consistency duration of only a few seconds, and physical simulations limited to simple collisions. However, the second-generation version released in December 2024 significantly improved these areas, featuring enhanced resolution, the introduction of 3D interaction, extended consistency duration, and more physical feedback.

Then came the highly anticipated third-generation version, previewed in August 2025, which achieved 720P high-definition, 20-24 FPS real-time interaction, and a maximum consistency duration of 3-5 minutes.

In AI-generated interactive content scenarios, the ability to interact and predict spatial changes after interaction, as well as maintaining long-term consistency, is crucial and represents the biggest difference from traditional video generation technologies.

Current AI often produces non-coherent images, such as distortions or objects suddenly disappearing when viewed from a different angle. Simply put, Genie 3 can already support creating a small level in a game and an immersive exploration scene.

The significant market impact on Friday stemmed from Google's announcement on the 30th that Genie 3 would be included in the Google AI Ultra package. Many users directly experienced it and found the implementation effect exceeded expectations.

The transition from a laboratory product only available for Google's internal research to user practical operation brought a different level of shock, leading to the narrative of disrupting game engines.

Google AI Ultra is currently the highest-tier version in the Gemini subscription package, priced at $250 per month, with a half-price discount for the first three months. It offers access to Google AI's premium products and highest usage limits (Gemini 3 pro, Veo 3/3.1, Gemini Code Assist, Gemini CLI, Gemini Antigravity, NotebookLM, etc.), along with an ad-free YouTube membership.

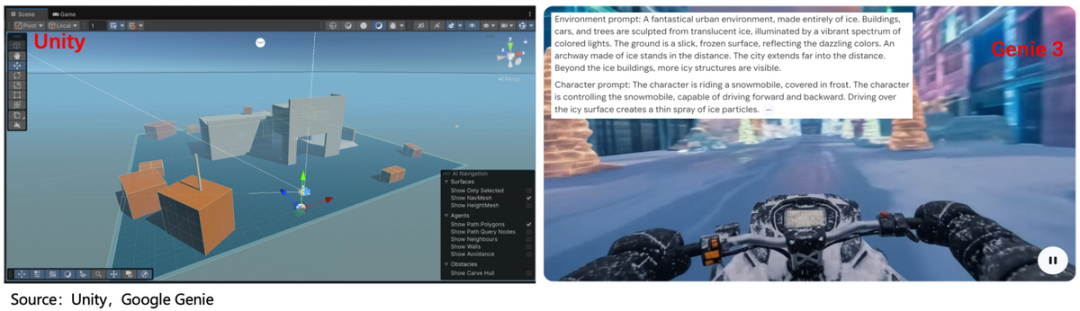

2. Theoretical Technological Layer: Genie's Potential to Replace Unity

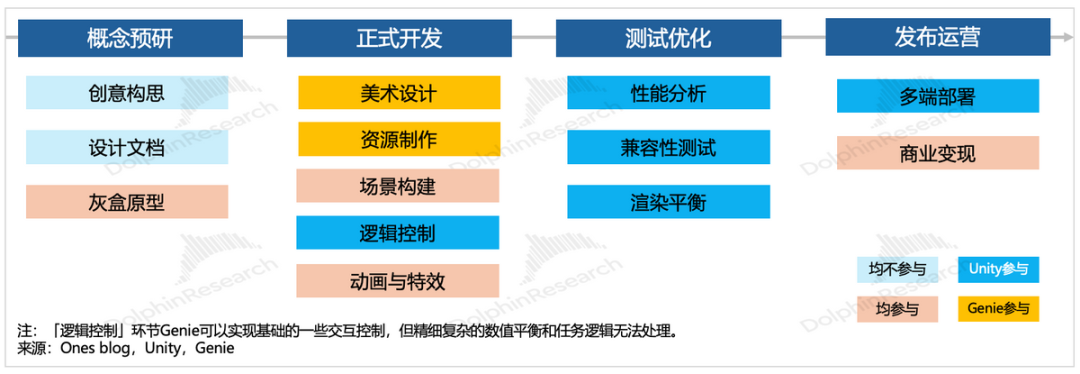

So, what changes will Genie bring to the current game development process? In other words, where does Genie's potential to replace gaming engines like Unity lie? Below, we compare Unity's role in a typical game development process with Genie's potential.

As shown in the figure, game development generally consists of pre-development conceptual planning, art design and resource production, logic control, testing and optimization, and release and operation. Among these, art design and program development are the formal production stages, which are also the most time-consuming and resource-intensive.

Unity is involved in gray-box prototyping during the pre-research phase, multi-modal asset integration, scene layout, lighting and rendering in formal production, precise physical simulation calculations in logic control, and coding for logic control (level mission systems, numerical logic, UI interactions), as well as final testing optimization and one-click generation of multi-platform versions during release.

Simply put, Unity participates in most stages of game development. In terms of specific functions, Unity's advantages over traditional counterparts include cross-platform deployment capabilities, low-power rendering (lightweight 3D effects), AR/VR content development, etc. Additionally, since Unity also offers an advertising platform for user acquisition and monetization, this closed-loop ecosystem further reduces friction costs for developers.

Now, let's look at Genie. Compared to the aforementioned development stages, Genie can theoretically accomplish the following tasks:

a. Conceptual pre-research (gray-box, logical interactions): Traditionally, developers manually build using Unity's components, and most interactions can directly adopt Unity's templates. However, complex and precise interactions (such as complicated treasure chest drop rate formulas or precise requirements for multiplayer synchronization) require coding to ensure accuracy.

b. Formal production (dynamic rendering, physical simulations, interactive logic control): In the formal generation phase, Genie can perform functions similar to those in the pre-research phase. However, compared to the simple visuals in the pre-research phase, Genie can also provide initial resource material organization, lighting and rendering, and basic physical feedback output.

These do not require Unity's rendering pipeline or physical engine, but for complex and precise physical simulations and logic control effects (mission logic, numerical balance, etc.), traditional engines are still necessary.

World models may have deviations or hallucinations, deviating slightly every second, which is hardly noticeable to the naked eye. However, over time, the degree of deviation gradually accumulates to a noticeable level. Currently, the public version of Genie 3 only supports generating interactive videos up to 60 seconds long.

c. Testing and optimization (performance optimization, multi-platform deployment): Unity's main feature in the testing and optimization phase is its ability to achieve 'one development, multi-platform deployment,' involving tiered rendering for devices with different performance levels to ensure stable operation from low-end to high-end mobile phones.

Genie cannot yet adapt to different performance terminals for flexible downgrading, as its deployment is primarily cloud-based. Therefore, it can achieve 'one generation, full-end access,' but this process is highly dependent on network transmission performance, similar to cloud gaming. However, if terminal deployment is still required, traditional engines like Unity are necessary.

Overall, from a theoretical technological perspective, Genie can partially substitute for Unity's functions, especially for lightweight single-player games with simple interactions. It can also participate in some stages of medium to large-scale games, such as gray-box pre-research, rendering of ordinary non-critical scenes, and physical simulations.

However, for complex and precise logic control, such as numerical balance, complicated level design, treasure chest probabilities, and multiplayer competitions, Genie is still not competent. Additionally, for final cross-platform terminal deployment, traditional engines remain more convenient.

d. Commercial monetization (game ad generation, Google ecosystem ad placement): Traditionally, Unity Ads provides developers with opportunities for user acquisition and ad monetization. However, the issue is that 60-second interactive videos are naturally suited for current game ad generation, and Genie, backed by Google's powerful ad ecosystem, can leverage this opportunity to place game ad budgets within its ecosystem and alliance ad network.

3. Cost-Effectiveness Layer: Genie's Potential for Cost Reduction Depends on the Situation

Apart from ordinary users' interest in experiencing the process of Genie generating interactive videos (or mini-games), a commercially viable game cannot only consider technical feasibility but also actual costs.

As an AI large model-generated content, Genie's main bugs are not temporary technical flaws but high computational costs:

(1) One-time game development:

In the development phase, compared to Unity, Genie's biggest cost saving lies in the reduction of large modeling, art, and programming teams, i.e., labor costs.

Genie is currently only available to U.S. users, with the Ultra package subscription fee being $250 per month, including 25,000 monthly credits. Generating a video under 60 seconds consumes 40-60 credits, allowing for approximately 400-600 60-second videos per month.

However, the cost of the Unity engine itself is not high, especially for lightweight games suitable for Genie's technological level. Currently, the Unity engine has been updated to version 6.0, with subscription plans including Personal, Professional, and Enterprise editions. The Personal edition is free, the Professional edition costs $210 per month (lower than Gemini AI Ultra), and it is free for enterprises with annual revenues under $200,000.

(2) Long-term game operation:

However, for a truly operational game, the focus is on longer-term operation. The computational power required for generating a 60-second video is only a tiny fraction of the total computational power needed during its lifecycle (e.g., an average of 3 years in the mobile game industry). During the future operation cycle, every player interaction will incur inferential computational costs for the enterprise. The longer the operation time and the more players, the higher the costs.

In contrast, traditional development represented by Unity incurs its main costs during the one-time development environment investment, which is essentially 'static code' on players' local devices. Subsequent operational server costs are relatively low. The longer the operation time and the more players, as long as the monetization design is appropriate, the game becomes a dynamic money-printing machine.

Considering points 1-3, Dolphin Research believes that in the short to medium term, Genie brings more inclusive value (lowering barriers) to the gaming industry rather than universal prosperity (limited commercial value as an independent solution). By comparing the technicality and cost-effectiveness of Genie and Unity, an optimal application is to adopt a 'Genie first, Unity later' combined approach:

Use Genie for practical verification of conceptual designs, i.e., the pre-research phase, as well as art design and direct generation of non-core scenes. Then, import this content asset into the Unity engine for subsequent complex and precise scene and logic development, game multi-platform version generation, etc.

This combined approach allows for 'quick' overall planning and design adjustments in the early stages while saving significant labor costs in art, modeling, and programming in the mid-stages. It also ensures the precision of complex scenes and interactive logic, the convenience of cross-platform deployment, and avoids high computational costs during long-term operation.

Therefore, for gaming productivity tool platforms like Unity, Genie's empowerment significance outweighs its disruptive significance, at least in the short term.

As Unity's CEO subsequently stated in official media:

The probabilistic nature of world models conflicts with the certainty and precision required for professional-grade game production, leading to issues in ensuring a stable gaming experience for players, especially for game levels that naturally require repetitive content.

We do not view world models as risks but rather as accelerators. The reason is that world models provide a wealth of initial game scene content assets, which can then be optimized through Unity's deterministic system (structured, deterministic, and fully controllable physical simulations). Our Agentic AI can already transform static video inputs into high-quality scenes.

World models simplify the process from 'static video' to 'game scene,' directly providing a game scene to advance to the next step in Unity, ultimately ensuring consistent behavioral experiences across different devices and sessions. Additionally, world models simplify the difficulty of transitioning from creativity to simple prototypes, inspiring more non-professionals to participate in development.

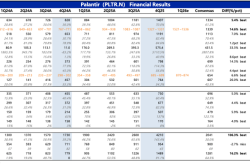

When it comes to Unity's performance, market research reveals a slight uptick in its Q4 gaming market share, thanks to the incremental boost from Vector. Nevertheless, the lingering impact of IronSource is expected to keep overall performance growth relatively sluggish. Looking ahead to 2026, the market anticipates a rebound in Unity's revenue, projecting growth of 10-15%, with advertising revenue nearing 20% and the engine business stabilizing at around 13%.

At the close of trading on Friday, Unity's market capitalization plummeted to $12.5 billion. Excluding the $10 billion attributed to the Grow business (valued at 20 times the 2026 adjusted EBITDA), the remaining Create business is valued at a mere $2.5 billion. This valuation corresponds to just 4 times the projected 2026 revenue, a stark contrast to the typical 8 times price-to-sales (PS) ratio, clearly reflecting a punitive valuation driven by concerns that traditional software is being disrupted by AI.

4. Roblox: Wrongly Affected but Facing Short-Term Challenges

Roblox, which also boasts game production capabilities, saw its shares drop by 13% on the same day. However, Dolphin Research believes that Roblox may have been somewhat unfairly impacted.

Roblox indeed offers tools on its platform for numerous independent developers and small studios to create lightweight games. While Genie may have limitations, such as insufficient precision and inadequate terminal deployment compared to Unity, it can be argued that Genie holds a dominant position when compared to Roblox's creative tools and cloud gaming operational model.

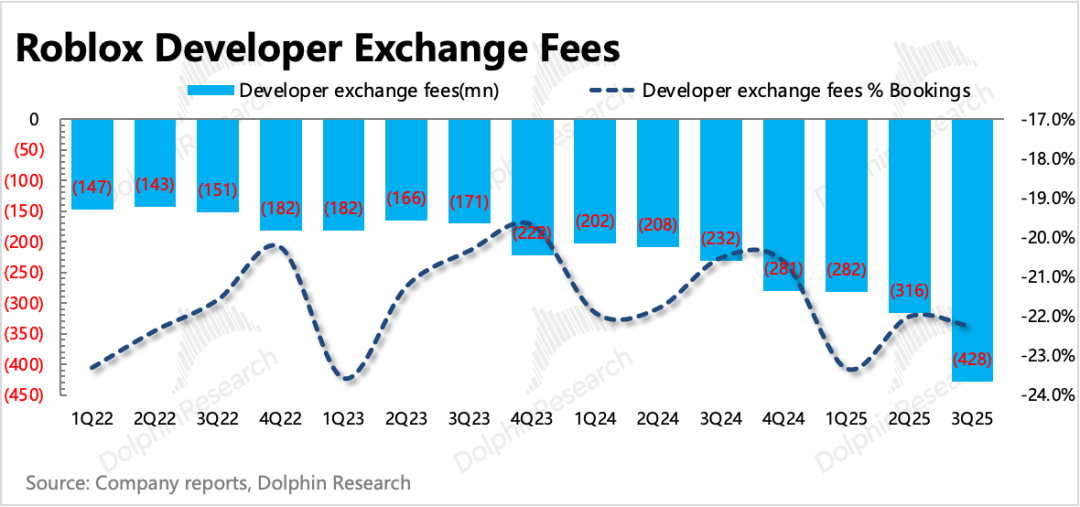

Currently, Roblox takes a 30% cut from game developers' revenue. After factoring in variables such as the exchange rate difference between Robux and real currency, as well as platform incentives for creators, the platform's revenue share ratio is calculated to be 22% based on financial reports. Can the platform sustain such a high take rate if developers choose not to use Roblox's editor for game development?

Moreover, under the narrative that 'AI will disrupt everything,' if Genie leads to a surge in lightweight games on the market, it could also impact user engagement within the Roblox ecosystem.

Considering the two 'ghost stories' of 'weakened monetization' and 'user competition,' does Roblox's decline seem justified? However, as a platform economy at its core, Roblox's true value lies in its 130 million daily active users and over 600 million monthly active users, comparable to a medium-sized game or platform. Roblox's ability to sustain long-term platform operations hinges on the well-established and balanced ecosystem it has cultivated over the years.

Roblox can be likened to an evergreen MMO game. Its virtual world attracts long-term user activity not through exquisite animations or rich, exploratory map scenes, but through the stable ecosystem it offers.

Combining the aforementioned economic analysis of Genie, Dolphin Research believes that Genie may not necessarily be the best choice for lightweight games at present. Therefore, rather than expecting Genie to disrupt or affect Roblox's monetization, we are more inclined to believe that Roblox will first integrate world model capabilities.

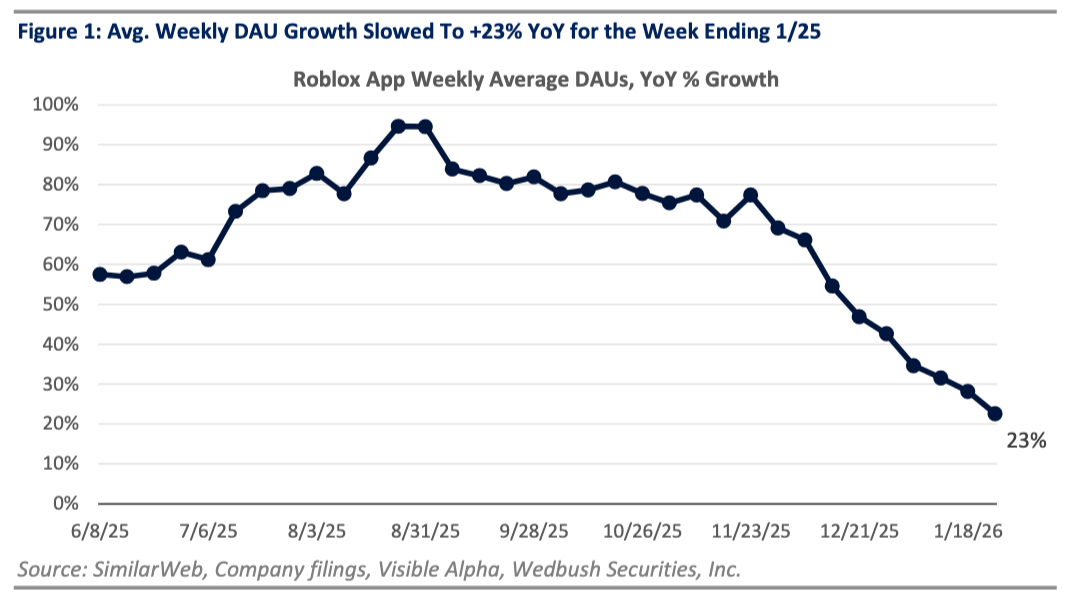

However, Roblox's persistent stock price slump actually stems from other factors—declining daily active user (DAU) growth and regulatory disruptions related to children's policies. As previously stated by Dolphin Research, Roblox should be viewed more as a platform economy than a gaming company. While ordinary gaming companies are influenced by their product cycles, Roblox, with its platform of numerous creators, should theoretically remain stable and not be overly concerned about hit games.

However, we may have overlooked a crucial point—developers on Roblox are not fully mature. They can develop games but may lack an understanding of long-term operations. Coupled with the relatively short lifecycle of lightweight games, once operations falter, activity often drops rapidly.

In summary, despite our positive view of Roblox's asset attributes, given the increased uncertainty in DAU growth, a short-term valuation adjustment is necessary to account for the certainty value. With a current valuation of 25 times enterprise value to adjusted EBITDA (EV/Adj. EBITDA) or 7 times enterprise value to sales (EV/Sales), combined with Friday's sell-off, the valuation has been deflated. The current level aligns with traditional gaming stocks but is below growth platform stocks. As long as short-term DAU growth stabilizes, the current opportunity outweighs the risks.

II. Is Thanos the Only Threat? Meta Joins the Battle

While Applovin initially started as a company with numerous lightweight games, it had gradually divested its gaming business by the end of 2024 to focus on advertising. Therefore, Genie's impact on game production should not directly affect Applovin. So why did Applovin also plummet by 17% on that day?

Dolphin Research believes that Applovin's decline may stem from concerns that Genie can automatically generate game ads, allowing Google to capitalize by directing game ad budgets within its ecosystem and ad alliance network. Additionally, there are fears that lightweight games generated by Genie could devalue Applovin's existing game ad inventory. Furthermore, Meta's recent advertising moves have further fueled panic.

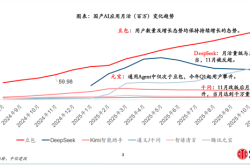

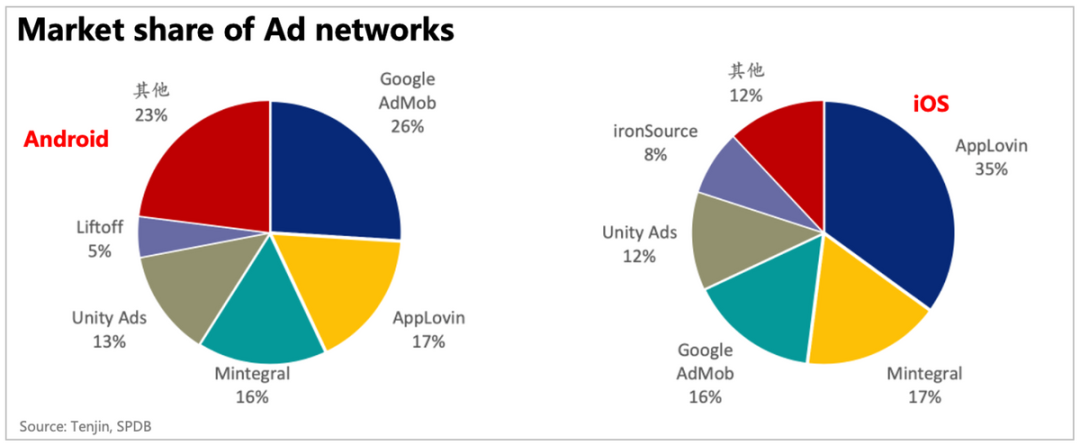

According to a survey of app publishers by TickerTrends, Meta significantly increased its effective cost per thousand impressions (eCPM) bids and quote density for in-app iOS ads in late January this year, expected to drive a 3-5 times revenue increase for third-party app publishers.

Besides the possibility of Meta spending its own money to capture market share, it is more likely that the 'high eCPM' and 'increased quote density' are results of advertisers' recognition of the current return on investment (ROI) of Meta Audience Network. So why did Meta suddenly make this change?

In 2021, with the implementation of Apple's Identifier for Advertisers (IDFA), Meta experienced a decline in ad ROI for users who did not authorize IDFA, leading to continuously suppressed eCPM bids. Eventually, considering profit margins, Meta proactively reduced in-app iOS ad placements for users who did not authorize IDFA. During this period, Applovin surged to dominate the in-app iOS ad market with its AXON technology.

With Meta's AI ad system, Advantage+, it likely achieved precise predictions for 'unauthorized traffic'—combining user behavior on Facebook (FB)/Instagram (IG) with compliant user information (app category, time, geolocation, device model) to predict the likelihood of conversion after a given ad impression through AI models.

Meanwhile, due to its massive capital expenditure (CapEx) investments, whether driven by considerations of its own cash flow or a desire to offset market dissatisfaction with its heavy spending through high revenue growth in the secondary market, Meta is visibly eager to boost monetization (whether by increasing ad load or accelerating the commercialization of Threads and WhatsApp). From this perspective, Meta's move into in-app iOS advertising becomes understandable.

For Applovin, not only is its growing e-commerce advertising business affected, but it now faces a strong competitor in its core gaming ad sector. The stage is set for a direct clash between the two companies' ad models.

While major players typically possess robust large model capabilities, and Meta's vast user data provides a unique advantage for model evolution, Dolphin Research believes Applovin remains competitive. The core reason lies in its initial model training data, derived from nearly comprehensive user data of its first-party (1P) game players and partner developers via Adjust, giving it a natural advantage in recommendation accuracy.

However, Meta's monetization pressure also indicates its serious return to the iOS in-app ad market. Even if it offers some subsidies to attract app publishers and replenish its high-quality ad inventory, it can still exert competitive pressure on Applovin.

Neither Genie 3 nor Meta's changes are expected to significantly impact Applovin's Q4 performance (current consensus expects ad revenue growth of 60%/45% for Q4/Q1, with a current valuation of 25 times EV/EBITDA. Compared to short-to-medium-term revenue growth, the price-to-earnings growth (PEG) ratio is notably low. However, compared to Genie's economic issues, Meta's current moves will directly compress potential rebound space). We recommend paying attention to Applovin's upcoming earnings report to see how management views this issue and its outlook for Q1 and the full year of 2026.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Reproduction requires explicit authorization.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, catering to users of Dolphin Research and its affiliated institutions for general reading and data reference. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any investment decisions made using or referencing the content or information in this report are at the investor's own risk. Dolphin Research shall not be held liable for any direct or indirect responsibilities or losses that may arise from using the data in this report. The information and data in this report are based on publicly available sources and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the information and data.

The information or opinions expressed in this report shall not, under any jurisdiction, be regarded as or considered an offer to sell securities or an invitation to buy or sell securities, nor shall it constitute advice, inquiries, or recommendations regarding relevant securities or related financial instruments. The information, tools, and materials in this report are not intended for or proposed for distribution to jurisdictions where distribution, publication, provision, or use of such information, tools, and materials contradicts applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliates would be required to comply with any registration or licensing requirements.

This report merely reflects the personal views, insights, and analytical methods of the relevant authors and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without prior written consent from Dolphin Research, no institution or individual may (i) produce, copy, duplicate, reproduce, forward, or create any form of copies or replicas in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all relevant rights.