Flowers Wither Quickly: Unraveling the Sales Enigma of Domestic SUVs Priced Between 200,000-250,000 Yuan

![]() 02/03 2026

02/03 2026

![]() 544

544

The concerted push by independent automotive brands into the 200,000-250,000 yuan price bracket has opened a window of opportunity for domestic SUVs to ascend to the mid-to-high-end market segment. Several models have captured market attention by capitalizing on their larger dimensions and feature-laden configurations to outshine their joint-venture counterparts, even achieving instant popularity upon their market debut. However, the market's scrutiny is relentless. With the exception of a select few, the majority have witnessed a precipitous decline in sales, with monthly figures plummeting to a thousand units or even a few hundred becoming the norm. Despite the incorporation of cutting-edge technologies like Huawei's intelligent driving systems, reversing this downward trajectory remains a formidable challenge. Why do domestic SUVs in the 200,000-250,000 yuan range struggle to break free from the cycle of fleeting popularity? This conundrum transcends mere product prowess; it is a comprehensive examination encompassing branding, supply chain management, and market strategies. It underscores the profound challenges independent brands encounter as they strive for upward mobility.

Severe Product Homogenization and Lack of Core Competitiveness

The thriving domestic SUV market within the 200,000-250,000 yuan price range is, in essence, a fierce competition centered on feature accumulation. Within this price bracket, independent brands have largely reached a consensus: to outmaneuver joint-venture competitors through larger body sizes, fully equipped intelligent cockpits, and an abundance of driving assistance features. Consequently, consumers can now find mid-to-large SUVs with wheelbases exceeding 3 meters, standard liquid crystal displays, L2+-level intelligent driving systems, and even some models boasting lidar and air suspension as standard equipment. The allure of their configuration lists leaves joint-venture models in the same price range trailing far behind. However, this feature-centric approach to product development has plunged the market into severe homogenization, causing products to lose their true core competitiveness.

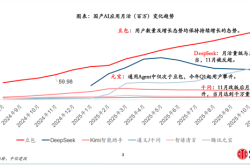

When 'Huawei Intelligent Driving' and 'HarmonyOS Cockpit' become ubiquitous labels across numerous models, and when plug-in hybrid, extended-range, and pure electric powertrains become standard fare, consumers often find themselves at a crossroads when faced with multiple options, struggling to identify truly differentiating features that resonate with them. Models like the Trumpchi Envision S9 and Seres S09, both equipped with Huawei's Qiankun Intelligent Driving System and comparable in terms of configuration, still grapple with poor sales. The root cause lies in equating technological advancements with core product competitiveness while neglecting the cultivation of unique brand and product identities. The failure of the Seres G318 is even more illustrative. Attempting to strike a balance between off-road capability and family comfort, it ended up in an awkward position of being 'neither rugged enough for off-roading nor comfortable enough for family use.' Its ambiguous product positioning led to a lukewarm reception from both off-road enthusiasts and family users. Despite initial orders exceeding 10,000 units, it ultimately fell to monthly sales of less than 500 units.

More alarmingly, some independent brands have succumbed to the trap of 'prioritizing parameters over experience' in their quest for feature accumulation. Many models boast ultra-high combined range and powerful performance metrics but suffer from high fuel consumption and poor ride smoothness in actual driving conditions. Some intelligent driving systems claim a rich array of functions but fall short in accuracy and operational fluency during real-world use. Others feature seemingly high-end interior materials but are plagued by flaws in detail craftsmanship and ergonomic design. This disconnect between 'paper prowess' and actual experience dashes consumer expectations and undermines the foundation for word-of-mouth promotion. Moreover, the lack of core technology makes it difficult for most models to establish genuine barriers. While Tank SUVs have solidified their position in the off-road market with their self-developed Hi4-T platform and Fangchengbao relies on DMO+Yunchan P technology, most brands are still engaged in technological patchwork, lacking original powertrain architectures and chassis tuning systems. Ultimately, they are left struggling in the quagmire of feature competition.

Simultaneously, product quality control issues have emerged as a significant bottleneck restricting sustained sales growth. Problems such as infotainment system failures, malfunctioning reverse cameras, and abnormal part noises frequently plague various domestic SUVs priced between 200,000-250,000 yuan. In today's era of highly developed social media, the spread of negative word-of-mouth far exceeds imagination. Once a model experiences concentrated quality control issues, it swiftly impacts consumer purchasing decisions. If the brand fails to provide timely and effective solutions, a vicious cycle of negative reputation ensues, plunging sales into a continuous decline. The Seres brand, having accumulated losses exceeding 7.7 billion yuan over three years, cites quality control issues with several of its models as a major contributing factor. This underscores the critical importance of quality control for sustained product popularity.

Intense Internal and External Competition, Insufficient Brand Premium to Sustain

The sales dilemma of domestic SUVs in the 200,000-250,000 yuan range stems not only from product-related issues but also from fierce market competition. This price bracket has transformed from a blue ocean for independent brands into a red ocean besieged by both domestic and foreign competitors. Independent brands must contend with intense internal rivalry while facing price reductions and technological upgrades from joint-venture brands. Their weak brand premium capabilities further exacerbate their struggles in this competitive landscape.

Internal competition among independent brands has reached a fever pitch. Traditional automakers' new brands and new energy vehicle startups are all vying for a share of the 200,000-250,000 yuan market, leading to an explosive growth in the number of models available. Consumers now have an increasingly diverse range of choices. From a powertrain perspective, pure electric, plug-in hybrid, and extended-range models each occupy a niche. From a model positioning standpoint, mid-size, mid-to-large, and large six-seater SUVs are readily available. This dense product layout has intensified competition among brands. To capture market share, price reductions have become the norm. Some models initiate official price cuts shortly after launch, with reductions reaching 30,000-40,000 yuan. While this may boost sales in the short term, it disrupts the brand's pricing system and harms the interests of early buyers, triggering a brand trust crisis. The Feifan R7, which dropped from an initial price of over 300,000 yuan to a starting price of 159,900 yuan, may have enhanced its cost-performance ratio, but it severely questioned the brand's residual value, ultimately trapping itself in a 'price reduction fails to boost sales' predicament.

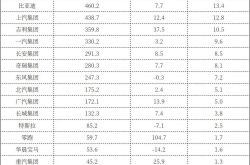

The counterattack from joint-venture brands has further intensified market pressure on domestic SUVs in the 200,000-250,000 yuan range. Previously, joint-venture SUVs like the Toyota Highlander, Honda CR-V, and Volkswagen Talagon dominated the mainstream market in this price bracket. Facing the onslaught from independent brands, joint-venture brands have begun to lower their stance. On one hand, they have reduced terminal prices, causing the entry-level prices of joint-venture SUVs to continuously decline. On the other hand, they have accelerated their new energy transformation, collaborating with technology companies like Huawei and Momenta to enhance intelligent cockpits and advanced intelligent driving systems, addressing their shortcomings in the intelligentization domain. Leveraging their years of accumulated brand reputation, mature supply chain systems, and stable product quality control, joint-venture brands have erected a formidable barrier for independent brands. When joint-venture SUVs approach domestic SUVs in terms of price and continuously catch up in terms of intelligence, the configuration advantages that independent brands excel in cease to be unique selling points, and consumers begin to re-evaluate their choices.

More importantly, independent brands generally face a deficiency in brand premium capabilities within the 200,000-250,000 yuan price range. Establishing brand premium requires long-term market accumulation, a clear brand positioning, and consistent value delivery. However, most independent brands are still in the early stages of their mid-to-high-end transformation, with brand recognition and reputation yet to be firmly established. When purchasing a vehicle within the 200,000-250,000 yuan budget, consumers consider not only product strength but also brand image, residual value, and after-sales service. In these aspects, independent brands still lag significantly behind joint-venture brands. The Exeed LX C-DM, priced between 209,900-233,900 yuan, embodies Chery's ambition to penetrate the high-end new energy market. However, due to insufficient brand recognition, consumers generally perceive its price as too high, resulting in long-term monthly sales hovering in the triple digits and struggling to gain market traction. Even the Xiaomi YU7, which has performed well in sales, faces consumer doubts about the reliability of 'new energy vehicle startups' due to its internet-centric brand attributes, and the sustainability of its sales remains to be seen over time.

Furthermore, feedback from the used car market further confirms the deficiency in brand premium for domestic SUVs. Domestic SUVs in the 200,000-250,000 yuan range generally exhibit low residual values in the used car market, far below those of joint-venture SUVs in the same price bracket. This discourages many consumers from making a purchase. For consumers of mid-to-high-end models, residual value is a crucial consideration. The low residual values of independent brands not only reflect market concerns about product quality but also indicate a lack of brand value, becoming a significant factor restricting the sustained popularity of domestic SUVs.

Public Opinion on Vehicles

The current situation of domestic SUVs in the 200,000-250,000 yuan range struggling to maintain sustained popularity represents a growth pain that independent brands must confront during their upward trajectory. This dilemma arises not only from product-level issues such as homogenization, lack of core technology, and quality control shortcomings but also from market-level challenges including intense internal and external competition and insufficient brand premium. However, this does not imply that the mid-to-high-end path for independent brands is unviable. The success of models like the Xiaomi YU7, Geely Galaxy M9, and Leading Ideal L60 proves that as long as domestic SUVs possess precise product positioning, exceptional product experiences, and distinct brand characteristics, they can still establish a firm foothold in this price range.

To break free from the cycle of fleeting popularity, independent brands must transcend the feature-stacking mindset, delve deeper into core technology research and development, and cultivate differentiated product competitiveness. Simultaneously, they must focus on building their brands through clear positioning, high-quality service, and long-term reputation accumulation to enhance their brand premium capabilities. Only by doing so can domestic SUVs in the 200,000-250,000 yuan range truly transition from 'fleeting blossoms' to 'enduring prosperity,' enabling independent brands to tread a more stable and distant path in their mid-to-high-end transformation.