A 'Great Reversal' at the Start of the Year: Xiaomi Overtakes Leapmotor, NIO Nearly Catches Up with Li Auto, New Energy Vehicle Sales Plummet Month-on-Month in January

![]() 02/03 2026

02/03 2026

![]() 319

319

The Cold Snap Continues

Author: Wang Lei | Editor: Qin Zhangyong

No surprise, 2026 began with a harsh blow to automakers.

Judging by the first sales reports of the year, market coldness exceeded expectations. While many reported year-on-year growth, the primary reason was the exceptionally low base in January of the previous year. Month-on-month declines from December of the previous year were severe, nearing a 'halving' effect. Not a single new energy vehicle brand achieved both year-on-year and month-on-month growth.

Automakers' January performance directly impacted their stock prices. On February 2, the Hong Kong stock market saw widespread declines, with some automakers' shares plummeting over 10%, creating a sea of green.

Of course, rather than focusing on post-surge declines, attention should shift to more normalized fundamentals. In January this year, several automakers still achieved over 20% year-on-year growth, revealing increasingly distinct market segments.

For instance, Xiaomi, Leapmotor, Seres, and NIO all saw over 20% year-on-year growth. Conversely, Li Auto and XPeng experienced varying degrees of decline due to product transitions and market conditions.

This signals another round of reshuffling, with 'rising stars' taking center stage. AITO topped the charts with 40,016 deliveries, the only automaker exceeding 40,000 units in January.

Xiaomi followed closely with over 39,000 deliveries, surpassing Leapmotor to rank second among new energy players. Leapmotor came in third with 32,059 deliveries, while 'NIO, Li Auto, and XPeng' fell to the 'second tier,' none exceeding 30,000 monthly deliveries.

With a 'dismal start' now widely acknowledged, a new elimination round begins, and the 'cutoff line' looms.

01

The Cold Snap Continues

In fact, once the year-end sales surge faded, the ensuing cold snap became predictable.

On one hand, end-of-2025 measures like purchase tax subsidies and cash incentives pre-emptively exhausted some demand. Entering 2026, consumers adopted a wait-and-see attitude during policy transitions, further dampening sales.

Starting January 1, 2026, the new energy vehicle purchase tax policy shifted from full exemption to a 50% reduction, adding thousands of yuan to vehicle costs. Additionally, trade-in details remained unreleased in some provinces, a critical factor for price-sensitive markets, placing sales under pressure.

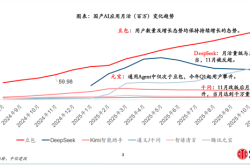

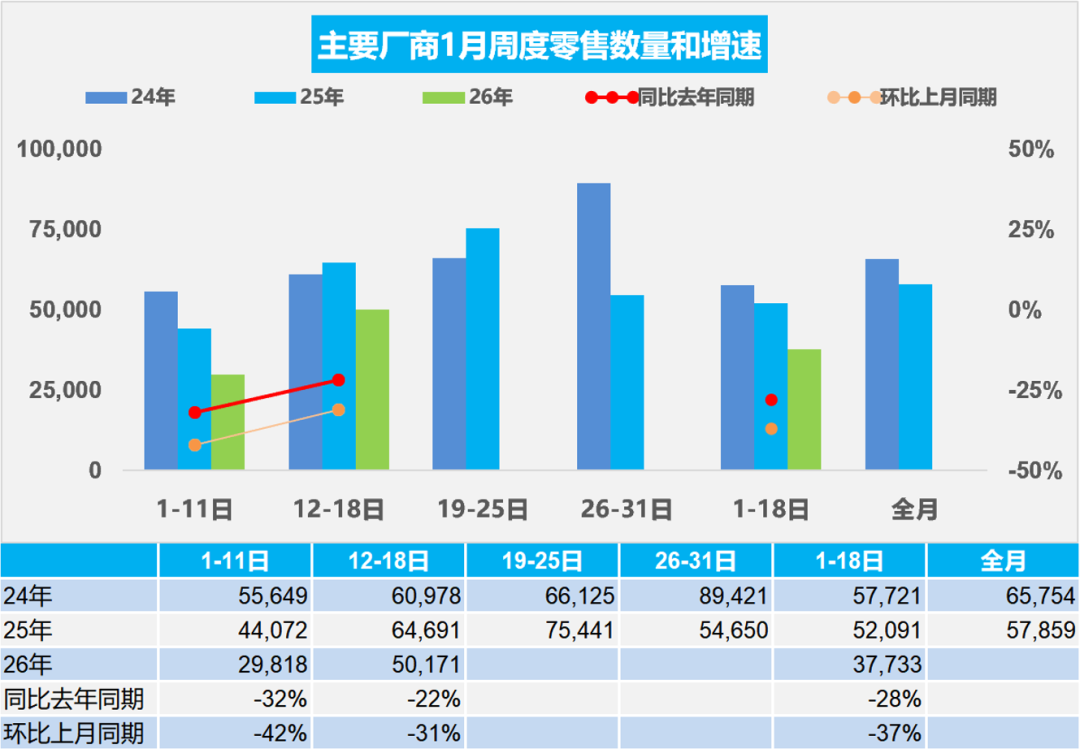

Data from the China Passenger Car Association showed that from January 1 to 18, 2026, nationwide passenger car retail sales reached 679,000 units, down 28% year-on-year and 37% month-on-month. The new energy passenger car market saw a 16% year-on-year decline and a steep 52% month-on-month drop. Manufacturer wholesale volumes stood at 740,000 units, down 35% year-on-year and 30% month-on-month.

Such broad declines indicate that month-on-month slippage in January was inevitable.

However, do not assume relief once January passes.

The China Automobile Dealers Association issued a warning, stating in its latest 'China Automobile Dealer Inventory Alert Index Survey' that while a small car purchase (car buying) peak may emerge 1-2 weeks before the Spring Festival due to urgent needs and returning travelers, the extended holiday shortens effective sales periods. Additionally, the exodus to smaller cities significantly impacts foot traffic in larger urban centers, placing February's auto market under considerable downward pressure.

This suggests the auto market's cold snap may persist into February.

Amid the chill, automakers are ramping up efforts. BMW adjusted official pricing for 31 models at the year's start, with 24 seeing over 10% reductions and five exceeding 20%. FAW Toyota halved the starting price of its all-electric bZ3 sedan by 76,000 yuan, bringing joint-venture electric vehicle prices below 100,000 yuan.

To stimulate demand, a 'financial war' erupted early in the year. On January 6, Tesla introduced a seven-year ultra-low-interest financing plan for its Model 3/Y/YL variants.

Domestic brands quickly followed, with over ten automakers, including Xiaomi, Li Auto, XPeng, Geely, Dongfeng eπ, and NIO, extending loan terms from the traditional three years to seven years. Many also offered zero-interest financing for varying durations.

Some automakers unveiled financial plans for February 2026 alongside their January sales reports. For example, on February 1, 2026, NIO introduced a 'seven-year ultra-low-interest' financing scheme for its new ET5, ET5T, ES6, and EC6 models, as well as the L60 and L90 under its Ledo brand, and for its Firefly brand.

Others, like VOYAH, preemptively revealed their 2026 product roadmaps. At a recent media briefing, VOYAH announced four new models—'Three Kings and an Ace'—to capture potential buyers' attention amid market uncertainty.

Several automakers also began teasing facelifts or all-new product leaks, such as Xiaomi's upcoming SU7 and AITO's new M6 model.

Judging by these moves, an even fiercer competition than previous years is on the horizon.

02

Monthly Decline, Yearly Growth

The bleaker the market, the greater the fighting spirit. The Matthew effect becomes even more pronounced.

The new energy vehicle segment saw clear tier differentiation in January, with the 30,000-unit delivery threshold serving as a tier divider. AITO, Xiaomi, and Leapmotor maintained high delivery volumes above 30,000 units, while most new energy brands clustered between 10,000 and 30,000 units.

The 30,000-Unit Divide

AITO surprised by surpassing Leapmotor with over 40,000 deliveries, claiming January's new energy vehicle sales crown and becoming the only brand to exceed 40,000 units that month. While deliveries fell 31% month-on-month, they soared 83% year-on-year.

AITO's performance boosted Harmony Intelligent Mobility's January deliveries to 57,900 units, up 65.6% year-on-year but down 35% month-on-month. Clearly, AITO dominates Harmony's lineup, accounting for nearly 70% of its sales.

Excluding AITO's 40,016 monthly sales, the remaining 'Four Brands' totaled just 17,899 units, averaging under 4,500 per brand.

Xiaomi secured second place among new energy players with over 39,000 January deliveries. While this marked a sharp 22% month-on-month decline from December's over 50,000 units, it represented a staggering 95% year-on-year increase.

Lei Jun explained during a subsequent livestream that the decline stemmed from halting new orders for the initial SU7 model, with only scattered in-stock, display, and used vehicles available. Deliveries primarily focused on the Xiaomi YU7, meaning the over 39,000 figure relied almost entirely on one model.

'I consider this achievement remarkable,' Lei remarked.

Leapmotor fell from the top spot to third place, delivering 32,059 units. While this marked a 27% year-on-year increase, it represented a 46.9% month-on-month decline from December's 60,400 units.

Leapmotor's decline tied closely to subsidy policy adjustments. Its products predominantly target the 150,000-yuan-and-below market, making them highly sensitive to subsidy changes. However, the upcoming D19 launch after the Spring Festival and the subsequent MPV model D99 position Leapmotor to compete in the premium 300,000-yuan-plus segment.

NIO, Li Auto, and XPeng: 2026 Holds Promise

Amid intersecting factors, 'NIO, Li Auto, and XPeng' retreated to the second tier, with deliveries clustering around the 20,000-unit mark.

Li Auto delivered 27,668 units, ranking fourth among new energy players. However, it was one of only two brands experiencing both year-on-year and month-on-month declines, with deliveries falling 37% month-on-month and 8% year-on-year.

Li Auto attributed this to battery supply constraints, which delayed production ramp-ups for its all-electric SUV i6 and i8 models. In late January, some i6 pre-order holders received notices stating, 'Due to slower-than-expected core component production, some orders face delivery delays.'

Now, attention focuses on Li Auto's L-series facelift. Spy shots of the new L-series models have surfaced online, raising hopes that Li Auto can reclaim its peak performance through these updates.

NIO followed with 27,182 new vehicle deliveries, up 96.1% year-on-year but down 43% month-on-month.

The all-new NIO ES8 dominated deliveries, with 17,646 units accounting for 65% of the total. It also became the fastest pure electric three-row SUV to reach 60,000 units, achieving the milestone in 134 days.

In contrast, NIO's Ledo and Firefly brands faced greater sales pressure. Ledo sold 3,481 units in January, down 41% year-on-year and 62% month-on-month. Firefly sold 2,807 units, down 60% month-on-month.

To boost sales, NIO unveiled a February 2026 financing plan alongside its January sales report, offering seven-year ultra-low-interest financing for the new ET5, ET5T, ES6, and EC6 models, as well as the Ledo L60 and L90, and for the Firefly brand.

XPeng became the second new energy brand to experience both year-on-year and month-on-month declines, delivering 20,011 units, down 47% month-on-month and 34% year-on-year.

2026 marks XPeng's major extended-range electric vehicle (EREV) push. Last year, it officially adopted a 'pure electric + EREV' dual technology strategy. EREV models generally enjoy higher acceptance, and XPeng's EREVs feature differentiated advantages. The upcoming G01 EREV model is expected to become XPeng's new flagship, with subsequent growth anticipated.

Traditional Automakers: Leadership Shuffle

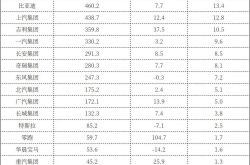

Among traditional automakers, January's top spot changed hands. Geely Auto Group delivered 270,000 units, achieving both year-on-year and month-on-month growth (the latter up 14%). Surpassing BYD's 210,000 units in January, Geely kicked off 2026 with a 'strong start,' claiming the domestic auto sales crown.

Focusing on the new energy sector, Geely sold 124,252 units. Its Galaxy brand contributed the most, with 82,990 units, followed by Zeekr at 23,700 units. Zeekr achieved a 99.7% year-on-year increase, though it saw a 21% month-on-month decline.

Geely views 2026 as a major product year. It plans to launch 1-2 all-new models each quarter, including several hybrid vehicles and next-generation methanol-hydrogen energy models, aiming for a full-year sales target of 3.45 million units.

BYD sold 210,000 new energy vehicles in January, down 30.11% year-on-year and 50.04% month-on-month from December's 420,000 units. Nonetheless, it retained its title as China's top-selling new energy vehicle brand.

Among them, the sales volume of passenger vehicles was approximately 205,500 units, a year-on-year decrease of 30.67%. The sales volume of pure electric vehicles was approximately 83,200 units, a year-on-year decrease of 33.60%. The sales volume of plug-in hybrid electric vehicles was approximately 122,300 units, a year-on-year decrease of 28.53%.

In terms of specific brands, the mainstays remained the Dynasty and Ocean series, with sales reaching 178,000 units. The best-performing single brand was Fangchengbao, with sales of 21,581 units. Although it showed year-on-year growth, there was a month-on-month decrease of 58%. Denza only contributed an incremental increase of 6,002 units.

However, it is worth mentioning that although the domestic market was affected by factors such as adjustments to purchase tax subsidies, BYD maintained high growth in overseas markets. In January, BYD's passenger vehicles and pickup trucks achieved overseas sales of 100,009 units, a year-on-year increase of 43.3%, accounting for 47.6% of BYD's total sales in January.

Chery still held the third position, with overall sales of 200,269 units in January, a month-on-month decrease of 18.2%. Among them, new energy vehicle sales were 52,131 units, and the group's exports reached 119,605 units, having exceeded 100,000 units in exports for nine consecutive months.

Several other traditional automakers also presented their respective achievements. GAC Group's overall sales in the first month of 2026 were 116,600 units, a year-on-year increase of 18.47%. Among them, sales of self-owned brands exceeded 49,000 units, a year-on-year increase of 87.58%. The integrated Hycan Aion BU achieved sales of 23,591 units in January, a year-on-year increase of 63.9% and a month-on-month decrease of 41.1%.

Great Wall Motors' sales in January were 90,312 units, a year-on-year increase of 11.6% and a month-on-month decrease of 27.2%. Among them, new energy vehicle sales were 18,029 units. Broken down by brand, Haval sales were 50,513 units, Tank sales were 14,505 units, WEY sales were 7,873 units, and Ora sales were 2,057 units.

It is worth mentioning that Dongfeng's VOYAH also maintained a scale of over 10,000 units, delivering 10,500 units in January, a year-on-year increase of 31.3% and a month-on-month decrease of 34%.

In this wave of cold snap at the beginning of the year, whether it was new forces or established self-owned automakers, the 'sales champions' changed hands simultaneously, which was absolutely rare in the past. When high growth is difficult to sustain and competition continues to intensify, 2026 will be a year of reshuffling and fluctuations, offering plenty to watch.