Abandoned Cars: From Unwanted to Highly Sought-After

![]() 02/03 2026

02/03 2026

![]() 353

353

A Budget-Friendly Option or a Deceptive Lure?

Models from brands such as HiPhi, WM Motor, Neta, and Jiyue have been dubbed "abandoned cars" following the collapse of their manufacturers. With after-sales service and maintenance becoming increasingly difficult to access, these vehicles have lost their appeal for many buyers.

However, the situation has shifted, and these once-ostracized "abandoned cars" are now drawing interest from specific consumer groups. The HiPhi X, originally priced at 730,000 yuan, can now be snapped up for 190,000 yuan. The Neta L, initially costing 149,900 yuan, is now available for a mere 74,000 yuan. Meanwhile, second-hand WM Motor EX5 models are being sold for approximately 40,000 yuan.

In social media forums dedicated to "bargain hunting for abandoned cars," some users share their car-buying experiences and impressions, while others proudly display their "dream cars" acquired at rock-bottom prices. Nevertheless, numerous owners also voice complaints about maintenance difficulties. "Investing 60,000-70,000 yuan in a Neta or Jiyue abandoned car for Didi driving can allow you to recoup the cost in just half a year." "Buying one for personal use and driving 100,000 kilometers makes it a worthwhile investment." For some second-hand car "prospectors," resale value takes a backseat to whether the core components are from reputable manufacturers and if the price is right.

Netizens Engage in "Abandoned Cars" Discussions on Social Media

Is purchasing a low-priced "abandoned car" a savvy financial move or a deceptive trap with hidden risks?

The Surprising Appeal of "Abandoned Cars"

"I could only afford it because HiPhi went bankrupt," remarked a netizen, who saw owning a former luxury brand, the HiPhi X, for less than 200,000 yuan as a way to "get more bang for your buck."

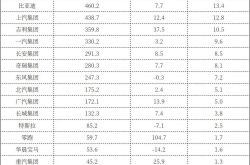

The resurgence of interest in "abandoned cars" is a unique phenomenon amidst the broader shakeout in China's new energy vehicle (NEV) industry. In recent years, the market has experienced rapid growth, with some automakers rising to prominence and then falling into bankruptcy within just a few years. At its peak, China's NEV market boasted over 400 brands, but now only around 40 remain. The products left behind by these bankrupt automakers have become unwanted "electronic orphans."

However, these "abandoned cars" are now attracting a wave of young bargain hunters in the second-hand car market. These young individuals, predominantly male, prioritize extreme cost-effectiveness and cutting-edge technologies, and are active in various related online communities. For these "prospectors," low prices are just one factor. They also pay close attention to whether the model has a solid foundation. "As long as key components like batteries don't fail, minor issues can mostly be resolved at local repair shops."

During the boom period of the NEV market, automakers vied for market share by "piling on features." Today, although some new-force automakers have collapsed, the suppliers of their core components remain industry leaders. For instance, CATL's battery cells and Qualcomm's chips have long been recognized for their quality and reliability. These same batteries and chips, when incorporated into new models from surviving brands, often come at a premium.

Image Source: HiPhi Official Website

Take the HiPhi X as an example. It is equipped with a CATL ternary lithium battery, providing a range of over 600 kilometers. It also features a Qualcomm Snapdragon 820A chip, supports various intelligent interaction functions, and boasts a unique "wing door" design. These configurations were top-of-the-line at the time and remain impressive today.

However, finding the desired "abandoned car" is no easy feat. Due to limited supply, many buyers have to endure the hassle of "searching nationwide and traveling across cities to pick up the vehicle." A consumer flew from Hainan to Shanghai to purchase a well-maintained WM Motor EX5, and even with the round-trip travel expenses and purchase price, it was still significantly cheaper than buying a new car with the same configuration.

According to data from the China Automobile Dealers Association, in 2025, China's used car transactions reached a record high of 20.108 million units, up 2.52% year-on-year, with a total transaction value of 1,289.79 billion yuan. Among them, used NEVs accounted for 1.6 million units, or 7.9% of the total used car transactions. However, there is currently no authoritative data or official statistics on the proportion of "abandoned cars" in the used car market, as they remain a niche segment.

Hidden Risks Behind the Low-Price Appeal

There's no such thing as a free lunch. Behind the allure of low prices lies a series of unresolved risks, including the cessation of after-sales service, vehicle connectivity issues, and potential "discriminatory" policies from mainstream insurance companies towards these models.

The first concern is the after-sales gap. Although the "Automobile Sales Management Regulations" mandate that automakers ensure at least 10 years of spare parts supply and after-sales service for discontinued models, this provision often goes unenforced due to a lack of effective supervision and penalties. After automakers collapse, vehicle connectivity issues and system updates becoming unavailable are common occurrences. Whether it's a minor part failure or a major battery replacement, owners may find themselves in a difficult position.

The second issue is insurance discrimination. Mainstream insurance companies are wary of these "abandoned" models, either raising premiums or limiting coverage, which increases the overall cost of ownership.

More importantly, there is the safety concern. The battery and electronic control systems of NEVs are critical for driving safety. Without professional maintenance from official after-sales services, the long-term stability of these vehicles is questionable. Cars are not just fast-moving consumer goods; they are significant purchases that relate to life safety. The temporary allure of low prices may conceal long-term safety hazards.

Of course, the market is spontaneously seeking solutions. Platforms like Tuhu and Tmall Car Care have ventured into the NEV repair sector, providing some relief to owners. However, due to a lack of technical support from automakers and original spare parts, third-party repair platforms may not be able to resolve all complex issues.

Some consumers also hold out hope that certain bankrupt automakers will resume operations, believing that the current low prices may rise in the future. Indeed, brands like WM Motor, HiPhi, and Neta have all hinted at potential "revivals." WM Motor, which filed for bankruptcy reorganization, updated its Weibo in November 2025 with the message "Good things are coming. Stay tuned," accompanied by an image saying "What you never forget will eventually come back to you." Previously, WM Motor even stated in its "Supplier White Paper" that it plans to produce 100,000 units next year, prepare for an IPO in 2027-2028, and challenge an annual production of 1 million units with a revenue of 120 billion yuan by 2029-2030. HiPhi announced intervention from Middle Eastern capital and is rumored to have started trial production of its models. Neta also issued a public announcement recruiting a management operation trustee, showing positive signs of "revival."

Zhu Huarong, Chairman of Changan Automobile, once predicted that 80% of Chinese automobile brands would face shutdowns, mergers, or restructuring. This prediction is not far-fetched. The shakeout in the NEV industry is far from over, and the story of "abandoned cars" may continue to unfold.

For young people, whether "abandoned cars" represent a bargain or a pitfall has no one-size-fits-all answer. They can be a cost-effective alternative when budgets are tight but may also become a troublesome liability. One thing is clear: the core of automobile consumption always revolves around safety and reliability. Faced with the allure of low prices, consumers should exercise more rationality, verify the vehicle's origin, check the condition of components, and assess maintenance channels before deciding whether to join this "bargain hunt." After all, the joy of a good deal should not be overshadowed by subsequent troubles.