Single Platform & SIM Card Facilitate Effortless Transition Between Cellular and Satellite Communications, Propelling 3GPP’s Satellite IoT Development

![]() 02/03 2026

02/03 2026

![]() 541

541

Recently, telecommunications giant Vodafone forged a partnership with satellite operator Skylo Technologies to jointly evaluate non-terrestrial network (NTN) narrowband IoT (NB-IoT) satellite connectivity services. By integrating their network cores, the collaboration enables customers to seamlessly transition between cellular networks and NTN satellite networks using a single Vodafone SIM card. With the advancement of low Earth orbit (LEO) satellite technology and expanding markets, satellite IoT has emerged as a key area of focus. The 3GPP consortium’s robust promotion has led to increased recognition and adoption of IoT NTN standards based on the 3GPP framework. Leveraging the existing 3GPP ecosystem, the ability for IoT devices to switch effortlessly between cellular and NTN networks via a single IoT SIM card offers significant advantages over proprietary solutions.

The Expanding Satellite IoT Ecosystem Within the 3GPP Camp

Industry analysis categorizes NTN into three technology-based types:

1. Proprietary Technologies: This category includes traditional satellite communication methods. For decades, satellite phones and satellite TV have relied on proprietary technologies, with most relevant satellite operators adopting these exclusive solutions. A prime example is Apple’s collaboration with Globalstar to provide emergency SOS satellite messaging on the iPhone 14.

2. Traditional 3GPP Technologies: Supporting 3GPP Release 16 and earlier versions, some terminal devices communicate directly with satellites through various methods without requiring hardware modifications. A notable case is the partnership between U.S. cloud operator T-Mobile and Starlink, which previously offered satellite direct connectivity for T-Mobile’s 4G mobile phone users without any device changes.

3. 3GPP Release 17/18 and Beyond: The NTN standards defined by 3GPP Release 17 and subsequent versions aim to enhance NTN performance, introduce new features, and support technological evolution. These standardized technologies, proposed by 3GPP specifically for satellite communications, include NR-NTN for mobile communications and IoT-NTN for IoT. Skylo is a leading representative in this category, providing IoT-NTN narrowband communication services compliant with 3GPP Release 17 specifications.

In recent years, substantial progress has been made in satellite IoT based on the third category of 3GPP standards. The Vodafone-Skylo collaboration mentioned earlier serves as a prime example. Vodafone manages over 220 million IoT devices across more than 180 countries, offering IoT solutions for global enterprises. Its network partnerships span over 760 networks worldwide, maximizing its global reach. Meanwhile, Skylo’s network covers 36 countries and 70 million square kilometers, supporting multiple satellite constellations and compatible with existing chips and modules. Their in-depth collaboration drives the deployment of satellite IoT within the 3GPP camp.

Recently, several major players have also been vigorously advancing 3GPP-based satellite IoT initiatives. For instance, OQ Technology has partnered with IoT virtual operator Eseye to integrate its S-band low Earth orbit satellite constellation with Eseye’s AnyNet connectivity platform, enabling IoT devices to seamlessly switch between satellite and cellular networks using a single SIM card. This solution, based on the 3GPP Release 17 standard, supports multi-radio access technologies for non-terrestrial networks, achieving uninterrupted 5G IoT connectivity across land, sea, and air.

Veteran satellite operator Iridium Communications has also recently initiated on-orbit testing for its NTN Direct low Earth orbit satellite service, expected to enter commercial operation in the second half of 2026. Targeting 3GPP cellular NB-IoT and direct-to-device application scenarios, the testing primarily focuses on NB-IoT functionality, utilizing new 5G waveform algorithms implemented on Iridium’s software-defined satellites, compliant with 3GPP NB-IoT standards. The service activates mobile terminal messaging capabilities for relevant modules through software updates, providing global coverage through 66 operational low Earth orbit satellites and coordinated L-band spectrum.

Whether through collaboration or independent efforts, players in the 3GPP camp’s satellite IoT ecosystem are increasingly focusing on standardized models. By leveraging existing IoT terminal and platform advantages, they aim to achieve seamless integration between terrestrial and satellite networks. These standardized solutions will provide cross-border seamless connectivity for industries such as asset tracking, energy services, environmental monitoring, and fleet management, enabling customers to continue using a single management platform for unified management of cellular and NTN connections.

2026: A Pivotal Year for Satellite IoT in the 3GPP Camp

The GSMA’s 2026 forecast specifically highlights satellite IoT, noting that a significant number of telecommunications operator-satellite partnerships emerged in 2025, particularly in the IoT sector. Looking ahead to 2026, satellite connectivity is expected to become standard for wearable devices. The Apple Watch Ultra 3 now offers emergency SOS services via satellite, while Qualcomm and Skylo have collaborated with Google to launch the Pixel Watch 4, featuring NB-IoT and NTN connectivity for emergency messaging. This direct-to-device (D2D) satellite communication model is becoming a standard feature in the wearable ecosystem.

Regarding the adoption of IoT-NTN in wearable devices, market research firm Counterpoint proposed in its report “Smartwatch NTN Tracking and Forecasting” that smartwatches are entering a new era of satellite connectivity and global coverage. It is estimated that by 2030, the proportion of smartwatches supporting satellite communications in total shipments will surge from 2% in Q3 2025 to 28%. Driven by the scalable and interoperable 3GPP IoT-NTN standard, growing consumer demand for security, reliability, and “always-on” communication is accelerating the adoption of satellite technology. Currently, satellite functionality is primarily available in high-end smartwatches priced above $500, but as IoT-NTN scales, this threshold will gradually decrease. Since IoT-NTN does not require additional hardware for cellular network versions of watches, OEMs may prioritize introducing this feature in high-end models. Over the past year, multiple smartwatch models have adopted satellite communication technologies, with a clear trend toward 3GPP camp technologies.

Based on this, the GSMA believes that OEMs and chip providers should develop D2D connectivity as a standard feature in wearable devices, as NTN functionality represents a potential differentiator in the consumer wearables market. Leading brands such as the Apple Watch and Pixel Watch have recently introduced such services, and this functionality will soon extend to other brands and categories of wearables (e.g., smart glasses, smart rings). Satellite and chip providers need to collaborate to achieve hardware support for multi-network and potentially multi-SIM technologies (e.g., eSIM, iSIM).

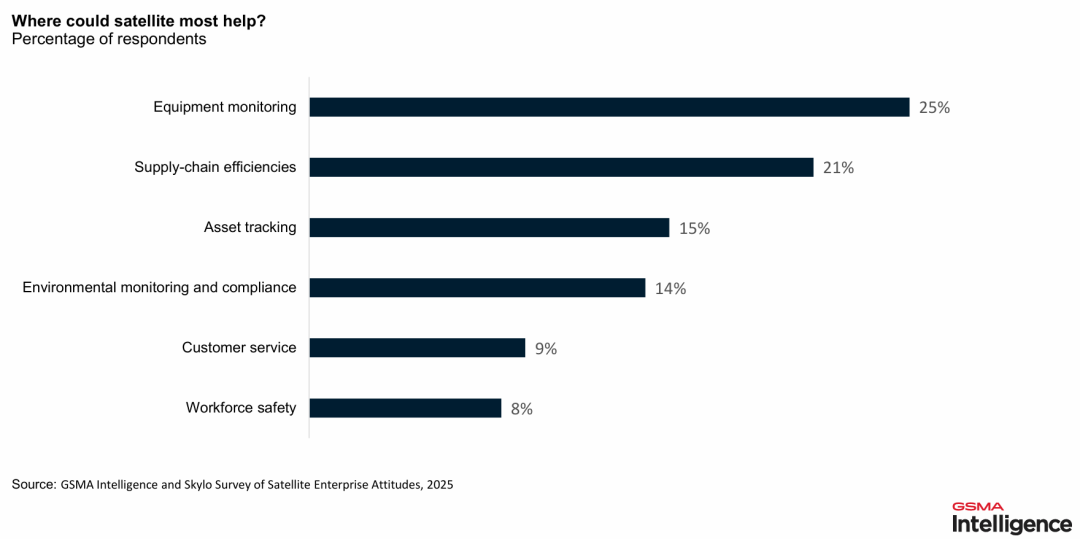

In the enterprise application sector of satellite IoT, the GSMA believes that commercial deployments are expected to surpass pilot programs and basic services such as remote sensing information and asset tracking. The next phase will target higher-value use cases, including automotive applications, satellite-cellular network switching, and advanced asset monitoring, extending to robotics and drones. According to a 2025 GSMA Intelligence survey, among enterprise demands for satellite IoT, device monitoring (25% of surveyed enterprises), supply chain efficiency (21%), and asset tracking (15%) were identified as the top target use cases. Naturally, among these use cases, IoT-NTN providers should also prioritize higher-value assets and services that can justify premium pricing and demonstrate measurable operational improvements.

Therefore, suppliers should focus more on solving enterprise problems as a competitive advantage. As the market grows, pricing pressure will intensify, and IoT-NTN suppliers should seek differentiated approaches rather than simply filling coverage gaps. Helping enterprises achieve tangible performance benefits should be the goal.

Gartner previously stated in a forecast report that spending on low Earth orbit satellite services is increasing year by year, becoming a core driver of satellite internet/IoT. Gartner predicts that the compound annual growth rate of global spending on satellite IoT communication services will be 27.2%, reaching $4.4 billion by 2029. This figure seems relatively modest compared to the current strong momentum of low Earth orbit satellite development. In this relatively limited service spending market, the competitiveness of the 3GPP camp, which can cost-effectively reuse existing resources, may become even more prominent.