2025 Mainstream Automaker Sales Review: Domestic Brands Lead, Joint Ventures Under Pressure

![]() 02/03 2026

02/03 2026

![]() 351

351

In 2025, China's auto market will continue its steady growth amid transformation, reaching new heights in production and sales while undergoing profound changes in market structure.

On January 14, 2026, the China Association of Automobile Manufacturers (CAAM) released the full-year 2025 automotive production and sales data, along with industry economic performance. The data shows that in 2025, China's domestic auto market will see production and sales both exceed 34 million vehicles, maintaining its global leadership for the 17th consecutive year, with the industry overall maintaining steady growth. Alongside the production and sales figures, the total sales (including commercial vehicles), NEV, and export rankings of domestic mainstream automakers in 2025 have also been finalized. Based on CAAM data, reporters from Auto Review have conducted a detailed analysis of the full-year sales performance of mainstream automakers.

Market Tiers Diverge, Resources Concentrate Toward Top Players

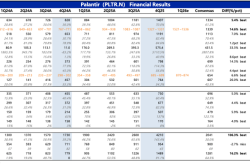

From the sales rankings, it is evident that China's domestic auto market in 2025 will present a clear three-tier structure, with top automakers firmly dominating the market. The combined market share of the top three automakers will reach 36.7%, nearly 40% of the total market, indicating an increasingly obvious trend of resource concentration toward leading players. Among them, BYD will top the list with 4.602 million units sold, up 7.7% year-on-year, achieving steady leadership with a 13.4% market share. Its full industry chain layout and comprehensive product matrix provide solid support for its steady sales growth.

SAIC Motor will follow closely with cumulative sales of 4.387 million units and a 12.8% market share, up 12.4% year-on-year. Leveraging its full-range product lineup and sustained efforts in overseas markets, it will maintain strong growth momentum, further solidifying its position among the industry's top players. Geely Auto will also shine, ranking third with 3.598 million units sold and a remarkable 37.5% year-on-year growth, demonstrating strong development vitality.

Among the second-tier automakers, FAW Group, Changan Group, Chery Group, Dongfeng Group, BAIC Group, GAC Group, and Great Wall Motor will form the backbone of China's auto market, with market shares ranging from 3.8% to 9.6% and a cumulative market share of nearly 50%. Among them, FAW Group will rank fourth in total sales with 3.302 million units, up 3.2% year-on-year, maintaining steady operations. Changan Group will sell 2.913 million units, up 8.5% year-on-year, outperforming the industry average. GAC Group will see a 13.9% year-on-year increase, becoming a bright spot in tier growth. Notably, Dongfeng Group will be the only company in this tier to experience a year-on-year decline, with annual sales of 2.473 million units, down slightly by 0.3%.

In the third tier, differentiated development is particularly evident. Leapmotor will emerge as the biggest dark horse, with annual sales of 597,000 units and a remarkable 104.7% year-on-year growth, capturing a 1.7% market share. The combination of high cost-performance products and full-domain self-developed technology will drive its scale breakthrough. XPENG Motors will also perform strongly, with annual sales of 429,000 units and a staggering 125.9% year-on-year surge, ranking first in growth momentum among all listed automakers.

Domestic Brands Fully Lead, Joint Ventures and Foreign Brands Generally Under Pressure

Combining the sales rankings and tier performance, it is clear that from sales data, year-on-year growth rates to market share distribution, all point to a core trend: In 2025, China's domestic auto market will see domestic brand automakers fully leading, while joint venture and foreign brands will generally face pressure.

This trend is not accidental but stems from the actual performance differences between domestic and joint venture/foreign brands, reflecting their divergent capabilities amid industry transformation. Domestic brands have continuously broken through with their first-mover advantages in new energy transformation, localized R&D, and full industry chain layout, while joint venture and foreign brands have gradually lost their market dominance due to lagging transformation and inadequate product adaptation.

Reporters have compiled public data and found that diversified operating groups such as SAIC Motor, FAW Group, Changan Group, and Dongfeng Group have seen a continuous increase in the proportion of their self-owned business sales, which has become the core support for group growth. Among them, SAIC Motor's self-owned brand sales will account for 65% of its total; Changan Group's self-owned brand sales will account for 85%; Dongfeng Group's self-owned brand sales will account for 63% of its total; FAW Group, although not surpassing its joint venture brands in sales, has seen steady progress in its self-owned sector. Specifically, in 2025, the Hongqi brand will sell over 460,000 units, up 11.7% year-on-year, achieving positive growth for eight consecutive years.

In contrast, Volkswagen, Ford, and Japanese brands will face overall pressure in 2025. Public data shows that in 2025, Volkswagen Group's cumulative sales in China will be 2.694 million units, down 8% year-on-year. Changan Ford's wholesale sales in China in 2025 will be 121,500 units, with retail sales at only 99,400 units, both halving from the 2024 base of 247,000 units. Nissan China will see sales decline for seven consecutive years, with cumulative sales of about 653,000 units in 2025, down 6.26% year-on-year. Honda's sales in China will be 645,300 units, down 24.28% year-on-year. Among the Japanese Big Three, only Toyota will achieve a slight 0.225% increase, maintaining its base with 1.78 million units sold, but its once-dominant hybrid technology is being gradually diluted by similar products from domestic automakers, with severely insufficient growth momentum. Luxury joint venture brands will also face growth challenges, with BMW Brilliance seeing sales of 536,000 units and a 14.2% year-on-year decline, becoming the company with the largest drop in the rankings, further reflecting the common issue of slow new energy transformation among joint venture brands.

Even top foreign brands will not be spared. Data shows that Tesla (China) will sell 852,000 units in the full year, down 7.1% year-on-year, marking its largest annual decline since entering the Chinese market. The core issues lie in lagging product iterations and inadequate localization adaptation. Additionally, its FSD advanced driver assistance system has not been officially commercialized in China, and the basic version's performance is poor due to weak adaptation to road scenarios, leading to a significant loss of users to local models such as the Xiaomi SU7.

Xu Haidong, Deputy Chief Engineer of the China Association of Automobile Manufacturers, previously stated in interviews that despite increasing competitive pressure between joint venture and domestic brands, with domestic brands steadily increasing their market share, joint venture brands still possess formidable comprehensive strength in technology accumulation, supply chain management, and brand influence. He emphasized that if joint venture brands want to reverse their declining trend in the future, they must actively adapt to China's market trends in new energy and intelligence, accelerating localized R&D and product iterations. Otherwise, their market share may face further shrinkage, and the industry's divergence will continue to intensify.

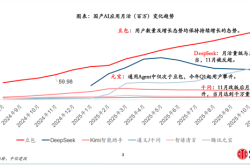

New Energy Vehicles Lead Growth, Market Landscape Renewed

From the segment rankings, the new energy vehicle market will show significant concentration among top players. BYD will top the list with a 27.9% market share, although its year-on-year growth rate will slow to 7.8%. Leveraging its full-range product coverage, it will firmly maintain market dominance. Leading domestic automakers such as Geely, SAIC Motor, and Changan will also see rapid growth in their new energy businesses, becoming another core driver of group sales growth. Meanwhile, Xiaomi and Li Auto, two automakers not mentioned earlier, will present vastly different development trends, becoming important variables in the 2025 new energy vehicle market.

Among them, Xiaomi Auto will become the biggest surprise in the new energy vehicle market, with sales of 414,000 units and a remarkable 387.9% year-on-year increase. As a new entrant from a cross-industry background, Xiaomi will quickly achieve scale breakthroughs with its precise product positioning, intelligent technology empowerment, and comprehensive channel layout. Its sales of 414,000 units will surpass those of established automakers such as Li Auto and Great Wall Motor, ranking among the top 12 in new energy vehicles. Its core advantage lies in meeting the needs of young consumer groups, bringing core configurations such as smart cockpits and advanced driver assistance systems to the mid-range market, forming a high cost-performance competitive barrier. Additionally, leveraging its existing ecological chain resources, it will achieve user retention and conversion, ranking first in growth momentum among all listed automakers and demonstrating strong market penetration capabilities.

In stark contrast to Xiaomi's explosive growth, Li Auto will sell 406,000 units in the full year, down 18.8% year-on-year, making it one of the few automakers in the top 15 to experience a year-on-year decline. The core reasons for the decline include lagging product iteration rhythms, with its existing extended-range electric vehicles facing fierce competition from similar products of domestic and joint venture brands, while its pure electric vehicle lineup was introduced relatively late, failing to promptly meet shifting market demands. Additionally, the growth of its focused mid-to-large SUV market has slowed, coupled with users' diversified choices in new energy vehicle powertrains, leading to market share dilution. Nevertheless, Li Auto will maintain a 2.5% market share with its precise positioning for family users, and the performance of its subsequent pure electric products may become key to reversing its declining trend.

Besides, BAIC New Energy will return to the mainstream track with sales of 393,000 units and a 55.1% year-on-year growth, achieving recovery through its battery swap model and public vehicle market layout. FAW's new energy business will grow by 29.2% year-on-year, with the Hongqi brand's new energy models becoming the main growth driver, further enhancing its self-owned high-end new energy vehicle matrix. Overall, the new energy vehicle market has transitioned from "wild growth" to "intensive cultivation," with technological innovation, product iterations, and user positioning becoming the core of automaker competition. Xiaomi's breakthrough and Li Auto's pressure also reflect the dynamic adjustments and intensifying competition in the new energy vehicle market landscape.

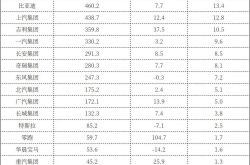

Exports Remain Strong, Global Layout Deepens

Notably, the advantage of domestic brands leading in the domestic market has successfully extended to overseas markets. CAAM data shows that in 2025, China's auto exports will reach 7.098 million units, up 21.1% year-on-year, setting a new historical high. Leading domestic automakers will drive the continuous rise of China's auto market share globally, with new energy vehicles also performing outstandingly, exporting 2.615 million units in the full year, up 103.7% year-on-year, achieving doubled growth. From a value perspective, China's auto exports have gradually shed their low-end label, with the average unit price increasing from about 100,000 yuan to 300,000 yuan over five years, achieving dual breakthroughs in scale and quality.

Specifically, Chery Group will continue to lead the export market, with annual exports of 1.344 million units, up 17.4% year-on-year, accounting for 18.9% of the national total. Leveraging its perfect overseas channels (well-established overseas channels), localized production bases, and a hybrid and pure electric product matrix tailored to different regional markets, it will form stable competitiveness in European, Southeast Asian, and South American markets. Its monthly performance will also remain robust, with December exports reaching 144,000 units, up 46.9% year-on-year, demonstrating strong resilience.

Chery Group stated that behind its "hardcore" performance lies the group's forward-looking layout (strategic layout , layout) and continuous deepening in strategic areas such as new fuel, new energy, and new overseas expansion. For example, the group adheres to "oil-electric synergy," creating a diverse product matrix that meets global user needs, launching flagship models such as the fifth-generation Tiger 8, providing gasoline vehicles with an "electric feel" and "intelligent experience." Additionally, while leading in export scale, the group is accelerating its entry into high-regulation markets, having successfully entered 15 European markets including the UK, Spain, and Italy.

BYD will export 1.054 million units in the full year, up 140% year-on-year, with particularly impressive growth. Leveraging its core advantages in new energy technology, it will deeply cultivate overseas markets, with several of its pure electric models gaining recognition from overseas consumers for their range and intelligent configurations. Its sales in European and Latin American markets will grow by 65% and 92% year-on-year, respectively, becoming a benchmark for global layout. SAIC Motor's export business will also progress steadily, with annual exports of 1.071 million units, up 3.1% year-on-year, ranking second in the industry. Among them, the MG brand will sell over 300,000 units in the European market, up nearly 30% year-on-year, forming a synergistic effect with the growth of its self-owned business in the domestic market, providing important support for the group's overall 12.4% year-on-year growth.

Other leading automakers will also achieve breakthroughs in their overseas layouts: Changan Auto will export 637,000 units in the full year, up 18.9% year-on-year, with its overseas market recognition continuously improving thanks to its advantage of selling over 1 million new energy vehicles. Great Wall Motor will export 506,000 units, up 11.68% year-on-year, with its pickup models performing outstandingly in exports, up 17.03% year-on-year, while the overseas penetration of its new energy models will accelerate. GAC Group's self-owned brand overseas sales will be nearly 130,000 units, up 47% year-on-year, becoming a new growth highlight for the group's self-owned business. Geely Auto will export 420,000 units, up 0.4% year-on-year, currently in a strategic adjustment phase, with significant growth potential to be expected in the future. Dongfeng Motor will export 295,000 units, up 20% year-on-year, with growth driven by the overseas launch of new brands such as Voyah and E-Pai, demonstrating a differentiated competition approach.

Currently, China's auto industry is entering a critical transformation period from scale leadership to quality and efficiency leadership. The export scale of 7.098 million units and the explosive growth of new energy vehicles fully confirm China's auto industry's upgrade from "product exports" to "technology exports" and "ecosystem exports." According to CAAM forecasts, China's auto export scale is expected to reach 7.4 million units in 2026, up 4.3% year-on-year, with some institutions optimistically predicting it may even impact (challenge) the 8 million unit mark. In the future, with the accelerated integration of electrification and intelligence, the global auto industry landscape is also expected to continue reshaping with the rise of Chinese brands.

Note: This article was first published in the "Industry Reports" column of the February 2026 issue of Auto Review magazine. Please stay tuned.

Image: From the Internet

Article: Auto Review

Layout: Auto Review