Has Xpeng succeeded in turning around by seizing the opportunity?

![]() 11/11 2024

11/11 2024

![]() 606

606

Under the trend, Xpeng is seen as having taken off successfully.

Drive an Xpeng to Mars, travel through time and space, and glimpse the future world.

Xpeng's AI-generated video conference, officially released by Xpeng, concluded the two-day Xpeng AI Technology Day.

On November 6, Xpeng AI Technology Day arrived as scheduled. This year's event was significantly different from previous years, not only because it was moved from October 24 (Programmers' Day) to November 6 but also because the venue was returned to He Xiaopeng's alma mater, South China University of Technology, giving it a sense of returning to one's hometown in triumph.

Judging from the performance of the securities and end markets, Xpeng achieved some success at this year's Technology Day.

Firstly, the content released at the Technology Day showed investors the future value of Xpeng. As of last Friday's close, Xpeng's share price surged 25% to $14.49 on the US stock market.

The newly launched P7+ car, which followed the Technology Day announcement, also received an overwhelming response. According to information released by Xpeng, the number of pre-orders has surpassed all previous records.

Riding the AI wave, Xpeng is soaring upwards.

Chasing Trends

At Xpeng's AI Technology Day, almost all content revolved around the topic of AI, and each segment focused on the hottest investment areas, representing industries that capital markets are chasing.

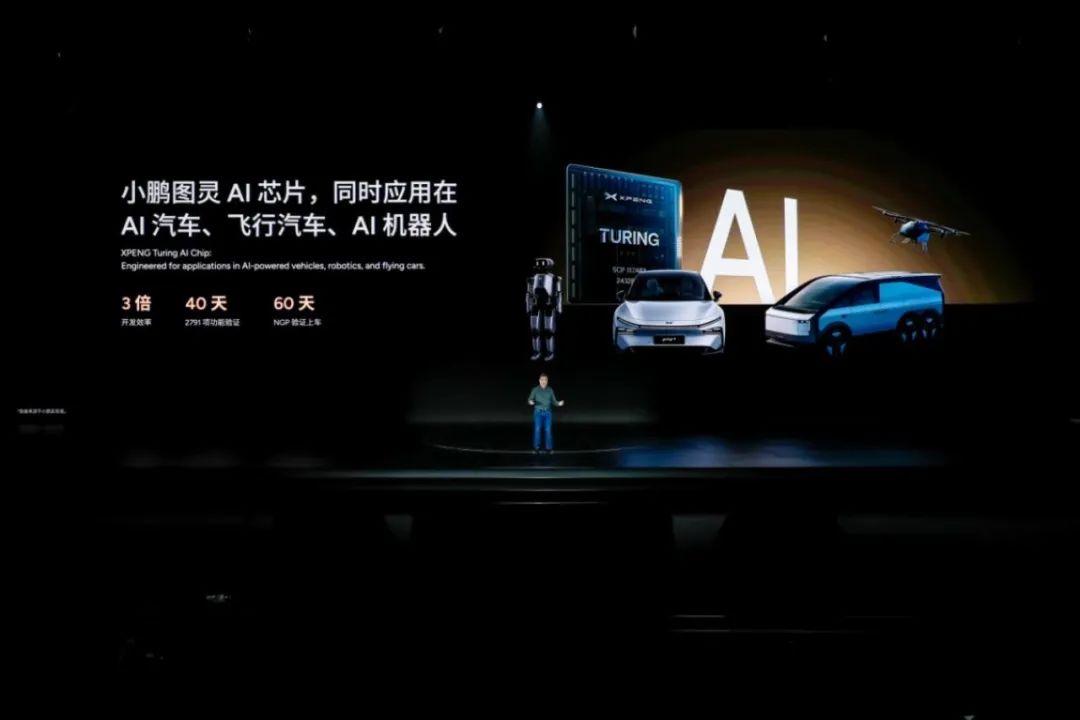

Specifically, Xpeng's AI system is divided into five major segments. The primary segment is Xpeng's automotive business, which, at this conference, was prefixed with AI, highlighting its role as Xpeng's main AI-related business. The flying car, a derivative of the automotive business, was also incorporated into Xpeng's AI system and became a separate major segment.

In addition to these two, the technical achievements presented at this year's Xpeng AI Technology Day included AI chips, AI robots, and an AI OS system akin to a soul, essentially encompassing all AI-related trending industries.

From an outside perspective, Xpeng's operations closely resemble those of Tesla, with the only significant difference being that Elon Musk focuses on sending humans into space, whereas He Xiaopeng aims to send humans into the sky.

Undeniably, these three segments are currently emerging industries highly regarded by capital. Among them, AI chips have contributed to NVIDIA's trillion-dollar market capitalization. In less than a year, NVIDIA's market capitalization surged from $1 trillion to $3.65 trillion, briefly making it the world's most valuable publicly traded company.

According to the presentation at the conference, Xpeng's first AI chip will offer triple the computing power of NVIDIA's current Orin chip, utilizing TSMC's 5nm process technology. It is poised to become the core chip for future AI vehicles, AI robots, and flying cars.

Behind the AI OS lies an AI cockpit based on a large model. Xpeng's Tianji AI OS deploys a large model with billions of parameters locally to enable more natural and seamless human-machine interaction.

This is also one of the biggest investment trends this year. Last year, the sudden popularity of ChatGPT introduced the world to OpenAI, a technology company that raised billions of dollars in just a few years as a startup. Following ChatGPT's success, the company's market valuation was estimated at $157 billion.

Xpeng aims to become China's OpenAI in the intelligent cockpit sector. As for how AI will transform current vehicles, He Xiaopeng provided a detailed description at the second P7+ launch event.

Finally, Xpeng didn't forget to mention another trending topic: AI robots, or embodied intelligent robots, a new term emerging from the intersection of artificial intelligence and robotics. This term has once again become a cutting-edge investment technology in recent months amid the AI wave.

According to data from the International Federation of Robotics (IFR), a prestigious organization, the global robotics market is projected to reach $23 billion by 2024 and is expected to grow at a rate of over 50% in the coming years. Related investments have also been expanding recently, with many startups securing hundreds of millions of dollars in funding.

In summary, Xpeng's AI Technology Day resembled a report session summarizing advanced technology research and development. Although everything was labeled as AI, it seemed more like a pursuit of capital trends, promoting whatever could attract investment.

Undercurrents

Amidst Xpeng's boasting about AI, bad news spread across the Taiwan Strait.

On November 8, multiple media outlets reported that TSMC had sent official emails to all its Chinese mainland AI chip customers, announcing that starting from November 11, it would suspend supply of all 7-nanometer (nm) and more advanced process chips to Chinese mainland AI/GPU customers.

For Xpeng, which had just concluded its AI Technology Day, this could be considered a severe blow. If Xpeng adopts a 7nm process, it might still find domestic alternatives. However, opting for a 5nm process is a gamble for Xpeng.

Unless Xpeng can amass an undisclosed amount of Kirin 9000 chips, like Huawei once did, and maintain a three-year supply, it faces uncertainty.

Of course, these are afterthoughts. Compared to the future, Xpeng's current focus is on the present. At the conference, He Xiaopeng apologized to car owners in a slightly sarcastic tone due to MONA production capacity issues but mainly conveyed to the outside world that Xpeng had not anticipated such high order volumes.

Similar issues arose with the P7+. According to netizens, Xpeng's servers crashed on the night of the launch. In response, He Xiaopeng posted two Weibo messages, which, while apologetic, still had a sarcastic tone.

Server issues are minor compared to the bigger question: Can Xpeng handle this "overwhelming sales volume"?

Capacity is currently the biggest constraint on the development of leading new energy enterprises. This year, several popular models, including Xiaomi's SU7, have faced long delivery times and delivery difficulties.

For example, Xiaomi, a newcomer to the automotive industry, had initially planned its factory capacity based on an output of 80,000 vehicles, and component suppliers had stocked up accordingly.

In contrast, Xpeng, possibly due to long-term low sales, had not received such large orders before, and the delivery volume of MONA M03 did not increase significantly over two months. Although it helped Xpeng return to monthly sales of 20,000 vehicles, as a 10-year-old automaker, Xpeng still faces numerous challenges in ramping up production capacity.

For comparison, on November 2, He Zhiqi, Executive Vice President of BYD, announced that the company had hired 200,000 people over three months from August to October, increasing production capacity by nearly 200,000 vehicles. All production bases are currently operating at full capacity.

He Xiaopeng recently tweeted that he would expand production capacity as soon as possible to deliver vehicles to users. The extent of this expansion will depend on Xpeng's confidence in itself.

A Technology Day revived Xpeng's stock price, and a new car launch reinvigorated the market. Can Xpeng continue to sail smoothly from here on out?

Having already experienced the harsh realities, Xpeng certainly does not want to return to the valley. The only option is to soar high on the wind and fly higher to go further.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.