Most people's perceptions are outdated regarding the US' suppression of electric vehicles

![]() 08/06 2024

08/06 2024

![]() 659

659

This article is based on public information and is solely intended for information exchange and does not constitute any investment advice

The significance of things lies beyond them. The repeated uncertainty among political parties regarding new energy policies reflects the depth of the US electric vehicle industry, which goes beyond electric vehicles themselves. To gain insight into this, let's start with a recent global sensation...

01 The Noisy "Trump Trade"

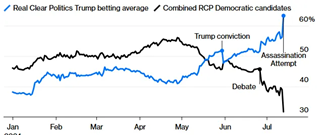

Election years are always exciting: epic assassination attempts and Biden's withdrawal have significantly increased Trump's chances of winning.

In Bloomberg's Real Clear Politics odds, Trump's "survival" has boosted his support, with his chances of victory once reaching 71%, while all possible Democratic candidates combined did not exceed 30%.

Apart from the humorous surge of Zhisheng Intelligent, Trump's policy platform has been scrutinized by astute investors hoping to capitalize on early trends and eat from the early bird's nest. Capital markets have shifted investment strategies around the "Trump Trade," moving from Biden-era leadership in energy, technology, and industrial stocks to steel, defense, and construction.

This early positioning is not exclusive to Trump.

Recall that Biden's Infrastructure Bill, Chip Act, and Inflation Reduction Act totaled $1.2 trillion in fiscal spending, driving a surge in demand for China-US new energy industries: from 2020-2021, LONGi Green Energy's share price rose from 12 yuan to 71 yuan, CATL from 58 yuan to 375 yuan, and Tesla from $28 to $414.

Trump's platform, on the other hand, advocates reversing restrictions on oil drilling, accelerating domestic shale oil extraction, reducing oil prices, and easing inflation: If oil prices fall under Trump's policies, oil and gas companies that have enjoyed a few good years will face the tough, low-price, long-cycle era before 2020 again.

Markets are trading two scenarios:

Firstly, increased US production leading to lower oil prices, and secondly, a US economic recession following waning fiscal stimulus. This "Trump Trade" is spreading among A-share oil and gas companies facing extreme liquidity scarcity:

Already overcrowded companies like CNOOC have seen their share prices drop by nearly 15% in half a month.

This trade implies the opposing energy philosophies of Trump and Biden: the former supports oil, while the latter opposes shale drilling.

But this is not the whole story.

02 Biden's "Closet" Oil and Gas Support

Does Biden support or oppose oil? Let's look at the data.

The US Energy Information Administration predicts that US domestic oil production will reach a record 12.9 million barrels per day by the end of 2024.

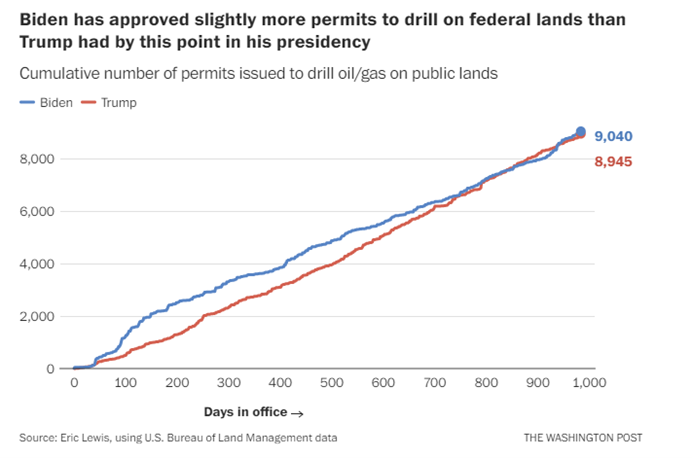

E&E News data analysis shows that in the first two years and seven months of Biden's presidency, the Bureau of Land Management approved more oil and gas leases on federal lands than during Trump's early presidency.

What about the promised energy transition and ban on new public land leasing during presidential debates?

The devil is in the details:

Upon taking office, Biden issued an executive order suspending new oil and gas drilling permits and requiring stricter environmental reviews. In April 2021, the government set a target to reduce greenhouse gas emissions by 50% to 52% from 2005 levels.

That summer, the government revoked the Keystone XL pipeline's key permit and blocked drilling permits in Alaska's Arctic National Wildlife Refuge.

Amidst these mostly symbolic actions, a neglected detail is that in 2021, many existing oil and gas land leases had idle capacity. After leasing the land, drilling did not occur. Most oil and gas companies sustained production increases through continued development in existing blocks.

Furthermore, many oil and gas land leases are on private land. In the low oil price year of 2021, few companies dared to lease new federal land.

Over the next four years, crude oil prices, especially US gasoline prices, surged primarily due to supply disruptions from the Russia-Ukraine war, nearly $2 trillion in US economic stimulus, and long-term capital expenditure cuts in the US refining industry, leading to supply shortages.

Almost every US oil and gas company profited handsomely during these four years, but both listed and private companies used their cash flows for dividends, buybacks, debt repayment, privatization, or carbon reduction projects. Significant capital expenditures were nearly non-existent.

This is a key reason behind Biden's high-profile criticism of major oil and gas companies for inaction when gasoline prices soared in 2022:

Biden is frustrated because policy-wise, he's been the most pro-oil president in US history:

In Biden's first three years, the top 10 listed US oil companies' net income totaled $313 billion, almost triple that during Trump's presidency. In 2023, US oil and gas production hit an all-time high.

If "energy independence" means exports exceeding imports, the US has exported more crude oil and petroleum products than it imported for 22 consecutive months, far longer than during Trump's presidency.

Biden issued more drilling permits than the Trump administration, including millions of acres of lease sales, such as 958,000 acres in Alaska and 73.4 million acres in the Gulf of Mexico.

In his first 1,000 days, Biden granted more public drilling permits than Trump. Brandon Rottinghaus, a political science professor at the University of Houston, said voters often perceive Democrats as tough on renewable and alternative energy but weak on fossil fuels. They also tend to think Republicans support oil and gas but oppose greener energies.

Moreover, Rottinghaus noted that voters rarely delve into policy details. If gasoline prices rise, they're likely to blame the president, even if it's beyond their control and drilling levels have risen.

In a Reuters report, the pro-decarbonization editor sarcastically titled an article "Biden's Oil Boom," highlighting policy inconsistencies.

03 A Good Son of Pennsylvania's Rust Belt

Biden unexpectedly defeated minorities like Kamala Harris in the 2020 Democratic primary, partly due to his "old white guy" image and Pennsylvania roots:

Born in Scranton, Pennsylvania, the second-largest shale gas producer in the US after Texas, Pennsylvania is one of the few swing states that can determine who enters the White House. Its electoral votes can swing the presidential election.

Leveraging his 50 years in the Senate and support for his home district, Biden reclaimed Pennsylvania: Trump won the state handily in 2016, but Biden narrowly reclaimed it this time.

Pennsylvanians and other Midwesterners trust Biden because his economic policies have never been driven by extreme ideologies over the past 50 years:

Drilling oil on public land generates revenue for the government. Local governments typically receive half the revenue. During Biden's presidency, the Gulf of Mexico lease sale in Texas generated 200 transactions totaling $64 million, the highest since 2014.

Faced with fast oil revenues, from federal to state levels, everyone talks the talk but walks the walk: After announcing the Gulf of Mexico lease sale, the Biden administration also announced significant protections allowing non-profit organizations to lease federal land for conservation.

The message is clear: if you want to protect nature, pay to lease and conserve it.

The harsh reality is that for the US federal government, states, and ordinary people, empty wallets and soaring gasoline prices hurt more than distant climate change.

Everyone plays the game of saying one thing and doing another, and seasoned Senator Biden excels at this game: first, gain power with a decarbonization platform, then use tangible policies to support Rust Belt constituents who understand each other's tactics.

04 The Unpredictable Trump

In contrast, Trump hasn't even listed energy as a top-five issue in this campaign because:

Firstly, there's limited room for Trump to outdo Biden's pro-US oil stance: Issues like the Keystone pipeline connecting Canada and Texas or Alaska wildlife refuge oil development are more political than economic. With Permian Basin shale oil dominating, Trump can hardly boost oil and gas production through any package.

In other words, the core concern behind slow US oil and gas production growth is uncertainty over debt repayment, inflation, and capital expenditure returns, purely economic considerations.

Secondly, globally, US oil companies have relentlessly expanded in the past four years: OPEC's production cuts have been offset by repeated US shale oil increases, reducing OPEC's ability to raise oil prices through Middle Eastern oil and gas cartels each year.

Over the past four years, through geopolitical alignment post-Russia-Ukraine war, the US has fully squeezed out oil and gas competitors like Russia from export markets, becoming a stable net oil and gas exporter. Trump's further economic sanctions on Iran and Venezuela would worsen oil supply, boosting US oil and gas revenues.

In this context, lower oil prices go against US interests, reducing oil and gas company and government revenues while making it harder to sustain US exports. As the architect of America First, Trump's policies and effects are unpredictable.

"It's hard to know what Trump's stance is: you never know if it will change daily," said Mary Landrieu, former US Democratic senator and now an oil and gas lobbyist. "The industry is caught between Trump and Biden."

05 Most People's Perceptions Are Outdated

An undeniable fact is that in the past 16 years, the US has had four presidents, with US oil production rising every four years. Each president, regardless of their pre-election climate change stance, ultimately claims credit for US fossil fuel achievements.

This underscores that the shale technology revolution's impact far exceeds any ruler's. Nearly 17 years after the shale revolution, its influence remains unrecognized by all. Overinterpreting Trump's oil and gas policies reflects outdated perceptions.