From "Redmi Car" to "Land Aircraft Carrier", has Xpeng gone crazy?

![]() 09/06 2024

09/06 2024

![]() 547

547

From the release of the mid-year report in 2024, to the explosion of MONA M03 orders, to the debut of the new electric vehicle "Land Aircraft Carrier", Xpeng has continued to receive positive news, and its share price has risen for multiple consecutive days, with a cumulative increase of nearly 20% in 10 trading days.

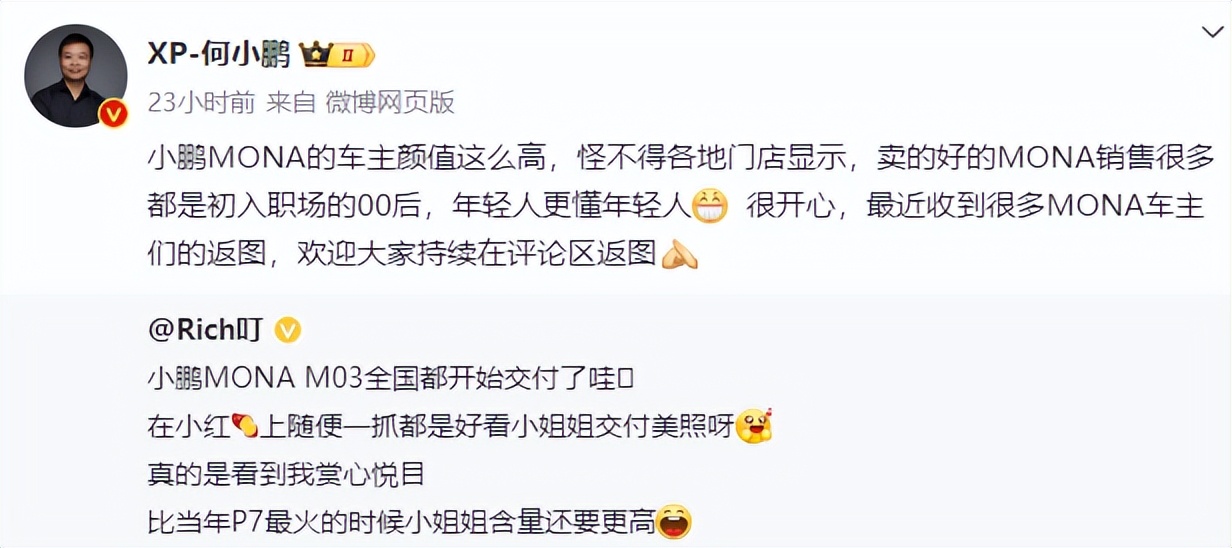

On the news front, on September 3, auto blogger Xiaolvski wrote that to celebrate the explosion of Xpeng's MONA M03 orders, He Xiaopeng personally delivered afternoon tea to employees. It is reported that Xpeng MONA M03 sold over 10,000 orders within 52 minutes of its launch and exceeded 30,000 orders within 48 hours.

And on the same day, Xpeng's ecological enterprise, Xpeng Huitian, conducted a public test flight of its split-body flying car, the "Land Aircraft Carrier." Xpeng Huitian stated that the "Land Aircraft Carrier" is scheduled to start pre-sales by the end of this year, with mass production and delivery expected in 2026 at a price below 2 million yuan.

On one hand, there are big sales of new cars, and on the other, there are major moves in the smart mobility ecosystem. Xpeng has once again ushered in its high-glory moment during this period.

Since last year, with the soaring sales of Lixiang and Seres, more and more people believe that the brand landscape of new-energy vehicle makers is being reshaped, with Lixiang and Seres as the top two brands. This view is reflected in the capital market, with Lixiang Auto's total market value exceeding 150 billion yuan and Seres' exceeding 110 billion yuan, while Xpeng's latest market value is 62 billion yuan.

Now, with both data and stories to support it, can Xpeng regain investors' favor and return to the first tier in the automotive and stock markets?

Did Xpeng create a "Redmi Car" to stage a comeback with cost-effectiveness?

As soon as the price of Xpeng MONA M03 was announced, many people said, "This is Xiaomi" or "Xpeng made it before Lei Jun made a 'Redmi Car.'"

At the press conference, after hearing the price, the crowd cheered, but Xiaomi's Chairman and CEO Lei Jun remained silent amidst the cheers.

Image source: 12 Cylinders Auto

The reason is simple: Xpeng MONA M03 has too many similarities to Xiaomi SU7:

1. Intelligent Driving

Since Xpeng officially launched the MONA brand at the Beijing Auto Show in April, "Intelligent Driving" has been its keyword. Xpeng MONA M03 is a smart pure electric hatchback coupe with over 20 intelligent sensing hardware as standard, boasting L2-level intelligent driving capabilities and full-scenario smart parking.

Xiaomi SU7 also has efficient sensing capabilities, including highway and city navigation assist, as well as valet parking functions. At the recent Chengdu Auto Show, Xiaomi mentioned that its highway/city navigation assist feature (NOA) has achieved nationwide coverage.

2. Younger customer base with a significant female presence.

According to CNMO Tech, Xpeng MONA M03 primarily attracts consumers aged 22 to 40. Among them, female customers have praised the Xinghan Rice color scheme of the Xpeng M03.

Image source: Weibo Web Version

Xiaomi SU7 is also popular among young female car owners due to its stylish design and sun protection features. Lei Jun mentioned in an internal Xiaomi sharing session that nearly 30% of Xiaomi SU7 owners are female, while the actual percentage of female drivers may be as high as 40% to 50%.

Unsurprisingly, both Xpeng MONA M03 and Xiaomi SU7 sold like hotcakes. Xiaomi SU7 received over 50,000 orders within 27 minutes of its launch, while Xpeng MONA M03 surpassed 10,000 orders within 52 minutes.

It's worth mentioning that MONA M03 is cheaper than SU7. Xiaomi SU7 is priced between 215,900 and 299,900 yuan, competing with models like NIOH S, Geely Yihe E8, and Zeekr 007. However, Xpeng has set its price below 150,000 yuan, accelerating into the automotive technology cost reduction cycle.

No wonder many people call it the "Redmi Car."

Xpeng's "all-in" move has hidden reasons

Xpeng's aggressive pricing strategy stems from its pressing need to catch up: it has gradually fallen behind in the new-energy vehicle sector.

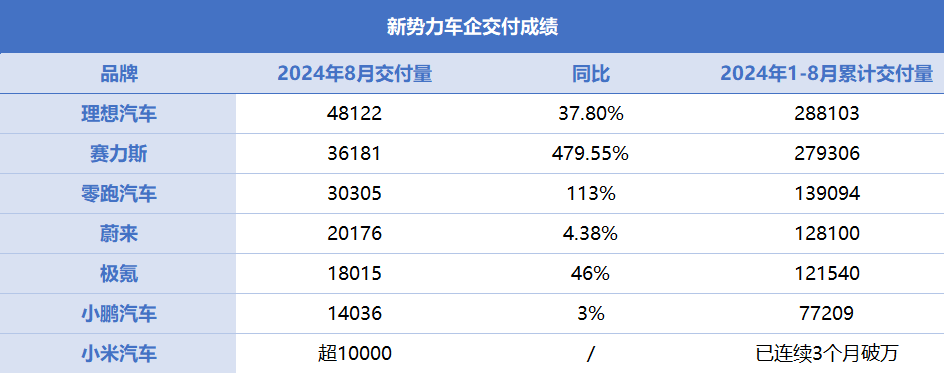

In terms of deliveries, Xpeng delivered a total of 77,209 new vehicles in the first eight months of this year, with an average monthly delivery below 10,000 units. Both its total deliveries and year-on-year growth have significantly lagged behind brands like Lixiang and Seres.

Therefore, MONA embodies Xpeng's hope for a turnaround, riding on its low pricing strategy.

Judging from the current situation, if the order lock-in rate for M03 remains high, Xpeng's annual report this year should bring another round of positive news to stimulate its share price.

The only concern is that Xpeng MONA M03 carries the label of Didi – MONA emerged from Didi's vehicle manufacturing project named "Da Vinci.""Didi sold its smart vehicle development assets to Xpeng in the form of additional shares, and there is a "sales bet" between the two parties. He Xiaopeng, Chairman of Xpeng, also stated that if Didi sells 100,000 vehicles in its travel system each year, it will generate additional consideration payments, with the highest transaction consideration potentially accounting for up to 5% of Xpeng's Class A ordinary shares after the completion of the transaction. This means that Xpeng MONA M03 is bound to appear in large numbers in the ride-hailing market.

If labeled as a ride-hailing vehicle, Guangqi Aion's experience of being dragged down by the ride-hailing image in C-end sales is likely to be repeated with MONA.

Therefore, it's too early to celebrate halfway through the game. Xpeng has a long way to go in managing its brand effectively in the future.

Will investors bite into the "pie" of flying cars?

While the future of MONA remains uncertain, Xpeng's current highlight is undoubtedly its flying cars.

Xpeng has repeatedly mentioned its aspiration to be an "explorer of future mobility." The two keywords for future mobility are "intelligent driving" and "mobility ecosystem." If MONA embodies Xpeng's ideal of exploring AI intelligent driving, flying cars represent one of the core scenarios for the mobility ecosystem.

Flying cars expand transportation from two-dimensional to three-dimensional, significantly enhancing traffic efficiency and promoting urban and rural logistics development.

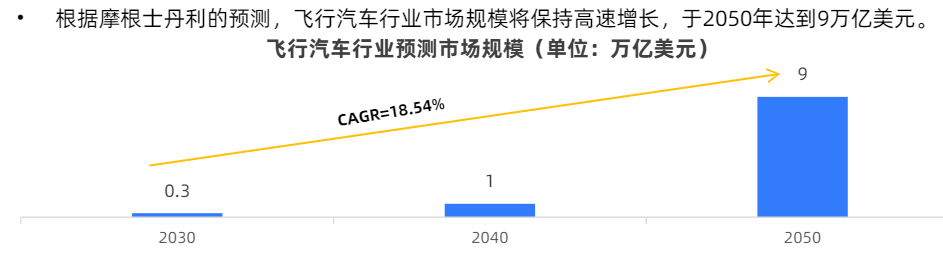

For automakers, this represents an emerging trillion-dollar blue ocean market. According to Morgan Stanley's forecast, the flying car industry is expected to maintain rapid growth, reaching a market size of $9 trillion by 2050. Currently, over 200 companies or institutions worldwide are developing flying car products.

Image source: Dongjian Research Report

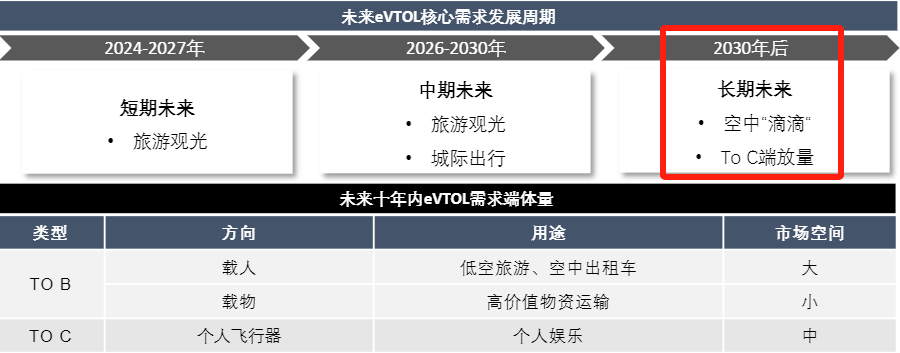

In China, this year marks a turning point for the development of flying cars. On one hand, the central government led the way with its top-level design, and "low-altitude economy" was included in the government work report for the first time, with local policies starting to take shape. On the other hand, the mainstream technology path for flying cars – eVTOL productization – is developing rapidly, with automakers like Geely and Xpeng accelerating commercialization.

Domestic eVTOL OEM players; Image source: Toubao Research Institute

According to the Hong Kong Stock Research Society, Xpeng Huitian, which launched the flying car "Land Aircraft Carrier," is an essential part of Xpeng's smart mobility ecosystem. According to Tianyancha, He Xiaopeng himself and Guangdong Xpeng Automobile Industry Holding Co., Ltd. hold 60.1% and 19.9% equity in Guangzhou Huitian Aerospace Technology Co., Ltd., respectively.

Image source: Tianyancha

It's worth mentioning that among the mainstream products currently available on the market, the "Land Aircraft Carrier" is the most suitable flying car form for automakers to leverage their vehicle manufacturing expertise and drive integration and development in related fields.

Image source: Toubao Research Institute

As a split-body flying car, this product consists of a flying module and a ground-based "mother ship." Compared to standalone eVTOL products, the "car" as a carrier offers numerous advantages. For example, the "mother ship" is a uniquely styled six-wheeled "MPV" that requires only a small vehicle driver's license to operate.

Meanwhile, the foldable flying module hidden in the trunk combines manned and unmanned technology routes, aligning with current passenger usage habits and psychological considerations, facilitating a gradual cultivation of user habits.

This also reveals Xpeng's differentiated perspective in entering the "low-altitude economy": Compared to unmanned B/G-end applications, Xpeng focuses on manned flight and application scenarios.

Image source: Xpeng Huitian's official website

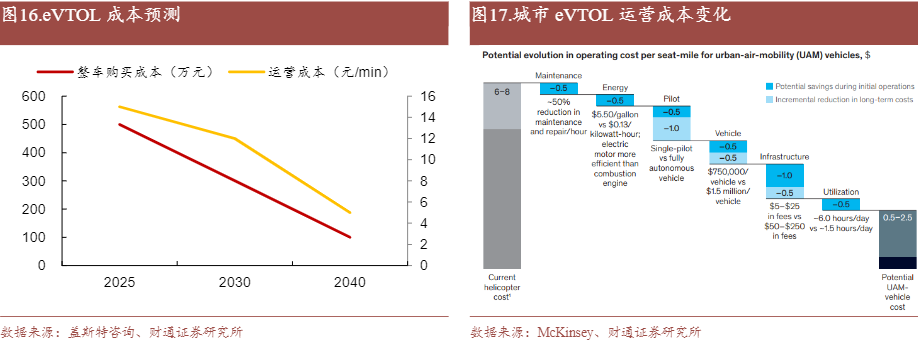

Currently, flying car applications are mainly focused on B-end scenarios such as aerial photography, surveying and mapping, inspection, and pesticide spraying due to the high commercial operation costs of manned flight. According to Gaster Consulting's forecast, the purchase cost of four-seat or more urban flying general aviation aircraft will reach up to 5 million yuan in 2025, with significant cost reduction potential but requiring a decade-long timeline. In terms of operating costs, Zhao Deli also mentioned that the current cost of flying cars is high, with a single flight hour costing 10,000 yuan.

Additionally, issues such as energy consumption and the difficulty of flying vehicle operation also constrain flying car manufacturers from entering the manned flight sector.

Therefore, a differentiated market positioning represents less competitive pressure but also implies more challenges. In response to various issues, Xpeng Huitian is navigating through obstacles: in terms of pricing strategy, Xpeng Huitian has set the product price below 2 million yuan; to address the short battery life of the first-generation flying module, Xpeng Huitian has contacted Seres Group, hoping they can develop an aviation range extender suitable for flying applications; regarding operation difficulty, Xpeng Huitian has abandoned the traditional "hands and feet" complex control method of flying vehicles, aiming to lower the learning threshold for users through a single-lever control system.

Clearly, selling flying cars is a long-term chapter in Xpeng's story as an "explorer of future mobility.""

Image source: Toubao Research Institute

It remains to be seen whether investors will wait for this "super pie" to materialize.

Conclusion

Xpeng's new car sales explosion coupled with share price growth has once again shifted the landscape of new-energy vehicle makers.

Amid the wave of intelligent revolution, smart mobility + low-altitude economy undoubtedly resonates with investors. According to the Shanghai Securities News, in the first half of this year, many renowned hundred-million-yuan private equity funds increased their investments in Hong Kong stocks. From an industry perspective, top private equity funds prefer the technology sector, with 39.13% of them most optimistic about the technology growth sector amidst the AI wave.

However, both MONA's connection with Didi and the long road to commercializing flying cars suggest uncertainties in Xpeng's turnaround efforts.

So, can Xpeng recreate another "Xpeng" and catch up with or even surpass its top competitors in terms of performance and market value? Let's wait and see.

Source: Hong Kong Stock Research Society