Meituan's First Quarter Report: Fierce Competition, But Meituan Remains Strong

![]() 06/12 2024

06/12 2024

![]() 727

727

Choosing to release the financial report on June 6th, Meituan must be psychologically prepared to "bring the world's attention to you." Either it comprehensively exceeds expectations, giving the market a big surprise, or if the performance is poor, it would be a mockery.

Certainly, Meituan's financial report did exceed expectations comprehensively, but the market's understanding of it was not all about pleasant surprises. Ultimately, in the storefront business, fierce competition from competitors has added some shadows to this report, preventing it from showing a fully positive trend. Meituan's competitive advantage remains, and its barriers are deep, but it still needs to continuously prove its capabilities to the market.

Summary:

As our core metric for measuring Meituan and also Meituan's most important moat, the number of instant delivery transactions increased by over 28% in the first quarter of this year, surpassing the year-on-year growth rate of 25.2% in 2023 Q4. Achieving such scale growth during the takeaway off-season spanning the Spring Festival in the first quarter is very impressive, proving the robustness of the company's moat.

The company's revenue exceeded expectations by 6% in the first quarter, benefiting from its comprehensive growth; adjusted net profit exceeded expectations by 25%, and the adjusted net profit margin increased by one percentage point year-on-year to 10.2%, benefiting from the significant reduction in losses in Meituan's new businesses. Overall, after the organizational restructuring, Meituan has unleashed considerable growth and profit potential. With such a reduction in losses from new businesses, it may achieve profitability in the second and third quarters.

A not-so-good sign is that the operating profit margin of the core local business segment declined by nearly five percentage points year-on-year to 17.7%, attributed to a significant increase in related business sales costs. Overall, the increase in sales costs is partly due to the substantial growth in order volume and partly related to the need to increase rider expenditures during the Spring Festival holiday. However, as market competition gradually intensifies, whether the operating profit margin of the local core business can recover in the second quarter remains questionable.

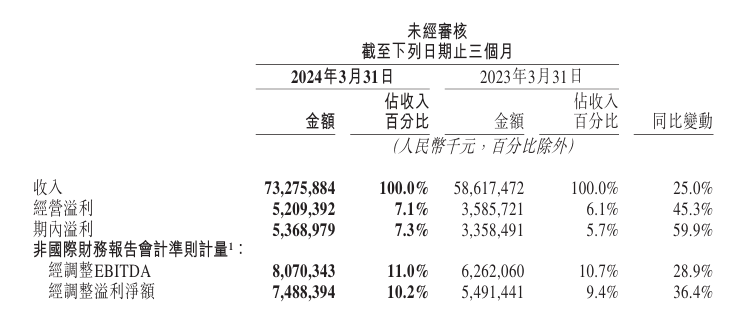

Overall, Meituan's financial report is impressive. In the first quarter of 2024, the company's revenue reached 73.28 billion yuan, a year-on-year increase of 25%, and net profit reached 5.37 billion yuan, a year-on-year increase of 45.3%. Adjusted net profit was 7.49 billion yuan, a year-on-year increase of 36.4%. All core financial data achieved double-digit growth, representing a very impressive performance.

Source: Meituan 2024 Q1 Financial Report

After carefully analyzing this financial report, we found that Meituan's moat is still quite robust. The core number of instant delivery transactions reached 5.46 billion in the first quarter, representing a year-on-year increase of 28.1%. In the management's elaboration of this part of the business, both the core takeaway business and Meituan's flash purchase service, which offers "everything delivered to your home," achieved good growth in the first quarter.

Here, we need to highlight Meituan's flash purchase service. The ultimate goal of the takeaway business is to "buy anything," a concept proposed by Meituan in 2022. It will not be limited to food alone but will extend to all aspects of retail. This concept has been continuously proven in Meituan's performance in recent quarters, and the continuous expansion of instant retail transactions is the best embodiment. It meets consumers' fragmented and impromptu needs, and currently, no competitors are visible in the market.

This is also where we understand Meituan's moat to be. No matter which content platform wants to enter, this user mindset and fulfillment capability are not easily displaced. There is also a natural logic that can be extended from "eating at home" to "eating out." As long as Meituan still controls this chain, it has a competitive advantage.

However, this does not mean that competition will not have an impact.

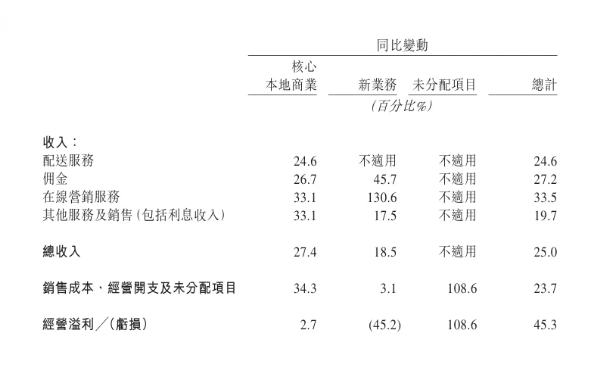

Source: Meituan 2024 Q1 Financial Report

In the first quarter of this year, Meituan's core local business revenue reached 54.63 billion yuan, a year-on-year growth rate of 27.4%. However, sales costs reached 44.93 billion yuan, with a growth rate of 27.4%, causing the overall operating profit margin of this business segment to decline by five percentage points to 17.7%.

From the perspective of several major cost items, the increase in instant retail transactions should be the main contributor; however, the increase in instant delivery order volume (28%) is lower than the sales cost. Therefore, the cost increase from the commission part, such as Meituan's rebates to merchants, should be higher. This can be understood as the impact of competition on Meituan at the merchant level.

Meanwhile, in this quarter, Meituan's sales and marketing expenses continued to maintain high growth, with an increase of 33.1%, exceeding the overall revenue growth rate of 25%. Under the current competitive situation, if Meituan wants to maintain its market share and revenue growth rate, it must expand its marketing expenses, and this situation is temporarily unresolved.

Finally, let's discuss a surprising point in this performance, which is the growth rate of advertising revenue in Meituan's core local business. In the first quarter, advertising revenue reached 10.3 billion yuan, representing a year-on-year increase of 33.1%, making it the fastest-growing segment among all of Meituan's business sub-sectors. Moreover, the gross profit margin of the advertising business is likely the highest among Meituan's various businesses, and its increased growth rate has a positive impact on profits.

From a broader perspective, this is also likely an important positive effect brought about by competition among short video platforms. Local businesses are becoming popular on various social media platforms, and various activities and advertisements are capturing consumers' attention. However, to stand out among numerous merchants, it is necessary to increase promotion, which means an increase in advertising expenses.

Whether it's on Douyin, Kuaishou, or Meituan, every merchant must think about how to increase consumers. As long as Meituan can maintain the "storefront + home delivery" link, it will occupy an important position in local life.

Disclaimer: This article is for learning and exchange purposes only and does not constitute investment advice.