Lingguang Secures 2 Million Users in Six Days, Steering Clear of Doubao and Other Competitors

![]() 12/05 2025

12/05 2025

![]() 574

574

The unexpected rise of DeepSeek earlier this year acted like a catalyst, stirring up China's AI landscape, which was previously considered to have settled into a stable hierarchy.

This significant upheaval reverberated through Ant Group, located on Hangzhou's Xixi Road, sparking a mix of excitement, urgency, and a slight sense of embarrassment for being perceived as 'late to the party.' As a fintech behemoth with a user base exceeding one billion, Ant Group indeed appeared to be a 'late entrant' in the initial round of the large language model (LLM) competition.

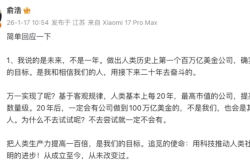

On November 24, Ant Group made its first significant move: the standalone AI-native app 'Lingguang' amassed over 2 million downloads within just six days of its launch. To put this into perspective, Sora 2 took five days to reach the one-million-download milestone. This was undoubtedly a stronger-than-expected debut. During media interactions, He Zhengyu even shared an internal perspective from Jack Ma: the original key performance indicator (KPI) was deemed 'too modest,' and Lingguang needed to 'elevate its game.' This reflected both the pressure and strategic urgency within the company.

Prior to this, the App Store's free chart resembled a 'ByteDance-dominated list.' Data indicated that as of November 17, the top five positions were firmly occupied by ByteDance-affiliated products such as Doubao, Hongguo Short Drama, and Douyin Mall.

Lingguang's entry introduced fresh competitive dynamics into the App Store's free chart, which had long been dominated by ByteDance products. It also hinted at a shift in market expectations for AI, moving from mere 'conversational' capabilities to 'practical task execution,' with users demonstrating a clear appetite for functional tools.

Unlike Doubao or Kimi, which emphasize long-text generation or emotional companionship, Lingguang's product philosophy is rooted in a distinct 'engineer-like' rationality. Rather than relying on mainstream chat modes, it focuses on 'Flash Apps': generating interactive interfaces directly through natural language.

This is undeniably a pivotal point for observing Ant Group's strategic transformation. With its core financial business reaching a plateau and AI becoming a critical battleground for tech giants, Lingguang embodies the company's anxieties and aspirations for user retention.

Alipay has long been the cornerstone and traffic foundation for Ant Group, but the value of internet companies extends beyond just Monthly Active Users (MAU). Alipay users have a clear purpose: to make payments, check balances, and then leave. This 'use-and-go' efficiency becomes a structural weakness in the internet's latter stages, where user engagement time is fiercely contested, making it challenging to retain content.

Thus, the million-plus downloads are merely an entry ticket. What Lingguang truly aims to address is not just technical feasibility but whether Ant can cultivate a C-end traffic ecosystem that is truly its own, beyond the confines of Alipay.

01. Avoiding Chat Companionship: Steering Clear of Doubao's Domain

The AI application landscape in 2025 is already fiercely competitive.

QuestMobile data reveals that nearly 60% of native apps experienced negative growth in the third quarter. For new entrants or smaller apps, the window to independently build a successful native app is narrowing. The top three positions in the AI-native app scale rankings are firmly held by Doubao, DeepSeek, and Yuanbao. Meanwhile, Wenxiaoyan and Kimi have already secured a significant user base.

In contrast, Ant Group resembles a 'late arrival.' Although its Mixture of Experts (MoE) model 'Bailing' commenced around the same time as DeepSeek, Ant Group lagged in the final stages of application deployment.

DeepSeek's unexpected popularity heightened internal anxiety at Ant Group and accelerated resource mobilization and strategic prioritization. Facing this 'existing market struggle,' Ant's 'Lingguang' cautiously positioned itself, deliberately staying out of the effective range of competitors like Doubao, which focus on 'general chat assistants.'

In March, He Zhengyu took charge, rapidly assembling a 200-plus-member independent AGI team, 'Inclusion AI.' Their strategic focus was clear: avoid 'time-wasting' entertainment and casual chat, and instead focus on 'time-saving' efficiency tools.

On November 18, the 'Lingguang' app officially launched. The product's core logic shifted from simple dialogue to execution. As product lead Cai Wei proposed, 'Generate a response with one sentence and run it immediately,' it's evident that Ant Group is essentially betting on the future of AI agents.

As a latecomer, Lingguang has sought to break conventions from the outset, deeply integrating Graphical User Interface (GUI) with Language User Interface (LUI) and redefining AI assistants with 'multimodal + coding capabilities.' As Cai Wei put it, 'For a new product, making your strength exceptionally strong before addressing other weaknesses might be the most efficient way to leave a mark on users.'

For example, when a user inputs 'Generate a centered blue submit button' in Lingguang's 'Flash Apps,' traditional AI assistants would output a string of code. In contrast, Lingguang directly generates an interactive component. This ability, dubbed 'Vibe Coding' or 'Lingguang Moment,' essentially transforms coding productivity into consumer-grade content visible to users.

In a sense, this resembles Ant Group's attempt at a 'latecomer's shortcut.' For early movers, vast user dialogue data is both an asset and a burden. Users may turn to ChatGPT or Doubao, but only for 'chatting.' Reversing this mindset inertia is extremely difficult.

In the current AI market, traffic might be acquired through 'sheer force,' but retention cannot. According to AppGrowing data, Tencent Yuanbao spent over 1 billion yuan in a single month in June and July, briefly boosting its chart rankings. However, user growth quickly plateaued.

From January to June, Yuanbao's user base grew by only 22 million, far below DeepSeek (163 million) and Doubao (58 million) during the same period, ranking last among the top three growth leaders. At Tencent's Q2 2025 earnings call, president Martin Lau explicitly stated that the company would not 'acquire new users solely through market spending' but instead focus on deep integration with existing platforms. This proves that mere 'flooding' cannot build a genuine competitive advantage.

If short videos satisfy people's desire to kill time, AI tools must address the urge to 'work less, accomplish more.' Ant Group is betting that after DeepSeek popularized AI for the masses, the market has entered a 'pragmatism' phase where users no longer settle for chatting with AI but urgently need a true assistant for coding, report-making, and even financial planning.

This explains why Ant Group is not rushing to compete for general-purpose entry points but instead prioritizing depth in coding and multimodal capabilities. Before AI's 'iPhone 4 moment' arrives, all early advantages may prove temporary. Only problem-solving abilities hold cross-cycle value.

However, this route demands extremely high requirements for model capabilities and engineering optimization. Compared to ordinary text dialogues, converting natural language instructions into executable code often results in a token generation inflation rate of 5-6 times or more.

Take Lingguang's 'Flash Apps' feature as an example. For a mere 15-character instruction like 'Generate a centered blue submit button,' if the model is to generate a modern, interactive component, its output typically includes a complete layout container, style definitions, and interaction logic. The code volume can easily balloon to hundreds or even thousands of characters (or consume hundreds of tokens). Ensuring high performance and stability is an engineering challenge Lingguang must overcome.

Indeed, just two days after Lingguang's launch, its Flash Apps feature was 'overwhelmed.' Through its official account, Lingguang acknowledged the crash, stating, 'We'll be back soon.' This may also signal that the journey toward a super AI assistant has just begun.

02. Standalone App: Escaping Alipay's Gravitational Pull

Ant Group's launch of Lingguang is also an attempt to escape the notion that 'Alipay is everything.'

Before Lingguang's arrival, the initiative to rebuild user entry points was not entirely in Ant Group's hands. The internet operates under a harsh paradox: tools that pursue ultimate efficiency are more prone to becoming invisible.

Over the past decade, Alipay has not only been China's most successful 'toolbox' but also Ant Group's most prominent brand. From payments to wealth management, healthcare to government services, Alipay has virtually taken over every aspect of national life. However, this 'strong tool' attribute became its Achilles' heel: users 'use and go.' Consequently, even with traffic comparable to WeChat's, Alipay has always lacked WeChat's user stickiness.

Whether through content ecosystems, mini-programs, casual games, or offline 'bump-to-connect' features, Alipay has tried to broaden user entry points and retain users with the shortest payment paths. Yet, these efforts mostly optimized payment experiences, lacking sufficient gravitational pull for deep user engagement.

In the AI era, this weakness is further amplified. If AI assistants from other companies can directly handle payments, wealth management, and ticket bookings in the future, the frequency of users actively opening the Alipay app will inevitably decline, shaking the commercial foundation Ant Group has painstakingly built over the years.

Without self-revolution, Ant Group risks becoming an 'underlying pipeline' in the AI era, similar to today's telecom operators—indispensable yet losing direct dialogue with users.

This 'user relationship' is precisely the scarcest resource in AI-to-C (consumer AI). Without sufficient dwell time, true communities and ecosystems cannot form, making it hard to create 'super entry points' like Douyin or WeChat. Doubao's dominance largely stems from its backing by Douyin's vast content ecosystem, giving users reasons to 'kill time' within it.

New Position believes this is Ant Group's exploration of future boundaries. Its growth cannot remain confined to the financial sector; it must break into broader service spaces. However, forcibly inserting these new scenarios into Alipay would not only feel out of place but might also disrupt the purity of its core experience.

In Ant Group's strategic vision, the AGI era demands a national-level product of its own—be it AQ, Maxiaocai, or Lingguang. Facing the dual uncertainties of technology and market in the AGI wave, Ant Group's deployment logic resembles searching for water in a desert: 'Never send everyone in the same direction.'

This is corroborated by Ant Group's other AI application, AQ. According to QuestMobile data, AQ became the fifth AI-native app with monthly active users exceeding 10 million, following Doubao, DeepSeek, Tencent Yuanbao, and Jimeng AI. In terms of growth speed, AQ's time from launch to surpassing 10 million MAUs ranked second only to DeepSeek and Doubao, with its core momentum stemming not from model superiority.

Currently, Lingguang serves as an ideal testing ground. Here, Ant Group can experiment with low-code development user demand through 'Flash Apps' and explore information service market potential via 'Kaiyan' visual recognition at a low trial-and-error cost. Which features precisely hit pain points and which scenarios hold commercialization potential can all be validated here.

However, with the AI entry point landscape still unsettled, the ultimate decision rests in the hands of users who vote with their feet.

03. Epilogue

The vastness of the AI track is far from hitting the ceiling of 'existing market competition.' As model capabilities evolve exponentially and user demands continue to expand, it is clearly too early to declare the 'pattern settled.'

Yet Ant Group's strategic posture is clear. No longer content to be the 'digital wallet' lying passively in a phone's corner, responding only to payment needs, it aspires to evolve into a 'smart brain' capable of proactively planning finances and even managing life.

Its multifaceted approach focuses not only on 'tapping into' its own ecosystem potential, such as vertical-scene-focused AI products like Maxiaocai and AQ, but also casts its gaze beyond the system toward the broader AI-to-C arena. The deployments of the Bailing LLM and the embodied AI company 'Lingbo Tech' form a subtle 'hidden thread' in Ant Group's AGI strategy.

At this juncture, debating whether Ant Group is a 'latecomer' holds little meaning. After all, in commercial competition, the definition of 'early' or 'late' often does not hinge on starting times.

*The featured image and illustrations within the text are sourced from the internet.