From Microsoft to Alibaba: Has AI's Backup Plan Hit Its "Ceiling"?

![]() 12/12 2025

12/12 2025

![]() 418

418

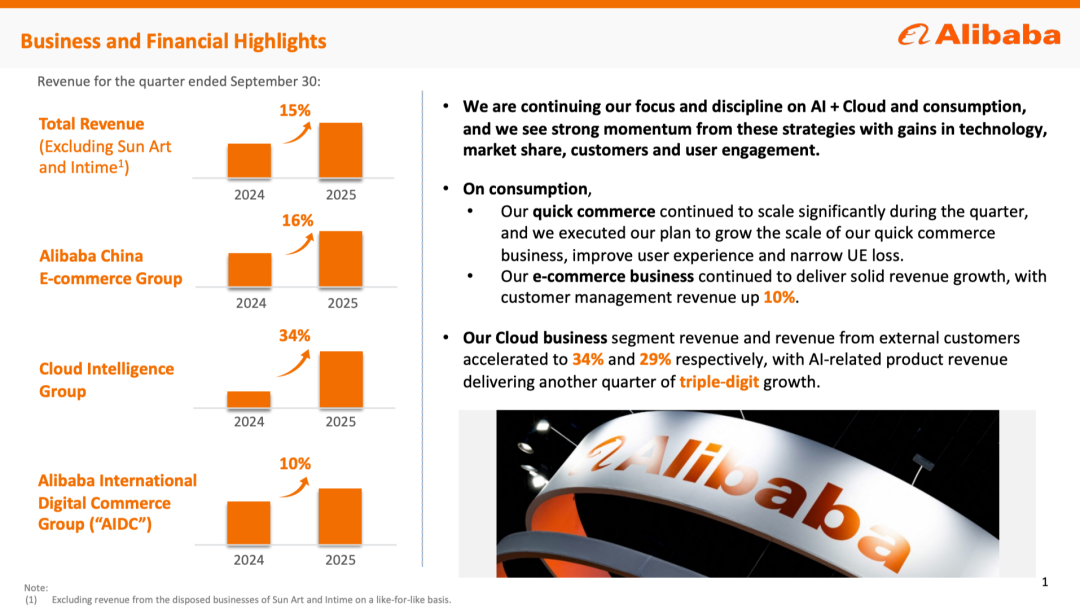

During its recent earnings announcement, Alibaba declared a 'truce' in the food delivery battle, while simultaneously unveiling a significant boost in AI investment, allocating 380 billion yuan over the next three years. From a fiscal standpoint, this move is logical. The food delivery competition led to a 34 billion yuan year-on-year decline in adjusted EBITA for Alibaba's Chinese e-commerce division. In contrast, Alibaba Cloud's growth rate surged to 34.5%. When presenting these figures, Wu Yongming likely faced minimal resistance during decision-making meetings.

Alibaba's Q3 2025 Quarterly Financial Results

Across the Pacific in Silicon Valley, AI cloud services have similarly yielded substantial performance improvements for major tech companies. In the latest quarter, Google Cloud reported a 33% year-on-year growth, with a 155 billion USD backlog. Microsoft's Azure cloud (excluding currency impacts) saw a 39% year-on-year surge...

Despite Microsoft's latest earnings report highlighting significant Azure cloud growth, its stock price still dropped nearly 3% on that day, reflecting increasingly stringent investor expectations.

Recently, reports surfaced indicating that Microsoft internally revised sales targets for several AI products, including Foundry. Although Microsoft denied altering its overall AI product sales goals, this did not prevent a stock price decline on December 3.

On December 9, Microsoft announced its largest-ever Asian investment—a 17.5 billion USD data center in India. However, a day later, Oracle, a company with deep partnerships with both Microsoft and OpenAI, saw its stock plunge over 10% following its earnings release, casting a shadow over the prospects of this industry titan and the entire sector.

Microsoft Official Website Screenshot

In reality, cloud infrastructure is akin to a gold-digging shovel, much like GPUs. If the AI narrative falters and the 'gold rush' subsides, these 'shovel sellers' may experience a sharp revenue decline. The notion of an AI bubble appears to be a consensus, even openly acknowledged by the CEOs of Microsoft and Google. The suspense now centers on two key questions: the duration of the short-term bubble and whether the industry can rebound after it bursts.

"B2C" or "C2B"?

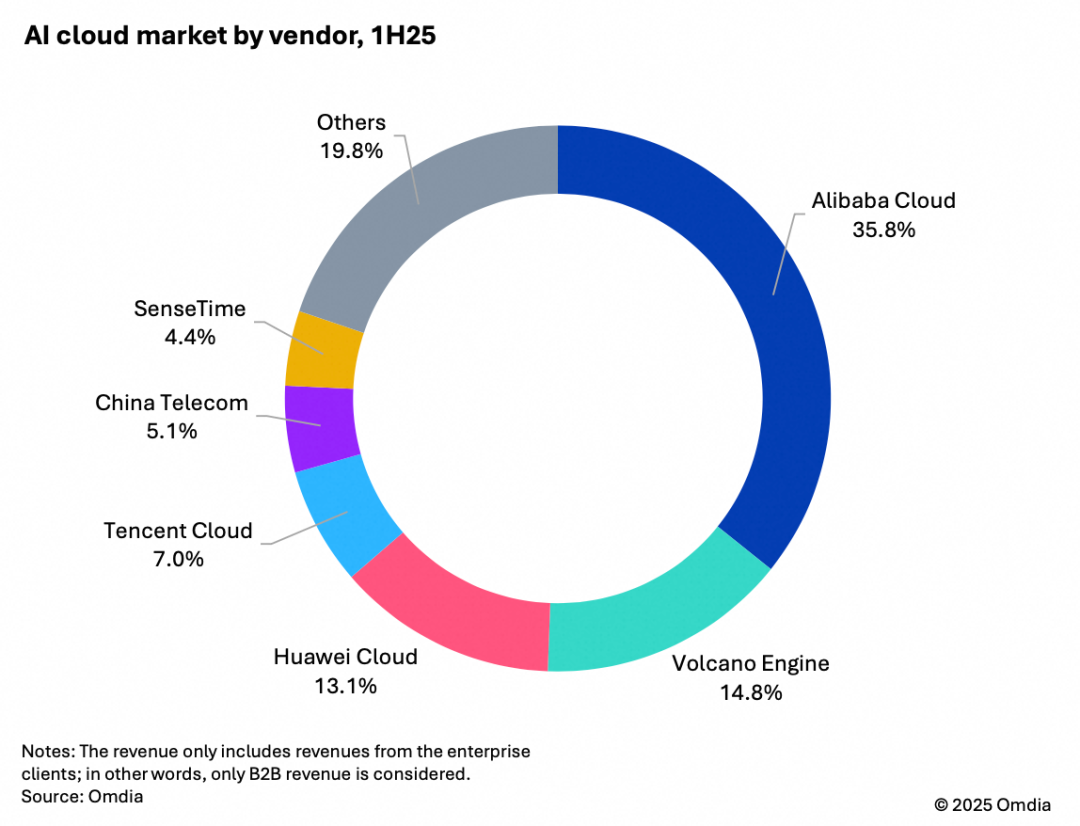

Regarding the first question, Alibaba's Wu Yongming stated, 'An AI bubble is unlikely for at least the next three years.' Hence, he decided to double down on AI over the next three years. According to a report by global market research authority Omdia, Alibaba dominated China's AI cloud market in the first half of this year, holding a 35.8% share, far ahead of the combined market share of the second to fourth place. The runner-up is ByteDance, a company Alibaba struggles to compete with in the consumer market. ByteDance's Volcano Engine holds a 14.8% market share, making it Alibaba's top rival.

Omdia's 'China AI Cloud Market, 1H25'

Therefore, Alibaba has not abandoned the consumer market. While the decision-making logic differs in the B2B sector, if enterprise clients' leaders frequently use Doubao (ByteDance's AI product) as consumers, it could significantly hinder the adoption and contracting of AI features on Alibaba Cloud. Volcano Engine President Tan Dai revealed that many clients approach them with chat records from Doubao. This exemplifies the 'high-frequency beating low-frequency' and 'rural areas surrounding cities' strategies in the large model industry. Perhaps for this reason, Alibaba has elevated the strategic importance of its AI 'C Plan,' continuously upgrading products like Kuake and Qianwen, along with visible budget allocations, indicating a shift in Alibaba's AI strategy.

Alibaba Kuake AI Glasses

AI is a massive financial drain. Other internet giants either find it financially unviable and opt for stability, like Tencent, whose capital expenditures last year were similar to Alibaba's but lacks the urge to expand further. Or, despite going all-in, they lack the scale, like Baidu, whose total capital expenditures in 2024 were only 8.134 billion yuan, roughly a tenth of Alibaba's or Tencent's. In terms of business models, if Alibaba Cloud emulates Amazon's AWS, then Alibaba's AI strategy also draws inspiration from Google, currently the most prominent global player. These two companies are arguably the world's only full-stack AI technology firms, with in-house development spanning AI chips and infrastructure to large models and applications. Alibaba chose this path partly because it aligns with its corporate culture. Building ecosystems is Tencent's forte; Alibaba's past acquisitions aimed at integration, with Jiang Fan and Zhang Xuhao serving as contrasting examples.

Alibaba Cloud's NBA Partnership

Additionally, Alibaba Cloud was once China's leader and the world's third-largest. However, it fell out of the top three last year due to Google Cloud's AI-driven surge. Learning from this, Alibaba chose to 'join the winners.' Despite the emulation, significant gaps remain between Alibaba and Google. For instance, Google's TPU has attracted clients with lower power consumption than NVIDIA chips, while Alibaba's self-developed chips are still in development. Although Alibaba's models are competitive, its AI applications have not created the same consumer-end urgency for ByteDance as Google's surpassing of OpenAI. Thus, Alibaba's most realistic AI strategy is to enable its existing Alibaba Cloud clients to adopt AI features, while ByteDance aims to have leaders of large organizations use Doubao first. With ByteDance unlikely to halt its efforts, Alibaba must counterattack. Neither company can afford to stick rigidly to its territory in the short term.

Select Volcano Engine Partners

ByteDance plans to invest 150 billion yuan in 2025, making it Alibaba's sole rival in terms of investment scale. Both are betting on the future, but does AI have one?

Large Model Unicorns as Leading Indicators

To answer this, we must evaluate whether AI genuinely enhances productivity at the application level. The further up the AI supply chain we look, the more detached from reality it becomes. NVIDIA's strong performance stems from massive investments by Google, Microsoft, Alibaba, and ByteDance. These companies' performance, in turn, depends on investments by other large organizations, which ultimately hinge on AI large models' ability to boost productivity.

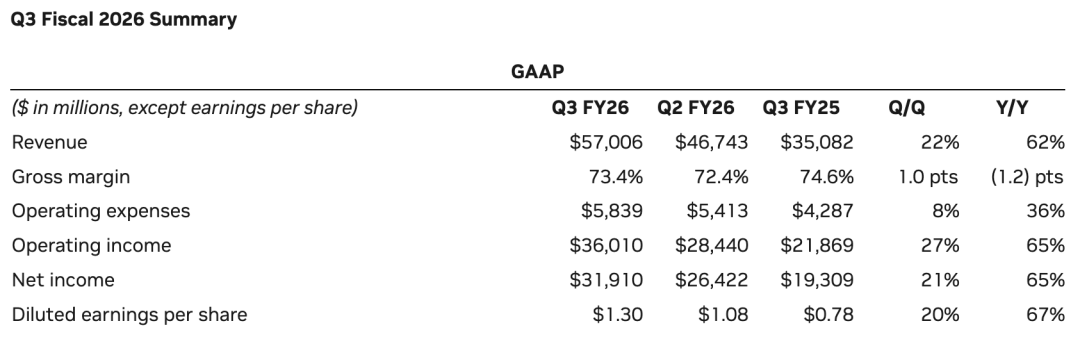

NVIDIA's Q3 FY2026 Earnings Report

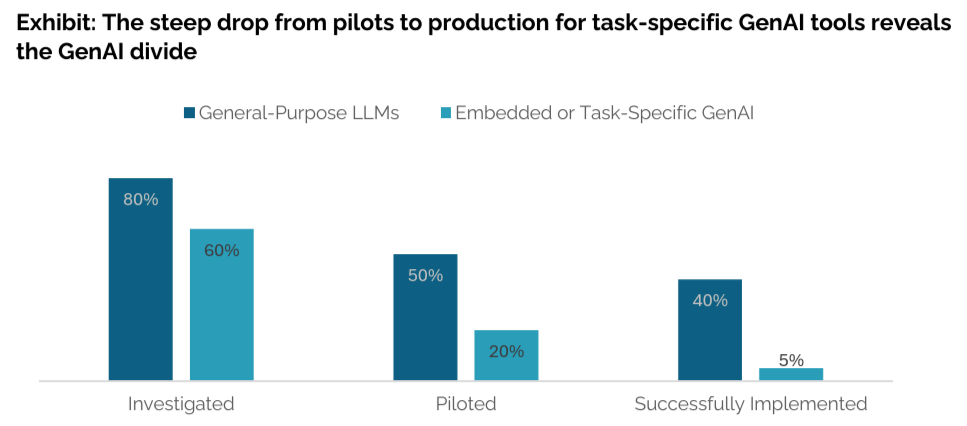

As Microsoft CEO Nadella stated, 'AI must genuinely enhance overall economic productivity and drive broad GDP growth; otherwise, it's a bubble.' Nobel laureate in economics Daron Acemoglu published a paper in May 2024 titled 'Simple AI Macroeconomics,' estimating that only a quarter of currently AI-adopted tasks may be cost-effective over the next decade, accounting for just 5% of total work tasks. Thus, AI could boost U.S. productivity by only 0.5% over the next decade, contributing to a mere 1% cumulative GDP growth. An August MIT report noted that only 5% of firms have successfully leveraged AI tools to enhance productivity, while the remaining 95% have seen their AI investments go to waste.

MIT's 'The Generative AI Divide: The State of Business AI in 2025'

Generative AI has indeed improved the tech and media/telecommunications sectors but has failed to optimize key workflows in professional services, healthcare, consumer retail, financial services, advanced industries, and energy/materials. A simple criterion exists: Only when large model and application firms like OpenAI, Anthropic, Kimi, and Zhipu become profitable can we say that generative AI's business model has truly been established. If not, and the bubble bursts, what would happen? We can draw an analogy from the robotics rental market. Early this year, almost concurrently with the large model boom sparked by DeepSeek, the Spring Festival Gala's robot performances triggered a robotics craze.

Spring Festival Gala Robot Performance

At the time, daily rental rates for humanoid robots reached 10,000 yuan, while robot dogs cost 2,000 yuan. Now, these rates have plummeted to 2,000 yuan and 500 yuan, respectively. This is no joke. For the 95% of firms, large models that fail to enhance productivity are akin to robots dancing on the Spring Festival Gala. The AI narrative's shift from Artificial General Intelligence (AGI) to cost-effectiveness will accelerate the bubble's burst. This is an inevitable law of industry development. Increasing markets can accommodate numerous players, while mature markets see fierce price wars. Instant retail operates this way, and AI large models are no different. However, AI's competition on energy costs and token prices presupposes a 'productivity boost' promise or an AGI vision. Once this premise fails, hiring more college graduates or purchasing employee subscriptions may be the ultimate solution.

For CEOs of major firms engaged in the AI arms race, the current hope is not that the bubble never bursts but that AI can become infrastructure akin to early 21st-century fiber optics, early 20th-century power grids, and early 19th-century railways. All experienced bubble bursts but ultimately laid the foundation for industrial revolutions. In the short term, everyone is acting as a 'patch-up artist.' Wu Yongming was still promoting ASI at the September Cloud Town Conference. However, if U.S. executives no longer buy into AGI, will Chinese executives embrace ASI?