Is BYD to Blame for the Intense Competition?

![]() 06/12 2024

06/12 2024

![]() 705

705

Author | Li Guozheng

Editor | Zhen Yao

Produced by | Bangning Studio (gbngzs)

At the 2024 China Automotive Chongqing Forum, automotive industry leaders gathered to discuss topics ranging from long-termism and high-quality development, which inevitably shifted to intense industry competition, including the resulting flow wars and price wars.

On June 6, during the forum's speeches and dialogues, Zeng Qinghong, Chairman of GAC Group, expressed his views on price wars and flow wars. Regarding the current price wars (intense competition) in the automotive market, he said that price competition is not a problem, as it is determined by supply and demand and market laws. GAC does not oppose price wars and is not afraid of them, but they must be rational and have boundaries, not excessive. Providing discounts is fine, but doing so unsustainably is not. Without profitability, companies cannot survive, which will have adverse effects on taxation, employment, and upstream and downstream industries.

▲Zeng Qinghong

Zhu Huarong, Chairman of Changan Automobile, described himself as an "optimist" in his forum speech. He believes that competition is a process of good money driving out bad money. He said that competition itself means pursuing excellence, which will push Chinese brands to new heights, maximize user benefits, and truly create value for users. "I believe that in the next ten years, there will be more Chinese brands that will become world-class brands through competition."

▲Zhu Huarong

The next day, the topic of intense competition continued to develop.

Li Shufu, Chairman of Geely Holding Group, said, "Healthy competition is the key to achieving high-quality development. The level of intense competition in China's automotive industry is the highest in the world, and the price wars are also unparalleled. This phenomenon is both good and bad. If there is a high level of marketization, sound laws, strict enforcement, and transparent and fair competition, it is good. Otherwise, it is bad."

▲Li Shufu

Discounts versus profitability, good money versus bad money, good things versus bad things... Zeng Qinghong, Zhu Huarong, and Li Shufu expressed their views on intense competition in the industry from different angles.

Unlike them, another industry leader directly pointed the finger of intense competition at BYD.

On June 1, at the 2024 Shenzhen Future Automotive Pioneers Conference, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Smart Car Solutions BU, bluntly said, "In fact, in the field of smart electric connected vehicles, BYD is the number one player worldwide in terms of intense competition, because it has the ability to achieve ultra-low costs... Huawei hopes that this industry will develop in a positive virtuous cycle, allowing those good at price competition to compete on prices, while Huawei's HarmonyOS Intelligent Mobility focuses on creating value."

Why was BYD labeled as the "king of competition" by Yu Chengdong? This is undoubtedly related to BYD's market position and recent performance.

In 2023, BYD surpassed Tesla to become the new global leader in new energy vehicle sales with 3.02 million vehicles sold. This year, shortly after the Spring Festival, this new leader took the lead in launching the weapon of "electricity cheaper than oil" to engage in a decisive battle with gasoline-powered vehicles - BYD Qin's price dropped below 80,000 yuan, DM-i models entered the 70,000 yuan range for the first time, and EV models directly entered the 100,000 yuan range.

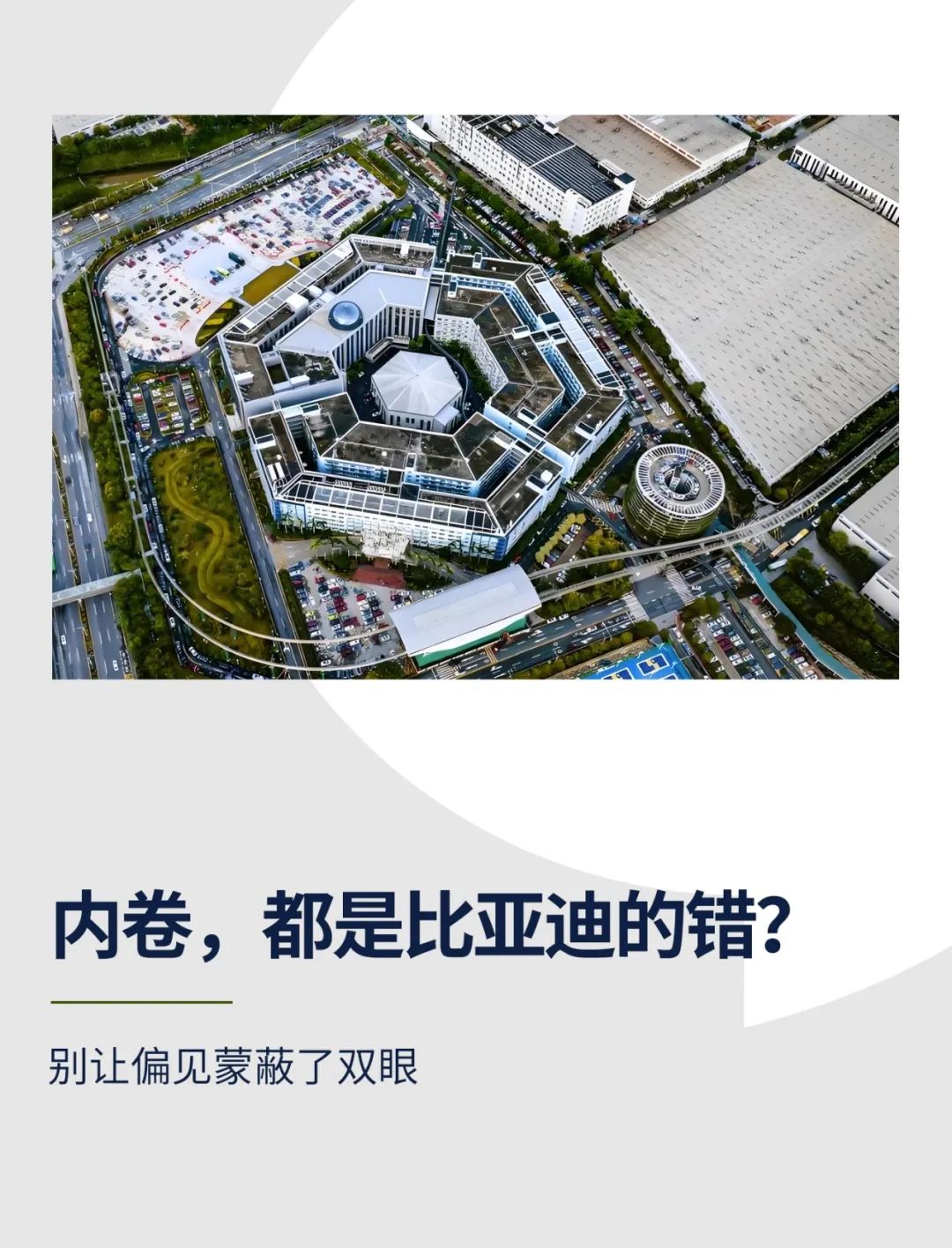

With a command from the hexagonal building in Shenzhen, BYD's various sub-brands marched down Pingshan in droves. Within half a month, they successively launched glory or championship editions of models such as Dolphin, Han, Tang, Song, and Sea Lion, and took the opportunity to significantly reduce prices, leaving the细分市场 in these new vehicles devastated, with few competitors.

Subsequently, automakers such as SAIC-GM-Wuling, Changan Qiyuan, Nezha Automobile, and Geely Automobile took the initiative to engage in the battle, while joint ventures such as Beijing Hyundai and SAIC-GM were forced to follow suit. In the first half of the year, the Chinese automotive market was dusty, with constant "price cuts".

The initial battle was bloody. Cui Dongshu, Secretary-General of the China Passenger Car Association, couldn't help but lament that 2024 is a crucial year for new energy automakers to establish a firm footing, and competition is destined to be fierce.

In fact, his words are too温和 and含蓄. If spoken bluntly, it is the brutal market competition that directly determines the survival of automakers.

How to view this year's "trend of competition"?

BYD Chairman Wang Chuanfu has his own explanation, saying, "Competition is a kind of competition and the essence of market economy... What is the core of market economy? It is competition, which can produce prosperity... Competition is a kind of competition, so I believe that all entrepreneurs should embrace and participate in this competition, embrace this competition, and stand out in the competition."

▲Wang Chuanfu

Regarding this, some agree, believing that price wars are inevitable in the rapid development of Chinese brands, as past facts have proven. Typical industries include mobile phones, home appliances, construction machinery, and photovoltaics. After more than a decade of winnowing, only a few global players remain in those industries.

There are also skeptics who believe that price competition is normal, but if it is excessive, it is not normal. They believe that endless intense competition and简单粗暴 price wars will only lead to cut corners, fraud and fake sales, and unregulated competition.

Should companies engage in price wars, value wars, or moral wars? Everyone has their own opinions, and there is no consensus. The sound waves stirred up by the Chongqing Forum quickly spread to every corner through social media.

Bangning Studio believes that pointing the finger of intense competition in the automotive industry solely at BYD is biased.

On the one hand, as the global leader in new energy vehicle sales, BYD does have the strength to engage in price wars. This automaker has a highly vertically integrated capability across the entire industry chain, improving efficiency through resource endowments and delivering products with ultimate cost-effectiveness. Moreover, BYD has a research and development team of 100,000 people, investing billions of yuan in research and development expenses annually to encourage innovation, allowing new models and technologies to be continuously rolled out like dumplings, with prices continuously declining, bringing wave after wave of pain to the industry.

However, on the other hand, it should also be noted that most of BYD's price reductions are for relatively low-end models. High-end brands and models such as Fangchengbao, Tengshi, and Yangwang have not deeply engaged in price wars, and some have still achieved impressive results. For example, in 2023, Tengshi D9 surpassed Buick GL8 to rank first in MPV sales; in April this year, Tengshi ranked first in MPV sales, while Buick GL8 sales were halved.

From an industry perspective, the current reasons for intense competition are multifaceted, with the most fundamental one being the large number of automakers in China and the unsettled industry structure, which is currently undergoing a painful period of reshuffling.

A recent report in the American magazine The New Yorker suggested that China's electric vehicle industry has three experiences worth learning from the United States, one of which is China's encouragement of new entrants and competition without favoring established companies.

The report said that although there are now fewer than about 500 companies compared to 2019, China currently has over 100 electric vehicle manufacturers. In such a fiercely competitive market, companies are forced to cut costs and reduce prices, which benefits consumers and drives sales.

In the United States, Tesla has almost monopolized the electric vehicle market over the past decade or so, as the top three American automakers have focused on high-fuel-consumption sport utility vehicles (SUVs) and pickups (a strategy that has brought huge profits to traditional automakers but left them far behind Tesla and Chinese companies in the development of electric vehicles).

The report also quoted an economist as saying, "(China's approach) is not pure central planning, but ultimately there is still market testing. They have nurtured many companies, and only a few have survived. The principle of combining planning and competition is something we can learn from."

Full competition is the only way for the market to mature, which can be seen by looking at the growth history of Western multinational automakers. During their development, the U.S. and European automotive markets also emerged with hundreds of automakers, but after残酷的竞争, how many automakers survive in these two markets today? Each region can be counted with one hand. The result of competition is survival of the fittest, which not only reduces the number of automakers but also makes product prices tend to be balanced and stable.

China now has over 100 electric vehicle manufacturers, and the price war among them is destined to be fierce for survival. In this regard, automakers should be prepared for even more intense competition.

Under heavy pressure, some people hope that relevant departments will intervene in the price competition in the automotive industry.

This is a fantasy. The automotive industry is a competitive market, and automakers independently set market-regulated prices. While the government, as the "visible hand," maintains fair competition in the automotive industry and promotes its healthy and orderly development based on laws and regulations such as the Price Law, Anti-Monopoly Law, and Anti-Unfair Competition Law.

Moreover, China's automakers are relatively complex in terms of types: on the state-owned side, there are large central enterprises and local state-owned enterprises; on the foreign side, there are wholly foreign-owned and Sino-foreign joint ventures; on the private side, there are more diverse ownership structures. Due to their different types, automakers have different starting points in product pricing.

Competition is a market law and an inherent driving force for industry growth. Assuming that the government intervenes in automotive pricing, it may seem to reduce or eliminate the pressure of price wars among automakers on the surface, but in essence, it creates a greenhouse, allowing companies to rest in their comfort zones. In such a state, who would be willing to spend a lot of money and effort on technological innovation?

Don't forget how China's automotive industry achieved its current achievements. As former Minister of Industry and Information Technology Miao Wei said, "The fundamental reason for the rise of China's new energy vehicles lies in the establishment of a technology innovation system with enterprises as the main body, enabling breakthroughs in key component technologies." Obviously, without competition, there would be no technological innovation in enterprises and no achievements of China's automotive industry today.

Before the big picture is determined, competition will be the norm in the automotive industry. However, this competition is relative. Those automakers without core advantages can only passively follow suit and eventually be eliminated by market laws.

Of course, even a strong player like "King of Competition" BYD is not without worries. Just like Henry Ford of the United States creatively launched the Model T in the early 20th century, it seemed to own the world for a while, but only 20 years later, Ford Motor Company started to lose money. Warren Buffett once lamented: Historically, the automotive industry is indeed very difficult. Although the automotive industry will not disappear, it will surely be different in 5 to 10 years, whether it is the automotive architecture or market structure.

Now, instead of complaining about competition, Chinese automakers should abandon fantasies, face competition squarely, and explore how to maintain technological, product, and service advantages in the long run, thereby gaining price advantages, taking the initiative in competition, and achieving what others do not have, what others have but are better, and what others are better but are still competitive.

(The title image is BYD's hexagonal building, source: Shenzhen News Network, photographed by Ning Jiewen)