The Leading-Edge Configuration Won’t Remain Dominant Beyond Six Months

![]() 12/01 2025

12/01 2025

![]() 406

406

Introduction

Features once exclusive to million-dollar luxury cars or supercars are now rapidly entering the mainstream automotive market.

In recent years, many automakers have emphasized the concept of "leading configurations" when promoting their new vehicles. In today's fast-paced automotive landscape, where new models are launched frequently, configuration leadership has become a key differentiator in product competition.

However, recent insights from industry insiders suggest that being a leader in a single configuration no longer guarantees a competitive edge.

“Magnetorheological suspension will largely replace CDC globally within three years, with an eventual market ratio of 8:2 in favor of magnetorheological suspension over CDC,” Liu Xihe, Global CEO of Jingxi Zhixing, confidently predicted after the launch of the Shenlan L06.

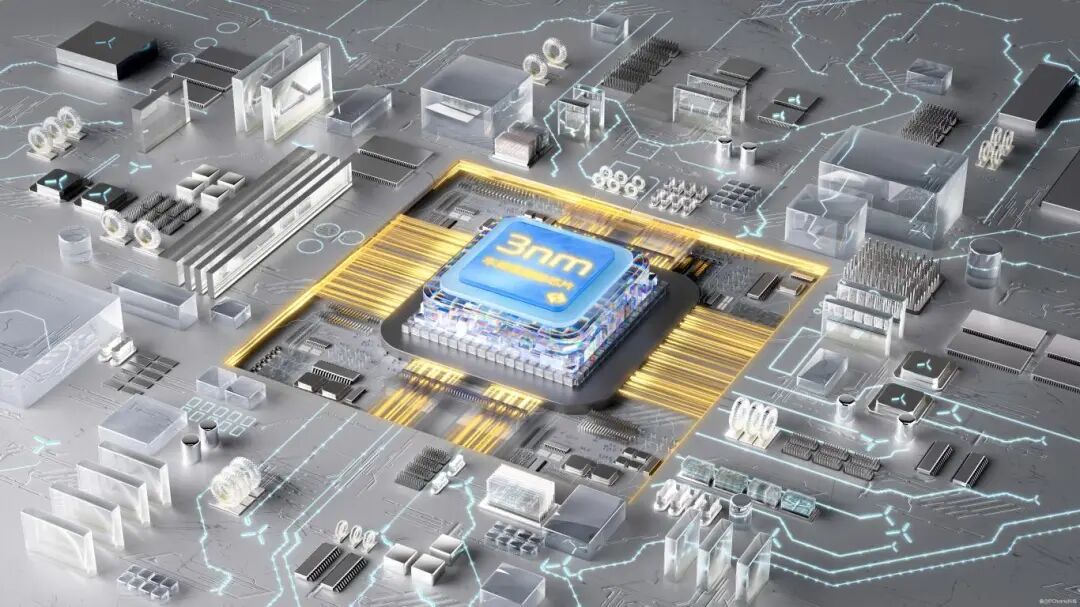

At the same event, Wang Hai, General Manager of MediaTek China, revealed that the 3nm Dimensity S1 Ultra chipset, featured in the Shenlan L06, would soon be adopted by more models.

Li Bin, founder of NIO, was even more candid at the Guangzhou Auto Show: “Within six months, innovations from China will be widely adopted by others. We used to think we could maintain a one-year lead, but now, with an interconnected supply chain, this is understandable.”

This casual remark accurately highlights the rapid monthly pace of technological diffusion in today’s new energy vehicle (NEV) industry and reflects the new innovation ecosystem supported by China’s supply chain system.

01 Rapid Adoption Driven by the Supply Chain

“OEMs contribute only one aspect; the supply chain is equally important,” said Deng Chenghao, Chairman of Shenlan Auto, in an interview after the launch of the new Shenlan L06, emphasizing the core mechanism behind the rapid adoption of NEV technology.

In China’s highly competitive supply chain environment, any technological innovation quickly spreads through a mature supply chain network. The magnetorheological suspension technology used in the Shenlan L06 is a prime example. Originally featured in the Ferrari 296GTB supercar, this technology now appears in a mainstream electric vehicle priced at around RMB 130,000.

Chen Weigang, Vice President of Engineering at Jingxi Zhixing, revealed that the magnetorheological shock absorber has undergone four generations of product iteration, with its technical maturity fully verified, laying the foundation for large-scale adoption. Additionally, localized production has significantly reduced costs. Liu Xihe admitted, “When production reaches hundreds of thousands or even millions of units, prices will drop further.”

Localized production has become the key driver of cost reduction. The completion of Jingxi Zhixing’s Shenzhen factory has accelerated this process. With an annual capacity of 600,000 magnetorheological shock absorbers, the factory can support 150,000 vehicles this year and plans to support 1.5 million to 2 million vehicles in the coming years.

Liu Xihe admitted, “When production reaches hundreds of thousands or even millions of units, prices will drop further.” This cost advantage is not an isolated case but a concentrated reflection of China’s manufacturing cluster effect.

The same applies to chips. After the launch of MediaTek’s 3nm Dimensity S1 Ultra chipset in the Shenlan L06, Wang Hai, General Manager of MediaTek China, stated, “You will see more products and more chipsets next year and the year after.” He elaborated on MediaTek’s philosophy: “We hope to make many high-end features accessible to the masses.”

The technology diffusion speed in the NEV industry has compressed from “yearly” to “monthly.” The leading advantage of a configuration has shortened from two to three years to less than six months, with the competition in intelligent driving chipsets being particularly typical.

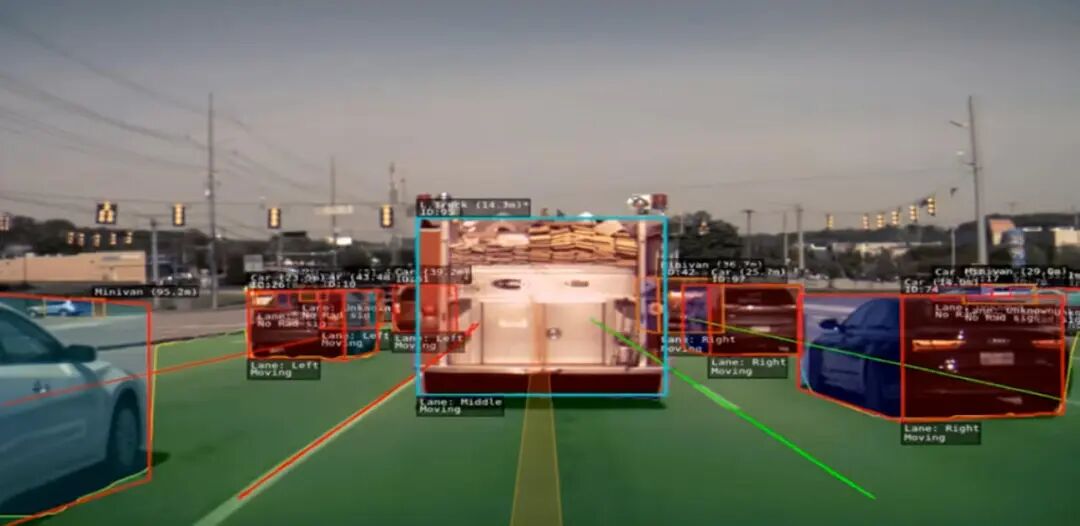

This phenomenon is especially evident in the intelligent driving chipset sector. In early 2025, NVIDIA’s Thor chipset was a rare asset for a few automakers, with the Lynk & Co 900 using it as a core selling point. Within six months, models like the IM LS9, Li Auto L Series, and Zeekr 001/009 adopted the Thor chipset, while BYD, GAC, and XPeng announced plans to replace Orin with Thor by the end of 2025 or early 2026.

Behind this rapid technology diffusion lies the shared nature of the supply chain. Li Bin admitted, “It’s understandable now that the supply chain is connected, but I think this healthy competition benefits users.”

Next in line for widespread adoption could be magnetorheological suspension technology. According to Jingxi Zhixing, over ten mainstream OEM models in China will start mass production and apply this technology from the fourth quarter of 2025 to the first half of 2026.

02 The Underlying Logic of Technology Adoption

The core driver of rapid technology adoption lies in the automotive industry’s transformation toward standardized hardware and software-defined features. This model lowers the barriers to technology adoption while preserving space for differentiated competition, becoming a key enabler of supply chain collaborative innovation.

When explaining the rapid adoption of magnetorheological suspension, Liu Xihe pointed out, “Magnetorheological suspension adjusts vehicle performance through software, allowing quick switching between handling and comfort with fast response. Its hardware is also highly standardized across different models.”

Chen Weigang further explained that compared to electromagnetic valves, magnetorheological shock absorbers adopt a single-tube structure without complex mechanical valve systems, offering higher reliability, better cost control potential, and a more convenient software calibration process due to their simpler design. This hardware standardization and software customization model significantly shorten the technology implementation cycle and reduce OEM R&D investment.

The standardization feature is even more pronounced in the chipset sector. Wang Hai stated, “Once this chipset is sold, whether it’s used at 10%, 50%, or 80% capacity, the price remains the same.” This pricing model reflects the high standardization of chipset hardware.

The 3nm process technology and unified interface protocols allow automakers to quickly adapt without redesigning electronic architectures, while computational flexibility is achieved through software. Wang Hai added that MediaTek’s vision is to “make high-end chipset technologies accessible to the masses. The more users, the better.”

It’s not hard to infer that the acceleration of technology diffusion is reshaping the competitive landscape and business models of the entire automotive industry. The competition among automakers no longer focuses on who is the first to adopt a certain configuration but on who can deliver the best experience with standardized hardware. The competitive focus has shifted from configuration races to experience competitions, forcing companies to concentrate their core capabilities on software development and user demand insights.

This transformation is particularly evident in the intelligent driving sector. Multiple automotive intelligent engineers pointed out that computational power is just one indicator of chipset capability, with many other factors being equally or even more important. Chipsets have different evaluation criteria based on their positioning and usage scenarios.

Deng Chenghao emphasized the critical role of China’s supply chain in this transformation: “Ten years ago, when I visited overseas supply chains in Germany and Japan, I was envious. But today, we can see equally great supply chains in China.”

He further pointed out, “To maintain continuous leadership, we need collaborative innovation.” “Whether it’s the technical architecture for AI automation or the new direction of integrating ‘powertrain, chassis, and intelligence’ (‘Dynamic Bottom Intelligence’), it requires joint efforts from the supply chain.”

Most importantly, when the window for technological leadership shortens from three years to six months, all participants are forced to innovate at a faster pace. As Deng Chenghao said, “If we want to continue leading, it depends on our collective efforts.” In this never-ending technology marathon, there are no permanent leaders.

Editor-in-Chief: Yang Jing Editor: He Zengrong

THE END