Southeast Asia Overseas Express | Malaysia Launches ASEAN's First Electric Vehicle Battery Passport Standard, Vietnam's Imported and New Energy Vehicles Drive Growth

![]() 12/01 2025

12/01 2025

![]() 402

402

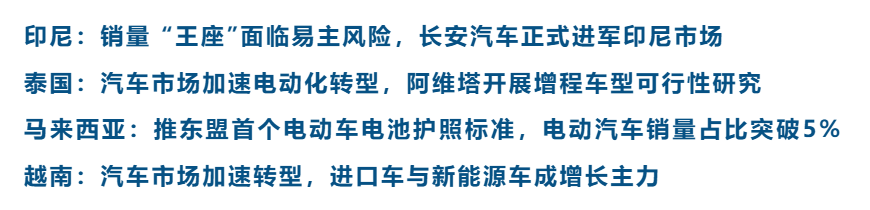

▍Indonesia: Sales 'Throne' at Risk of Being Overtaken, Changan Automobile Officially Enters Indonesian Market

From January to October 2025, the Southeast Asian automotive market experienced structural changes. According to data from industry associations in both countries, Indonesia's wholesale sales reached 634,844 units, while retail sales stood at 660,659 units, marking year-on-year declines of 10.6% and 9.6%, respectively. In contrast, Malaysia's new vehicle registrations during the same period totaled 655,328 units, experiencing only a slight decline of 2%. The sales gap between the two countries has narrowed to less than 10,000 units. Data indicates that Malaysia, with its more stable market performance, is mounting a strong challenge to Indonesia's long-held title as the 'King of Southeast Asian Automotive.' This contest for the top spot may reshape the regional automotive industry landscape.

Bob Azam, Vice President of Toyota Indonesia, warned that if Indonesia loses its top sales position in Southeast Asia, its automotive industry ecosystem could face relocation risks. As a vital economic pillar, the automotive sector not only contributes to fiscal revenue but also serves as a key area for employment security.

Recently, China's Changan Automobile held a brand launch event in Jakarta, Indonesia, officially entering the Indonesian market. Ye Pei, Executive Vice President, emphasized adherence to the principle of 'In Indonesia, For Indonesia,' promoting localization of products, research and development, and manufacturing through collaboration with the Indomobil Group. Besides introducing intelligent electric vehicle products, Changan plans to establish a nationwide after-sales service system in Indonesia and considers local production to support the country's automotive electrification transition and supply chain upgrades.

▍Thailand: Automotive Market Accelerates Electrification Transition, Avatr Conducts Feasibility Study on Extended-Range Models

Thailand's automotive electrification trend has significantly accelerated. According to data from the Federation of Thai Industries, from January to October 2025, Thailand produced 50,576 pure electric vehicles, surging by 530.15% year-on-year; in October alone, production reached 9,393 units, up 1,265% year-on-year. Hybrid vehicle production totaled 175,823 units, a 10.46% increase year-on-year.

In contrast, traditional internal combustion engine (ICE) passenger vehicle production declined by 30.84% in the first ten months, with domestic ICE passenger vehicle sales in October dropping by 17.80% year-on-year. On the sales front, pure electric passenger vehicle sales reached 8,479 units in October, soaring by 128.11% year-on-year, indicating robust market demand.

In terms of exports, despite a slight decline in total vehicle exports, new energy vehicle exports emerged as a bright spot, with hybrid vehicle exports growing by 40.80% year-on-year. Industry experts anticipate that, driven by year-end auto shows, Thailand's annual automotive market could reach the 600,000-unit target, with the electrification wave continuing to reshape its automotive industry landscape.

Chinese brand Avatr plans to conduct a feasibility study on extended-range electric vehicle technology in the Thai market. If market feedback is positive, Avatr will consider local assembly to enhance price competitiveness.

▍Malaysia: Launches ASEAN's First Electric Vehicle Battery Passport Standard, Electric Vehicle Sales Exceed 5% Market Share

Recently, Malaysia officially released MS 2818, ASEAN's first electric vehicle 'Battery Passport' standard, marking a breakthrough in building a sustainable electric vehicle ecosystem. The standard tracks key information throughout the lifecycle of electric vehicle battery packs, focusing on transparency, traceability, and sustainability in battery management. It aims to strengthen regulatory efficiency and promote the recycling of power batteries. This innovative standard will accelerate the improvement of Malaysia's electric vehicle ecosystem and support the industry's smooth transition to electrification.

Data shows that in October 2025, Malaysia registered 4,345 electric vehicles, a 177% year-on-year surge, setting a new monthly record. BYD stood out, with four models including the Atto 3 securing four of the top five sales spots. Not only did BYD solidify its position as Malaysia's leading electric vehicle brand, but it also became the first electric vehicle brand to exceed 10,000 registrations in ten months in Malaysia.

This robust growth brought electric vehicles' market share to 5.34% of Malaysia's total automotive sales. With the impending expiration of the tax exemption for fully imported electric vehicles, market demand is expected to continue rising in the fourth quarter.

▍Vietnam: Automotive Market Accelerates Transformation, Imported and New Energy Vehicles Drive Growth

Customs data reveals that from January to October 2025, Vietnam imported 171,000 vehicles, a 20% year-on-year increase, reaching a three-year high. During the same period, imported vehicle sales grew by 17%, significantly outpacing the 6% growth of locally assembled vehicles, indicating a shift in consumer preference toward imported models.

Consumer demand for clean transportation options is rising. In the first ten months, hybrid vehicle sales increased by 73%, while electric vehicle sales reached 9,798 units. VinFast held over 60% market share, with Toyota and Honda maintaining strong positions through hybrid models. Foreign brands like BYD reduced costs through local production. Consumer surveys show that 63% of buyers prefer imported vehicles for quality, while 54% consider purchasing new energy vehicles within the next two years.

Experts predict that, driven by policy incentives and consumption upgrades, Vietnam's automotive market will maintain a 6-8% annual growth rate from 2025 to 2030, with new energy vehicles expected to exceed 40% market share by 2030.

Layout 丨 Zheng Li

Sources 丨 Oto.detik, Autolifethailand.tv, Autobuzz.my, Vietnamnews.vn

Image Sources 丨 Qianku Network