Can Li Auto Reclaim Its 'Ideal' Through Embodied Intelligence?

![]() 12/03 2025

12/03 2025

![]() 506

506

Lead | Introduction

As the inaugural new energy vehicle (NEV) manufacturer in China to attain annual profitability, Li Auto once set the standard for emerging NEV firms. By precisely gauging user needs, it fused the once-outmoded extended-range technology with amenities such as refrigerators, large TVs, and sofas, achieving remarkable success. However, since officially venturing into the pure electric vehicle market with the MEGA, Li Auto appears to have lost its bearings. Recent events, including a quarterly loss and the MEGA recall, have raised alarms for the company.

Published by | This article is produced by: Heyan Yueche Studio

Written by | Article written by: Zhang Dachuan

Edited by | Edited by: He Zi

Full text: 2,715 characters

Reading time: 4 minutes

Li Auto is currently experiencing a downturn.

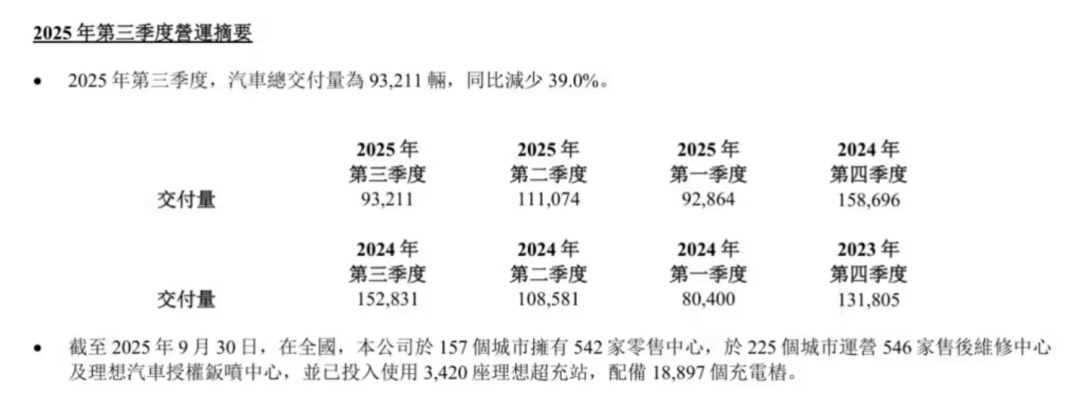

According to Li Auto's financial report for the recently concluded third quarter, the company delivered 93,200 vehicles, marking a 39.0% year-on-year decrease. Consequently, its revenue was 27.4 billion yuan, a 36.2% decline from the previous year. Gross profit stood at 4.5 billion yuan, a 51.6% drop year-on-year. The quarterly operating loss was 1.2 billion yuan, and the net loss amounted to 624 million yuan, in stark contrast to the 2.8 billion yuan profit recorded in the same period last year. This represents Li Auto's first loss since achieving profitability in the fourth quarter of 2022.

△ Li Auto Reports Another Quarterly Loss

Another Loss

Notably, Li Auto's gross profit margin also saw a significant decline. Its Q3 gross profit margin dropped to 16.3%, a 5.2 percentage point decrease from 21.5% in the same period last year. The vehicle gross profit margin was even lower at 15.5%, well below last year's 20.9%. Even excluding the adverse impact of the MEGA recall, the vehicle gross profit margin remained lower than last year at 19.8%. According to Li Auto, capital investment during the pure electric transition period, the MEGA recall, and price wars have all contributed to squeezing profit margins.

△ The MEGA recall has inflicted significant losses on Li Auto.

What is somewhat surprising is that Li Auto's outlook for the fourth quarter is equally unoptimistic. In the upcoming quarter, it anticipates delivering only 100,000 to 110,000 vehicles, a 37% to 30.7% year-on-year decrease. Revenue is projected to range between 26.5 billion yuan and 29.2 billion yuan, a 40.1% to 34.2% decline from the previous year. Given its existing product lineup and production plans, it will be challenging for Li Auto to stage a turnaround in the fourth quarter. The question of what strategies remain to be employed is a daunting one facing Li Xiang.

△ Li Auto's outlook for the fourth quarter is equally unoptimistic.

Selling Cars Is No Longer Easy

In comparison, as Li Auto's primary competitors, XPeng, NIO, and Leapmotor witnessed year-on-year sales increases of 149.3%, 40.8%, and 101.77%, respectively, while Li Auto's deliveries decreased by 39.0% year-on-year. This shift not only caused Li Auto to relinquish its top position in the domestic new NEV company sales rankings but also placed the company, once renowned in the domestic automotive market for its 'refrigerators, large TVs, and sofas,' in an unprecedented crisis.

From a product matrix perspective, Li Auto has consistently adhered to a dual strategy of extended-range and pure electric vehicles. In particular, extended-range vehicles have been the cornerstone of Li Auto's success. However, under the relentless pressure from competitors like Seres and Leapmotor, this sales pillar has begun to show signs of weakness. Leapmotor, often dubbed the 'half-price Li Auto,' has claimed the top spot in the domestic new NEV sales rankings, with extended-range models being its primary sales driver. Data reveals that in the third quarter of this year, deliveries of Li Auto's L series models decreased by 42% year-on-year, with models like the L7, L8, and L9 experiencing significant sales declines.

△ Li Auto's extended-range models have lost their competitive edge.

For instance, the Leapmotor C16 and the Li Auto L8, both mid-to-large six-seater SUVs targeting the family travel market and offering similar configurations, differ significantly in price. The official guide price for the Li Auto L8 ranges from 321,800 to 379,800 yuan, while the Leapmotor C16 ranges from 151,800 to 189,800 yuan, nearly half the price of the Li Auto model. In terms of configuration, the Leapmotor C16 comes standard with 800V high-voltage silicon carbide fast charging, front and rear parking radar, 360° panoramic imaging, and rear seat heating/ventilation. High-end models also include lidar and NVIDIA Orin high-computing-power chips. In this context, users opting for Leapmotor's equivalent models over Li Auto's becomes a cost-effective choice.

△ Leapmotor, dubbed the 'half-price Li Auto,' has diverted a significant portion of sales that would have otherwise gone to Li Auto.

In the pure electric vehicle sector, Li Auto faces even greater challenges. The previous setback with the MEGA caused Li Auto to delay the launch of new pure electric models. The long-anticipated Li Auto i8 and i6, which were expected to make a splash this year, underperformed, faring much worse than the nearly simultaneously launched NIO ES8 and LeDao L90. The Li Auto i8 was forced to adjust its configuration and effectively reduce its price by 20,000 yuan just one week after launch. Meanwhile, the Li Auto i6 suffered from limited production capacity, resulting in lower-than-expected actual deliveries. In October, the i8 sold 5,749 units, while the i6 sold only 5,775 units. In contrast, the NIO ES8 sold 6,703 units, and the LeDao L90 sold 11,772 units during the same period. According to Li Auto, the total orders for the two new models have exceeded 100,000 units, but the challenge of converting these orders into effective deliveries remains.

△ The NIO ES8 and LeDao L90 clearly outperform the Li Auto i8 and i6.

In reality, whether in the extended-range or pure electric vehicle sectors, Li Auto faces fierce competition. Take NIO, for example, which has adopted battery swap technology. Although this initially burdened the manufacturer with heavy capital expenditures for building swap stations, the competitiveness in vehicle pricing brought by the Battery as a Service (BaaS) model is undeniable. As for Leapmotor, its significant cost advantage, built through a strategy of in-house development across the board, is something Li Auto will find difficult to match in the short term.

△ BaaS gives NIO's pure electric models a significant pricing advantage.

Can the Embodied Intelligence Track Be Pursued Successfully?

During the recent financial results conference, a statement by Li Xiang, the head of Li Auto, provoked deep thought. In Li's view, the current competition in China's domestic electric vehicle industry has fallen into the trap of 'parameter stacking.' However, do an extra 10mm of wheelbase or 10km of range truly enhance the user experience? The answer is no. Without achieving decisive breakthroughs, automakers can only resort to finding product highlights that do not require significant technological advancements. Some automakers have even gone as far as installing bathrooms and floor heating in their vehicles, which greatly deviates from the original purpose of automobiles. Additionally, price competition has intensified, with various methods being used to reduce vehicle costs, even at the expense of squeezing suppliers' profits to the limit.

To find new growth points, Li Auto will shift its focus to the field of embodied intelligence. One of the most typical applications of embodied intelligence in the automotive industry is high-level autonomous driving. Currently, many automakers and intelligent driving companies are engaged in autonomous driving business, but high-level autonomous driving represents an extremely complex application scenario. Relevant companies need to build full-stack in-house capabilities encompassing perception, modeling, computing power, and chassis systems, while also maintaining a cost advantage. In this context, relying solely on suppliers will make it difficult to achieve decisive breakthroughs. In response, Li Xiang outlined Li Auto's future plan—to focus on embodied intelligence/autonomous driving. Over the past few years, Li Auto has invested significant resources in developing core technologies such as the M100 chip, Xinghuan OS, and wire-controlled chassis, aiming to establish its full-stack in-house capabilities in the autonomous driving field.

△ Next, Li Auto will focus on high-level autonomous driving to drive growth in the embodied intelligence industry.

However, high-level autonomous driving is extremely challenging, and without long-term investment, significant achievements are unlikely. Huawei, Tesla, and Momenta are all making sustained efforts. Whether Li Auto can leverage its past experience in understanding user needs to make breakthroughs in key areas that provide tangible benefits to users will be the foundation for its success in high-level autonomous driving. Expanding the perspective further, the broader embodied intelligence sector, which includes humanoid robots, offers vast market potential but even fiercer competition. For Li Auto to achieve a comprehensive corporate transformation, the challenges are even greater.

△ The broader embodied intelligence sector, including humanoid robots, offers vast market potential but even fiercer competition.

Commentary

In the ruthless second half of the new energy vehicle era, anyone can fall behind. A year or two ago, no one would have imagined that Li Auto, once so successful in the domestic automotive market and even issuing weekly reports, would find itself in this position today. However, no company's development is smooth sailing, and encountering difficulties is normal. The challenges Li Auto faces today are inevitable for any new NEV company on its growth path. Even multinational automotive giants like Volkswagen, Toyota, and the BBA luxury brands face similar situations. For Li Auto, having committed to embodied intelligence, the next step is to invest sufficient resources and find a way to succeed in autonomous driving. However, this path is far more challenging than offering refrigerators, large TVs, and sofas.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)