New Energy Vehicle "Three Kingdoms Showdown": Why is Galaxy Leading, Fengyun Overtaking, and Qiyuan Losing Its Way?

![]() 12/04 2025

12/04 2025

![]() 472

472

Introduction

Is it a case of one step slow leading to all steps slow, or one wrong step leading to all steps wrong?

The Chinese new energy vehicle market in 2025 is witnessing a brutal elimination race. Against the backdrop of BYD and Tesla dominating the top positions, major traditional automakers are fiercely competing for survival space in the new energy sector. Geely Galaxy, Changan Qiyuan, and Chery Fengyun have emerged as representative players in the new energy market for traditional automakers.

When comparing these three leading automakers, it becomes evident that this is ultimately a test of top-level design and systemic capabilities. Geely Galaxy is surging ahead with a clear product matrix and technological identity, while Chery Fengyun, backed by solid hybrid technology, is accelerating its pursuit as a dark horse, steadily building its market territory.

However, Changan Qiyuan, another core player in this intense competition, is struggling in a puzzling manner. Its temporary lag is superficially due to the lack of a blockbuster model that can define the market, but the deeper issue lies in its systemic inability to form a synergy in strategic planning, brand narrative, channel refinement, and user engagement capabilities.

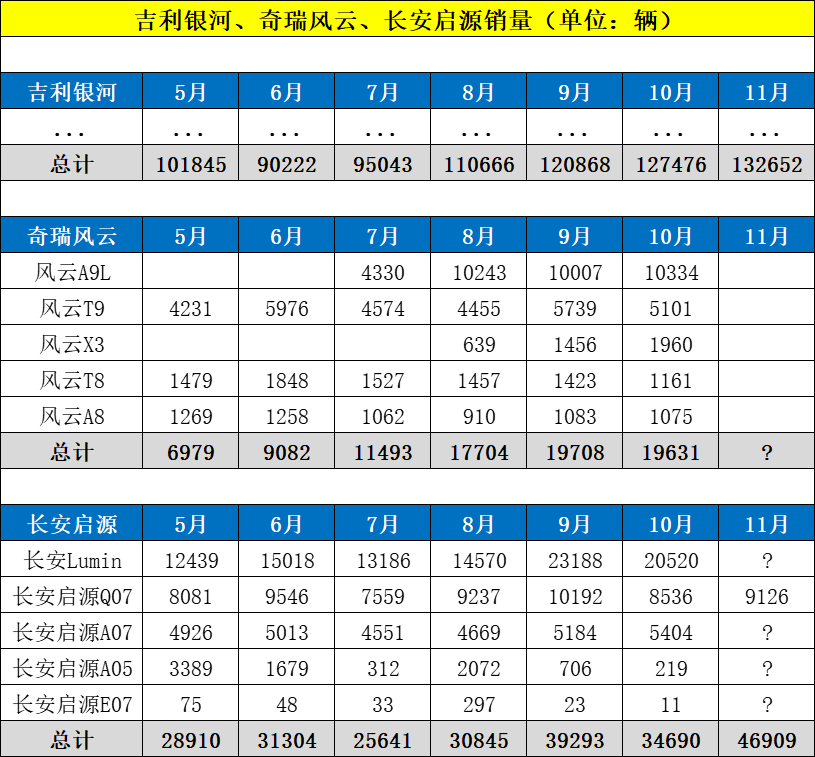

Sales data provides the most intuitive insight into this struggle: In November this year, Geely Galaxy's monthly sales climbed to a peak of 132,700 units, demonstrating strong market dominance. Chery Fengyun's monthly sales also stabilized at around 20,000 units, maintaining a steady pace.

In contrast, despite Changan Qiyuan's total November sales jumping to 46,900 units due to the inclusion of a large number of low-cost micro-vehicles, the Changan Lumin, in the statistical scope, its core product lines such as the A07 and Q07 have consistently hovered below the 10,000-unit threshold per model, far behind the flagship products of competitors.

01 The Far-Reaching Impact of Lacking a Blockbuster Model

Currently, Changan Qiyuan's sales heavily rely on the micro-electric vehicle Changan Lumin, which contributes more than half of the brand's sales. Of course, everyone is aware that such a low-margin vehicle is clearly insufficient to support Changan Qiyuan's brand narrative. Therefore, the Changan Qiyuan Q07, the first model launched in Changan Qiyuan's 2.0 phase, is truly the model with the potential to break the mold.

However, this model, placed at the core of Changan Auto's transformation, as a mid-sized new energy SUV carrying the expectations of the "Great Single Product Strategy," had set an ambitious goal of consistently surpassing 20,000 monthly sales. Yet, the cold reality of the data paints a different picture.

Since its launch, the vehicle's retail sales have struggled below the 10,000-unit mark, only briefly touching 10,192 units in September 2025 before dropping back to 8,536 units the following month. This means that the Q07's failure to meet its blockbuster target also signifies a key setback in Changan Qiyuan's transformation.

The Changan Qiyuan Q07, launched on April 23 this year, initially had a "perfect start." In the mid-sized new energy SUV market, neither BYD, Geely Galaxy, nor Chery Fengyun had products that could directly compete in terms of product strength and price range. Everyone believed that the Q07 would naturally become the "dark horse" of the year.

However, contrary to expectations, the Q07 failed to sustain its initial sales momentum and was instead surpassed by later entrants such as the Leapmotor C10 and BYD Sealion 06. More critically, Geely Galaxy, with its Xingyao 8 and M9, and Chery Fengyun, with its A9L, climbed past the 10,000-unit monthly sales threshold with higher-priced models, beginning to surpass Changan Qiyuan in brand stature.

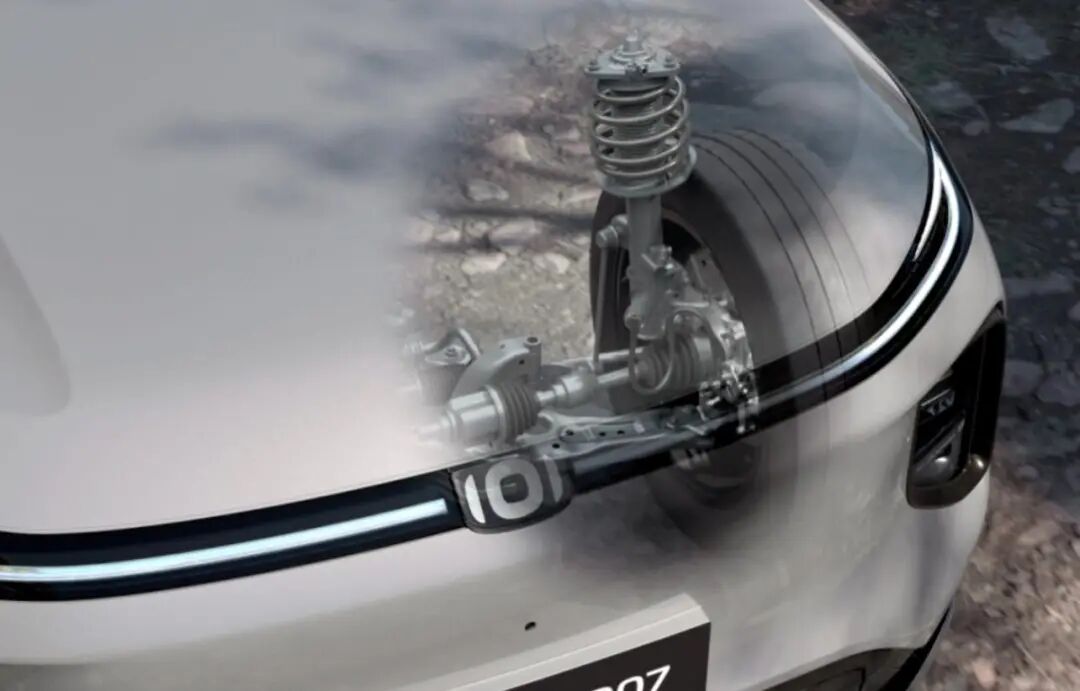

The Q07's predicament primarily stems from inherent deficiencies in brand top-level design and severe operational inefficiencies in subsequent management. When the Q07 was introduced to the market, it needed to establish a technological flagship image with superior configurations such as the initially promoted LiDAR and CDC Magic Carpet Suspension, while also shouldering the burden of high-volume sales with an aggressively priced strategy.

This strategic ambiguity directly led to scattered resource allocation and a blurred product positioning. From its inception, the Q07 was mired in identity anxiety, expected to simultaneously play two almost contradictory roles: meeting the rigid indicator (translated as "metrics" or "targets") for scale through high cost-performance models while achieving brand elevation through premium products.

In fact, this flaw is highly likely to recur with the Changan Qiyuan A06, launched on November 9, which is of equal importance to the Q07. As Changan Qiyuan's first strategic mid-to-large new energy family sedan, priced between 109,900 and 149,900 yuan, it offers "Maybach-level" space and seating experience, along with LiDAR-equipped intelligent driving.

However, as of early December, Changan Qiyuan released a poster claiming that the A06 received over 30,000 orders in its first month of price and benefit announcement, yet it did not disclose specific November sales figures. During this period, with the continuous emergence of new products, the vehicle has lost the initial heat of "launching with high volume."

In contrast, the Geely Galaxy A7 and Chery Fengyun A9L in the same category have higher sales. After the Guangzhou Auto Show, a plethora of new car launches overshadowed its momentum, and even the newly launched Dongfeng Nissan N6 continued to garner sustained attention. This highlights Changan Qiyuan's failure in brand communication and user engagement, making the A06 another casualty.

In other words, alongside its vague strategy, Changan Qiyuan has failed to establish a distinct, unique, and credible technological or value label for itself in terms of communication. While competitors have built robust cognitive fortresses around "safety," "intelligent driving," and "hybrid technology," Changan Qiyuan's communication appears scattered and ineffective.

For example, what is the first impression that comes to mind when you think of the Changan Qiyuan Q07 and A06? This is a difficult question to answer. In contrast, the Geely Galaxy A7 represents ultimate cost-performance and pure family sedan attributes; the Chery Fengyun A9L embodies a stately and steady (translated as "stable" or "composed") sedan representative. This is where Changan Qiyuan begins to gradually fall behind Geely Galaxy and Chery Fengyun.

Changan Qiyuan's technology is not without highlights. On the A06 model, Changan showcased the technological prowess of the SDA Tianshu architecture, including an 800V silicon carbide high-voltage platform, 6C flash charging technology, and an innovative "ten-horizontal, nine-vertical" Ark cage-type steel-aluminum hybrid body. However, the presentation of these high-end technologies has not translated into increased market recognition or sales growth, revealing a disconnect between technological advantages and market performance. This reflects Changan Qiyuan's shortcomings in brand building and market communication.

02 What is the Essence of Development?

Examining the paths of Geely Galaxy and Chery Fengyun, their phased success (translated as "phased success") shares a commonality: they have both achieved, to a certain extent, a systemic synergy in strategy, product, brand, and user operations.

Geely Galaxy clearly anchored its positioning in high-value hybrids from its first product and reinforced this label through continuous technological validation, with its product matrix expansion ordered (translated as "orderly") unfolding around this core positioning. Chery Fengyun, leveraging the group's profound engine and hybrid technology accumulation, effectively translated the recognition of "Technological Chery" into the new energy sector. Its product launches may have been slightly later, but with solid technological foundations and a clear cost-performance strategy, it quickly gained market acceptance.

Their actions demonstrate a goal-oriented consistency. In contrast, Changan Qiyuan's issue does not stem from a lack of resources or technological reserves but from insufficient systemic integration capabilities to transform resources into sustainable competitive advantages.

Internally, the company may have recognized the problems and attempted organizational changes, such as appointing product CEOs to bridge the gap between product and marketing, and proposing an ambitious Great Single Product Strategy. However, the effectiveness of these strategic implementations still requires market validation. The current market environment does not allow for prolonged trial and error. The window of opportunity is narrowing, and consumer patience and attention are limited.

For Changan Qiyuan, the path to breaking through does not lie in launching another isolated model claiming to "sell 20,000 units per month" but in undergoing a profound, systemic self-reconstruction. It must first answer: What is the irreplaceable core value of the Qiyuan brand to Changan and to consumers?

Within Changan Auto's new energy landscape, what is the unique user value and market positioning that the Changan Qiyuan brand offers that is irreplaceable? Is it based on "ultimate practicality and reliability" for family travel or "intelligence and individualized fun" for young tech enthusiasts? Once the answer is clear, the product line should be ruthlessly streamlined accordingly.

In fact, if we crudely interpret the product planning of Geely Galaxy and Chery Fengyun, the answer is simple: a vehicle at a certain price point should have a corresponding positioning. A model's positioning should not be broad and all-encompassing but should highlight one extreme advantage that caters to the pain points of consumers at that price point to potentially achieve sales breakthroughs.

To put it more plainly, mainstream consumers do not prioritize LiDAR-based intelligent driving or CDC shock absorption. Looking at new energy vehicles that sold over 10,000 units per month in October, except for high-end models emphasizing these configurations, the core labels of other best-selling models are not these advanced features.

Of course, it does not mean that these affordable models do not need these advanced features, but they require other distinct labels to take precedence. Just like the Geely Galaxy A7/Xingyao 8/M9 and Chery Fengyun A9L, these models also have advanced features, but their selling points are not these features. Instead, they hit consumer needs through precise product definition and positioning.

Moreover, Changan Qiyuan has been led astray by these advanced features. Public consumer complaints reveal that many owners who purchased the top-spec Changan Qiyuan Q07 in late September felt severely let down when, just a month later, Changan Qiyuan launched the "Tianshu Intelligent Laser Edition" with added LiDAR and advanced intelligent driving features at a similar price to the previous top-spec model.

This short-term overhaul of the product value system not only severely harmed the rights of existing owners but also sent a strong negative signal to potential consumers about the brand's hasty decision-making and questionable product value retention. Coupled with the perfunctory (translated as "perfunctory") and evasive responses from some after-sales service personnel (even complaints directed at engineering directors), it created a disaster scenario for user experience.

These operational inefficiencies mean that even though the Q07 possesses certain competitiveness in terms of space and range on paper, it struggles to translate into solid user reputation and sustained sales growth. This erosion of trust has a strong contagion effect, further impacting all subsequent new models from Qiyuan.

Another issue lies in the channel aspect. Although Changan and Qiyuan possess a vast sales network, their marketing strategies and channel empowerment have failed to effectively support the sales of high-end or complex products. For models like the Q07 and A06, which require explaining intelligent technologies such as CDC and intelligent driving value to consumers, traditional sales pitches and models may no longer suffice.

Of course, as a former "leader among independent brands" that has also risen from the depths to reach the pinnacle, Changan Auto should intermittently recognize these issues. Facing formidable opponents like Geely Galaxy and Chery Fengyun, it is believed that Changan Qiyuan can also find new solutions.

Editor-in-Chief: Shi Jie Editor: He Zengrong

THE END