Can Beijing Hyundai, Once a Sales Giant with a Million Vehicles a Year, Now 'Struggling in the Shallows', Create a New Splash with Li Fenggang at the Helm?

![]() 12/04 2025

12/04 2025

![]() 591

591

Writer | Xingxing

Source | Beido Business & Beido Finance

“In the next five years, Beijing Hyundai aims to hit a sales volume of 500,000 vehicles. At the product level, it will pursue a dual-path development of 'both gasoline and electric vehicles', with plans to roll out 20 new products by 2030,” Beijing Hyundai boldly declared its ambition to lead the market in the recently unveiled 'Smart Start 2030 Initiative'.

However, Beijing Hyundai's lofty future aspirations starkly contrast with its current sales predicament, creating a seemingly 'disconnected' scenario. Ever since it tumbled from the pinnacle of selling a million vehicles annually, the company's sales have languished in recent years, with 2025 posing an even steeper challenge.

As the automotive industry undergoes a seismic shift today, Beijing Hyundai is in urgent need of uncovering new growth avenues amidst the throes of change. Can the appointment of Li Fenggang as the new general manager and the introduction of the first pure electric platform SUV, the 'EO YIOU', usher in fresh turning points for this seasoned joint-venture automaker?

I. Persistently Sluggish Sales: A Once-Million-Vehicle Automaker Battles to Stay Afloat

Recently, Beijing Hyundai disclosed its latest sales figures, reporting 20,001 vehicles sold in November 2025, marking a 21% year-on-year surge, including a 72% year-on-year spike in domestic market sales. This marks the second consecutive month that Beijing Hyundai's monthly sales have eclipsed the 20,000-vehicle mark, following the 20,016 vehicles sold in October.

Regarding these numbers, Beijing Hyundai's self-assessment is one of 'unleashing strength and riding the wave', with domestic sales witnessing significant year-on-year growth, and it claims to 'lead the market with might'. Yet, given the current fiercely competitive market landscape, the 'leading' edge touted by the company still leaves ample room for scrutiny.

Firstly, when pitted against other joint-venture brands, SAIC Motor's SAIC Volkswagen witnessed a 32.04% year-on-year sales slump in November, yet it still managed to sell 90,050 vehicles in a single month. FAW-Volkswagen, too, achieved whole-vehicle sales of 149,100 units (inclusive of imported vehicles) in November, a scale that pales in comparison to Beijing Hyundai's.

Delving into Beijing Hyundai's annual sales data, the company asserts that its cumulative sales in the first half of the year surpassed 100,000 vehicles, with June sales alone reaching 21,713 units, a notable 66% month-on-month increase. Models like the all-new Elantra, all-new Tucson L, and Custo all posted month-on-month sales breakthroughs in June.

From a broader perspective, Beijing Hyundai's sluggish domestic market sales performance is an undeniable reality. Data from the China Passenger Car Association reveals that Beijing Hyundai's cumulative terminal sales in the first three quarters of 2025 stood at a mere 80,800 vehicles, and whether it can cross the 100,000-vehicle threshold this year remains uncertain.

Such lackluster performance stands in stark contrast to Beijing Hyundai's heyday. It's noteworthy that the company shone brightly in 2013, achieving 'double million' milestones by producing and selling a million vehicles annually and amassing five million vehicles in total sales, becoming the third domestic company to hit annual production and sales of over a million vehicles for a single brand.

Subsequently, Beijing Hyundai's sales continued to climb steadily, reaching 1.142 million vehicles in 2016, with an average monthly sales volume exceeding 95,000 vehicles, firmly entrenching itself among the top five joint-venture brands. Back then, no one could have foreseen that these impressive figures would mark both Beijing Hyundai's zenith and the onset of its sales decline.

In 2017, Beijing Hyundai's annual sales plummeted to 785,000 vehicles, directly slipping below the one-million mark, and then continued its downward spiral, with new vehicle sales of 502,000, 385,000, 284,000, and 257,000 vehicles from 2020 to 2023, respectively. In 2024, sales dwindled to approximately 150,000 vehicles, gradually leaving it stranded in the shallows of sluggish sales.

II. Selling Core Factories and Embracing Multi-Dimensional Transformations for Breakthroughs

The abrupt sales collapse has directly led to overcapacity and shrinking profits for Beijing Hyundai. To slash operational costs, the company has been compelled to offload its factories as a defensive measure.

Recently, it was reported that Beijing Hyundai has transferred its Chongqing factory to Changan Automobile for 1.62 billion yuan, which will serve as the production line for Changan's new energy brand, Shenlan Automobile. Shenlan Automobile disclosed that it has drawn up relevant usage plans, but the production commencement time and specific models to be produced remain under wraps.

This factory, sprawling over an area of 1.872 million square meters, is not only Beijing Hyundai's fifth vehicle production base in China but also a symbol of its peak period when demand outstripped supply. Construction of the Chongqing factory kicked off in 2015, and it officially commenced production in August 2017, boasting an annual production capacity of 300,000 vehicles. Upon coming into operation, it directly boosted Beijing Hyundai's total production capacity to 1.65 million vehicles.

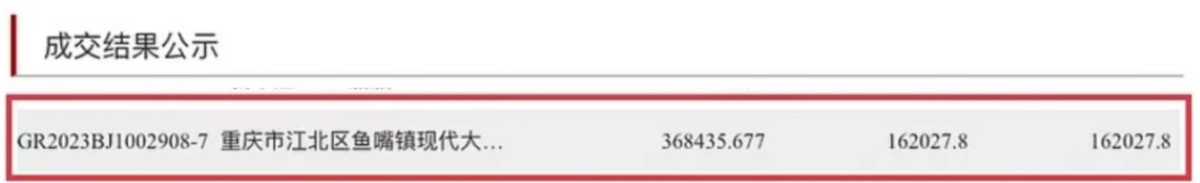

However, with Beijing Hyundai's decline in the Chinese market, the Chongqing factory has lain idle since December 2021. After multiple failed auctions and price cuts, the final transaction price was slashed from 3.684 billion yuan in August 2023 to 1.62 billion yuan, equivalent to a mere 20% of the total investment of 7.75 billion yuan at the time of construction.

In fact, as early as 2021, Beijing Hyundai had already offloaded its 'suspended' Shunyi First Factory to the new automotive contender, Li Auto. There have also been whispers that its Cangzhou factory has suspended operations and is up for grabs. However, even after slashing the total production capacity from 1.65 million vehicles to the current 450,000 vehicles, the company's capacity idle rate still exceeds 70%.

Interestingly, Beijing Hyundai's two factory acquisitions aptly mirror the reshuffling of the Chinese automotive market landscape—in the wave of the electrification era, independent new energy brands are rapidly ascending, while joint-venture automakers, primarily focused on traditional fuel vehicles, have witnessed a significant erosion in market share and are gradually being sidelined in the fierce competitive arena.

In fact, as early as 2016, Beijing Hyundai rolled out a new energy strategy dubbed the 'NEW Plan', aiming to launch nine new energy models by 2020. However, the products it ultimately unveiled, such as the Elantra EV and the all-new Sonata, were all 'fuel-to-electric' conversions and failed to make a dent in the market.

It wasn't until this year that Beijing Hyundai introduced its first SUV model, the EO YIOU, built on the E-GMP pure electric platform. It is reported that the price range of this model falls between 119,800 yuan and 149,800 yuan, accompanied by the launch of purchase incentives such as zero-down-payment financing, a 4,000-yuan trade-in subsidy, complimentary charging pile installation, and unlimited data. Pre-sales orders surpassed 5,000 units within three days.

At the same time, Beijing Hyundai underwent a leadership shakeup. On November 10, Hyundai Motor announced the appointment of Li Fenggang, the former executive vice president of FAW-Audi, as the general manager of Beijing Hyundai, tasked with overseeing the comprehensive management of Beijing Hyundai's production, sales, planning, and other specific development ventures, marking the first instance of a Chinese local talent assuming the general manager role on behalf of the South Korean side.

III. Conclusion

It's undeniable that Beijing Hyundai's new energy布局 (layout) and high-level personnel changes are intricately linked to its strategic transformation in the domestic market. Its transformation strategy not only holds the key to its own development prospects but also serves as a lens, reflecting the common opportunities and challenges faced by traditional joint-venture brands in the wave of electrification and intelligence.

However, the current new energy vehicle market has entered a phase of consolidation, with over 200 pure electric SUV products vying for attention. Many leading companies have gained an edge through technological breakthroughs and cost control, while some tail-end brands have been weeded out due to technological shortcomings and fractured capital chains. How Beijing Hyundai, which has missed the golden window of development, will carve out a niche remains to be seen over time.