BYD Sells 480,000 Units, Harmony Intelligent Mobility Alliance Hits 80,000 Units: What's Xiaomi's Tally?

![]() 12/04 2025

12/04 2025

![]() 563

563

Text by Wang Xin, Graphics by Yang Lingxiao, Produced by Electric New Species

As December approaches, major domestic new energy vehicle (NEV) companies have unveiled their latest November delivery figures. The overall performance underscores a thriving auto market this year, with leading brands further widening their lead while emerging players face intensifying competition.

From a data standpoint, BYD maintains an unassailable lead, with monthly deliveries surpassing 480,000 units, cementing its top spot in the industry.

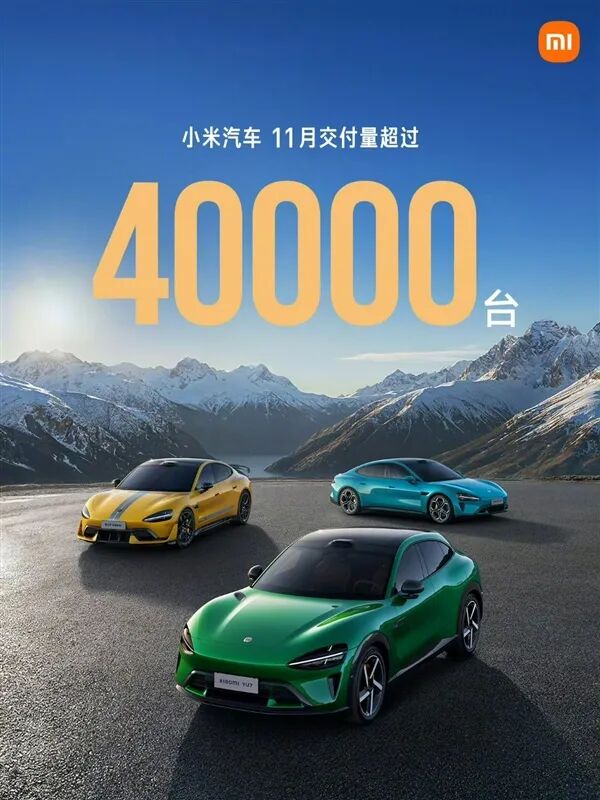

Huawei's Harmony Intelligent Mobility Alliance follows closely, with overall deliveries exceeding 80,000 units, setting a new benchmark. Leapmotor secures its market position with sales in the 70,000-unit range, while Xiaomi Auto has surpassed the 40,000-unit mark for the third consecutive month.

Additionally, NIO, XPeng, Li Auto, Seres, and BAIC maintain deliveries in the 30,000-unit range; Voyah reaches a new milestone with 20,000 units; and IM Motors continues to exceed 10,000 units monthly.

If the past two years were characterized by widespread growth, 2025 appears to be a year of fierce competition among leading brands. Nearly every major player is ramping up efforts, with none daring to slow down, as sales performance becomes a decisive factor for future success.

01 BYD Continues to Dominate

In November 2025, BYD once again led the pack with over 480,000 units delivered. Why does BYD remain so consistent? The question is not new, but each month's results reinforce its dominance.

Firstly, BYD benefits from a systemic advantage derived from scale. Its overwhelming competitiveness in the domestic market stems not from one or two standout models but from a comprehensive product lineup.

From the Seagull, Qin, and Song to the Han and Tang, and extending to the Fangchengbao and Denza brands, BYD's ecosystem resembles a vast net, covering mainstream consumer budgets from 70,000 to 400,000 yuan. Consumers need not overthink; BYD offers a solution for nearly every budget.

Secondly, BYD maintains a clear lead in DM (Dual Mode) technology. In an increasingly competitive market, the value of mature technological routes becomes evident. Hybrid technology has emerged as the top choice for many family users, and BYD's system is not only mature but also cost-effective.

Amid widespread price competition and supply chain cost fluctuations, BYD's technological stability has become a cornerstone for sustaining sales volume.

Another factor not to be overlooked is BYD's relentless overseas expansion. According to the European Automobile Manufacturers Association (ACEA), BYD's registrations in Europe surged by over 200% year-on-year in October. Rising export volumes have improved domestic factory capacity utilization and bolstered the brand's overall competitiveness.

BYD's 480,000 units represent not just a sales triumph but a concentrated demonstration of Chinese automakers' systemic capabilities: in-house R&D of core components, vertical integration, and deep supply chain partnerships have enabled Chinese brands to surpass joint ventures in industrial scale for the first time.

02 Harmony Intelligent Mobility Alliance Surges to 80,000 Units

If BYD symbolizes stability, the Harmony Intelligent Mobility Alliance embodies momentum. In November, the alliance delivered 81,864 units, surpassing October's 60,000-plus figure and jumping to the 80,000-unit level. Such a rapid surge within a single month is rare in the industry.

More critically, the Harmony Intelligent Mobility Alliance's growth is not reliant on a single brand but on its 'Five-Brand Matrix': AITO, Luxeed, Enjoyment, Zensect, and Shangjie.

This strategy is unprecedented in China's auto market history. Traditionally, automakers have operated under a 'one brand, multiple models' approach, whereas Huawei adopts a 'multiple brands, multiple models' strategy, treating its brand matrix as an 'operating system' and its product lineup as 'applications.' Through strong supply chain and intelligent capabilities, it achieves synergistic growth.

Several notable trends emerge from the data:

Models such as the AITO M8, M7, M9, and Luxeed R7 drive sales. The AITO M8, launched 200 days ago, has surpassed 120,000 cumulative deliveries, becoming AITO's biggest hit of the year.

The Zensect S800 received over 18,000 firm orders within 175 days of launch, with November deliveries exceeding 2,000 units, topping the luxury car sales charts above the 700,000-yuan mark for three consecutive months.

The Enjoyment S9 series leads in cost-effectiveness across multiple premium electric vehicle segments; Luxeed maintains monthly deliveries exceeding 10,000 units, with firm orders surpassing 10,000 for three consecutive months.

The Shangjie H5, launched on September 23, has rapidly ramped up production and deliveries, surpassing 10,000 units in November alone, with the factory now fully focused on boosting capacity.

The Harmony Intelligent Mobility Alliance's November performance reflects a reshaping of market dynamics—not through 'single-point breakthroughs' but through 'matrix-driven advancement.'

More importantly, its growth logic is not based on price wars but on a combination of intelligent experience, autonomous driving capabilities, cockpit ecosystems, and brand momentum.

Especially with the advent of ADS 4.0 in autonomous driving, technological experience now weighs heavily in consumer purchasing decisions. The Harmony Intelligent Mobility Alliance has precisely positioned intelligence as its core strength.

03 Xiaomi Exceeds 40,000 Units for Three Consecutive Months

In November, Xiaomi delivered over 40,000 units across its lineup, maintaining this level for three consecutive months. For Xiaomi, this achievement represents more than just a number—it signifies 'persistence against the odds.'

This year, Xiaomi Auto has faced intense media scrutiny and controversy. However, delivery trends reveal that market feedback holds more weight than public sentiment. The core consumer bases for the SU7 and YU7 remain stable.

A notable phenomenon: the more intense online debates become, the busier Xiaomi's offline stores get. This exemplifies 'emotional value consumption,' a unique path for internet brands entering the automotive sector.

More importantly, Xiaomi's December launch of 'immediate vehicle selection' shifts focus from 'emotion' to 'efficiency.' Immediate availability means faster deliveries and higher operational stability.

For consumers, shorter waiting times enhance satisfaction; for the brand, improved order turnover efficiency creates a positive cycle.

Furthermore, the introduction of the YU9 positions Xiaomi in the competitive 300,000-yuan six-seater SUV market. While fierce, this segment offers significant potential. Competitors like the AITO M9, Geely Galaxy M9, NIO ES8, IM LS9, and Leapmotor D19 are all vying for market share, but Xiaomi's brand momentum remains a formidable force.

Summary: Strong Players Break Through, Market Dynamics Continue to Evolve

November's sales rankings demonstrate that China's new energy vehicle market has entered an era of accelerated growth for dominant brands.

BYD's 480,000 units validate the value of systemic strength; the Harmony Intelligent Mobility Alliance's 80,000-unit performance showcases a new strategy for the intelligent era; Xiaomi's three consecutive months above 40,000 units prove that internet brands' momentum cannot be easily swayed by public opinion; Leapmotor's 70,000 units exemplify the ultimate in cost-effectiveness; NIO and XPeng are returning to improved gross margins and system stability; while Voyah's ten consecutive months of growth prove that 'state-owned enterprise new energy' can also compete fiercely.

The industry is no longer engaged in a simple 'sales battle' but in a comprehensive competition encompassing systems, brands, intelligence, supply chains, efficiency, and consumer perception—all undergoing realignment.

This is why we often say that China's auto market today is both the best and the toughest era. It is the best because of diverse innovation, technological advancements, and brand ascendancy; it is the toughest because any lapse could lead to falling behind.

However, November's rankings leave no doubt: Chinese companies are stronger than ever before.