Behind Pony.ai's Significant Q3 Performance Growth

![]() 12/08 2025

12/08 2025

![]() 458

458

The autonomous driving industry has recently seen new developments, with major L4 manufacturers expanding their robotaxi testing areas. The number of accidents has not increased linearly with the expansion of coverage.

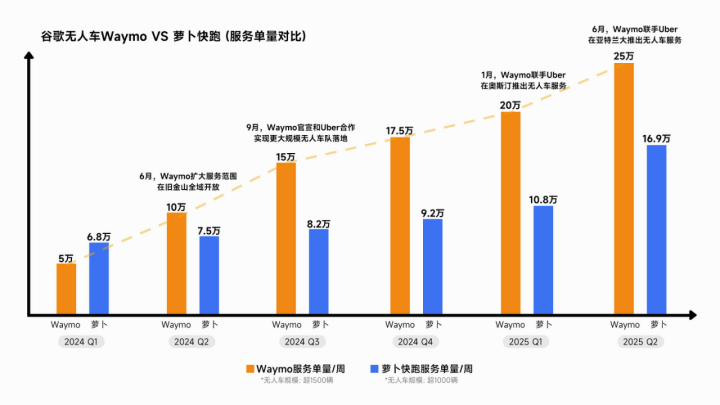

In the United States, Waymo continues to grow steadily, and Tesla has expanded its pilot regions. Domestically, various manufacturers have reported new highs in their average daily orders. Pony.ai and WeRide's Q3 financial reports show accelerated revenue growth and the potential for profitability in certain pilot regions, indicating an acceleration in industry growth.

The singularity of autonomous driving seems imminent. Autonomous driving has long been considered the easiest scenario for AI implementation, but despite the hype, orders are less than 1% of those for human-driven vehicles. Critically, while the industry is expected to double annually, some listed companies have shown revenue growth of less than 50% in the past two years. With low growth at this early stage, the projected 100% annual industry growth seems unrealistic.

With the marginal increase in Q3 growth, the anticipated high growth has arrived. Given this high growth rate, valuation issues become insignificant. As these companies have declined from their peaks, the question arises: what is the potential for autonomous driving stocks by 2026?

I. Performance Turning Point

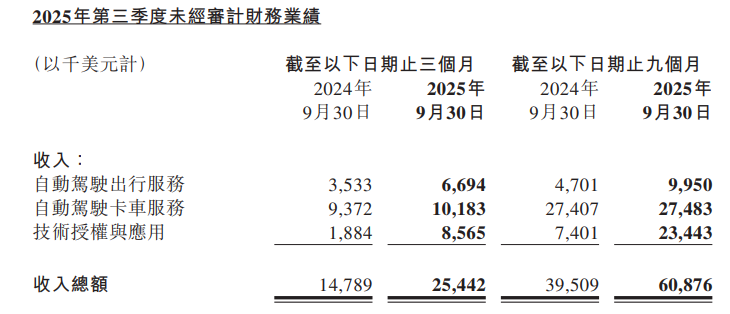

Last month, Pony.ai released its third-quarter financial report for 2025, showing total revenue of RMB 181 million, a 72% year-on-year increase. Robotaxi business revenue was RMB 47.7 million, surging by 89.5% year-on-year, with passenger fare revenue skyrocketing over 200%. In Guangzhou, city-level L4 Robotaxi Bicycle profitability (per-vehicle profitability) has turned positive.

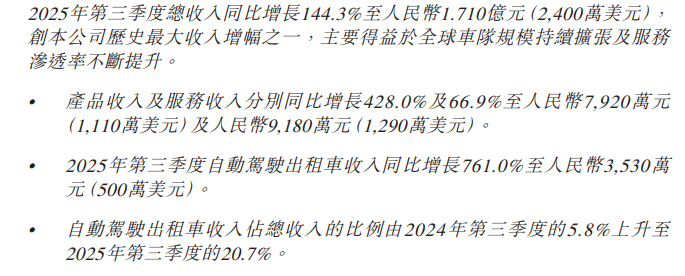

WeRide also performed well in Q3, with autonomous driving revenue growing by 761%, while other revenues from solution sales and whole machine sales were also strong.

Buoyed by multiple positive factors, the stock prices of both companies have rebounded from their lows to near their Hong Kong IPO prices.

From a performance structure perspective, domestic autonomous taxi companies previously struggled to gain market share for autonomous taxis and resorted to various means to generate revenue. They relied on simpler scenarios like autonomous trucks, which have limited market potential, and provided unmanned delivery solutions to automakers and logistics companies. However, they faced criticism for lacking progress in their core businesses and failing to validate demand.

Starting this quarter, it can be observed that core businesses have nearly doubled in growth. Additionally, technology licensing revenues, which are linked to autonomous driving capabilities, have also surged.

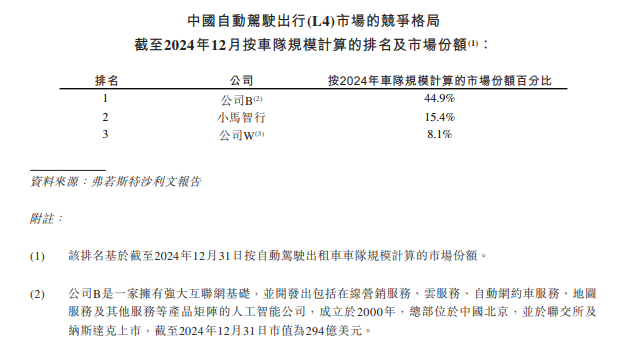

Baidu's Apollo Go, the market leader, has also reported positive news. In Q3, the total number of orders reached 3.1 million, a 212% increase. The Q2 order growth rate was 148%, showing a significant acceleration in Q3. The average order value for Apollo Go remained around RMB 18, indicating a 200% increase in business revenue.

In the outskirts of first-tier cities, Apollo Go has initiated large-scale fleet operation trials, with a noticeable increase in the density of autonomous vehicles on the roads.

Combining the Q3 financial reports, it is clear that the growth rate of autonomous taxis has significantly improved in Q3. The industry growth rate exceeds 100%.

Although technical metrics have not been disclosed, it is certain that the accident-free mileage is gradually approaching human-driven levels, as no major accidents involving autonomous taxis have occurred this year. Additionally, companies are likely benefiting from economies of scale, allowing them to reduce order charges as costs decline, enhancing price competitiveness.

Examining the order data details, Apollo Go has a fleet size of over 2,000 vehicles, with an average daily per-vehicle order count ranging from 10 to 15. This is still below the level of traditional taxis, which typically handle 15 to 20 orders per day. Considering Baidu's internal free ride services and Apollo Go trials on Baidu Maps, the actual market order volume is likely lower than reported.

However, Baidu claims that its cumulative order count in Q3 has surpassed Waymo's, indicating that Apollo Go's Q3 orders have outpaced Waymo's. Based on this, it can be said that Q3 may have seen significantly higher marginal growth in China compared to the United States.

Pony.ai has disclosed limited data but provided progress updates for specific cities. In Guangzhou, the city with the fastest progress and one of the most complex traffic environments in China, Pony claims an average daily per-vehicle order count of 23, approaching traditional taxi levels. Additionally, Guangzhou has achieved per-vehicle profitability. Despite some free orders, 23 orders after adjustments is still impressive, considering Waymo's best overseas region averages 25 orders per day.

WeRide, focusing on autonomous bus driving, has also made progress in the taxi market, with a peak average daily per-vehicle order count of 25 in Guangzhou.

Thus, in mature operational areas, the average per-vehicle order counts are approaching human-driven levels. After considering issues like intervention and slower driving speeds, this fully demonstrates the competitiveness of current autonomous driving fleets.

However, the industry also tends to report only positive news. Profits remain low, with Pony.ai's Q3 losses worsening compared to the previous quarter.

WeRide's losses have also not improved compared to Q2. Pony.ai emphasizes per-vehicle profitability in Guangzhou, indicating a viable UE model. However, there is room for manipulation, such as whether the group's overall R&D costs and marketing expenses are included. If only vehicle costs, maintenance, and energy replenishment fees are less than operational revenue, isn't this a bit opportunistic?

Examining each company's gross margin and expenses, profitability would require gross margins to increase nearly tenfold. Current gross margins are already in the single digits, with limited room for improvement. Therefore, revenue would need to multiply several times to achieve profitability on financial reports. Thus, these listed companies still have a long way to go in terms of financial performance.

II. How Far Has Growth Progressed?

Autonomous fleet revenue still follows the model of average daily per-vehicle orders multiplied by fleet size and average order value. It is unrealistic to expect the entire industry to achieve good financial report profitability soon. The catalyst for 2026 will likely be transitioning from local to national operational viability, attracting investors with high revenue growth and boosting valuations.

Based on the above data, order volumes are approaching human-driven levels, making further large-scale increases unlikely. Human-driven drivers work in shifts without breaks, handling up to 30 orders per day at most. Therefore, the industry's future revenue growth drivers will be fleet size and average order value.

Regarding average order value, this issue was analyzed in previous industry discussions, such as in 'WeRide and Pony.ai in the Robotaxi Wave.' It is a value that is difficult to increase. Essentially, the revenue potential of autonomous taxis is the combined income stream of traditional taxis and ride-hailing platforms (such as Uber and Didi) minus the income of ride-hailing drivers.

Replacing traditional platforms is merely an iterative transition for internet companies, which is acceptable. However, replacing drivers would inevitably cause unemployment. If autonomous taxi fares are not cheaper than human-driven ones and still cause unemployment, it would be a classic case where industrial development brings more harm than good.

During the autonomous driving replacement process, without price advantages, rapid penetration is unattainable. Therefore, the industry faces a clear time-price reduction curve, and a gradual decrease in average order value is expected to be the best-case scenario.

Subsequent revenue increases will then simply depend on fleet size.

However, growth will not be linear, as increasing fleet sizes may lead to a decrease in orders per vehicle. Similar to beverage stores, having too many outlets of the same brand in one area can reduce sales per store. Therefore, these manufacturers must expand their fleet sizes while ensuring full utilization and preventing order volume declines due to increased vehicle numbers.

Based on current fleet sizes, an income expectation for the robotaxi business can be estimated. For example, Apollo's 5,000 L4 vehicles by 2026 represent a 2.5-fold increase from the current fleet size. Pony's expected 3,000 vehicles next year represent a threefold increase. WeRide, with its global layout and many solution licensing models, has not provided a clear expectation. Overall, the theoretical maximum expected fleet growth rate for the robotaxi industry next year is around threefold. Considering the expected decline in orders per vehicle and average order value due to scale expansion, the actual robotaxi revenue growth rate will likely be much lower than threefold but should exceed onefold.

Considering the low growth of existing truck and bus businesses and the uncertainty of licensing businesses, a more optimistic expectation for the total revenue of these autonomous driving companies in 2026 is a doubling.

III. External Benchmarking and Constraints

Whether doubling revenue can support significant market capitalization growth is debatable. Many companies with doubled performance this year have seen their stock prices increase three to fourfold.

However, from a valuation perspective, Pony and WeRide, the two listed companies, are currently overvalued with excessively high market capitalizations. Their PS ratios for this year are 70 for Pony and 38 for WeRide. Even with an optimistic expectation of doubled revenue next year, their valuations remain far from low.

Sell-side analysts generally expect a 50% growth rate next year. Although lowering expectations to easily exceed them is a common practice, a onefold growth rate is likely the realistic expectation.

On the other hand, the autonomous driving sector includes other companies, such as those in the parts (component) industry. Currently, autonomous driving solutions allocate significant value to LiDAR. If future growth relies on fleet size expansion, LiDAR usage will also increase.

In other words, the same revenue growth will also benefit LiDAR companies. However, LiDAR companies already outperform robotaxi companies in terms of revenue and profitability, as they cater not only to L4 hardware demands but also to L2 hardware needs for regular self-driving vehicles.

Moreover, LiDAR companies generally have lower market capitalizations. With lower market caps, the same growth logic, and similar growth margins, it seems unreasonable for LiDAR stocks not to rise while robotaxi stocks have independent rallies.

Additionally, in terms of business models, profitability mainly hinges on replacing ride-hailing companies like Didi. However, Didi's market capitalization is already modest, and Pony's market cap is nearly a quarter of Didi's. If Pony's market cap continues to rise, along with Apollo and WeRide's, their combined market caps could surpass Didi's before even completing the replacement.

Of course, Tesla serves as a valuation benchmark, making any PS ratio seem acceptable. However, whether Tesla's valuation can be sustained long-term and whether autonomous driving companies can maintain Tesla-like valuations remain uncertain.

Conclusion

For current robotaxi companies, Q3 results indicate a gradual transition from zero to one. Next year's growth expectations should be revised upward from the current sell-side forecast of around 50%.

However, with increased market capitalization due to Hong Kong listings and a rebound from current lows, when compared to LiDAR, ride-hailing, and other internet companies, even high growth does not provide robotaxi companies with a clear growth advantage, especially since other stocks offer profit advantages.

Therefore, the industry has limited opportunities in 2026. A growth rate exceeding onefold would be considered above expectations. While low growth seemed almost hopeless six months ago, the current possibility of high growth provides some upside potential. With significant revenue increases, gross margin improvements, and vast imagination space, a short-term valuation-driven rally next year is feasible, but such opportunities are likely to be quarterly.