How Did Different Car Companies Fare in Sales During November's Final Sprint?

![]() 12/09 2025

12/09 2025

![]() 382

382

Written by: Xue Fei

Produced by: Five-Star Car Review

As 2025 nears its end, on December 1st, the thriving domestic brands and emerging players promptly released their November sales figures. Both segments continued to soar, consistently breaking (setting new) records for sales, the proportion of new energy vehicles, and overseas export volumes.

In contrast, most joint-venture and luxury brands are gradually losing market share. In this face-off with new energy vehicle models, traditional models have failed to innovate swiftly enough or to grasp consumer demands sensitively. At present, they haven't mounted a large-scale counterattack, roughly reflecting the overall tone of the automotive market in 2025.

01 Several Domestic Brands on Track to Reach 3 Million Units

BYD's November sales hit 480,000 units, setting a new annual sales record, with overseas sales exceeding 130,000 units, also a historic high. As of November, BYD's cumulative sales have reached 4.18 million units, leading SAIC Group and coming “tantalizingly close” to the annual target of 4.6 million units.

SAIC Group's November sales surpassed 460,000 units, with a cumulative total of 4.1 million units in 2025, outpacing the total sales of 2024. Among them, domestic brands experienced rapid growth, with cumulative sales reaching 2.66 million units, a growth rate exceeding 25%, becoming the main driving force behind SAIC Group's continuous breakthroughs this year. Simultaneously, sales from exports and overseas bases reached 960,000 units, also achieving double-digit growth, indicating the success of its overseas strategy.

Geely Group is undoubtedly one of the biggest winners this year, with passenger vehicle sales exceeding 310,000 units in November, marking nine consecutive months of month-on-month growth. This year's cumulative sales have reached 2.78 million units, and the annual target of 3 million units seems “well within reach”. Notably, Geely Group's new energy vehicle sales in November reached 187,000 units, accounting for over 60% of the total sales that month.

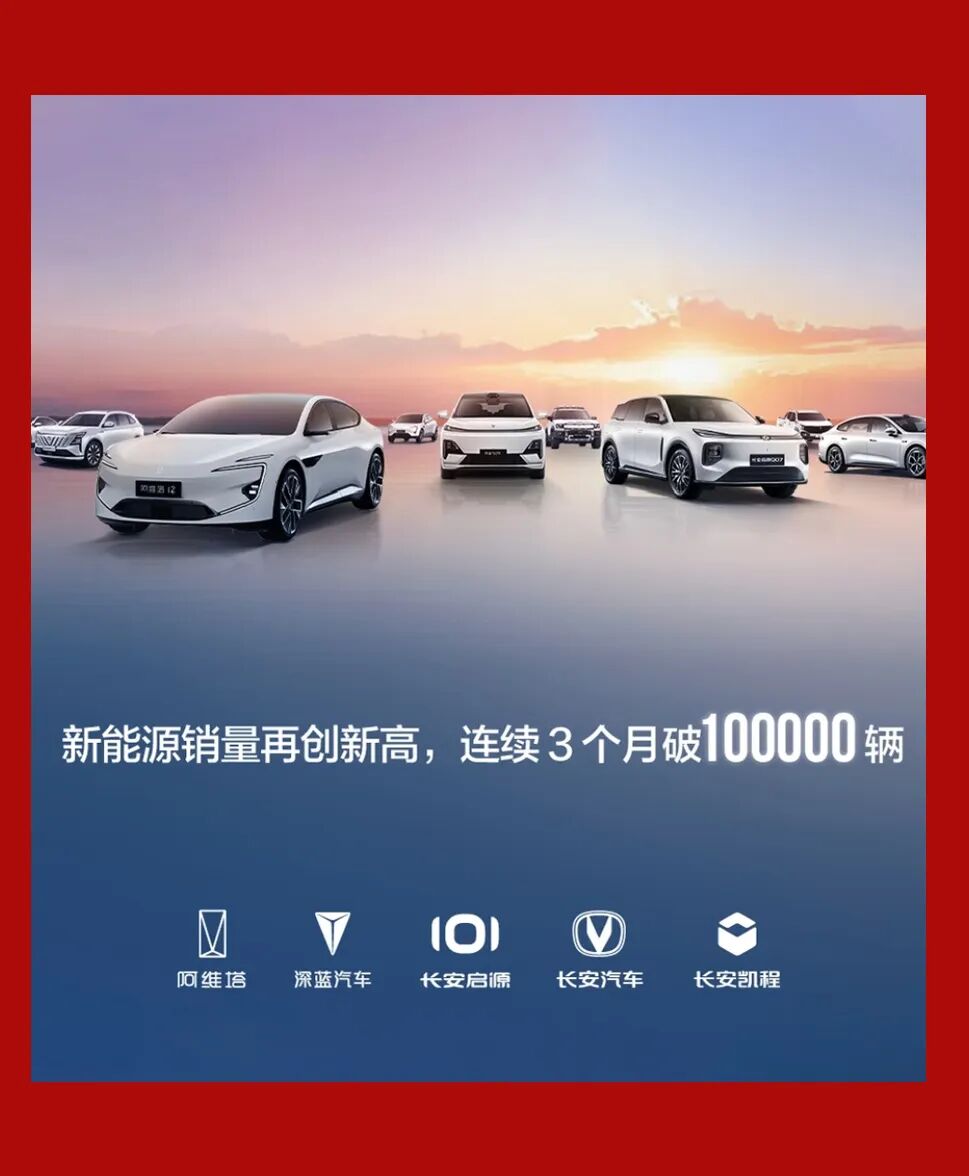

Changan Group followed closely, entering the final sprint stage with a monthly sales figure of 283,000 units and a cumulative total of 2.62 million units. The sales of its new energy vehicle models have exceeded 100,000 units for three consecutive months, slightly lagging behind Geely and BYD in the new energy transition.

Chery Group, which emphasizes its “tech-savvy” image and export strategy, can be described as silently prospering, delivering 278,000 units in November, including over 136,000 units in exports. This year's cumulative exports are nearing 1.2 million units.

Currently, the landscape of domestic brands is largely set, with BYD leading by a “massive volume” of over 4 million units, followed by Geely, Changan, and Chery, all nearing 3 million units. Great Wall, GAC, BAIC, and Dongfeng are currently in the second tier in terms of sales.

02 Luxury Brands Face Significant Challenges, with Price Systems in Tatters

Currently, luxury brands like BBA are making less and less of an impact. Due to their unique positioning, they are gradually fading from various rankings dominated by new energy competitors, and even the timing of their sales announcements is out of sync.

As of the writing date, the latest available data is still for the first 10 months, with Audi's cumulative sales exceeding 450,000 units, BMW's exceeding 430,000 units, and Mercedes-Benz experiencing the most significant decline, with cumulative sales of just over 380,000 units in the first 10 months. This is accompanied by the collapse of their price systems, with discounts on BBA's main models mostly exceeding 100,000 yuan, and some models even reaching a 35% discount.

The same goes for a series of second-tier luxury brands like Jaguar Land Rover, Cadillac, and Volvo, with a wide variety of mid-size luxury cars available for 180,000 or even 160,000 yuan. This includes Tesla, which once consistently led in sales, but this year's cumulative sales in the first 10 months have also decreased by about 10% year-on-year.

03 Leading Emerging Players Show Significant Growth, with the Titanium 7 Aiding Fangchengbao's “Comeback”

HiMode ranked first among the emerging players with 81,800 units sold, with AITO continuing to perform strongly, exceeding 50,000 units in monthly sales, a year-on-year growth of 60%. Its M7 and M8 models both delivered over 15,000 units in November, continuing to lead the mid-to-high-end SUV market among emerging players.

Leapmotor ranked second with 70,000 units delivered monthly. Through a market strategy of “ultimate cost-effectiveness”, Leapmotor has steadily established itself, completing its annual target of 500,000 units ahead of schedule, becoming an undisputed “dark horse” among domestic emerging brands.

Xiaomi Motor's sales report remains “vague”, but the figure of over 40,000 units does not affect the ranking, as none of the other emerging brands except the top two exceeded 40,000 units in November. Notably, the official data released by Xiaomi Motor last month also indicated over 40,000 units, but the final figure should be around 48,000 units, with an overall performance comparable to AITO.

Fangchengbao ranked fourth with 37,400 units sold, with the delivery of 24,000 units of the Titanium 7 playing a crucial role. This directly transformed Fangchengbao's marketing status, with the entire brand experiencing a 20% month-on-month increase and a 339% year-on-year increase, propelling it into the top five among emerging players.

XPeng Motors secured the last spot in the top five among emerging players with 36,700 units sold, surpassing NIO and Li Auto. This year, XPeng Motors has delivered over 390,000 units, far exceeding the annual target of 350,000 units set at the beginning of the year. Now, with the assistance of extended-range models, XPeng Motors will undoubtedly move towards the target of 500,000 units in 2026.

------- The end -------