Musk's Overt Strategy: FSD Bans Buyout, Subscription Only, Storm is Brewing

![]() 01/16 2026

01/16 2026

![]() 387

387

Reassessing Autonomous Driving

Author | Wang Lei

Editor | Qin Zhangyong

Musk has changed his tune.

On January 14, Musk tweeted a core message in one sentence: The 'one-time buyout' option for FSD (Full Self-Driving) will cease sales after February 14, after which FSD will only be available via monthly subscription.

The buyout price for FSD is $8,000 in the U.S. market (approximately RMB 56,000) and RMB 64,000 in the Chinese market. The decade-long one-time buyout system now becomes history as FSD moves toward the SaaS (Software as a Service) subscription era.

A month ago, Musk also stated that the next version of FSD would fully achieve autonomous driving and even admitted that Robotaxi driverless testing had already begun.

At this juncture, FSD being available for rent only signals a potential shift—it may no longer be a value-added asset for car owners, and Tesla's strategy toward autonomous driving is undergoing a significant transformation.

01

Has Its Own Calculations

Musk set the deadline for 'FSD buyout' on February 14, 2026, choosing Valentine's Day to 'break up' with the decade-long mechanism.

Predictably, once the shift to subscription occurs, both 'monthly active users' and sustained revenue will surge in the short term.

Revenue from one-time buyouts is short-term and one-off, whereas subscriptions can convert user demand into stable 'long-term recurring revenue,' smooth out cyclical fluctuations in car sales, and help tilt Tesla's valuation logic in capital markets from traditional automotive manufacturing toward Software as a Service (SaaS).

Not to mention, with a one-month window before the buyout mechanism ends, it is highly probable that potential FSD users who were previously on the fence will opt for full payment, providing a notable boost to Tesla's first-quarter financial performance.

Moreover, the market has widely believed that the buyout price is too high. The high threshold of the buyout system is one of the main reasons constraining FSD penetration. In contrast, charging RMB 99 for a trial is far easier than demanding RMB 8,000 for a buyout, further driving up adoption rates.

Although Tesla has not publicly disclosed the adoption rate of FSD, during last year's Q3 earnings call, Tesla CFO Vaibhav Taneja stated that the FSD adoption rate was 12%, far below expectations.

Notably, this 12% adoption rate is global; when broken down by market, the data is even more dismal. It can be said that the 22% adoption rate in the U.S. market is artificially raising the average. Domestic research has shown that Tesla's FSD adoption rate in China has consistently hovered between 1%-2%.

A simple economic calculation shows that in overseas markets, the one-time buyout price for FSD is $8,000, while under the subscription model, users pay $99 monthly (approximately RMB 700). The cost balance point between buyout and subscription is around 81 months (about 6.75 years). In other words, if you choose the buyout, you must keep the car for over seven years for the one-time purchase to be more cost-effective than a subscription.

However, given the current iteration speed of new energy vehicles, according to a survey by J.D. Power, 43% of Chinese car owners replace their vehicles within an average of three years, over 60% within five years, and 14% within one year. Only 1% of car owners keep their vehicles for over ten years.

Moreover, under Tesla's current policy, FSD is tied to the vehicle, not the owner's account, meaning it is 'vehicle-bound.' This implies that when an owner replaces their vehicle, the purchased FSD transfers with the original car to the new owner, rather than following the original owner to the new vehicle.

Although Tesla briefly launched an FSD transfer program in the third quarter of last year, allowing some owners to transfer purchased FSD from their old car to a new one, this policy was not permanent.

Clearly, subscriptions are more flexible and cost-effective.

After the shift to subscriptions, the decision changes from a 'one-time RMB tens of thousands' choice to a 'RMB hundreds per month' experience-based decision, making it easier to scale FSD usage. After all, according to Musk's approved decade-long, high-value incentive plan in 2025, there is a strict target to reach 10 million active FSD users.

To reach 10 million active FSD users within ten years, if calculated based on the then-required delivery of 20 million Tesla vehicles, one out of every two Tesla vehicles sold must use FSD, equivalent to an adoption rate of 50%.

After switching to pure subscriptions, the significantly lowered participation threshold will undoubtedly provide substantial assistance.

Moreover, subscriptions offer a hidden benefit regarding data. For FSD to iterate rapidly, it requires vast amounts of real-world road testing data. Under the buyout model, many who purchase FSD rarely use it.

However, subscription users, paying monthly, are more likely to use it regularly due to time sensitivity, generating more effective data. The more data available, the faster algorithm iterations occur, creating a positive feedback loop.

One must admit, this move is very Musk-like.

02

Has Musk Compromised?

Faced with such a significant change, Musk announced it with just one sentence, offering no in-depth explanation from the official side, sparking widespread debate.

A long-time Tesla supporter since 2012 complained that this deprivation of 'ownership' is a betrayal of early supporters. Some owners also believe that the price volatility risk brought by the subscription model is diluting Tesla's core value, labeling it an 'extremely poor decision.'

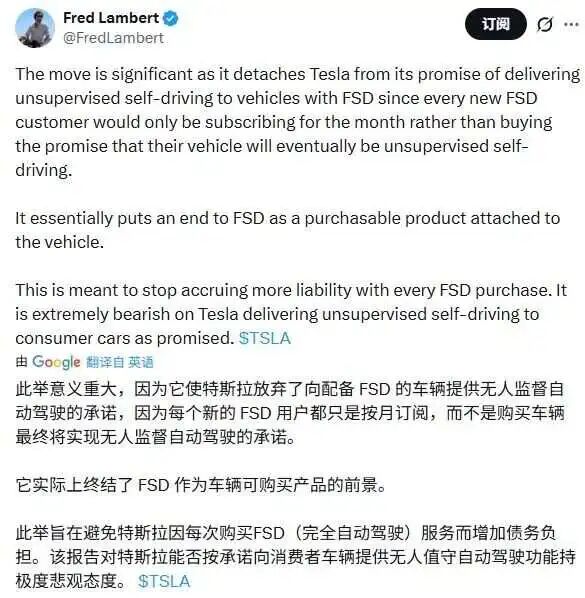

Fred Lambert, editor-in-chief of tech media outlet Electrek, stated, 'It makes Tesla abandon its commitment to providing unsupervised autonomous driving for vehicles equipped with FSD.'

In his view, this is a tacit admission by Tesla that it cannot achieve unsupervised autonomous driving in the short term, purely to control and avoid the risk of increasing debt burden with each FSD (Full Self-Driving) service purchase.

Despite Musk's recent hype about FSD, the reality is that FSD remains at the L2 level of assisted driving. You must stay vigilant on the road and be ready to take over at any time. Over the past decade, countless car owners have spent large sums not for current functionality but for the promise of 'future autonomous driving.'

Simply put, when you choose to buy out FSD, you are purchasing Tesla's commitment to 'lifetime autonomous driving for this vehicle.' If, in a couple of years, the HW3.0 hardware can no longer run the latest algorithms, Tesla is legally responsible for providing free hardware upgrades since it received payment for 'lifetime' service.

However, under the subscription model, things change. For a monthly paid service, if your hardware becomes outdated and can no longer keep up next month, you can simply cancel your subscription. Tesla no longer carries the burden of 'lifetime guarantees.' Moreover, since it is a rented service, you cannot demand perfection or sue for 'unfulfilled promises.'

Currently, regulatory pressure surrounding FSD is mounting. In October 2025, NHTSA launched an investigation into 2.88 million Tesla vehicles equipped with FSD, involving 58 reports of traffic safety violations, including 14 collisions and 23 injuries. Tesla even received a 30-day sales ban in California for allegedly exaggerating its assisted driving capabilities.

Clearly, in Fred Lambert's view, Tesla's shift to subscriptions reflects a lack of confidence in achieving full autonomous driving.

The capital markets also responded accordingly. After Musk's 'mandatory subscription order,' Tesla's stock closed down 1.79% on Wednesday.

Gordon Johnson, an analyst from GLJ Research, explained that Musk had long been selling owners the concept that 'FSD can appreciate in value'—meaning your car could one day earn money for you as a Robotaxi (autonomous taxi).

Conversely, if FSD can truly turn cars into money-making machines, why would Tesla cancel fixed-price sales? Does this imply that the long-term asset value of 'owning an FSD car' is not as high as imagined?

After all, in Musk's view, autonomous driving could bring Tesla a potential value of up to $1 trillion.

Back in China, the importance of autonomous driving to automakers is equally undeniable, yet its status is far lower. Many automakers, including Li Auto, have chosen to offer intelligent driving features permanently for free. Yu Kai, founder of Horizon Robotics, put it more directly: In his view, autonomous driving is the infrastructure of the smart car era and the most critical functional value point, but it is difficult to differentiate. Consequently, once autonomous driving becomes ubiquitous, it will be challenging for it to remain a core competitive edge for automakers.

As for how Tesla's core competitiveness will be demonstrated, it depends on how many people are willing to pay $99 per month.