【Annual AI Insight】2026: Auto Companies Launch a Counteroffensive in the Smart Hardware Arena

![]() 01/19 2026

01/19 2026

![]() 346

346

By | Intelligent Relativity

When the conversation turns to the most talked-about smart hardware of 2025, smart glasses undoubtedly emerge as a leading contender. Among the diverse array of players entering the market, the participation of auto companies stands out as particularly noteworthy.

Take Li Auto's unveiling of its AI glasses, Livis, as an example. This launch sparked intense discussions. Most of the buzz centered not only on the user experience and interaction logic of the AI glasses, such as their lightweight design and long battery life, but also on whether shouting "Li Auto Companion" during interaction would trigger a response from either the glasses or the vehicle itself. There was also speculation about potential conflicts between the two devices.

However, the reality is that Li Auto's introduction of these AI glasses represents, as the company itself has stated, another gateway to embodied intelligence. It signifies the automotive industry's endeavor, following the wave of intelligent assisted driving, to position vehicles and other smart hardware as distinct manifestations of embodied intelligent agents. When vehicles and smart hardware are unified through AI foundation models, the profit model for vehicles will undergo a fundamental transformation, shifting from a one-time vehicle sale to ongoing payments for intelligent software and hardware.

Expanding our view, we can see that the current shift of automobiles towards smart hardware is actually a continuation of the 2019 trend where hardware manufacturers ventured into automobile manufacturing. Back then, the automotive transformation initiated by hardware manufacturers paved the way for vehicle-machine interconnection and intelligent driving. Now, with the advancement of AI, automobiles and smart hardware increasingly share a common core (albeit in different forms), leading to new opportunities. The counteroffensive of automobile manufacturers into smart hardware has thus become an inevitable cycle.

However, it's crucial to recognize that the substantial investment required in AI, encompassing technology, data, computing power, and scale, also means that the Matthew effect (where the rich get richer) is pronounced in this competition. Winners are more likely to dominate, and the commercial struggle carries the usual tragic undertone of "fail and perish."

From Hardware to Automobiles to Smart Hardware: The New Business Possibilities Shaped by the "Optimal Profit Solution"

The greater commercial potential of smart hardware in the automotive sector is not a baseless claim but a natural progression stemming from two waves of trends: the 2019 hardware transition to automobiles and the 2025 automobile transition to smart hardware.

In 2019, the growth of hardware industries such as mobile phones peaked, with profits declining. That same year, China's new energy vehicle sales experienced explosive growth, with an annual increase of over 30%. This prompted mobile phone manufacturers to transition towards automobile manufacturing.

This transition took two paths: one was direct vehicle manufacturing, exemplified by Xiaomi, with Lei Jun announcing in 2021 that Xiaomi was officially entering the intelligent electric vehicle field;

The other path involved collaborating with auto companies to explore intelligent assisted driving and vehicle-machine integration solutions. For instance, Huawei announced in 2019 that it would focus on ICT (Information and Communication Technology) applications in vehicles, leading to the birth of the Huawei HI mode and HarmonyOS Intelligent Connectivity mode. At that time, mobile phone companies like OPPO, VIVO, and Meizu also competed to initiate collaborations with auto companies, with NFC keys and all-scenario intelligent in-vehicle solutions emerging endlessly.

Caption: In 2021, Xiaomi announced its entry into vehicle manufacturing.

This was essentially the first wave of profit-seeking by hardware manufacturers, moving from simple hardware (mobile phones) manufacturing to complex hardware (automobiles) manufacturing. However, it also formed the development trend of Chinese new energy vehicles, centered on intelligent entry into vehicles, vehicle-machine interconnection, and intelligent assisted driving, laying the foundation for vehicles themselves to become intelligent agents in the future.

In 2023, with the release of Tesla's FSD V12, the trend of intelligent driving surged. Over the next year or so, intelligent assisted driving technology rapidly iterated, with technical solutions converging towards end-to-end, unified AI models capable of self-learning, evolution, and iterative performance. Automobiles evolved into embodied intelligent entry points based on AI models.

By 2025, after fifteen years of development and concentrated growth from 2019 to 2024, China's new energy vehicles experienced the lowest growth rate in recent years in Q1 2021, along with multiple monthly declines in growth in 2024. The fierce price wars at the end of 2024 further revealed the harsh reality of industry growth constraints and declining profits.

At this critical juncture, the automotive industry must change. Within the trend of intelligent integration into vehicles, shaping vehicles as entry points for embodied intelligence under the development of intelligent driving and combining them with other intelligent agents has become a consensus choice within the industry.

Tesla is advancing the formation of an "Automobile + AI + Robot" ecosystem, expanding automobiles as part of the AI ecosystem and incorporating the possibilities of robots into this ecosystem;

XPeng Motors, with automobiles on the ground, HT Aero flying cars in the air, and Iron robots, is learning from Tesla to explore a path of "general model capabilities + multi-scenario carriers (automobiles/robots/aircraft)";

Caption: XPeng's AI Ecosystem

Volkswagen is collaborating with Microsoft on AR glasses HoloLens, providing vehicle driving information while also incorporating it into maritime scenarios to assist in the diagnosis and maintenance of remote maritime equipment;

BMW is collaborating with Huawei HiCar to promote the integration of in-vehicle connectivity hardware and intelligent applications;

This trend even includes NIO's launch of the NIO Phone in 2023, an innovation once deemed "boring" by many consumers. Now, it appears to be an integral part of the automotive industry's transition to smart hardware. However, its timing was unfortunate, as intelligent assisted driving and AI did not experience explosive growth in 2023, leading to its eventual quiet demise.

The two rounds of deep industry transformations have both explored high-margin business possibilities through strategic maneuvering. During this process, two trends have emerged: first, the acceleration of intelligent agent technology extension into in-vehicle scenarios; second, the establishment of a bridge between vehicles, as embodied intelligent agents, and diverse smart hardware for interconnection. It is the continuous development and mutual empowerment of these two trends that have, on the one hand, driven the maturation of smart hardware manufacturing processes and, on the other hand, created highly potential scenario extensions for in-vehicle interconnection.

Selling vehicles will gradually transform from a one-time transaction to a continuous payment business embedded in consumers' lifestyles.

Smart Hardware and the Vastly Different Profit Models of Auto Companies

When we examine the specifications of Li Auto's AI glasses: a frame weight of only 36 grams, a single battery life capable of taking 1000 photos, recording 41 minutes of video, playing 7.6 hours of music, and making 6 hours of calls—it is evident that these glasses are designed for all-day use beyond the vehicle.

This is also the advantage of smart hardware over automobiles: they are compact and portable; they are inexpensive, making users more willing to purchase them; and by being associated with Li Auto, they foster consumer brand loyalty towards Li Auto as a whole.

More importantly, smart hardware facilitates higher frequency and more sensor-rich collection of user data. When connected to Li Auto's in-vehicle large model and self-developed chip, it can effectively transmit daily collected data back to Li Auto's AI large model, forming a data closed loop and enhancing the overall capabilities of Li Auto's AI foundation model.

Caption: Li Auto's AI Glasses Livis

When Li Auto's business narrative evolves from merely "manufacturing vehicles" to a "consumer intelligent lifestyle platform," coupled with the advantages of a data closed loop and AI model capabilities, Li Auto can easily extend new business possibilities that attract capital attention and subsequently enhance its valuation. In fact, there are precedents in the industry. After XPeng Motors released its "Physical AI" strategy at the 2025 XPENG Tech Day, including the second-generation VLA large model, Robotaxi, the new IRON humanoid robot, and HT Aero flying cars, the company's stock price surged by 13% during the trading session and was hailed as a "Physical AI" pioneer in media evaluations.

Why are capital markets so optimistic about markets beyond vehicle manufacturing? Apart from the current trend of AI's popularity, it is also because manufacturing vehicles and creating AI-cored smart hardware are essentially two completely different businesses.

If we consider automobiles as a form of embodied intelligence, their internal AI foundation model is the core, while the external vehicle is merely the physical manifestation of AI and the portal for interaction with the world, i.e., Software-Defined Vehicles (SDV).

Then, the lifecycle of automobiles transforms from the previous logic of purchase, use, maintenance, and second-hand sale to a software platform with repeatable monetization through feature subscriptions, OTA upgrades, and cabin services. Such software service revenues often have higher gross margins than vehicle manufacturing.

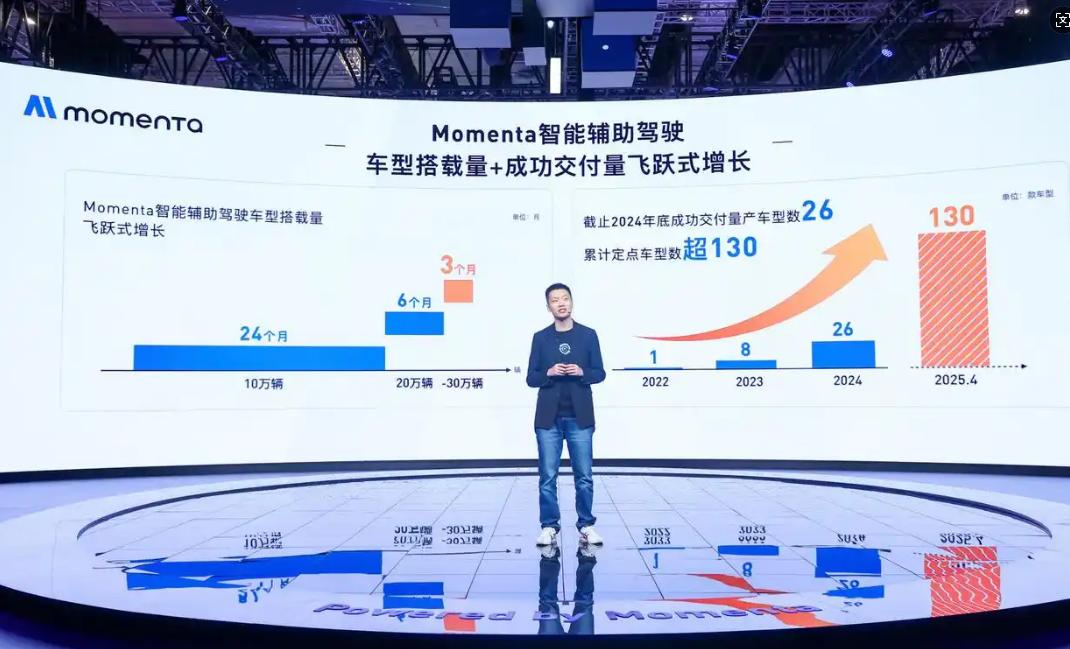

Secondly, the logic of future smart hardware is actually similar to that of automobiles, both serving as different entry points for embodied intelligence. Therefore, their AI foundation models can be interconnected, and perception, localization, generative interaction, and OTA platforms can be made into reusable components, thereby diluting the expensive costs of algorithms, computing power, and data. It is important to note that in the current field of intelligent assisted driving, Momenta has risen to the top and maintained high cost-effectiveness, largely due to its end-to-end flywheel model adapting to different automobile brands/models. Currently, it collaborates with over 130 vehicle models, diluting development and service costs through economies of scale.

Caption: Momenta's Increase in Installation Volume, Delivery Numbers, and Designated Vehicle Models

Thirdly, combined with the advantages of industrial chain spillover, AI can transcend the single scenario of automobiles and be applied to enhance production efficiency in the industrial sector. For example, Siemens uses AI to optimize production lines, improving capacity and yield, and further feeding back into cost reduction and delivery speed, making AI a cross-departmental shared capability and enhancing overall efficiency.

Higher-margin service revenues, diluted costs of computing power, algorithms, and data, and the overall acceleration of a company's products and operations form a new path for the development of smart hardware based on their underlying AI models. This will reshape the future capabilities and profit models of automobiles and smart hardware, bringing greater business imagination to enterprises.

The current transition of numerous auto companies towards smart hardware is essentially a transition towards AI foundation models and embodied intelligent agents. However, this transition will not be smooth sailing. In fact, due to the high entry barriers and costs of AI in terms of computing power, algorithms, and data, the Matthew effect in this sector will undoubtedly be more severe.

Under Transformation, the Landscape is Hard to Reshape

Transitioning to AI sounds wonderful but is difficult to execute—it is an industry vastly different from traditional manufacturing. Algorithms, computing power, data, supply chain integration, and scalability collectively form its barriers, imposing higher requirements on all entrants.

If automobiles and smart hardware both adopt the same AI foundation, the current algorithms being developed are either end-to-end or extensions of end-to-end, meaning the volume of data fed in must be sufficiently large to allow the algorithms to learn independently. Correspondingly, this raises the question of how many vehicles or other smart hardware an auto company can sell.

Tesla was able to quickly establish its advantage in intelligent assisted driving largely due to the driving data from its global fleet, i.e., the trifecta of "mileage training/verification/coverage of edge scenarios." The logic of extending towards smart hardware/embodied intelligence is similar: the more sold and used by consumers, the smoother the data closed loop can operate. Currently, only a few auto companies at the forefront and with the capability and resources to venture into smart hardware have a significant advantage. Middle and lower-tier auto companies have little advantage, although the possibility of a latecomer overtaking the frontrunners cannot be ruled out.

Purchasing computing power, conducting algorithmic research, closing the data loop, iterating algorithms, and configuring technical personnel all require substantial funds. For example, Li Auto's 2024 financial report mentioned approximately 11.1 billion yuan in R&D (Research and Development) expenditures. XPeng Motors plans to spend 9.5 billion yuan on R&D in 2025, with around 4.5 billion yuan allocated to AI. Tesla's investment is even more staggering, as its self-built Dojo supercomputer entails AI computing power investments in the billions of dollars, with R&D expenditures in 2024 reaching approximately 450-460 million dollars.

These figures are truly staggering, and they essentially reflect the investment made in just a single year. The market and investors are extremely attuned to such investments, often displaying a short-term optimism but maintaining a long-term focus on the ability to deliver results. If financial backing is provided yet technological progress falls short of expectations, obtaining further investments in the future could prove to be a daunting task.

Hence, on the whole, companies that can adeptly sail through the diverse realms of AI, automobiles, smart hardware, and embodied intelligence must, in essence, possess the support of funds, technical expertise, and the scalability to acquire chips or computing power, refine algorithms, and boost the overall performance of their foundational AI models through economies of scale.

These prerequisites imply that only brands that enjoy widespread consumer preference can truly accomplish this feat, resulting in an industry landscape that remains largely unaltered or even becomes more firmly entrenched.

*All images featured in this article are sourced from the internet.