Weekly Stock Review | After 17 Straight Days of Gains, What’s Next for the A-Share Market?

![]() 01/19 2026

01/19 2026

![]() 403

403

Weekly Review of Automotive Stocks: Diverse Trends in the Market

The A-share market in 2026 seems to be rewriting history on a daily basis.

By the close of Monday, January 12, the Shanghai Composite Index had notched up an impressive 17 consecutive days of gains, soaring from 3,822.51 points to 4,165.29 points—a level unseen in over a decade. Meanwhile, the Shenzhen Component Index surpassed the 14,000-point threshold, setting a new record in nearly four years.

Unfortunately, Tuesday failed to deliver the widely anticipated '18th consecutive rise.' Many investors had hoped to cash out at the peak, a move that collectively dampened market sentiment.

On January 13, the Shanghai Composite Index opened higher but ended lower, sliding from 4,179 points to 4,138 points. Although the decline was marginal, market sentiment experienced significant turbulence. Trading volume hit a record 3.7 trillion yuan, with some viewing it as a sign of market frenzy, while others saw it as a turning point in the primary uptrend.

The end of the 17-day winning streak, coupled with the subsequent decline amid massive trading volumes, signaled that an adjustment was inevitable, albeit delayed. On January 14, a regulatory move to raise the minimum margin requirement for financing effectively 'manually' cooled the market, successfully applying the brakes to the rapidly advancing bull run and gradually restoring rational market sentiment.

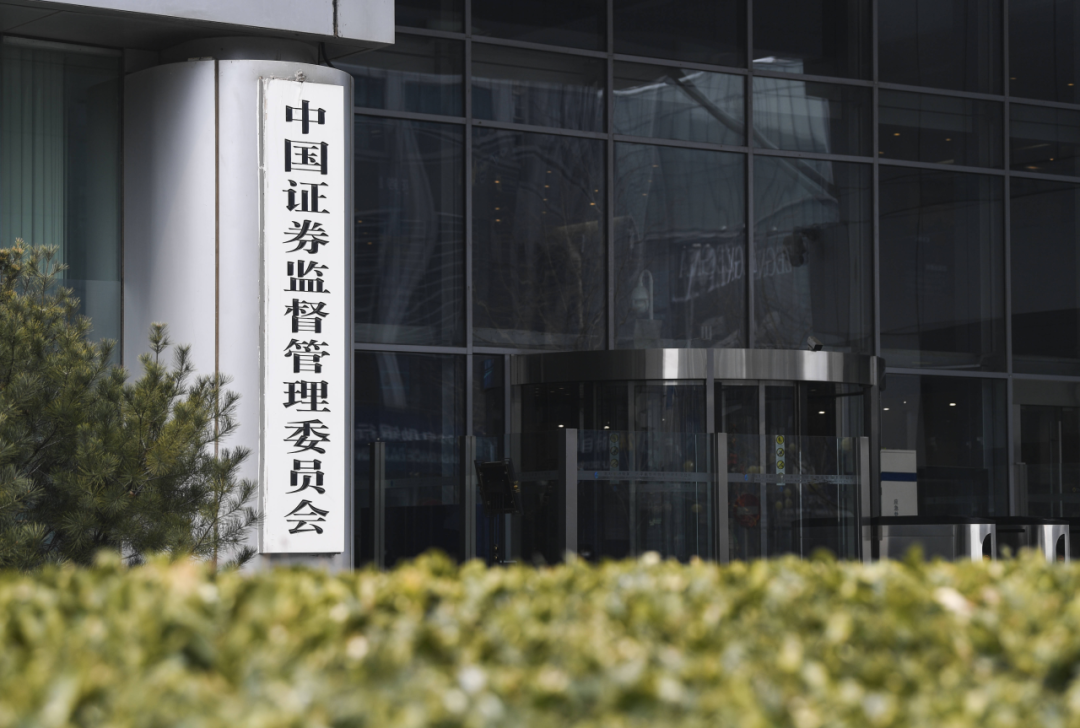

On January 15, the China Securities Regulatory Commission (CSRC) held its 2026 systemic work conference. The meeting underscored the importance of maintaining stability, consolidating the market's positive momentum, strengthening comprehensive market monitoring and early warning systems, promptly implementing counter-cyclical adjustments, and intensifying supervision over trading activities and information disclosure to ensure fair trading practices. The CSRC vowed to strictly investigate and penalize illegal activities such as excessive speculation and market manipulation, firmly preventing drastic market fluctuations.

On January 16, the A-share market opened higher but closed lower. By the end of the day, the Shanghai Composite Index fell 0.26% to 4,101.91 points, the Shenzhen Component Index dropped 0.18% to 14,281.08 points, the ChiNext Index declined 0.2% to 3,361.02 points, and the Beijing Stock Exchange 50 Index rose 0.23% to 1,548.33 points. Total trading volume across the market reached 3,056.4 billion yuan, up 118 billion yuan from the previous day.

On the other hand, the Shanghai Stock Exchange reported after Friday's close that during the week (January 12-16), it had taken self-regulatory measures against 365 instances of abnormal securities trading behaviors, such as price manipulation and false declarations. It closely monitored stocks with significant price fluctuations, including *ST Zhengping, *ST Yazhen, Guosheng Technology, Aerospace Power, Tianpu shares, and Sunvitro Materials, and conducted special inspections on 20 major events of listed companies.

The Shanghai Stock Exchange also intensified its joint supervision of information disclosure and abnormal stock price movements, initiating 28 requests for insider trading and abnormal transaction investigations in response to sensitive information disclosures or significant stock price anomalies.

During the same period, the Shenzhen Stock Exchange took self-regulatory measures against 387 instances of abnormal securities trading, involving behaviors such as intra-day price manipulation and false declarations. It conducted inspections on 15 major events of listed companies and reported 5 cases of suspected illegal activities to the CSRC.

Behind the market frenzy, signs of market manipulation by major players remain evident.

Overall, sectors that experienced growth were mainly concentrated in commercial aerospace, non-ferrous metals, media, 5G concepts, semiconductors, etc. Notably, amidst this wave of extraordinary gains, no stock in the automotive sector achieved a daily price limit increase, indicating lackluster performance.

Even industry leader BYD showed little improvement amidst the A-share market's winning streak, closing at 95.86 yuan on Friday, with a cumulative decline of 1.49% over five days.

Seres, currently holding the highest stock price among automotive manufacturers, even experienced a continuous downward trend this week. On January 16, Seres fell by 0.33%, closing at 120.92 yuan per share with a trading volume of 1.88 billion yuan, a turnover rate of 1.03%, and a total market capitalization of 210.641 billion yuan.

As of now, Seres has experienced seven consecutive days of decline, with a cumulative loss of 5.79% over the period.

On January 13, the 'AITO's 1 Millionth Vehicle Rollout' event was grandly held at the Seres Super Factory, with Seres Chairman Zhang Xinghai attending and delivering a keynote speech.

Since its brand launch in late 2021, AITO has crossed the one million vehicle threshold in nearly five years. However, from the delivery of its first vehicle to achieving this milestone, it only took 46 months—a year faster than NIO, the previous fastest-growing new energy vehicle company (which took 58 months).

Meanwhile, Seres Chairman Zhang Xinghai stated the ambition to achieve the second million-vehicle target within two years. Despite such favorable prospects, Seres' stock performance remained poor, illustrating that short-term stock price fluctuations are not directly linked to fundamental market conditions.

Additionally, CATL, the leading battery manufacturer, saw a cumulative decline of 4.78% over the week. To some extent, after experiencing its first market share decline in 2024, CATL has entered a period of bottleneck adjustment.

On January 13, CATL launched a dual strategy of securing 'massive long-term orders' and making 'strategic equity investments.'

Firstly, it locked in a five-year, over 120 billion yuan lithium iron phosphate supply agreement with cathode material company Ronbay Technology. Secondly, it planned to invest 3.175 billion yuan in a strategic investment in Fulian Precision, becoming a significant shareholder with over a 5% stake upon completion of the transaction, and simultaneously signed a procurement agreement for no less than 3 million tons of lithium iron phosphate products.

As the lithium iron phosphate industry continues to heat up, CATL is building an insurmountable supply chain moat for longer-term competition.

On the other hand, GAC Group and Dongfeng Motor, which have closer ties with Huawei, also performed poorly and did not even become part of the Huawei concept. The treatment of Qijing and Yijing by investors was not as friendly as expected.

GAC Group even took the initiative to distance itself from Huawei, stating that expressions that could easily cause misunderstandings or potentially harm the legitimate rights and interests of related brands, such as bundling 'Huawei' with 'Qijing' (e.g., 'Huawei Qijing,' 'Huawei Qiankun Qijing'), should be strictly prohibited.

In terms of stock prices, GAC Group saw a cumulative decline of 2.49% this week, closing at 8.62 yuan per share on Friday. In contrast, Dongfeng Motor appeared wiser, not rushing to make a clear distinction but attempting to integrate into the Huawei concept. Although its stock price remained generally low, the trend was relatively stable.

With less than two weeks and 15 trading days remaining until the Spring Festival holiday, after experiencing significant consecutive gains, the A-share market has begun to enter a period of calm consolidation. Most investors will also choose to withdraw funds at an opportune moment to secure profits.

In the next two weeks, 'cautious stability' may be a wiser choice than 'fear of missing out.'

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-