Series 9 Flagship Models Inundate the Market, Defying Trends to Secure Strong Positions

![]() 01/22 2026

01/22 2026

![]() 501

501

In 2026, the automotive landscape will witness a pivotal year for 'Series 9' offerings, as brands like BYD, SAIC Volkswagen, and Leapmotor unveil premium flagship models within this category. These vehicles are strategically positioned to capture the RMB 300,000-500,000 and even higher-tier market segments. Amidst a backdrop of market-wide consumption downgrades, this collective push towards high-end models might appear counterintuitive. However, it underscores the strategic vision of automakers. With BBA's (BMW, Mercedes-Benz, Audi) market share in the new energy high-end segment steadily declining, Chinese brands are seizing the opportunity to fill the void, leveraging their strengths in electrification and intelligent technologies. Simultaneously, the new energy vehicle purchase tax policy has transitioned from 'full exemption' to 'half reduction,' while the 'trade-in' subsidy mechanism clearly steers consumers towards upgrading to mid-range and high-end models.

Cui Dongshu, Secretary-General of the China Passenger Car Association, previously highlighted that adjustments to the new energy purchase tax policy and refinements to the 'trade-in' mechanism are driving a paradigm shift in consumer logic. This shift moves away from prioritizing 'low prices' towards 'paying for technology and quality.' This transformation is not an isolated occurrence but an inevitable outcome of the synergistic effects of policy guidance, evolving user expectations, and technological advancements. The once-prevalent price wars are fading into the background, replaced by in-depth competition centered on technological sophistication, product excellence, and user experience.

▍The High-End Market Push: More Than a Slogan, a Structural Trend

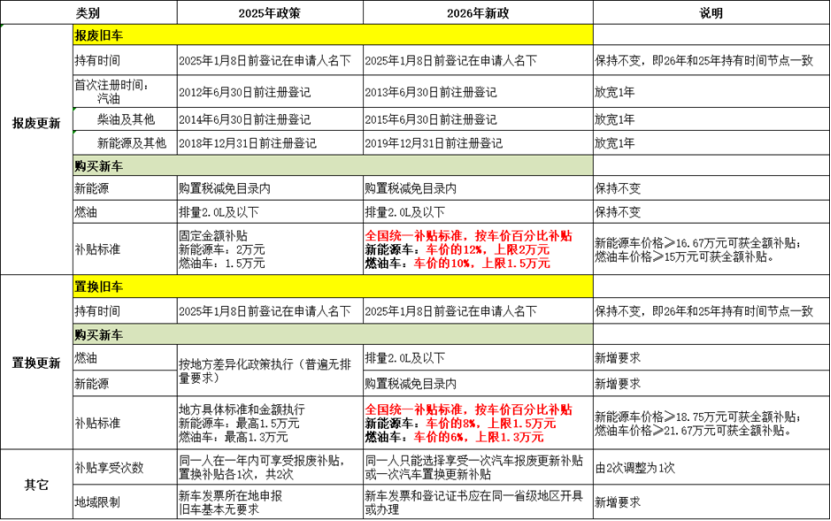

The high-end transformation of China's automotive market transcends mere marketing tactics; it represents a structural phenomenon driven by both policy direction and user demand. Subtle policy shifts have acted as catalysts for value-based competition. In 2026, the state made a pivotal adjustment to its new energy vehicle subsidy policy, transitioning from a blanket full tax exemption to replacement subsidies based on vehicle price proportions. This means that to maximize subsidies, consumers must opt for models priced above RMB 180,000 to 210,000. This ingeniously designed mechanism ties financial incentives directly to consumption upgrades, effectively nudging car purchase budgets upwards.

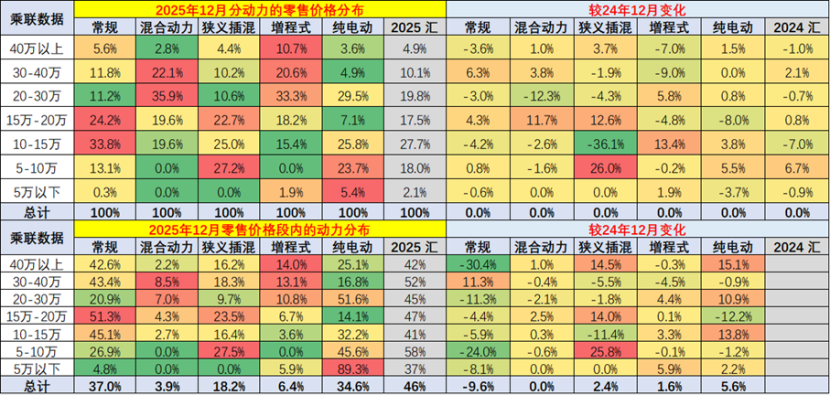

Concurrently, profound changes in consumer behavior are even more pivotal. As the post-95 generation emerges as the primary force in car purchases, having grown up in an era of material abundance and technological explosion, their car-buying decisions have evolved beyond simple income matching. They now consider a comprehensive array of factors, including family support, credit leverage, and identity recognition. McKinsey's consumer insights reveal a marked increase in young users' attention to advanced intelligent driving and smart cockpits, with car-buying logic shifting from 'functional satisfaction' to 'experiential identification.' Market data corroborates this trend: the average retail price of passenger vehicles has steadily risen from around RMB 150,000 in 2019 to RMB 184,000 in 2024, rebounding to this level in a single month in December 2025, underscoring the resilience of the consumer base.

In 2026, the new energy vehicle purchase tax policy shifted from universal exemption to tiered support based on vehicle price, with the 'trade-in' subsidy mechanism explicitly mandating that consumers purchase models priced around RMB 200,000 to receive full subsidies. This policy design cleverly aligns financial incentives with consumption upgrades, steering clear of the past 'universal price cuts' that led to internal market friction and compelling the market to migrate towards mid-range and high-end value anchors.

More significantly, the number of price-cut models has plummeted. Data indicates that in 2025, there were only 177 price-cut models throughout the year, a reduction of 42 from the previous year, signaling a diminishing effectiveness of price wars. McKinsey's '2025 China Automotive Consumer Insights Report' also highlights that the stimulating effect of price on car-buying decisions has plummeted from 3% in 2023 to 0.6% in 2024, with consumers now highly focused on the 'value floor'—whether products possess stable quality, leading technology, and innovative experiences. Consumers are no longer willing to pay for inflated brand premiums but are focusing on perceivable real values such as seat comfort, battery safety, and intelligent driving reliability. When 'paying for technology and quality' becomes a consensus, the synergy between policy and consumption forms an irreversible transformational momentum.

▍From Configuration Stacking to Full Lifecycle Experience Building

As 'value' becomes the linchpin of competition, automakers' strategies have undergone a fundamental transformation. In recent years, some brands relied on hardware configurations such as LiDAR and air suspension for 'parameter competition,' attempting to create hit models with high specifications at low prices. However, the core of value competition lies in quality upgrades. During past 'price wars,' automakers often achieved price advantages by reducing configurations and cutting costs, but this approach led to a decline in product quality and eroded consumer trust in 'low prices.' Today, quality is no longer an 'added bonus' but the cornerstone of 'value competition.'

However, market feedback in 2025 indicates that consumers are no longer paying for 'paper luxury' but are demanding that these technologies genuinely translate into safe, comfortable, and convenient daily experiences. The core of value competition has shifted from static configurations at the time of purchase to the dynamic evolutionary capabilities of vehicles throughout their entire lifecycle.

This logic has been validated in multiple successful cases. GAC Toyota's bZ4X not only comes equipped with dual-chamber air suspension, zero-gravity seats, and Momenta's advanced intelligent driving system but also offers 'three major guarantees': full compensation for battery spontaneous combustion, decay protection, and liability for parking accidents. This approach, which combines technological advantages with responsibility commitments, significantly enhances user trust. Xiaomi's SU7, priced starting at RMB 299,900, comes standard with an 800V platform, intelligent chassis, and urban NOA, redefining high-end standards under RMB 300,000 through 'technology democratization.' Meanwhile, traditional luxury brands like Mercedes-Benz and Audi have begun making practical features such as heated seats and OTA upgrades standard, abandoning some optional strategies. This bidirectional fusion—where new forces learn from joint venture brands' rigorous quality control, and joint venture brands absorb new forces' user experience thinking—creates a more resilient competitive ecosystem.

At a deeper level, the essence of value competition is an inevitable outcome of the 'software-defined vehicle' era. In the wave of intelligence, cars are no longer hardware products finalized upon delivery but 'smart terminals' capable of continuous evolution through remote upgrades. A Deloitte report points out that in the future, what is being sold is no longer 'factory quality' but 'dynamic quality throughout the lifecycle.' Users expect vehicles to continuously gain new functions and optimize performance during use, and this ongoing evolutionary experience is the true value. Therefore, leading companies are converting their scale advantages into R&D advantages, constructing difficult-to-replicate moats through the logic of 'using scale to nurture innovation and innovation to enhance quality.' BYD has increased its self-developed component rate to over 70% through high vertical integration, reducing costs by about 30% compared to traditional automakers and allowing more resources to be invested in the stability of the three-electric systems and chip independence. XPeng, Huawei, and others are focusing on iterative updates of intelligent driving algorithms, driving the transformation of advanced intelligent driving from 'luxury items' to 'standard features.'

Quality upgrades are also evident in the pursuit of safety. With the implementation of three mandatory national standards, including the 'Technical Requirements for Information Security of Complete Vehicles,' on January 1 of this year, the safety of intelligent vehicles now has 'mandatory regulations.' These standards require encryption for vehicle networking interfaces, software upgrades, and data transmission, eliminating safety hazards at the source.

However, the path of value competition is not without challenges. Industry analysts generally caution that if macroeconomic recovery falls short of expectations and resident income growth remains sluggish, the current high-end trend may face sustainability challenges. CPCA data shows that new energy vehicle sales declined by 38% year-on-year from January 1 to 11 this year, exposing vulnerabilities during the policy transition period. Additionally, some second-tier new forces, lacking core technologies and stable cash flows, may blindly follow the high-end trend and find themselves 'neither high nor low.' Roland Berger's industry analysis points out that by 2026, more than 50 automakers may face shutdowns or mergers and acquisitions, accelerating the industry's winnowing process. What will be eliminated is not high-endization itself but brands that rely solely on marketing or short-term price advantages to survive.

Guided by both policy and demand, value competition has become an irreversible mainstream direction. The future winners will not be companies skilled in short-term marketing or cost compression but those that truly grasp innovation initiative, ensure quality, and can establish full lifecycle connections with users. Ultimately, the industry's growth rate must rely on product improvements that users are willing to pay for. When users no longer ask 'why is it more expensive' but naturally agree that 'it's worth it,' the victory of value competition will have been achieved.

Layout | Yang Shuo Image sources: Cui Dongshu's WeChat official account, Qianku Network