January 2026 'Weekly Sales Figures' Unveiled: Multiple Brands Witness Over 20% Drop, Industry-Wide Inventory Tops One Million Units

![]() 01/26 2026

01/26 2026

![]() 480

480

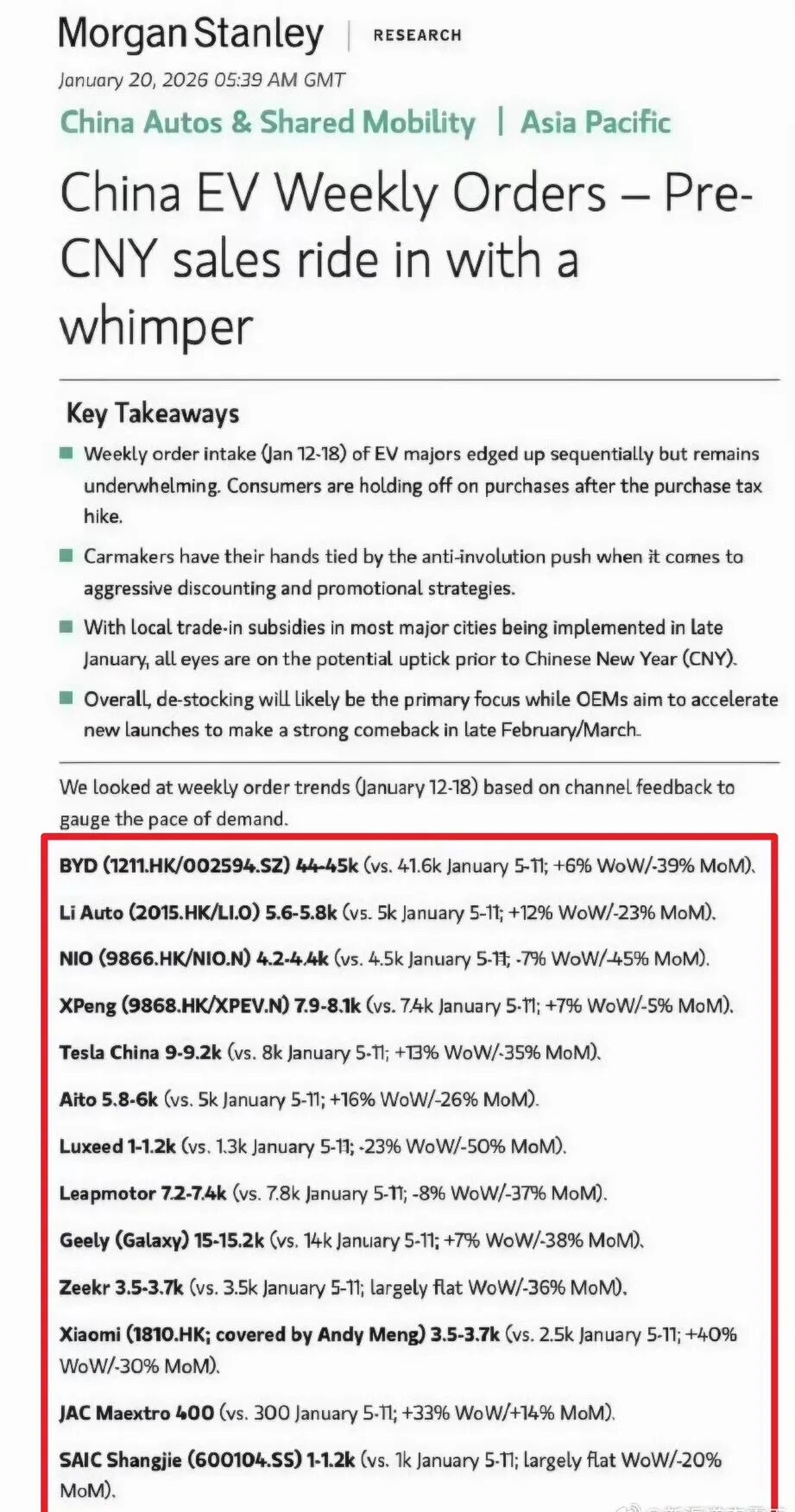

The 'weekly sales figures' metric, which had been absent for some time, has made a resurgence. This time, however, it's being released by Morgan Stanley, a prominent U.S.-based financial services firm. Furthermore, the 'weekly sales figures' data they're disseminating isn't the previously utilized insurance registration metric but rather order data.

According to a Morgan Stanley report circulating online, the company has aggregated weekly order data for major domestic EV brands based on feedback from channels. During the third week of January (from the 12th to the 18th), the weekly order data for domestic EV manufacturers showed a slight week-on-week uptick, with only a handful of brands experiencing declines. Morgan Stanley deems the overall order performance as subpar, attributing it to consumers postponing their purchase plans following the reduction in vehicle purchase subsidies in 2026.

Among the emerging automotive forces, Hongmeng Intelligent Mobility, which operates multiple brands, secured the highest number of new orders last week. Specifically, Aito garnered between 5,800 and 6,000 orders, emerging as the absolute cornerstone of Hongmeng Intelligent Mobility's order tally. Luxeed and Shangjie both secured between 1,000 and 1,200 orders, while Zunjie received 400 orders. Morgan Stanley's statistics did not encompass order data for the Xiangjie brand. The combined order volume for Aito, Luxeed, Shangjie, and Zunjie surpassed 8,200 vehicles last week.

XPeng secured the second spot. Last week, XPeng's order volume ranged from 7,900 to 8,100 vehicles, marking an increase of over 5,000 vehicles from the previous week. When evaluated on a single-brand basis, XPeng actually recorded the highest order volume last week. This was primarily due to XPeng's launch of the 2026 models of four vehicle types—P7+, G6, G7, and G9—at the outset of the year. Among these, the P7+ and G6 also introduced extended-range versions, becoming new catalysts for their sales growth.

Leapmotor ranked third. Last week, Leapmotor's order volume ranged from 7,200 to 7,400 vehicles, indicating a slight dip from the previous week. Previously, Leapmotor's weekly orders had consistently remained above 10,000 vehicles. The recent decline in orders below the 10,000 mark is mainly attributed to factors such as the year-end sales surge and the reduction in subsidies at the start of the year.

Li Auto claimed the fourth position. Last week, Li Auto's order volume ranged from 5,500 to 5,600 vehicles, showing an uptick from the previous week. Since the launch of the i6 last year, Li Auto's sales have exhibited a positive trajectory, although its full-year sales in 2025 still experienced a year-on-year decline. Facing sales hurdles, Li Auto plans to launch a counteroffensive in 2026, targeting an annual sales goal of 550,000 vehicles. According to media reports, the Li L series will undergo significant updates this year, particularly the L9, which will feature a larger battery capacity and support for 5C ultra-fast charging, aiming for annual sales exceeding 100,000 vehicles.

NIO secured the fifth spot. Last week, NIO's order volume ranged from 4,200 to 4,400 vehicles, indicating a slight decrease from the previous week. However, it remains unclear whether the NIO data compiled by Morgan Stanley refers solely to the NIO brand or encompasses the three brands: NIO, Ledo, and Firefly. Since launching the Ledo L90 and the all-new ES8 in the latter half of last year, NIO has witnessed robust sales growth momentum.

Xiaomi ranked sixth, placing last among the leading emerging automotive forces (considering Hongmeng Intelligent Mobility as a cohesive entity), which was quite unexpected. Xiaomi's order volume last week also ranged from 3,500 to 3,700 vehicles. In the preceding week (from the 5th to the 17th of January), Xiaomi's order volume stood at a mere 2,500 vehicles. This appears inconsistent with its monthly sales surpassing 50,000 vehicles and the high market enthusiasm. Clearly, after experiencing rapid growth previously, Xiaomi's order volume has become more subdued. To stimulate orders, Xiaomi introduced a seven-year low-interest car purchase policy on January 15th, which has, to some extent, spurred order growth. Additionally, the recent blind reservation (pre-order without seeing the actual product) for the new generation SU7 has also reinforced the wait-and-see attitude among consumers.

In addition to the aforementioned emerging automotive forces, Morgan Stanley compiled order performance data for several leading domestic EV brands and new brands from traditional automakers. Among them, BYD's order volume last week ranged from 44,000 to 45,000 vehicles, showing an increase of approximately 2,400 vehicles from the previous week, maintaining its top position. Recently, BYD has embarked on its 2026 product offensive, with a focus on 'plug-in hybrid pure electric long-range' as its selling point.

Geely's Galaxy brand had an order volume ranging from 15,000 to 15,200 vehicles last week, showing an increase of approximately 1,000 vehicles from the previous week. Zeekr's order volume ranged from 3,500 to 3,700 vehicles, showing a slight uptick from the previous week. The combined new order volume for these two brands under Geely last week was approximately 18,500 vehicles, which is two-fifths of BYD's order volume. Additionally, other brands under Geely, such as Lynk & Co and Reman, also offer new energy vehicle models, especially Lynk & Co, whose new energy vehicle sales have been outstanding. However, Morgan Stanley did not include the EV orders of these brands in its statistics. Through its multi-brand strategy, Geely is accelerating its pursuit of BYD.

Furthermore, Tesla's order volume last week was 9,200 vehicles, showing an increase of 1,200 vehicles from the previous week. At the beginning of this year, Tesla introduced a 'seven-year ultra-low-interest' car purchase plan for the Model 3/Y/Y L, along with a 'five-year zero-interest' plan, stimulating order growth. Subsequently, automakers such as Xiaomi, Li Auto, and XPeng followed suit, all introducing seven-year low-interest installment car purchase plans to compete.

Overall, the new orders for these EV brands last week were not substantial, which was also anticipated. There are two primary reasons behind this: First, at the end of 2025, various automakers launched robust promotional policies, such as 'guaranteeing the purchase tax,' to boost sales, which to some extent prematurely released consumer demand. Second, with the complete withdrawal of national subsidies and some vehicle models approaching their generational shifts, consumers' wait-and-see attitude has intensified.

The recent preferential policies in the market, such as the 'seven-year ultra-low-interest' car purchase plans introduced by various automakers, have had a relatively limited overall impact. Morgan Stanley's analysis points out that this is, to some extent, constrained by the industry's 'anti-price war' policy guidance, which has led automakers to exercise restraint in price competition. Therefore, these promotional activities in January may only be seen as a 'prelude' to the fierce competition in the 2026 automotive market. It is expected that by the end of January, specific local policies such as trade-ins will gradually be implemented. After the Spring Festival, with major brands intensively launching new products and models equipped with cutting-edge technologies hitting the market, the true competition in the market will fully unfold.

In mid-January, a senior executive from a large domestic automotive group revealed to Mingjing Pro that since the beginning of the year, the entire industry has accumulated around 1 million vehicles in inventory. Over the past two weeks, all automakers have experienced declines of around 20% to 30%. Now, this set of weekly sales figures data almost confirms this statement. Among the data released by Morgan Stanley, 10 automakers saw declines exceeding 20%, with one experiencing a single-digit decline, and only two automakers showing growth.

The executive believes that the situation at the beginning of this year is not favorable, with such a large inventory in the industry. Therefore, his prediction for the first quarter is a decline. He attributes the market's direction to the complete release of consumer demand in September and October of last year, making the first quarter challenging.

'At this juncture, there's no viable solution other than to focus on overseas markets. So, everyone's focus this year is on overseas markets. Domestically, the competition is too intense,' he remarked.