Is It Truly Unreasonable for Automobile Inspection Institutions to Have Far Higher Profit Margins Than Complete Vehicle Enterprises?

![]() 02/03 2026

02/03 2026

![]() 497

497

Author: Zhang Xin

Produced by: Insight Auto

In 2025, China's automobile industry will showcase a stark contrast in profitability. Complete vehicle enterprises are mired in fierce competition, with the industry's sales profit margin plummeting to a decade-low of 4.1%. In stark contrast, automobile inspection institutions such as the China Automotive Engineering Research Institute (CAERI) and China Automotive Shares have achieved net sales profit margins of 23.1% and 36.8%, respectively. This significant disparity in profit margins has ignited industry-wide discussions regarding its rationality.

However, objectively speaking, the high profit margins of automobile inspection institutions are accompanied by a profit amount scale that is far lower than that of complete vehicle enterprises. Moreover, as a core component of the producer services sector, their value aligns with the development needs of the automotive industrial chain. The claim of "unreasonable profits" overlooks the underlying logic of profit distribution across the industrial chain. Ultimately, the profitability breakthrough for complete vehicle enterprises hinges on enhancing their own core capabilities.

High Profit Margins Do Not Equate to High Profit Amounts

The profitability difference between automobile inspection institutions and complete vehicle enterprises primarily stems from a model of low volume with high returns versus high volume with low returns, rather than a simple inversion of profit margins.

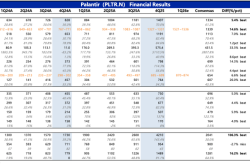

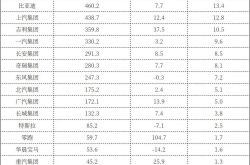

From a profitability perspective, automakers' gross profit margins often fall below 20%, with net profit margins for BYD, SAIC Motor, and Changan Automobile standing at just 4.28%, 2.6%, and 1.87%, respectively. In contrast, CAERI and China Automotive Shares boast gross profit margins of 46.15% and 60.61%, respectively, with the latter's site testing service gross profit margin even exceeding 70%.

However, the gap in profit amounts is substantial. In 2025, CAERI's net profit attributable to shareholders stood at 1.06 billion yuan, while China Automotive Shares' net profit for the first three quarters was 160 million yuan, totaling less than 2 billion yuan for both. In contrast, BYD's net profit exceeded 20 billion yuan, and SAIC Motor's surpassed 15 billion yuan. The profit scale of leading automakers is already ten to several dozen times that of leading automobile inspection institutions.

This disparity originates from a vast difference in market scale. In 2025, China's automobile industry revenue reached 11.18 trillion yuan, while the automotive testing field's industry revenue was merely 2-3 billion yuan. The high profit margins of automobile inspection institutions are a reasonable manifestation within their niche segments and do not constitute a squeeze on the industrial chain's profits.

The Underlying Logic of Industrial Chain Profit Distribution

The traditional perception that the "chain leader" in an industrial chain should occupy the profit high ground is shattered by the actual situation in the automobile industry. Whether it is traditional parts giants or emerging core enterprises in the industrial chain, profit distribution is determined by core competitiveness rather than identity.

Bosch, a global parts giant, has long topped the industry but faced significant financial pressure in 2025, with a profit margin of less than 2%. Its operating profit margin also dropped from 4.8% to 3.5% in 2024, forcing it to resort to successive layoffs to alleviate operational pressure.

ZF Friedrichshafen AG, another German automotive parts giant, saw its sales decline by 10.3% year-on-year in the first half of 2025, with a net loss of 195 million euros. Despite an improvement in its EBIT margin, it still had to sell its ADAS business to alleviate debt.

The predicaments of traditional giants indicate that even those at the core of the industrial chain cannot withstand the profit pressures brought about by market environments and technological transitions.

The same holds true for core enterprises in the industrial chain during the new energy era. Contemporary Amperex Technology Co. Limited (CATL), as the "cornerstone" of power batteries, has better profitability than complete vehicle enterprises but still lower profit margins than automobile inspection institutions. Its profits stem from continuous technological innovation, large-scale capacity deployment, and upstream resource deployment.

Huawei's Intelligent Automotive Solutions BU, as an emerging supply chain force, has achieved large-scale revenue and turned a profit. However, its R&D investment intensity remains high in the industry, with the proportion of software subscription revenue continuously increasing. The "hardware + software + ecosystem" model is still in its incubation period.

From Bosch to CATL and Huawei's Intelligent Automotive Solutions BU, it is clear that the logic of industrial chain profit distribution is as follows: Regardless of the segment, only by building core technological barriers and achieving efficient operations can reasonable profit returns be obtained.

The Core Supporting Force of Producer Services

The high profit margins of automobile inspection institutions are essentially a reasonable return for the value of their producer services.

Inspection and testing services originate from and serve the manufacturing industry, running through the entire manufacturing chain. As a knowledge-intensive supporting sector of the real economy, they directly support quality improvement, technological innovation, and compliance development in manufacturing and are an indispensable part of the automotive industrial chain.

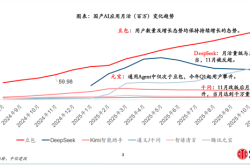

In 2025, the automotive industry will experience a significant year for safety regulation. The electrification and intelligent transformation have driven the frequent introduction of new regulations and standards. The expansion of the mandatory inspection market and the surge in demand for R&D testing have further highlighted the value of automobile inspection institutions.

As a national-level technical service institution, CAERI, along with China Automotive Shares, which boasts professional site testing capabilities, provides core technical support for the R&D and quality control of complete vehicle enterprises, helping them meet compliance requirements and enhance product competitiveness.

In the field of intelligent connected vehicles, CAERI's intelligent connected vehicle business revenue and net profit both increased by over 90% year-on-year. Behind this high growth is the precise adaptation of automobile inspection institutions to the testing demands of intelligent connected vehicle technologies. This achievement stems from their continuous R&D investment and the iterative upgrading of testing scenarios and technologies.

As a supporting sector for the automotive manufacturing industry, automobile inspection institutions also shoulder the mission of driving industry technological progress. By identifying product issues through testing and evaluation and participating in the formulation of industry standards, they integrate advanced testing concepts into the industrial development process.

Their niche segment nature determines a limited market scale, but their supporting role in the automotive industrial chain is irreplaceable. Even if there are occasional controversies over the impartiality of testing in the industry, these are merely issues in development that can be resolved through strengthened regulation and improved mechanisms, rather than a denial of their core value.

Profit Improvement Ultimately Relies on Internal Strengthening

Faced with profitability dilemmas, complete vehicle enterprises should not dwell on the profit margins of automobile inspection institutions but should focus on enhancing their own capabilities. This is an inevitable requirement for the development of the industrial chain and the core path for enterprise breakthroughs.

Technological innovation is the core driving force for profit improvement. In the race towards electrification and intelligence, breakthroughs in core technologies such as batteries, intelligent driving, and intelligent cockpits are key to achieving product premiums. BYD has improved its profitability through its Blade Battery and DM-i hybrid technology, while Huawei's HarmonyOS Intelligent Automotive Solutions high-end models have gained market recognition through their technological configurations, serving as the best evidence.

Cost control is a crucial link. With the current price war in the automotive industry intensifying, complete vehicle enterprises need to reduce operational costs by optimizing their supply chains, promoting intelligent production, and adjusting their product structures. At the same time, they should learn from CATL's experience and strengthen their upstream resource deployment to mitigate the risks of raw material price fluctuations.

Brand building and model innovation are equally important. Against the backdrop of consumption upgrading, strong brands can command higher premiums. NIO has established a high-end image through its user community and high-quality services, laying the foundation for product premiums.

Meanwhile, new business models such as software subscriptions and mobility services are emerging as new profit growth points in the industry. Complete vehicle enterprises need to accelerate their transition from "selling products" to "selling services" and tap into the full lifecycle profit potential.

In addition, overseas market expansion can effectively open up growth space and reduce domestic market competition pressure, serving as an important support for profit improvement.

The high profit margins of automobile inspection institutions are a dual manifestation of technological barriers in their niche segments and the value of producer services. Their limited profit amount scale determines that they have not encroached upon the profit space of complete vehicle enterprises. The questioning of "unreasonable profits" overlooks the underlying logic of industrial chain profit distribution.

For complete vehicle enterprises, rather than fixating on the profitability performance of external links, they should focus on their own technological innovation, cost control, and brand building. Only by solidifying their core competitiveness can they achieve profit improvement in the fierce market competition and drive China's automotive industry towards higher-quality development.

END