BMW's Premier Tactical Strategist—Claus Keller: How Will He 'Engage' with China's Luxury Auto Market?

![]() 02/03 2026

02/03 2026

![]() 508

508

On the surface, Claus Keller's succession of Maximilian Hael appears to be a routine transition as per BMW's internal procedures. However, beneath the surface, it signifies BMW's latest strategic move, with a strong focus on the Chinese market.

On January 30th, BMW announced significant personnel changes in China. Starting from April 1st of this year, Claus Keller will assume the role of President and CEO of BMW Group Greater China, taking full responsibility for all business operations in the region.

In contrast to the typical 4-6 month transition periods observed at other multinational automakers, BMW has allocated a mere 2-month lead time for its new successor. This underscores the substantial challenges Claus Keller will face on behalf of BMW in China. In May 2026, the BMW Group Chairman will officially complete the handover following the shareholders' meeting. Although a direct connection between the two appointments has not been established, the coordinated strategic planning at the top level inevitably raises questions about the significance of China in BMW's current strategy.

What demands even greater attention is that since the unveiling of the new generation models equipped with the sixth-generation eDrive system and 800V high-voltage platform in Munich last September, BMW aims to finalize its market orientation and strategic formulation for China by April this year. The synchronicity of these two timelines highlights the immense responsibility on Claus Keller's shoulders in ensuring business continuity for BMW in China.

Against this backdrop, China's luxury car market is officially bidding farewell to the era of incremental growth and venturing into the challenging waters of electrification transformation. Coupled with challenges such as market price volatility and dealer inventory pressures over the past two years, BMW's primary objective in China has clearly shifted towards enhancing operational quality and achieving healthy, sustainable profitability.

This also indicates that at the crossroads of strategic pressure and market opportunities, Claus Keller, the group's 'premier tactical strategist,' will soon officially represent BMW in 'engaging' with China's luxury car market!

Editor | Li Jiaqi

Image Source | Internet

1

The Premier Tactical Strategist Stepping onto the Front Stage

Claus Keller's professional journey is almost entirely centered around BMW's sales and marketing. Since joining the BMW Group in 1998, he has served as a sales leader in BMW Germany, the MINI brand, and the crucial Nordic region. Prior to his appointment as CEO of BMW China, he continued to oversee operations in the German market.

When Claus Keller took over as CEO of BMW Germany in 2024, the local luxury car market was engulfed in a fierce price war. Dealers faced profitability challenges due to excessive terminal price differentials and mounting inventory pressures, with some even considering withdrawing from the network. He began by selecting flagship dealers in 50 key cities and introducing a 'hybrid agency sales and direct sales' model. During the initial reform phase, many dealers expressed concerns about changes to their revenue models. Claus Keller personally led teams to visit 12 core dealer groups, using data to demonstrate the profit stability under the new model. He also introduced a '3-month transition subsidy' policy to mitigate the impact. After three months of trials, the price differentials for the same models narrowed from a maximum of 5% to nearly zero, commission income fluctuations decreased by 30%, and customer complaints due to price transparency dropped by 40%.

Building on the pilot's success, Claus Keller swiftly implemented a nationwide rollout, completing the transition across all German dealers within six months without significant disruptions. He is widely recognized within the BMW Group as the 'premier tactical strategist.'

In the Norwegian market, Claus Keller precisely introduced the pure electric model i3, quickly establishing it as a benchmark for urban premium commuting. Addressing the Nordic region's preference for station wagons, he strategically launched and promoted PHEV versions of station wagons instead of forcefully pushing pure electric models. This approach retained the spaciousness and off-road capability of station wagons while meeting Nordic families' demands for low fuel consumption and environmental friendliness.

As one of the most mature automotive markets globally, Europe, like China, has bid farewell to the era of incremental growth and entered a phase of intense market competition. Constantly navigating this mature, saturated, and fiercely competitive market segment, along with challenges from companies like Tesla and BYD, has forged several critical traits in Claus Keller: resilience, pragmatism, and efficiency.

These traits align perfectly with BMW's headquarters' assessment of China's core needs today: starting in 2026, BMW must shift from strategic planning to tactical execution! Reviewing Maximilian Hael's tenure in China, BMW accomplished two crucial milestones:

1. Deepened localization by driving collaborations with Chinese suppliers such as CATL and Eve Energy in the supply chain domain. BMW's iFACTORY in Shenyang also completed upgrades for the new generation production line. 2. Anchored electrification by accelerating the introduction of locally produced electric models like iX3, i3, and iX1, while expanding and upgrading BMW China's R&D center—one of the largest globally—to lay the foundation for the 'New Generation' model project in China.

With his acute perception of the Chinese market and strategic foresight, Maximilian Hael constructed a future-oriented, robust 'strategic framework' for BMW, preparing it for full-scale electrification competition. What BMW China needs now is not direction but the tactical execution capability to translate systems into advantages and strategies into performance.

In the midst of fierce price wars, how can brand value be maintained while balancing sales volume and profitability? How can rapid responses be achieved in the ever-changing landscape of public opinion and marketing wars to effectively reach target customers? How can every link, from product launch and pricing to delivery, be executed flawlessly for a flagship product? How can dealer partners smoothly transition to electric vehicle sales and service models while effectively managing inventory health?

Facing 2026, a year with diminishing 'room for error' and intensifying competitive pressures, it becomes evident that BMW needs a strong execution-oriented 'tactical talent' like Claus Keller in China to systematically advance the next phase of competition.

2

'Operational Quality' is BMW's Top Priority in China!

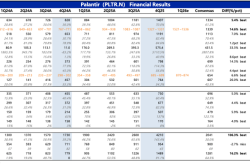

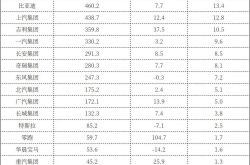

Over the past two years, the competitive landscape of China's luxury car market has undergone fundamental changes. Incremental growth dividends have vanished, and market competition has become brutal. BMW's operational pressures in China have mounted simultaneously across sales volume, profitability, and channel dimensions. On the sales front, BMW's scale in China declined by 12.5% year-on-year in 2025. On the profit front, impacted by declining sales and price wars, BMW's profit margins continued to erode, with the group's pre-tax profit for the first three quarters of 2025 declining by 9.1% year-on-year. On the channel front, BMW's network shrank by nearly 100 dealers in 2025, with 51% of BMW dealers operating at a loss.

Multinational automakers are struggling in China, and BMW is no exception! In 2025, the combined sales of Mercedes-Benz, BMW, and Audi in China decreased by approximately 260,000 units compared to the previous year. Enhancing operational quality and achieving healthy, sustainable profitability are the primary challenges Claus Keller faces after assuming the role of BMW China CEO. However, compared to Mercedes-Benz and Audi's single-track breakthroughs, BMW has at least three cards to play under Claus Keller's leadership:

The first card is the foundational support provided by technological advancements. BMW has invested over €10 billion to create a comprehensive technological base for its 'New Generation' models: the pure electric Exclusive platform (dedicated platform) Neue Klasse, sixth-generation eDrive system, 800V high-voltage platform, large cylindrical batteries, and new chassis technologies. These advancements equip BMW's new generation models with differentiated market competitiveness, and enhancing product strength is the core foundation for rebuilding pricing systems and escaping price wars.

Take the sixth-generation eDrive system as an example. By comprehensively upgrading field-excited synchronous motor technology and introducing asynchronous motors, the new generation of BMW models achieves a 40% reduction in energy loss, a 10% weight reduction, and a 20% improvement in overall efficiency compared to existing pure electric models. Coupled with the sixth-generation battery project, which has initiated trial production at the Shenyang production base and will fully equip new generation models this year, technological guarantees are firmly in place.

The second card is the market validation of the product matrix. BMW plans to launch approximately 20 new models in China in 2026, including 7 new generation models. By the end of 2027, over 40 entirely new or refreshed models will be introduced, equivalent to 4-5 models debuting each quarter. Compared to BMW's previously slow pace in China, it's easy to understand why BMW chose a 'sales-driven' leader for the Chinese market.

This is because, as models gradually land over the next two to three years, BMW China needs strong sales and market development capabilities to successfully convert resources into products and market momentum. In fact, Claus Keller's market conversion capabilities for new generation models have already been validated in the German market. Since its debut at the Munich Auto Show last year, he has led the market promotion of BMW's first core new generation model, the iX3, securing over 30,000 orders within six weeks of its launch—nearly covering most of its 2026 production capacity.

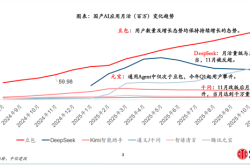

The third card is the full realization of end-to-end localization. BMW has already localized its core supply chain, including batteries and components. In 2026, battery companies like CATL and Eve Energy will supply new large cylindrical batteries for BMW's new generation models, ensuring a stable supply and technological leadership for the most critical components. Additionally, in collaboration with Momenta, BMW has developed full-scenario driving assistance, which will debut on the BMW iX3, enhancing the intelligence and localization adaptability of BMW's new generation models.

3

How Can Multinational Automakers Replace 'Localization Capabilities' with 'Localization Systems'?

With Claus Keller assuming the role of BMW China CEO, the leaders of BBA (BMW, Mercedes-Benz, Audi) in China have largely transitioned to 'headquarters-appointed' executives without Chinese tenure or local backgrounds. This marks a shift in the talent strategy of multinational luxury automakers in China—'China experts' are no longer a must-have for localized development.

The reason is simple: in the Red Sea of market competition and electrification crunch period, the core needs of multinational automakers in China have shifted from 'understanding the Chinese market' to 'strong strategic execution, profit efficiency control, and transformation implementation.' Compared to locally appointed executives, headquarters-appointed leaders are better positioned to address these pain points.

In reality, the talent strategy for CEOs of multinational automakers in China has evolved through three stages alongside the development of China's auto market: during the adaptation period, automakers, due to insufficient understanding and low efficiency in adapting to the Chinese market, relied on 'bringing in reinforcements' from headquarters, which led to efficiency issues and systemic challenges. During the golden age of rapid growth, foreign executives familiar with the local market and consumer preferences became core candidates. 'China experts' like Mercedes-Benz's Klaus Maier and Hubertus Troska, Volkswagen and Audi's Jochem Heizmann and Fred Kappler, and BMW's Christoph Stark and Maximilian Hael helped multinational automakers seize growth opportunities.

With localization efforts largely completed, the role of CEOs for multinational automakers in China has shifted from exploring localization to aligning with the group's global strategy, coordinating global resources to support the local market, and driving the implementation of localized systems. Talents with a global vision, systematic operational capabilities, and the ability to bridge Chinese and foreign resources have become the core need.

It's akin to a chain restaurant: in the past, individual 'star store managers' relied on personal capabilities to drive single-store operations, customer acquisition, and management. Today, standardized operational processes and service systems built by headquarters have taken over. New store managers simply need to execute these systems and optimize tactics to ensure stable operations and profitability. BMW's current personnel appointment changes in China, to some extent, reflect the substitution of mature localized system capabilities for individual localized talents.

By 2025, BMW had streamlined hundreds of its retail outlets, with over 90% of its stores completing renovations to establish dedicated zones for new energy vehicles. Additionally, all staff members had attained full certification in new energy vehicle operations. Simultaneously, through a range of policies, including fee reductions, enhanced efficiency, and optimized rebate schemes, BMW significantly eased the financial burdens on its dealer partners, thereby boosting the vitality and overall health of its terminal operations. Moving forward, Claus Keller is poised to further enhance the operational quality of BMW's distribution channels.

Throughout this transformation, Claus Keller's pivotal role has been to seamlessly integrate BMW's global strategic vision within the context of China's localized business environment. Drawing on BMW's three-decade-long presence and development in China, Claus Keller, as a frontline executive with a profound understanding of the group's strategic planning and resource allocation strategies, can swiftly align BMW's global technological and product resources with China's unique market demands, facilitating the swift launch of next-generation products. Moreover, he acts as a crucial liaison between the Chinese and international markets, enabling the BMW Group to gain a deeper insight into China's market needs and strike a harmonious balance between globalization and localization efforts.

For BMW, the change in leadership marks merely the starting point of a broader transformation. Internally, it involves clarifying developmental directions, while externally, it necessitates reshaping value propositions, bolstering confidence within the supply chain and distribution channels, and ensuring long-term, sustainable operations. However, for Claus Keller, the challenges BMW confronts in the Chinese market are both immediate and formidable!

End