The Fuel Vehicles You Overlook Are the 'Lifeblood' for These Automakers

![]() 02/03 2026

02/03 2026

![]() 477

477

Lead-in

Introduction

Amidst the surge of the new energy wave, fuel vehicles continue to be significant contributors to the sales volume and profitability of many automakers.

Driven by global 'dual carbon' objectives and sustained policy incentives, China's new energy vehicle (NEV) market is rapidly reshaping the automotive landscape at a noticeable pace, becoming a pivotal force in driving the global automotive industry's transformation.

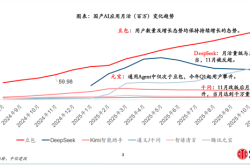

According to data from the China Association of Automobile Manufacturers (CAAM), in 2025, China's NEV production and sales volumes exceeded 16 million units, reaching 16.626 million and 16.49 million units respectively, with year-on-year growth surpassing 28%. The market share of NEVs in total vehicle sales climbed to 47.9%, up 7 percentage points from the previous year, indicating that one out of every two newly added vehicles is a new energy model.

From the consumer's perspective, market acceptance has transitioned from being policy-driven to a spontaneous choice. In December 2025, the retail penetration rate of new energy passenger vehicles reached 59.1%, with 147 cities across the country exceeding 50% NEV penetration. The eastern coastal regions have formed dense clusters of NEV consumption.

Against this backdrop, 'going all-in on new energy' has become a strategic choice for many automakers, with several success stories emerging. Multiple domestic brands have achieved overtaking through the new energy track. In 2025, Chinese brand passenger vehicles accounted for 69.5% of the market, with a penetration rate of 80.9% in the new energy sector, completely breaking the market monopoly of traditional joint-venture brands.

However, the rapid advancement of new energy has not entirely squeezed out the living space for fuel vehicles. While the industry focuses on breakthroughs in NEV penetration rates, a set of data deserves attention: in 2025, China's fuel vehicle production still reached 18.25 million units, down only 1% year-on-year but still accounting for over half of total vehicle production.

In fact, many automakers continue to rely on fuel vehicles for stable profitability. For numerous companies, fuel vehicle sales constitute over 50% of their total sales. These fuel models are not only steady sources of revenue but also serve as 'profit cows' supporting their new energy transition and technological R&D. During the challenging period of new energy transition, the sustained contributions from fuel vehicles provide automakers with more ample buffer space in the fierce market competition.

01 Fuel Vehicles Support Half the Sky

In the 2025 automotive market, the value of fuel vehicles has not been entirely overshadowed by the brilliance of new energy. Especially joint-venture brands, luxury brands, and some leading domestic brands still achieve dual guarantees of sales volume and profit through their robust fuel vehicle product matrices.

However, not all automakers prioritizing fuel vehicles gain recognition in terms of sales volume. Data indicates that many automakers have fuel vehicle sales accounting for over 50% of their total sales. Their common characteristic is that their fuel models, having undergone long-term market testing, have formed stable user bases and brand reputations, becoming core pillars of corporate profitability.

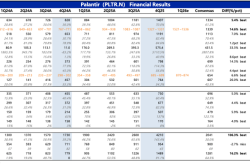

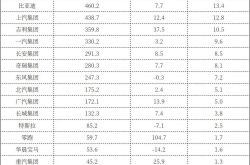

For example, among joint-venture brands, Volkswagen has performed exceptionally well. In 2025, fuel vehicle sales accounted for over 90% of the total for both FAW-Volkswagen and SAIC Volkswagen. FAW-Volkswagen sold 1.587 million vehicles, with its fuel vehicle market share increasing by 0.9 percentage points against the trend. Classic models like the Sagitar and Magotan continue to lead the compact and mid-size car markets, serving as stable 'ballast stones' for sales. SAIC Volkswagen sold over 1 million vehicles annually, with models like the Passat and Tiguan L remaining highly competitive. Its fuel vehicle market share reached 8.3%, contributing most of the company's revenue and profit.

Additionally, in the luxury brand sector, the fuel vehicles of the German Big Three remain highly valuable. In 2025, the fuel vehicle sales of BBA (BMW, Benz, Audi) in China still accounted for over 70% of their total sales.

Specifically, BMW sold 625,500 vehicles in China in 2025, with fuel models like the 3 Series, 5 Series, and X3 remaining sales pillars. The 5 Series, in particular, consistently ranks among the top sellers in the mid-to-large luxury sedan market. Benz sold 575,000 vehicles in China, with strong performances from fuel models like the C-Class, E-Class sedans, and GLC SUV allowing Benz to pursue electrification without rushing. Audi sold 617,000 vehicles in China, with FAW-Audi's fuel vehicles taking the top spot in the domestic fuel luxury car market share. Models like the Q5L and A6L have long dominated the sales rankings in their respective segments, providing solid support for Audi's brand influence and profit growth.

Meanwhile, Japanese brands continue to rely on fuel vehicles.

Toyota sold 1.78 million vehicles in China in 2025, with stable sales of fuel models like the RAV4, Avalon, and Corolla serving as the core competitiveness of Japanese fuel vehicles. Nissan sold approximately 800,000 vehicles in China, with the Sylphy, a 'perennial favorite' in the compact car market, consistently ranking among the top sellers and becoming one of Nissan's core sales sources. Honda sold around 700,000 vehicles in China, with fuel models like the Accord and CR-V, though experiencing slight sales declines, remaining the main sales contributors and maintaining strong market competitiveness.

Additionally, among domestic brands, many companies also achieve stable development through fuel vehicles.

Hongqi sold over 400,000 vehicles annually in 2025, with fuel vehicles accounting for over 60%. Fuel models like the Hongqi H5 and HS5 have performed outstandingly in the mid-size car and SUV markets, becoming benchmark models for domestic brand fuel vehicles. Geely's fuel SUVs like the Xingyue L and Boyue rank among the top sellers in the domestic fuel vehicle market, providing ample financial support for Geely's new energy transition... These domestic brands' fuel vehicle businesses not only supplement sales but also lay the foundation for comprehensive corporate transformation in terms of technological accumulation and supply chain improvement.

02 New Energy Is the Future, but Fuel Vehicles Will Not Exit

Currently, new energy vehicles have become the industry's consensus future direction. Almost all automakers have elevated electrification transition to a strategic height, with the NEV sales share becoming an important indicator for measuring corporate transition effectiveness.

From industry data, in 2025, the penetration rate of Chinese brands in the new energy sector has reached 80.9%, while mainstream joint-venture brands only stand at 8.2%. This significant gap has prompted joint-venture brands to accelerate their electrification layouts, launching new NEV models and platforms to narrow the gap with domestic brands.

At the same time, at the policy level, the 'Evaluation Methods and Indicators for Passenger Vehicle Fuel Consumption' implemented in 2026 is known as the 'strictest fuel consumption standard.' Through differentiated assessments and full-cycle supervision, it compels automakers to accelerate their new energy transitions. In 2026, automakers' new energy credit ratios must reach 48%, rising to 58% in 2027, further reinforcing the development orientation of new energy.

Undeniably, the core trend of the future automotive market will inevitably be the continuous increase in the proportion of new energy vehicles. With continuous breakthroughs in battery technology, the growing improvement of charging infrastructure, and the deep integration of intelligent technologies, the product competitiveness of new energy vehicles will continue to strengthen, further squeezing the market space for fuel vehicles.

From a global perspective, the popularization of new energy vehicles is an irreversible trend. As the world's largest new energy vehicle market, China will continue to lead this transformation. It is expected that the NEV penetration rate will continue to rise to higher levels in the coming years, gradually becoming the absolute mainstream in the automotive market.

However, this does not mean that fuel vehicles will completely disappear. On the contrary, for a considerable period in the future, fuel vehicles will still serve as important contributors to sales volume and profitability for many automakers.

From a market demand perspective, fuel vehicles still have a stable core audience. Users who frequently travel long distances or lack fixed charging stations value the '5-minute full tank' refueling efficiency of fuel vehicles, avoiding charging wait times and range anxiety. Consumers in cold northern regions prefer the stability of fuel vehicles in low-temperature environments, circumventing the range reduction issues of new energy vehicles. The middle-aged group aged 45 and above places greater emphasis on the continuity of driving experience. The linear power output, mature mechanical texture, and long-accumulated usage habits of fuel vehicles make it difficult for them to quickly switch to new energy vehicles.

The existence of these niche demands provides sustained living space for fuel vehicles.

From a technological development perspective, fuel vehicles are undergoing 'secondary evolution' through efficient and clean upgrades rather than heading toward extinction. The industry is currently pushing the thermal efficiency of internal combustion engines toward the theoretical limit of 48%, optimizing combustion systems through technologies like direct cylinder injection, variable valve timing, and lift, combined with the application of lightweight new materials to significantly reduce fuel consumption.

Meanwhile, hybridization has become an important transition direction for fuel vehicles. Hybrid technologies like BYD's DM-i 5.0 have achieved feed-in fuel consumption as low as 2.6 liters, fully meeting stringent fuel consumption standards while addressing consumers' refueling anxiety, serving as a strategic buffer during the transition period. Additionally, the industrial exploration of clean fuel technologies like hydrogen and methanol also provides possibilities for the long-term existence of fuel vehicles, enabling them to adapt to environmental requirements under 'dual carbon' goals.

Therefore, for automakers, the sustained profitability value of fuel vehicles cannot be ignored. After all, new energy transition requires massive capital investment, including R&D, production line transformation, supply chain construction, and other aspects. The stable profit flow from fuel vehicles can provide strong support for these investments. Especially for joint-venture and luxury brands, the fuel vehicle business is not only the current profit core but also the key to maintaining brand influence and stabilizing the dealer system.

The automotive market will likely form a pattern of 'new energy as the mainstream, fuel vehicles as the supplement.' Fuel vehicles will focus on niche scenarios and precise user groups, continuing to exist with a 'niche boutique' positioning and contributing value to automakers.

Editor-in-Chief: Li Sijia Editor: He Zengrong

THE END