Shanghai Witnesses the Outbreak of a "Market War"

![]() 02/03 2026

02/03 2026

![]() 484

484

Introduction

Introduction

The dust from the year-end "final showdown" in the automobile market has barely settled, and the curtain has already been raised on automobile consumption in 2026, thanks to policy initiatives.

Recently, two significant developments have propelled the competition in the year-end automobile market to new heights. Firstly, several automakers have announced the introduction of "7-year low-interest" auto financing policies. Secondly, Shanghai and other regions have unveiled details for trade-in auto purchases in 2026.

These developments have shifted the competitive landscape in the automobile market from mere price wars to a multifaceted contest involving policy support and financial services. To achieve their annual targets, over ten automakers have recently intensified their financial policies, with "7-year low-interest" and "instant purchase" schemes becoming the norm. Essentially, they are vying for existing replacement users by lowering the barriers to car purchases.

The implementation of Shanghai's trade-in details aligns seamlessly with the demands of automakers, providing a policy boost to this consumption battle.

As a prime example of the synergy between local policies and national guidelines, the details released by Shanghai are based on the "2026 Automobile Trade-In Subsidy Implementation Details" jointly issued by seven departments, including the Ministry of Finance and the Ministry of Commerce, on December 30, 2025. These details have been optimized to reflect the high-end and new energy trends in the local automobile consumption market, ensuring both policy consistency and consideration for the uniqueness of the local market, accurately depicting the activation of local existing replacement demand.

Unlike previous "indiscriminate" policies, Shanghai's current trade-in subsidies are precisely targeted at individual consumers, employing a core process of "registration-notarized lottery-winning qualification" to prevent fraudulent subsidy claims from the outset.

The details also outline core requirements: the owner of the used passenger vehicle and the new purchased vehicle must be the same individual, and each consumer can only choose to receive either a scrap and renewal subsidy or a replacement and renewal subsidy once nationwide, without repetition. This ensures that subsidy funds are directed towards genuine consumption demand.

In defining the scope of subsidies, Shanghai's details specifically target the stock of old vehicles, precisely covering three core types of used cars: gasoline passenger vehicles registered before June 30, 2013 (inclusive), diesel and other fuel passenger vehicles registered before June 30, 2015, and new energy passenger vehicles registered before December 31, 2019. This definition not only aligns with the national policy orientation of "phasing out old vehicles and promoting green transformation" but also fits the stock structure of old vehicles in Shanghai.

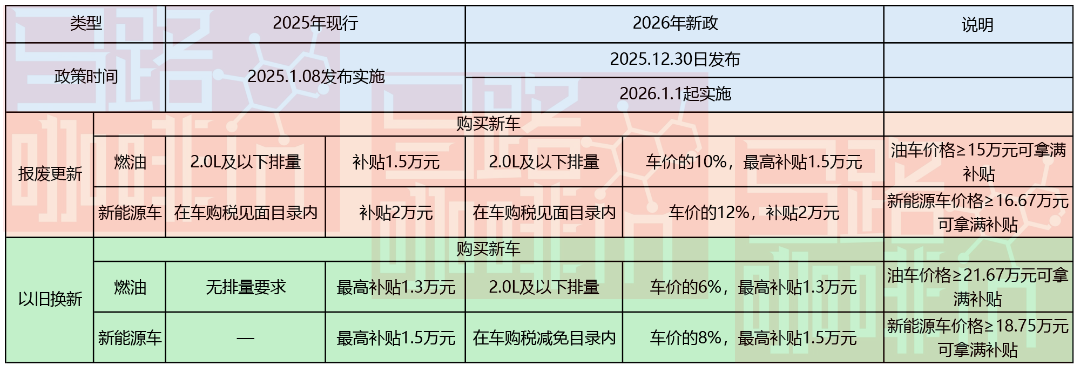

The latest subsidies differ from previous ones in that the policy subsidy intensity is clearly tied to vehicle model orientation, further promoting new energy vehicles: for scrapping eligible old vehicles and purchasing tax-exempt new energy passenger vehicles, a subsidy of 12% of the new vehicle's sales price (including tax) will be provided, up to a maximum of 20,000 yuan (rounded to the nearest yuan); for purchasing new fuel passenger vehicles with a displacement of 2.0 liters or less after scrapping old vehicles, a subsidy of 10% of the new vehicle's price will be provided, up to a maximum of 15,000 yuan.

Overall, the subsidy standards for replacement and renewal remain in sync with national new policies: for replacing with eligible new energy passenger vehicles, a subsidy of 8% of the new vehicle's price will be provided, up to a maximum of 15,000 yuan; for replacing with eligible fuel passenger vehicles, a subsidy of 6% of the new vehicle's price will be provided, up to a maximum of 13,000 yuan. To enhance consumer participation convenience, the details also outline a simplified four-step process of "registration-lottery-winning query-subsidy application," ensuring efficient and transparent policy implementation.

The early implementation of the 2026 new policies in Shanghai and other regions is not coincidental but is based on the significant achievements of the trade-in policies over the past two years.

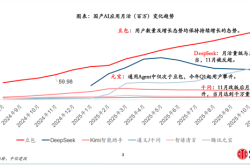

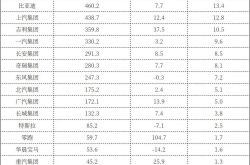

Looking back at 2025, amid multiple pressures faced by the Chinese automobile market, the trade-in policy emerged as a core driver for consumption stimulation: the total volume of automobile trade-ins exceeded 11.5 million vehicles throughout the year, with new energy vehicles accounting for nearly 60%, far surpassing the overall market penetration rate of new energy vehicles. This data not only confirms the accelerating effect of trade-ins on replacing fuel vehicle stocks but also highlights the key role of policies in promoting the green transformation of the transportation system.

More notably, the spillover effect of trade-ins has extended beyond automobile sales, creating resonance across the entire industry chain. In 2025, this policy has driven consumption of related goods and services exceeding 2.6 trillion yuan, benefiting over 360 million people, fully demonstrating the pulling effect of automobile consumption as a pillar industry of the macroeconomy. It is precisely based on this "multiplier effect" that the implementation pace of policies across various regions has significantly accelerated in 2026, with provinces and cities such as Beijing, Guangdong, and Shanghai successively releasing details, forming a nationwide policy push.

Despite the challenge of a decline in purchase tax subsidies in the 2026 automobile market, the densely implemented trade-in policies have become a core support for stable growth.

From a policy design perspective, the 2026 national new policies introduce, for the first time, a differentiated subsidy model linked to new vehicle prices, achieving a balance between "inclusiveness" and "guidance" by setting subsidy caps to create implicit price thresholds—allowing ordinary consumers to enjoy tangible benefits while guiding policy resources towards mid-to-high-end vehicle models, compelling the industry to shift from "price wars" to "value wars."

The early arrival of funding guarantees further eliminates "gaps" in policy continuity. The state has already allocated the first batch of 62.5 billion yuan in ultra-long-term special treasury bonds to support trade-in plans in advance, ensuring that consumers can enjoy subsidies starting from January 1st, effectively avoiding consumer hesitation and market fluctuations in the first quarter. With the successive implementation of policies in Shanghai, Guangdong, Jilin, Yunnan, and other places, the national automobile consumption market will gradually heat up, and the synergistic effect of policies will be fully unleashed.

Overall, the Chinese automobile market in 2026 will bid farewell to significant fluctuations and enter a new stage of technological upgrading, brand enhancement, and consumption quality improvement. Shanghai, as one of the first cities to implement local details, provides replicable implementation experience for other regions across the country with its notarized lottery regulatory model and simplified application process, further enhancing the implementation efficiency of national policies.

Driven by both precise policy guidance and upgrading market demand, the penetration rate of new energy vehicles will further accelerate, and the path to high-quality development of the automobile industry will become increasingly clear. With the comprehensive implementation of the new round of trade-in policies, a new development cycle for the Chinese automobile market has quietly begun, not only providing strong support for macroeconomic growth but also driving the automobile industry to complete a crucial transition from scale expansion to quality and efficiency transformation.

Editor-in-Chief: Li Sijia; Editor: He Zengrong

THE END