Nine Auto Manufacturers Kick Off '7-Year Low-Interest' Campaign, Igniting Fierce Competition in the Auto Market This Year

![]() 02/03 2026

02/03 2026

![]() 497

497

Lead

Introduction

For automakers, this "financial battle" at the start of the year is not just a vital strategy to capture the first wave of consumer interest in the new year, but also a do-or-die effort to set the stage for achieving annual sales targets.

Even before the peak consumption period of the Spring Festival arrives, the auto market at the beginning of 2026 is already engulfed in fierce competition.

The trend of intense internal competition, which has persisted since 2025, reached a new level at the start of the new year. The catalyst was Tesla's groundbreaking move of introducing a seven-year ultra-low-interest financing plan for car purchases. This initiative, which breaks away from the traditional loan cycles in the automotive industry, swiftly triggered a chain reaction. Eight other automakers, including Li Auto, Xiaomi, XPeng, Geely, and Dongfeng eπ, soon followed suit. Within a matter of weeks, nine automakers had jumped into the fray, pushing the level of internal competition in the auto market at the start of the year to unprecedented heights.

Looking back at the evolution of competition in the auto market, from the "price war" at the beginning of 2025, where over 30 automakers collectively slashed prices, to the subsequent "five-year interest-free" financial competition embraced by multiple automakers, the nature of competition has shifted from mere cash discounts to in-depth comparisons of financial policies. The wave of "seven-year low interest" at the start of 2026 has taken this competition to an extreme.

Unlike previous attempts at offering discounts in the range of a thousand yuan, the current competition has escalated to a contest over the entry barriers to car ownership and the cost of capital. The efforts of these nine automakers have not only propelled the auto market into a "Warring States Era" before the Spring Festival but also sent a clear signal: intense competition in the auto market has become the norm, and internal competition within the industry in 2026 will only become more ruthless.

For automakers, this "financial battle" at the start of the year is both a crucial strategy to capture the first wave of consumer interest in the new year and a do-or-die effort to pave the way for achieving annual sales targets. For consumers, the plethora of financial incentives, while seemingly offering more choices, also requires rational judgment amidst the promotional noise.

01 Launching the '7-Year Low Interest' Financial Battle

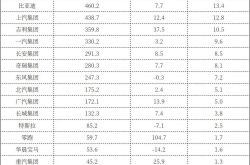

Overall, the "7-Year Low Interest" financial purchase plans introduced by these nine automakers are characterized by their broad coverage and low entry barriers, nearly achieving full coverage of all models and price ranges under 500,000 yuan. From economical commuter cars to mid-to-high-end family vehicles, corresponding financial plans are available to cater to the purchasing needs of different consumer tiers.

As the initiator of this round of "financial battles," Tesla's plan is highly competitive: a Model Y requires a down payment of 79,900 yuan with monthly installments of only 1,918 yuan, significantly lowering the threshold for young consumers to purchase mainstream new energy vehicle models.

Led by Tesla, major automakers have rolled out highly attractive terms. Among them, the Xiaomi YU7 offers a plan with a minimum down payment of 49,900 yuan and monthly installments starting from 2,593 yuan. Li Auto provides car purchase options with a minimum down payment of 32,500 yuan and monthly installments starting from 2,578 yuan, while also offering a three-year interest-free policy for the MEGA and i8 models. XPeng Motors has adopted a strategy of uniformity across all models, with the MONA M03 model requiring a down payment as low as 17,970 yuan and monthly installments of only 1,355 yuan, almost equivalent to the average monthly taxi fare in some cities... Some automakers have even introduced zero-down-payment options, lowering the car purchase threshold to its minimum.

From an industry perspective, the mainstream car loan cycle typically ranges from 3 to 5 years. However, the collective extension of this cycle to seven years by the nine automakers this time presents significant benefits for both consumers and automakers.

For consumers, the most direct benefit is a substantial reduction in the car purchase threshold, significantly alleviating the pressure of high down payments. Down payments as low as ten thousand yuan or even several thousand yuan enable more budget-constrained consumers to fulfill their car purchase needs ahead of time. Meanwhile, the advantage of low monthly installments brought about by the ultra-long cycle significantly reduces subsequent financial pressure, spreading car purchase expenses over seven years and effectively lowering daily consumption pressure, making car ownership no longer a heavy economic burden.

For automakers, this wave of "seven-year low interest" plans is a multifaceted strategy.

Firstly, at a time of fierce competition for consumer attention at the start of the year, highly topical financial plans can quickly attract market attention, generating substantial traffic and exposure for brands and models, and standing out amidst numerous promotional messages. Secondly, low-threshold car purchase conditions can effectively expand the pool of potential customers, converting budget-constrained consumers who were previously on the fence into actual car buyers, directly driving sales growth.

More importantly, the seven-year ultra-long loan cycle can significantly enhance user loyalty. During the loan period, automakers can maintain deep connections with users through after-sales maintenance, charging services, OTA upgrades, and other means, creating opportunities for subsequent value-added services and secondary consumption. In the long run, a stable user base and continuous service revenue can also provide automakers with substantial profit returns, opening up new profit growth points amidst the backdrop of narrowing profits due to mere price reductions.

However, the drawbacks hidden behind the seemingly win-win "seven-year low interest" plan should not be overlooked.

The most prominent issue is the mismatch between vehicle technological iteration and the loan cycle. The current new energy vehicle industry is in a period of technological explosion, with technological iteration speeds far exceeding those in the past. By 2026, semi-solid-state batteries have begun to be installed in vehicles in bulk, and fully solid-state batteries have entered a commercialization critical point. L3 conditional autonomous driving has also officially landed in multiple cities. At this iteration speed, not to mention a seven-year loan cycle, even within three years, vehicles may face significant depreciation and technological obsolescence.

Therefore, in the coming years, when more advanced technologies such as solid-state batteries and high-level autonomous driving become widely available, consumers may still be repaying loans for an "outdated" old vehicle. This psychological gap and disparity in actual usage experience will become a concern for many users. More critically, the decay rate of the residual value of old vehicles may likely far exceed the decline rate of the loan balance. At that point, consumers will not only have to bear loan pressure but also face the dilemma of difficulty in liquidating their vehicles.

Moreover, behind the low down payments and low monthly installments lies an implicit increase in the total cost of car purchases. Many consumers are easily attracted by the apparent low threshold but overlook the cumulative effect of interest. Taking the Tesla Model Y as an example, with a total price of 263,500 yuan, opting for the seven-year ultra-low-interest plan with a down payment of 45,900 yuan, an annualized interest rate of 1.36%, and monthly installments of 2,718 yuan, the total interest over seven years is approximately 10,700 yuan. This means that while consumers have reduced short-term financial pressure, they have to pay an extra interest cost for this "ease," ultimately resulting in a higher total cost of car purchase rather than a lower one.

Furthermore, the potential risks associated with long-term debt should not be underestimated. The seven-year loan cycle spans a long time, during which unavoidable incidents such as income fluctuations and family changes may occur. Once these issues arise, the previously seemingly manageable monthly installments may become a heavy burden. More severely, loan defaults not only incur hefty penalties but also adversely affect personal credit records, posing hidden risks to consumers' future lives.

02 The 'Great Escape' in the Auto Market Has Begun

Looking back at the promotional history of the auto market, the scene at the beginning of 2025 is still vivid. At that time, over 30 automakers collectively joined the price war, with domestic brands, new forces, and joint-venture luxury brands all participating. The discount methods covered various forms such as limited-time offers, cash red envelopes, trade-in subsidies, and policy guarantees, with discount amounts ranging from several thousand yuan to nearly 200,000 yuan, constituting a rare "price war" in the history of the auto market.

Although that price reduction wave temporarily boosted sales, it also led to a further decline in industry profit margins, failing to fundamentally improve the sluggish trend of the automotive industry profit margin standing at only 4.3% in 2024. Subsequently, multiple automakers, including Tesla, initiated "five-year interest-free" policies, attempting to replace direct price reductions with financial incentives. While this alleviated profit pressure to some extent, it also intensified the internal competition and financial rivalry within the industry.

It is worth noting that the price reduction wave in 2025 and the "five-year interest-free" policy were essentially passive measures taken by automakers in response to market pressure. Just as the auto market in 2024 relied on policy stimuli to achieve a smooth transition, these promotional tactics were ultimately just short-term regulatory tools. At that time, industry insiders expressed concerns that large-scale promotions would overdraft (pre-empt) future consumption, and in a less-than-ideal economic environment, the auto market might subsequently fall into a slump.

The "seven-year low interest" wave at the beginning of 2026 seems to be a continuation of these concerns: automakers, in order to seize market share, have to continuously increase promotional efforts, extending the cycle of financial incentives time and again.

Therefore, looking ahead to the auto market in 2026, the "seven-year low interest" plans introduced by the nine automakers are likely to trigger a new round of industry follow-suit. Just as over 30 automakers followed suit in lowering prices in 2025, if this "seven-year low interest" plan achieves significant results, more automakers will inevitably join this "financial battle" in the future, with the intensity of incentives possibly further increasing and even more financial plans breaking industry conventions emerging.

For consumers, this may bring more short-term benefits, but in the long run, excessively intense competition will further compress automakers' profit margins. The continuous decline in profits will inevitably affect automakers' investments in technological research and development and product quality improvement. As warned by automaker executives such as Geely's Li Shufu and Great Wall Motors' Wei Jianjun, issues such as cutting corners and using inferior materials that may arise from price wars will ultimately harm consumers' interests.

Meanwhile, the consumption pre-emption effect brought about by "seven-year low interest" may impose greater pressure on the auto market in the second half of 2026 and beyond. After all, a seven-year loan cycle means that a significant amount of consumer demand will be released ahead of time, potentially weakening the growth momentum of the auto market in the coming years.

Furthermore, with the implementation of new regulations for the upgrading of the new energy vehicle industry in 2026, which comprehensively raise technological standards and accelerate the popularization of new technologies such as solid-state batteries and high-voltage platforms, consumers who choose to purchase vehicles under the "seven-year low interest" plan in 2026 may face the dilemma of outdated vehicle technology and significantly depreciated residual values in the coming years. This will not only affect consumers' car purchase experiences but may also impact the stable development of the second-hand car market.

Overall, the "seven-year low interest" wave at the beginning of 2026 is an inevitable result of the escalation of competition in the auto market and also reflects the immense pressure faced by the industry. Whether this "financial battle" is an effective path for automakers to break through or a catalyst that exacerbates industry difficulties remains to be seen over time. However, one thing is certain: the auto market in 2026 is destined to be a year full of challenges.

When facing a dazzling array of financial incentives, consumers also need to remain rational, comprehensively considering factors such as their repayment ability and the risks of vehicle technological iteration, to avoid falling into the consumption traps hidden behind the "low threshold."

Editor-in-Chief: Li Sijia Editor: Chen Xinnan

THE END