How did Leapmotor, in desperate straits, become the biggest 'dark horse' in China's automotive industry?

![]() 10/23 2024

10/23 2024

![]() 674

674

Introduction: Among the emerging auto manufacturers, Leapmotor was initially the most underestimated and seemingly had the least chance of success. Nevertheless, in these dire circumstances, Leapmotor has steadily progressed and eventually risen to the top two in sales among China's emerging auto manufacturers. Undoubtedly, it has become the biggest surprise and "dark horse" in the industry. So, how did it achieve this?

Written by Lishi Business Review | Published by Lishi

1

Entering the second half of 2024, a "super dark horse" emerged in China's new energy vehicle industry. It is neither the star enterprises among emerging auto manufacturers like NIO, XPeng, and Li Auto, nor traditional Chinese automakers like Geely, Chery, or Great Wall Motors. Instead, it is Leapmotor, one of the least visible emerging auto manufacturers in China's new energy vehicle industry. Unlike other automakers whose CEOs have become internet celebrities, few people outside the automotive industry know the name of Leapmotor's founder.

In the recently released sales rankings for September 2024 among China's new energy vehicle brands, Leapmotor has risen to the top three among emerging auto manufacturers. With sales of 32,382 vehicles, representing a year-on-year increase of 94.6%, it trails only Li Auto and Hongmeng Zhixing, which sold 53,709 and 38,355 vehicles respectively, and surpasses NIO and XPeng, which sold 20,349 and 18,562 vehicles. It even outsold established automaker Haval, which sold 30,900 vehicles.

However, this is far from Leapmotor's limit. If everything goes as expected, Leapmotor is likely to surpass Hongmeng Zhixing in sales in October, rising to the top two in China's monthly sales rankings for emerging auto manufacturers. This prediction is not baseless. In recent weekly sales data, Leapmotor has consistently surpassed Hongmeng Zhixing for several consecutive weeks, firmly occupying the second place in the weekly sales rankings for emerging auto manufacturers.

2

Leapmotor's emergence as a top player has surprised many, as it initially seemed to lack advantages compared to its competitors.

Firstly, compared to emerging auto manufacturers from the internet sector like NIO, XPeng, and Li Auto, Leapmotor lacks their significant funding advantages and topic traffic advantages.

Secondly, compared to the sub-brands of traditional automakers like ZEEKR, Aion, AVATR, ARCFOX, Lantu, IM Motors, and GAC Arcfox, which have invested heavily in the new energy era, Leapmotor lacks their automotive industry experience and funding advantages.

Thirdly, compared to tech giants from the smartphone sector like Huawei and Xiaomi, Leapmotor lacks their brand, R&D, and channel advantages.

Yet, despite these seemingly insurmountable odds, Leapmotor has steadily progressed and eventually risen to prominence in China's new energy vehicle industry, a feat that has shocked the industry. Some may attribute its success to its strong R&D capabilities, others to its product strategy and quality, and still others to its refined management capabilities. While these views have some merit, the author believes that they are merely outcomes rather than causes. Behind factors like technology, products, and management lies a core reason: an extremely mature leader, namely Leapmotor's founder, Zhu Jiangming.

Born in 1967, Zhu Jiangming is now 57 years old. He is not a newcomer to entrepreneurship but rather a co-founder of Dahua Technology, a renowned Chinese security company, with nearly three decades of experience in managing large enterprises.

As CTO of Dahua Technology, Zhu excelled in technological research and development, leading his team to achieve significant breakthroughs in multiple key technologies. For instance, the 8-channel embedded digital video recorder (DVR) developed by his team helped propel Dahua Technology to become the second-largest global player in the security industry and successfully list on the A-share market in May 2008 with a market value of 55 billion Chinese yuan.

In 2015, while traveling in Spain, Zhu stumbled upon several small electric vehicles produced by Renault. Recognizing the potential market for such vehicles in China and the potential to leverage Dahua Technology's expertise in electronic equipment and self-developed hardware and software, Zhu decided to embark on his second entrepreneurial venture. On December 24, 2015, he officially founded Leapmotor.

Leveraging his deep experience in technology and product development, Leapmotor quickly launched its first pure electric sports car, the Leapmotor S01, in January 2019. However, the launch was unsuccessful, with cumulative sales of less than 3,000 vehicles over three years from 2019 to 2021, leading to its eventual discontinuation in 2022.

The failure of its first product could have been devastating for many entrepreneurs, potentially leading to a downfall. However, Zhu demonstrated his maturity as an entrepreneur by remaining calm and focused. Instead of panicking, he launched the Leapmotor T03, a mini-car resembling a "little old man's toy," in May 2020, as planned. Surprisingly, this unassuming little car saved Leapmotor.

With a driving range of over 400 kilometers and a price range of only 65,800 to 75,800 Chinese yuan, the Leapmotor T03 offered significant differentiation and cost-effectiveness compared to most products on the market at the time. According to public data, in 2020, T03 sales reached 10,266 vehicles, accounting for 90.12% of Leapmotor's total sales; in 2021, sales were 11,391 vehicles, maintaining the same percentage; and in 2023, sales reached 61,919 vehicles, accounting for 55.70% of total sales. Although T03 did not generate significant revenue or profit for Leapmotor, its success helped stabilize the company's operations and boost team confidence.

After stabilizing operations with T03, Zhu further demonstrated his abilities as a mature business leader. After thoroughly analyzing market demand, he planned two pure electric vehicle models, the C11 and C01, which better suited mainstream market needs. Launched in 2021 and 2022, respectively, these models underwent continuous upgrades to enhance their product capabilities.

The C01 is a mid-to-large sedan with a length exceeding 5 meters, while the C11 is a mid-size SUV. Zhu demonstrated his courage as a seasoned entrepreneur in pricing these models, understanding that as a relatively unknown brand, setting high prices would limit sales and doom the company. To ensure survival, he prioritized volume sales by adopting aggressive pricing strategies that resulted in negative gross margins, keeping Leapmotor's gross margin consistently lower than its peers.

Zhu refers to this strategy as the "value-for-price" approach, stating publicly, "Value-for-price means that our product capabilities should approach those of Porsche, but we sell them at the price of a Passat. That's our logic behind making cars." This strategy is crucial to Leapmotor's long-term development, as it combines competitive products with cost-effective pricing, enabling the company to gain a foothold in the fiercely competitive market and drive further sales growth and product structure optimization.

For example, in 2022, Leapmotor's annual sales reached 111,168 vehicles, representing a year-on-year increase of 154.1%. The T03 accounted for 55.7% of sales, while the C11 accounted for 39.9%, marking the beginning of a dual-vehicle strategy. In 2023, Leapmotor delivered a total of 144,155 new vehicles, up 29% year-on-year, with the C-series accounting for over 73% of deliveries, significantly improving the company's previously over-reliance on the T03.

After establishing a foothold in the industry with C-series models like the C11 and C01, Zhu demonstrated his prowess as a seasoned entrepreneur in capital operations. He led Leapmotor in two significant capital market moves: listing on the Hong Kong Stock Exchange and attracting the global automotive giant Stellantis as a strategic investor. The two companies jointly established Leapmotor International, which will exclusively handle Leapmotor's overseas export and sales operations in the future. These two milestones are of great significance.

Leapmotor's listing on the Hong Kong Stock Exchange not only secured valuable funding but also significantly enhanced its brand image. Meanwhile, attracting Stellantis as a strategic investor opened up vast opportunities for the company's overseas expansion. Both moves significantly benefit Leapmotor's long-term development. Through its partnership with Stellantis, Leapmotor has already launched sales in 13 countries, including Belgium, France, and Germany, and plans to expand into Asia-Pacific, the Middle East, Africa, and South America. Zhu confidently stated, "We will definitely see Leapmotor outpace some domestic and even international automakers in terms of global expansion speed and sales volume."

While capital operations are crucial in today's business world, good products remain paramount. Leapmotor has not disappointed, launching two significant products based on the LEAP 3.0 technology platform in 2024: the C10 and C16. These two models have significantly contributed to Leapmotor's sales surge this year.

The C10 is Leapmotor's first global strategic model, targeting the mid-size SUV market priced between 100,000 and 150,000 Chinese yuan. Designed to meet both China and Europe's five-star safety standards, it boasts industry-leading smart electric technologies such as a central integrated electronic and electrical architecture, CTC battery-to-chassis integration, and a flagship smart cockpit. Equipped with Qualcomm's flagship SA8295P smart cockpit chip and optional lidar and NVIDIA Orin-X chips for advanced driver assistance, the C10 offers a premium driving experience comparable to luxury vehicles. With a CLTC driving range of 530 kilometers, the C10 has consistently maintained monthly sales of over 5,000 units since its launch.

The C16 is a mid-to-large SUV with a length exceeding 4.9 meters, combining the spacious comfort of an MPV with the styling of an SUV. Equipped with Qualcomm's SA8295P chip as standard and optional lidar and Orin-X chips for advanced driver assistance, the C16's all-electric version features an 800V silicon carbide high-voltage platform with a three-in-one electric drive system offering high performance, efficiency, intelligence, and longevity. Despite its high-end specifications, the C16 is priced between 155,800 and 185,800 Chinese yuan, offering significant cost-effectiveness in its segment. Since its launch, the C16 has gained widespread popularity, with monthly sales in the domestic market reaching 889, 2,812, 8,032, and 7,371 units from June to September, respectively.

The C16's greatest significance lies not only in boosting Leapmotor's monthly sales to over 30,000 units but also in securing the top position in the mid-to-large SUV market priced between 150,000 and 200,000 Chinese yuan, surpassing competitors like Xingji Yuan ET, ARCFOX G318, Buick E5, EXEED TXL, and Haval H9. Achieving this strategic breakthrough has further optimized Leapmotor's product mix.

Taking September sales as an example, Leapmotor's C11, T03, C16, C10, and C01 sold 8,370, 7,754, 7,331, 7,181, and 1,746 units, respectively. Among the five models on sale, four exceeded 7,000 units in monthly sales, a leading proportion in the industry.

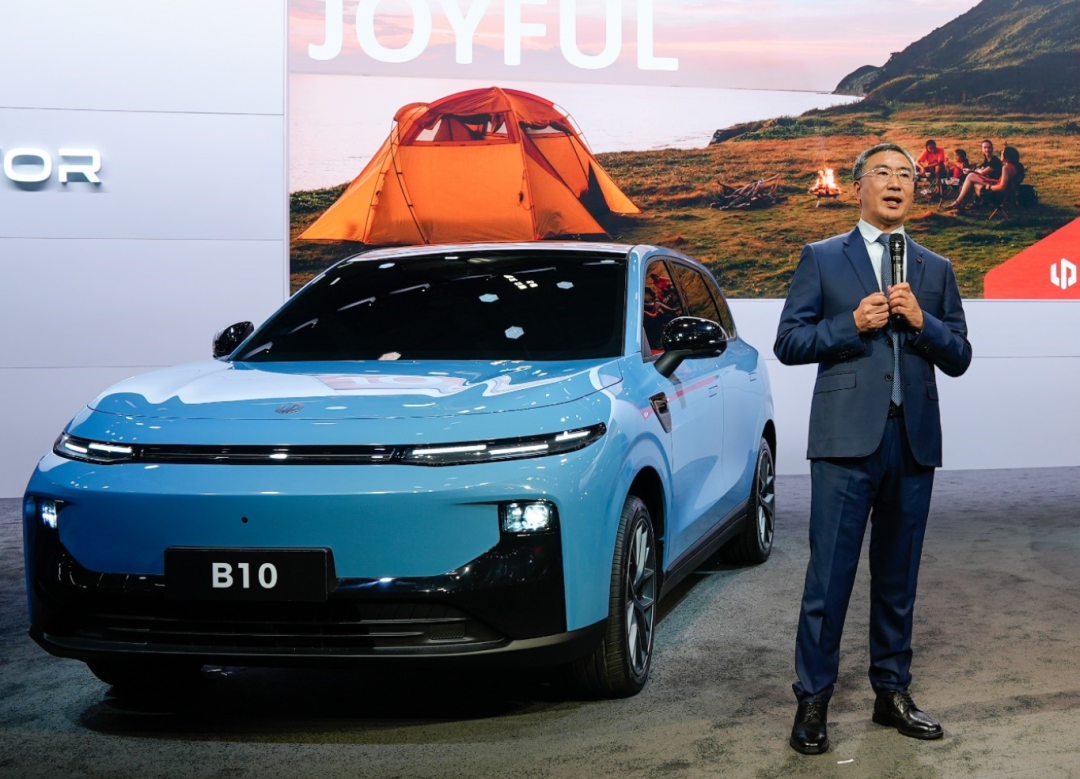

Recently, Leapmotor unveiled its latest A-segment SUV, the B10, at the Paris Motor Show. As the first model from Leapmotor's new B platform, the B10 boasts a sturdy and robust design, is equipped with Qualcomm's Snapdragon 8295 chip and 8650 intelligent driving chip, and excels in intelligence. It is expected to be another best-seller following the C16, driving significant sales growth for Leapmotor. Benefiting from its rapid sales growth and long-term potential, Leapmotor has attracted close attention from capital markets, with multiple securities firms rating it as a "buy" or "overweight."

The success of these products is closely related to Leapmotor's commitment to "full-domain in-house research and development" in core technologies. Unlike other emerging auto manufacturers that focus solely on software in their "full-stack in-house research and development" approach, Leapmotor's "full-domain in-house research and development" encompasses both hardware and software for its entire intelligent driving and electric drive systems, from resistors to code.

In July 2023, Leapmotor unveiled its "Clover" central integrated electronic and electrical architecture, becoming the first in the industry to integrate power, body, intelligent driving, and cockpit domains into a single unit. On January 10, 2024, it launched the upgraded LEAP 3.0 technology platform, covering six key technology areas: electronic and electrical architecture, smart cockpit, intelligent driving, smart battery, smart electric drive, and vehicle architecture. This makes Leapmotor the first emerging automaker in China and the second globally to possess full in-house research and development capabilities for smart electric vehicles, with a self-sufficiency rate exceeding 70%.

As Lepin Auto's founder Zhu Jiangming has a technical background, the company's R&D efficiency is higher compared to other automakers, providing solid support for its proposed "value-for-price" strategy. With continuous expansion of scale and improvement in R&D efficiency, Lepin's gross margin has significantly improved in the first half of 2024, and is poised to set a record-high gross margin in the latest third quarter. This has given Zhu Jiangming the confidence to state in an interview, "Our cost control is not inferior to BYD's. If BYD lowers its prices, we'll follow suit. Haven't we been doing that all year?"

3

In its long-term business research, Lishi Business Review has found that the best indicator for accurately predicting the long-term development of a company is not current financial data such as sales, revenue, and profits, but rather its core competencies. The certainty of capabilities leads to the certainty of performance.

Due to the lower average selling price of Lepin Auto's current models, there is still a significant gap in financial data such as revenue and profits compared to competitors like Li Auto and NIO. However, the fact that Lepin has survived and thrived in the most unfavorable competitive environment from the outset proves that it possesses a special ability that has not been previously recognized by the industry. This ability can be succinctly summarized as the ability to "navigate complex competitive environments, adapt flexibly, and effectively solve problems." This core competency is crucial for long-term competition in the new energy vehicle industry, but it is a capability that has yet to be demonstrated by sub-brands backed by traditional automakers like Zeekr, Ora, Shenlan, Lantu, AVATR, IM Motors, and ARCFOX, as well as new players like NIO and XPeng, which received significant capital investments and celebrity founder endorsements from the outset.

Moreover, Lepin Auto's pragmatism is a rare commodity in the currently impetuous new energy vehicle industry. During the 2024 Beijing Auto Show, when asked about automakers' CEOs "going all in" and engaging in "dream collaborations" to generate buzz, Zhu Jiangming responded, "I don't have a huge following or high visibility, so I'll just focus on doing my job well and striving to improve our technology." To support Lepin Auto's development, Zhu Jiangming, after Lepin's IPO in 2022, resolutely waived his annual salary of approximately 2 million yuan and refused to draw a penny from the company. Subsequently, he and his spouse Liu Yunzhen pledged in an announcement on October 31, 2023, not to transfer or reduce their shareholdings in the company in any way for the next ten years, choosing to stand with the company through thick and thin, demonstrating his leadership and commitment as a corporate leader.

Looking ahead, Lepin Auto has a clear plan. Zhu Jiangming believes that automakers with annual sales of 500,000 vehicles can survive, while those with sales of 1 million have stronger staying power, but to truly succeed in the long run, sales of over 3 million vehicles are necessary. To achieve its long-term survival goal, Lepin Auto will focus on three main areas: firstly, continuing to focus on the domestic market, leveraging its fully self-developed technological capabilities to continuously launch cost-effective and premium-configured products through a "dual-power" layout of pure electric and extended-range vehicles, with plans to introduce at least 2-3 new models annually over the next three years; secondly, expanding the sales scope of self-developed components, with the goal of supplying components to other manufacturers; and thirdly, accelerating overseas expansion and achieving notable results in international markets.

Competition in China's new energy vehicle industry is bound to intensify in the future, but Lepin Auto, as the biggest dark horse in the industry, has already proven its ability to survive in adversity. With a mature and responsible leader like Zhu Jiangming at the helm, we believe that Lepin Auto will continue to find ways to further breakthrough and implement them in the long and arduous competition ahead. Therefore, ranking second in China's new energy vehicle sales is just the beginning for Lepin Auto; its long-term achievements are worth looking forward to.