Musk makes a fortune from his investment, his net worth soars by $20.9 billion overnight

![]() 11/08 2024

11/08 2024

![]() 568

568

The top donor doesn't do losing business

Author | Liu Yajie

Editor | Qin Zhangyong

All-in is an art, and Musk has won big.

The Trump 2.0 era is about to begin, and as the top donor, Musk's net worth has also skyrocketed.

Last night, Tesla's share price surged by 14.75%, hitting a new high since July 2023. The company's market value increased by approximately $120 billion, and Musk's net worth soared by $20.9 billion (equivalent to RMB 149.6 billion) overnight, bringing his total assets to $285.6 billion, solidifying his position as the world's richest person.

However, after Trump takes office, it seems that he is not friendly to the entire electric vehicle industry, and the high-tariff policy may intensify, making it even more difficult for Chinese automakers to successfully enter the North American market.

Musk is the biggest winner

In the early hours of Wednesday morning, local time, Trump mentioned Musk 11 times in a three-minute speech, calling him a "super genius."

"We have a new star, a star is born, and that star is Elon."

Trump also praised SpaceX, stating that the recent successful rocket launch and Starlink technology have brought internet access to people affected by hurricanes in North Carolina.

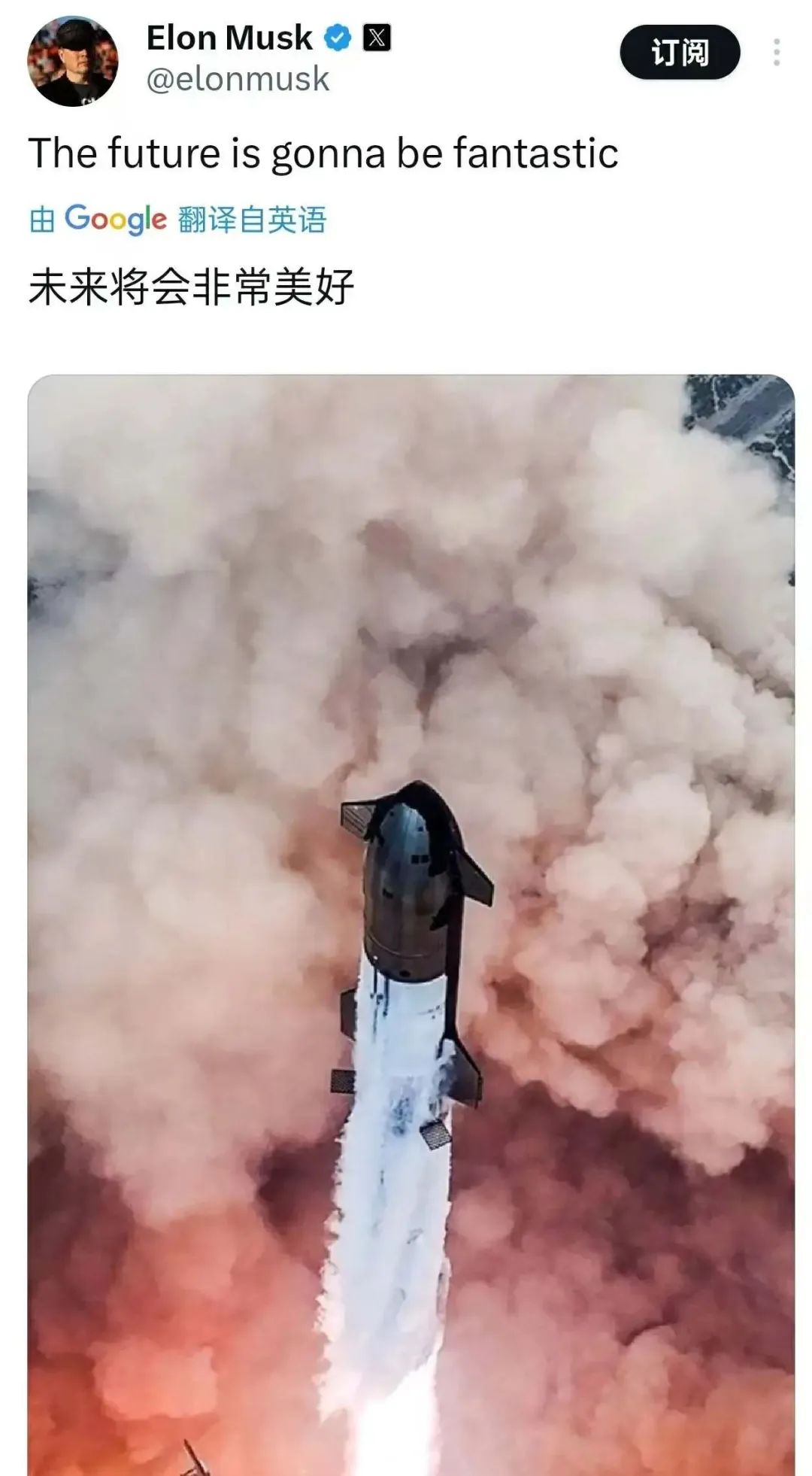

After Trump's victory, Musk also joked that he would be safe for the next five years and would not face any "prison disasters." He also posted on social media, saying, "The future will be very bright," accompanied by a picture of a large rocket.

Previously, Musk had spent over $132 million to support Trump's campaign and had even stated that if Trump lost, he would be "ruined."

However, Trump did not disappoint him. Overnight, Musk's net worth increased by $20.9 billion, and the money spent on Trump returned in the form of a 158-fold increase.

In the weeks leading up to the election, the market viewed Tesla as one of the "Trump trades." So, what can Musk, as Trump's biggest supporter, gain from this?

In previous interviews, Trump has repeatedly stated that he would give Musk a government position.

However, the chairman of Trump's transition team stated that due to conflicts of interest involved in holding a government position, Musk's plans for a "government post" should be considered unsuccessful. However, Musk can choose to place his own people in the "public administration sector," so this valuable network of connections will still be useful even after Trump's term ends.

This can be interpreted as Trump giving Musk the green light. After Trump takes office, Tesla will be able to develop various technologies more freely.

In particular, the regulatory scrutiny on Tesla's current focus, Robotaxi, will decrease, and the approval speed for Tesla's autonomous driving technology by relevant state departments should also accelerate.

In the general electric vehicle industry, Trump's election is also beneficial to Tesla.

For example, if Tesla wants to expand its market share in the North American market and improve its energy replenishment system and hardware systems such as vehicle-to-city connectivity required for Cybercab, it cannot do without the help of its good friend Trump.

Professor Gordon of the University of Michigan also believes that Musk believes that current regulatory agencies are hindering the development of his research and development technologies, "He wants to be an unshackled, cutting-edge entrepreneur."

Moreover, Trump has publicly supported the goal of achieving human landing on Mars, which is a significant boost for SpaceX's innovation in the technology field.

Impact on other electric vehicle companies

After Trump takes office, electric vehicle tax rebates and tax incentives may decrease, which may adversely affect other companies in the electric vehicle industry.

For example, while Tesla's share price surged, the share prices of Rivian and Nikola fell by over 8% and nearly 2%, respectively. Chinese new energy vehicle stocks also fell pre-market, with Li Auto down 5% and Xpeng Motors and NIO both down 3.6%.

Even before his election, Trump stated that he would revoke the Biden administration's subsidies for electric vehicles in the United States and would also block Chinese-made cars from entering the US market.

More troublingly, Trump has consistently advocated for high-tariff policies. During his previous administration, Chinese cars, in addition to facing the general 2.5% import tariff applicable to imported cars in the United States, were also subject to an additional 25% tariff.

In a speech in October this year, Trump also stated that if he were re-elected, he would impose high tariffs on imported cars from Europe and Mexico. "We will impose a 200%, or even 1000%, tariff on every car entering from Mexico. If I am elected president, you won't be able to sell these things."

According to the United States-Mexico-Canada Agreement (USMCA), many product categories exported from Mexico to the United States and Canada enjoy lower tariffs or even zero tariffs.

Therefore, Mexico has become the choice for most Chinese automakers to enter the North American market.

Earlier this year, BYD was reported to be planning to invest $1 billion to build an electric vehicle factory in Mexico. In May, BYD's first pickup truck, the BYD SHARK, was launched in Mexico. Additionally, SAIC MG and Chery have also been reported to be planning to build factories in Mexico.

Public data shows that currently, the number of A-share auto parts companies with factories in Mexico has exceeded 20. Among them, 16 companies had overseas revenue accounting for more than 30% of their total revenue in 2023.

According to data from the China Passenger Car Association, from January to September 2024, Mexico ranked second in terms of cumulative exports of approximately 353,400 vehicles among the top ten countries in China's total vehicle exports.

Trump's high-tariff policy on Mexico will obviously reduce the enthusiasm of Chinese automakers to invest in Mexico, which is not conducive to Chinese automakers going to sea.

However, Trump is open to Chinese automakers building factories in the United States. He has publicly stated on multiple occasions that he is willing to invite Chinese automakers to build factories in the United States, but only if they hire American workers; otherwise, a tariff of up to 200% will be imposed on each vehicle.

Trump, who has a business background, has indeed played a smart move. Although he has cut off the roundabout route for Chinese automakers to bypass Mexico, he has still provided an option for them to go to sea by building factories in the United States.

Whether it is worth taking the risk for the North American market is something that Chinese automakers need to consider.