Can Japanese automakers break free from the shackles of 'path dependence' amid profit pressure?

![]() 11/14 2024

11/14 2024

![]() 597

597

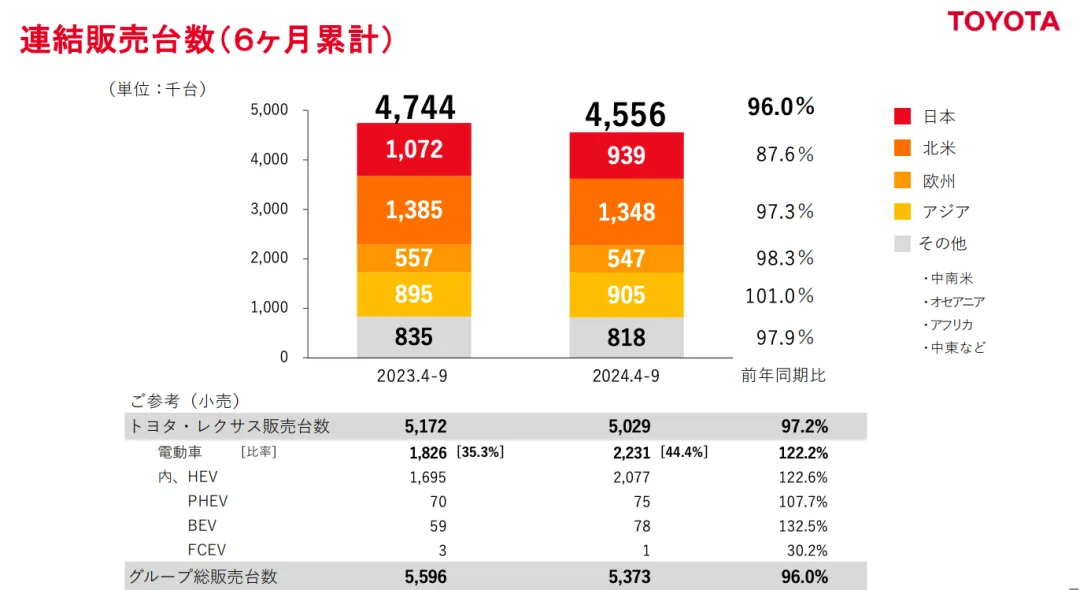

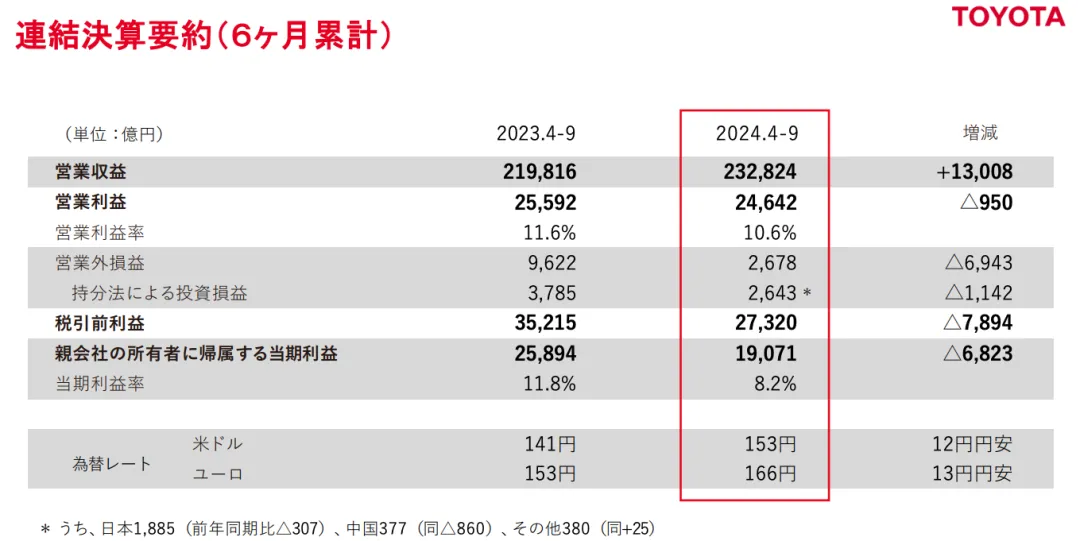

According to the data released by several mainstream Japanese automotive companies for the first half of the 2024 fiscal year (April-September), Japanese automakers are "weathering the winter" in terms of net profit, a key indicator: Toyota saw a decline of 26.4% to 1.91 trillion yen, Nissan plummeted 93% year-on-year to 19.223 billion yen, hitting its lowest level since 2020. Honda fared slightly better, raising its full-year sales forecast after releasing its second-quarter data, but its operating profit in the second quarter still declined by 15% year-on-year, reaching only 257.9 billion yen.

Moreover, both Mitsubishi and Mazda also experienced significant declines in net profit compared to the same period last year. Facing such results, the question of how to "weather the winter" becomes even more pressing.

▍Profit margins "collapse" collectively

If only revenue data is considered, Toyota saw an increase in performance in the first half of the 2024 fiscal year (April-September), with a turnover of 23.28 trillion yen, an increase of 5.9% compared to the same period last year. Operating profit was 2.46 trillion yen, a year-on-year decrease of 3.7%; net profit was 1.9 trillion yen, a year-on-year decrease of 26.4%.

However, Toyota also faced considerable challenges in the second quarter, with operating revenue of 11.44 trillion yen, flat with the same period last year, but operating profit fell by 20% year-on-year to only 1.16 trillion yen, and net profit was halved to only 573.7 billion yen, compared to 1.28 trillion yen in the same period last year.

Regarding Toyota's recent profitability challenges, Yoichi Miyazaki, Executive Vice President and CFO of Toyota, explained the reasons for the significant decline in net profit, with the core reason being the "falsified certification data" scandal.

In June this year, due to the falsification of test data, Toyota was required to rectify the issue and suspend the production of related models. The direct impacts of the "falsified certification data" scandal were twofold: firstly, recertification, production rectification, and recalls incurred high costs for Toyota; secondly, the brand's reputation was damaged, ultimately leading to a simultaneous decline in production and sales. Toyota sold 4.556 million vehicles in the first half of the fiscal year, a year-on-year decrease of 4%, with declines in multiple regional markets including Japan, North America, and Europe compared to the same period last year.

Honda's financial report also raised market concerns. Honda's latest financial report showed a year-on-year increase of 12.4% in revenue for the first half of the fiscal year (April-September), reaching 10.8 trillion yen, with operating profit also increasing by 6.6% year-on-year to 742.6 billion yen. However, Honda's pre-tax profit for the first half of the fiscal year declined by 15.6% to 741.9 billion yen, with a more significant decline in profit indicators in the second quarter (July-September).

Specifically, Honda's sales in Japan surged by 22% in the second quarter, with an 8% increase in the United States. However, global sales ultimately declined by 1.5% to 2.8 million vehicles, with the Chinese market again emerging as the "problem area."

Despite a 22% increase in sales in Japan, Honda's global sales still declined by 1.5% due to the impact of sales in the Chinese market, and global production in September had already dropped to less than 300,000 units, a year-on-year decrease of 20%.

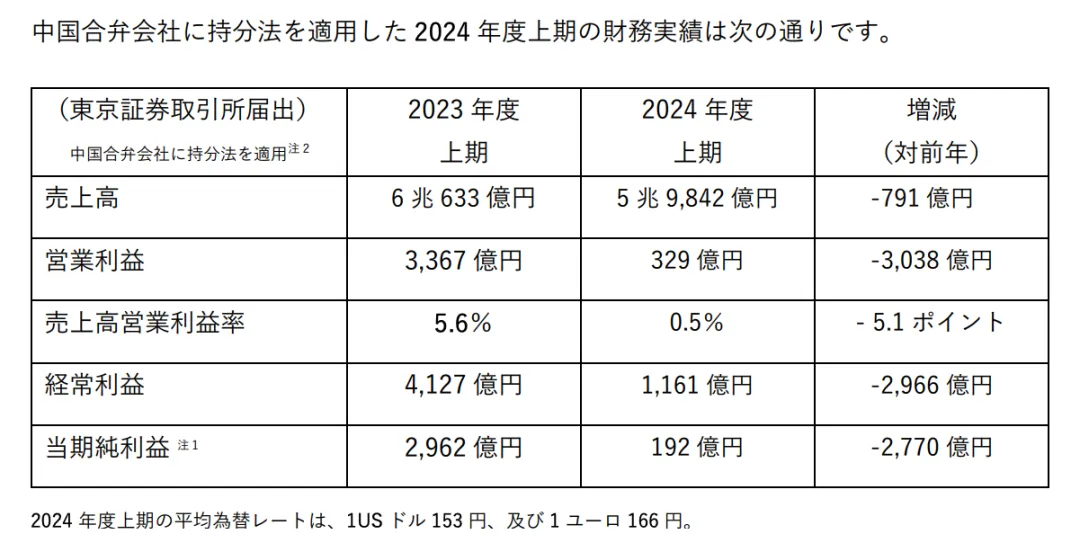

Nissan posted the worst financial report among the three major Japanese automakers, with net revenue for the first half of the year at 5.98 trillion yen, a year-on-year decrease of 1.3%; operating profit plummeted by 90.2% year-on-year to 32.9 billion yen. Following the release of the financial report, Nissan promptly announced a series of cost-reduction and efficiency-enhancement plans, including reducing global production capacity by 20%, laying off 9,000 employees worldwide, and some executives voluntarily forgoing 50% of their monthly salaries.

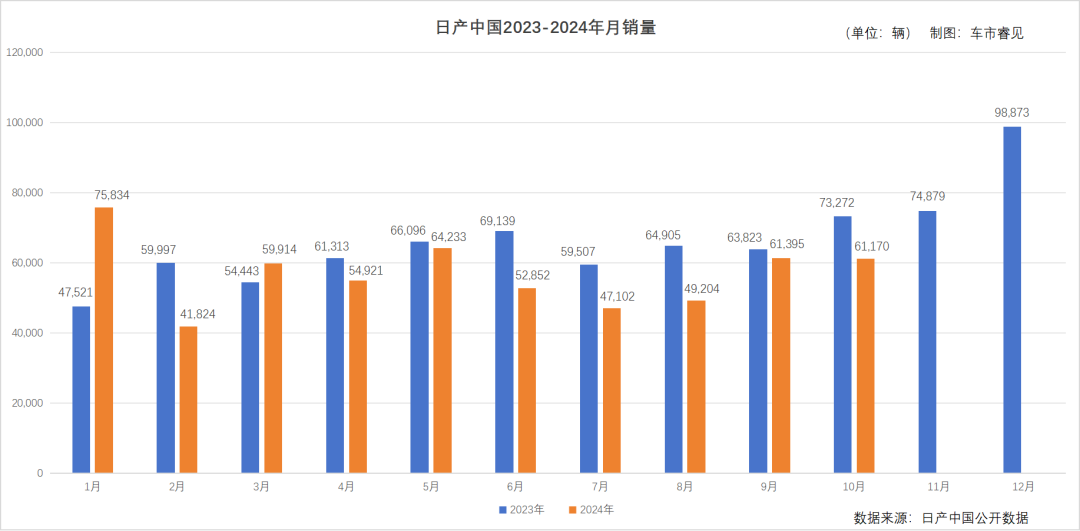

The reason behind Nissan's "worst performance" remains China: in terms of the global market, Nissan's sales declined by 4% year-on-year, with a 0.2% year-on-year decrease in the North American market and a 5% year-on-year decrease in the European market. From January to October in China, Nissan sold 558,168 vehicles (including commercial and passenger vehicles), a year-on-year decrease of 9.98%.

▍Drawbacks behind 'path dependence'

From an external perspective, Japanese automakers have collectively been exposed in scandals related to falsified data this year, and the uproar caused by production suspensions and recalls has yet to subside. After consumer goodwill has been significantly diminished, it will take a long process to restore brand reputation.

At the same time, the intensifying competition in the core market and the subtle shift in demand structure pose severe challenges for Japanese automakers. Especially in the Chinese market, consumer demand has undergone tremendous transformation. To date, China remains a core market for Japanese automakers, second only to their domestic and North American markets. However, as Chinese consumers' demand for intelligent new energy products increases, the Chinese market can no longer serve as a robust growth engine for Japanese automakers as it once did.

The challenges faced by Japanese automakers are not only from market competition but also a direct reflection of changes in consumer brand preferences and car-buying philosophies. Emerging Chinese consumers are no longer constrained by tradition, and an increasing number of young people prefer to choose autonomous brands with an innovative spirit and flexible operational methods.

Amid the fierce price war, Japanese automakers have had to follow suit, entering into a brutal "price-for-volume" competition. For Japanese automakers, the nature of the Chinese market has fundamentally changed – consumption is shifting from gasoline vehicles to new energy vehicles, a trend that is irreversible. New energy vehicles are narrowing the gap with gasoline vehicles in terms of purchase cost and refueling convenience, while offering superior usage costs. In terms of the popularization of intelligent functions, end-to-end intelligent driving and smart cockpits can better match new energy vehicles.

In the first three quarters, the Chinese market sold a total of 21.571 million vehicles, of which 8.32 million were new energy vehicles, accounting for 38.6% of total vehicle sales. Among new energy vehicle sales, with the exception of Tesla, the presence of other multinational brands is generally weak. The latest data shows that in October, Chinese brand passenger vehicle sales reached 1.931 million units, a year-on-year increase of 30%, with a market share of 70.1%, a year-on-year increase of 10.4 percentage points.

The Chinese market is one of the most important markets for Japanese automakers. Although Japanese brands are currently facing widespread sales pressure, recent statements from corporate executives indicate that they are seeking change through methods such as "decentralization" and "generational change." Toyota may give the Chinese management greater autonomy in research and development and sales decision-making. At the recently concluded China International Import Expo, Kunio Sekiguchi, Executive Vice President of Nissan Motor Co., Ltd., Vice President of Dongfeng Motor Corporation, and General Manager of Dongfeng Nissan Passenger Vehicle Company, stated that amid all uncertainties, one certainty is to cooperate with Chinese partners to "shift gears and accelerate."

Typesetting 丨 Yang Shuo Image Sources: Toyota, Nissan, Honda, Shutterstock