China's Auto Exports Reach 6 Million Vehicles: Who's Left Reeling, and Who's Heartbroken

![]() 01/15 2025

01/15 2025

![]() 544

544

Introduction

Whether it's sales data, export volumes, or industry significance, China's continuous overseas achievements have not only solidified its position as the world's largest auto exporter but have also emerged as a pivotal driver of automotive production and sales growth.

The year's tumultuous journey has culminated in the release of comprehensive statistical tables, encompassing various categories, dimensions, and sources across the industrial chain. Indeed, the auto industry has once again reached the milestone moment of its year-end report.

Despite ending the year under neutral or slightly negative buzzwords like price wars and internal competition, the final report delivered is nothing short of impressive.

In 2024, domestic auto production and sales surpassed the 30 million mark once again, with cumulative production and sales reaching 31.282 million and 31.436 million vehicles, respectively, representing year-on-year increases of 3.7% and 4.5%. Notably, the rapidly growing new energy vehicle sector maintained its momentum, with annual production and sales exceeding 10 million vehicles for the first time and a market share exceeding 40%, heralding a new era of high-quality development.

While the domestic auto market continues to flourish, China's auto exports are also in full swing.

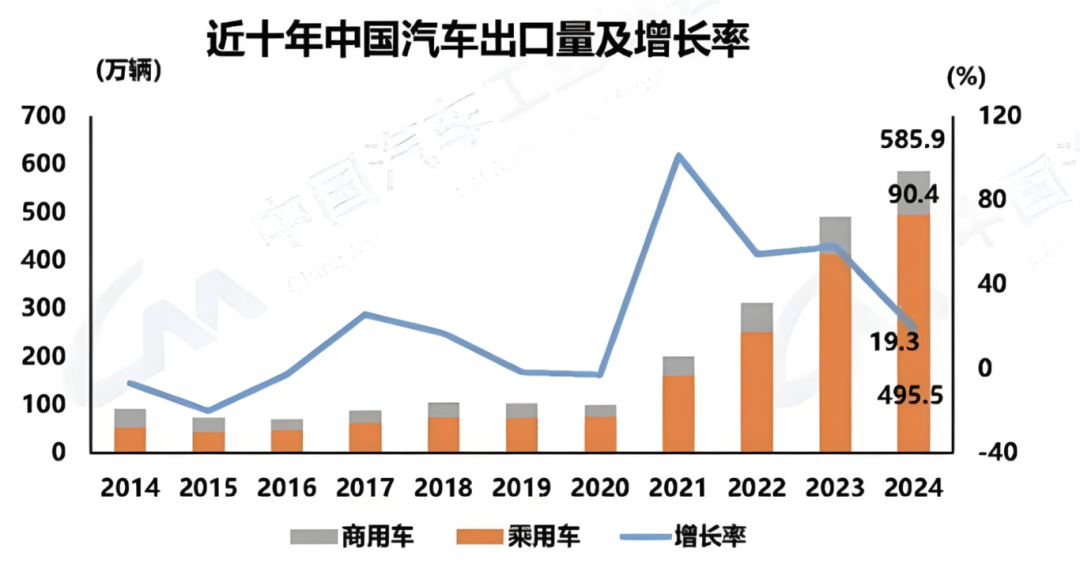

Data reveals that despite factors such as the EU anti-subsidy investigation, China's auto exports still achieved remarkable results in 2024, with full-year export sales reaching 5.859 million vehicles, a year-on-year increase of 19.3%, providing a triumphant conclusion to this busy year.

With the rapid development of China's auto industry, the sector is now at a crucial juncture, transitioning from export-driven growth to global development. The overseas successes, marked by significant sales data, export volumes, and industry impact, have not only solidified China's position as the world's largest auto exporter but have also become a vital force driving the growth of automotive production and sales.

"From Beijing to Rome"

Passenger vehicles, including sedans, SUVs, and MPVs, remain the backbone of China's auto exports. In particular, passenger vehicle exports reached 4.955 million vehicles, a year-on-year increase of 19.7%. SUV models, renowned for their off-road capabilities and spacious interiors, have become the preferred choice for overseas consumers.

Additionally, commercial vehicles, comprising trucks and buses, are also significant contributors to China's auto exports, with a total export volume of 904,000 vehicles, a year-on-year increase of 17.5%. As global infrastructure construction continues to advance, the demand for commercial vehicles is on the rise, offering ample opportunities for China's commercial vehicle exports.

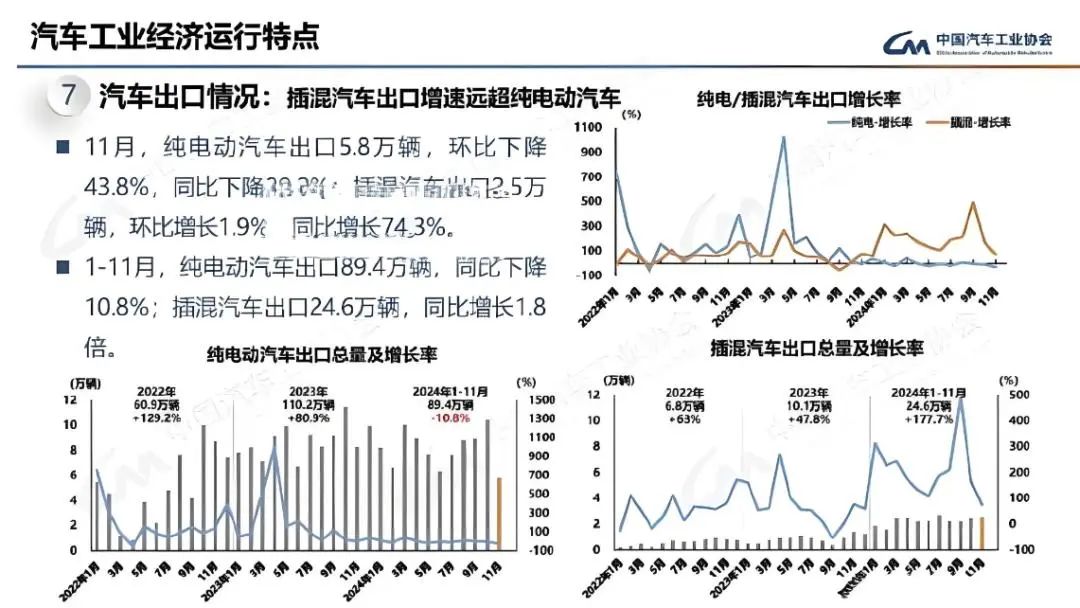

From the perspective of fuel drive forms, new energy vehicles stand out as a highlight of China's auto exports, distinguishing Chinese autos from foreign brands and showcasing their excellence.

If in 2023, China's auto exports surged to the top of the world rankings, it was largely due to the significant contribution of traditional fuel vehicles. However, with the global emphasis on environmental protection and sustainable development intensifying, the competitiveness of China's new energy vehicles in the international market is rapidly improving.

In the past year, China's new energy vehicle exports achieved year-on-year growth. During the first 11 months of 2024, China exported 1.8234 million new energy passenger vehicles, a year-on-year increase of 17.5%. According to the General Administration of Customs, China's new energy vehicle exports surpassed 2 million vehicles for the first time in 2024. The General Administration of Customs remarked, "As the saying goes, 'all roads lead to Rome.' If these new energy vehicles were connected end-to-end, they could traverse from Beijing to Rome."

Looking back, from the negligible proportion of new energy vehicles in China's auto exports in 2021 to the current milestone of 2 million vehicles, lifting independent brands to new heights. During this period, China has surpassed South Korea, Germany, and Japan to become the world's largest auto exporter, with new energy vehicles becoming a distinctive label for Chinese autos in overseas markets.

So, which automakers contributed to these 6 million vehicles exported from China?

Based on past performance, the top ten automakers in the list of whole vehicle exports are primarily SAIC, Chery, Tesla, Changan, Dongfeng, Geely, Great Wall, BAIC, JAC, and Sinotruk. With the exception of Tesla, the other nine are Chinese automakers, and their combined export volume accounts for nearly 90% of China's total auto exports.

In 2024, these major exporters continued to excel. Chery led the pack with 1.144 million vehicles, closely followed by SAIC. Changan, Geely, Great Wall, BYD, BAIC, Tesla, JAC, and Dongfeng jointly occupied the top ten spots among exporting automakers.

In terms of growth rate, BYD topped the chart with 433,000 vehicles, a year-on-year increase of 71.8%, followed by Changan and JAC, which achieved growth rates of 49.6% and 46.7% with 536,000 and 249,000 vehicles, respectively.

From the perspective of export destination countries, China's auto export market exhibited diversification characteristics over the past year, encompassing not only developed country markets but also emerging markets and developing country markets.

Currently, the top three destination countries for China's whole vehicle exports are Russia, Mexico, and the United Arab Emirates.

Among them, exports to the United Arab Emirates achieved triple-digit growth year-on-year. In the first 11 months of 2024, China exported 1.0597 million whole vehicles to Russia, a year-on-year increase of 26.1%; 422,000 whole vehicles to Mexico, a year-on-year increase of 12.1%; and 291,600 whole vehicles to the United Arab Emirates, a year-on-year increase of 113%.

From a country distribution standpoint, Chinese automakers performed well in mainstream markets such as Brazil, Thailand, Israel, the UK, Germany, and others. In the Nordic markets, automakers like SAIC, Geely, and BYD fared relatively better. Notably, Belgium, the UK, and Brazil are the top three export destinations for China's new energy passenger vehicles.

In the first 11 months of 2024, China exported new energy passenger vehicles worth US$6.432 billion to Belgium, a year-on-year increase of 21.7%; US$3.356 billion to the UK, a year-on-year decrease of 24.5%; and US$2.928 billion to Brazil, a year-on-year increase of 148.7%.

With increasing sales performance, market expansion, automaker participation, and export volume growth, more and more cars from China are making their way to Rome and beyond, spanning the globe.

To go far, one must first go wide

Although China's auto exports now stand at 6 million vehicles, this journey has not been without its challenges.

Since 1957, when the chairman of the Jordan Overseas Trade Corporation ordered three domestically produced cars, China's auto exports achieved a breakthrough from zero. However, for a considerable period afterward, China's auto exports faced numerous hurdles. It was not until 2012 that China's auto exports surpassed the 1 million mark, with actual exports of 1.05 million vehicles, marking the first significant leap.

The real quantitative transformation occurred over the past three years, with China's auto export scale achieving consecutive milestone breakthroughs. From exceeding 2 million vehicles in 2021 and surpassing South Korea to become the world's third-largest auto exporter; to surpassing 3 million vehicles in 2022 and outpacing Germany to become the world's second-largest auto exporter; to surpassing 5.22 million vehicles in 2023, crossing two million-vehicle thresholds and breaking Japan's seven-year reign as the top auto exporter, China ascended to the pinnacle as the world's largest auto exporter.

After becoming the world's largest auto exporter, China accelerated its overseas auto layout.

Last year, nine departments, including the Ministry of Commerce, issued the "Opinions on Supporting the Healthy Development of Trade Cooperation in New Energy Vehicles," proposing measures in six key areas: enhancing international operation capabilities and levels, improving international logistics systems, strengthening financial support, optimizing trade promotion activities, creating a favorable trade environment, and enhancing risk prevention capabilities. These measures aim to boost the quality and efficiency of trade cooperation in new energy vehicles.

Driven by these policies, a group of Chinese automakers accelerated their overseas expansion. Taking BYD as an example, its overseas sales of passenger vehicles reached 410,000 in 2024, a year-on-year increase of 71.9%. Simultaneously, it invested in factories in countries such as Thailand, Hungary, and Brazil, further bolstering its production capacity and competitiveness in overseas markets.

Today, BYD's new energy vehicles are present in 96 countries and regions worldwide, particularly in Europe and South America, where BYD's automotive products have garnered recognition from local consumers.

BYD's story is not unique; many other automakers, from traditional manufacturers to newcomers, are actively strengthening international cooperation and steadily building a full-value chain for the automotive industry overseas. This includes innovative R&D centers, production bases, marketing centers, supply chain centers, and financial companies. Their products and services have penetrated numerous countries and regions globally.

Among them, SAIC Group, with the most comprehensive chain, boasts three overseas R&D and innovation centers, four vehicle manufacturing bases, over 100 parts production and R&D bases, and more than 2,800 marketing service outlets. It has emerged as an automaker with a fully integrated industry chain extending overseas.

However, challenges for China's auto exports persist.

In the second half of last year, the EU decided to impose additional tariffs of up to 35.3% on electric vehicles imported from China. This unfair practice, akin to "cheating when unable to compete," not only challenges the competitive landscape within the auto industry chain but also disrupts the healthy development of the global auto market.

Nevertheless, for Chinese automakers, following the EU's tariff imposition, their export focus will shift to markets such as the Middle East, Latin America, and Southeast Asia, where the share of electric vehicles is growing rapidly. Additionally, Chery and Spain's Ebro-EV Motors have agreed to establish a joint venture to develop electric vehicles collaboratively; Stellantis has also forged a joint venture with Zero Run. In the process of going overseas, Chinese automakers have undoubtedly grown stronger through trials and tribulations.

It's worth mentioning that while many claim China's auto exports have already "crossed countless mountains," we must still view the title of "the largest auto exporter" with rationality, eschewing blind confidence and excessive self-satisfaction.

Compared to traditional auto industry powers, there is still a gap in our overall sales and influence in overseas markets.

In 2023, Japanese automakers sold 20 million vehicles in overseas markets, and German automakers sold over 15 million vehicles. In contrast, Chinese autos are primarily exported as complete vehicles and have yet to truly establish roots overseas. Their volume is not comparable to Japanese and German cars in terms of overseas R&D and production.

Fortunately, with policy support and corporate strategic foresight, many overseas automakers are choosing to build factories, localize supply chains, and establish their brand images and corporate cultures. In summary, for China's auto exports, only by taking a broad path can we ensure a promising future.