2025 Patterns and Trends | (Part 2): Automobiles Soar Southeast

![]() 01/22 2025

01/22 2025

![]() 589

589

Introduction

Akio Toyoda journeys south, Jen-Hsun Huang ventures east, and the automotive future takes flight southeast.

In 2027, just two years hence, Akio Toyoda, the 71-year-old chairman of Toyota Motor Corporation, will travel south from Nagoya to China to unveil the first locally produced electric and intelligent Lexus at Toyota's wholly-owned Shanghai super factory. This moment will surely evoke memories of January 7, 1989, when his father, Shoichiro Toyoda, captivated the world by unveiling the LS400 in Detroit.

On January 6, at 6 PM US time in Las Vegas, Jen-Hsun Huang, CEO of NVIDIA, reemerged at the Consumer Electronics Show (CES), dubbed the "Tech Industry's Spring Festival Gala," after a five-year hiatus. With great fanfare, he announced that the Thor chip would enter mass production this year, and that the autonomous driving platform DRIVE AGX Hyperion, based on the Thor chip, would be integrated into the latest vehicles in the first half of the year.

Earlier that day, at 1 PM on January 6, in a smaller exhibition hall 300 meters from the NVIDIA event, Akio Toyoda also made his CES appearance after a five-year absence, coinciding with Jen-Hsun Huang. He announced that Toyota's future city project, Woven City, unveiled during its CES participation, was nearing completion, and that Toyota would actively explore rocket technology, heralding a new era of human mobility.

Between the conclusion of Toyota's press conference at 1:45 PM and Jen-Hsun Huang's stage appearance that evening, the two held a secret meeting for almost an hour and a half in a small hotel conference room. Subsequently, Jen-Hsun Huang announced that Toyota would begin integrating DRIVE AGX Orin to build the next generation of vehicles from the following year.

Bringing the world's largest automaker under its wing has significantly boosted NVIDIA's confidence, which recorded only $1.1 billion in automotive revenue last year. With great fanfare, it announced that its automotive revenue target would soar to $5 billion by 2026. Jen-Hsun Huang's automotive circle of friends continues to expand, now including notable members such as Mercedes-Benz, Zeekr, BYD, Jaguar Land Rover, Volvo, and Li Auto.

Capitalizing on Tesla's sluggish global sales in 2024 and Elon Musk's preoccupation with assisting President Trump's inauguration, Jen-Hsun Huang, with China in one hand and Akio Toyoda in the other, has emerged as the new automotive industry super icon, usurping Musk.

On January 21, Jen-Hsun Huang appeared in Lujiazui, Shanghai. Following CES, Huang traveled east, from Shenzhen to Beijing, and then to Shanghai. In this global hub of new energy and intelligent vehicles, he completed an emotional roadshow for his NVIDIA chip empire.

Akio Toyoda journeys south, Jen-Hsun Huang ventures east, and the automotive future takes flight southeast.

New Automobiles Head South

Two years from now, the first electric version of the Lexus rolling off the production line at the Shanghai factory will be equipped with NVIDIA's Orin chip, DriveOS operating system, and will be a new generation of autonomous driving vehicle built on the NVIDIA DRIVE AGX platform.

His son, Daisuke Toyoda, should stand quietly beside his 71-year-old father, Akio Toyoda. Not far away, on Jinshan Beach, the waves crash against the shore, echoing with the city of Toyota in Nagoya, 1,200 kilometers away.

This marks only the second time in the past 30 years that Akio Toyoda has personally visited China. Twenty years ago, in 2004, he and his father, Shoichiro Toyoda, stood together on a banana plantation in Huangge Town, Guangzhou, to shovel soil for the new GAC Toyota base. This southern land laid the foundation for Toyota's 20-year run in China.

Lexus's settlement in Shanghai is even more crucial and urgent than Toyota's reconstruction of Guangzhou in the past. As the world's largest automaker, Toyota has comprehensively lagged behind in new energy and intelligence. According to Toyota's plan, sales of pure electric vehicles will reach 3.5 million by 2030, with the Lexus brand accounting for 1 million. After the opening of the Lexus Shanghai factory, annual production is expected to reach 500,000 vehicles or even higher, on par with the opening of Tesla's Shanghai super factory in 2020.

History eerily repeats itself. In 1984, a top-secret business plan named F1 was presented to Shoichiro Toyoda, then president of Toyota. This plan bore fruit in the summer of 1989 in the United States – the resounding success of the Lexus ES altered the luxury car landscape in the American market. Its emergence not only laid the foundation for Toyota to become the global leader 20 years later but also pioneered an eastern luxury automotive brand.

Thirty years later, standing at the turning point of a new era of electrification and intelligence, Toyota and Lexus are once again confronted with new choices. At the 2023 Tokyo Motor Show, Toyota Motor Corporation outlined its future new energy roadmap: the Toyota brand will focus on HEV+PHEV, while Lexus will embrace pure electricity.

After 36 years, Lexus has chosen to embark on a new journey from China. Akio Toyoda, who succeeded his father, Shoichiro Toyoda, firmly believes that in the global trend of electrification and intelligence, only by establishing roots in China can Lexus secure its future.

In Shanghai, there lies not only Tesla's successful experience over the past five years but also a comprehensive industrial chain deeply evolved by China's electrification process. Leveraging this global industrial chain with the highest efficiency, most advanced technology, and lowest cost, Toyota can swiftly shed the shackles of its old partners like Denso and reshape a new future for Lexus's intelligent luxury.

Moving 1,500 kilometers south from Nagoya to Jinshan, Shanghai, marks a new starting point for Toyota's firm move south. The deserted Detroit Auto Show and the bustling CES indicate that the focus of the American automotive industry is also firmly shifting south. The 2025 Detroit Auto Show was the first to be held in January since 2020, but the atmosphere in Detroit was vastly different from the past, with no press conferences or new car launches even on media open days.

However, a week earlier, global media and exhibitors flocked to the southern city of Las Vegas to participate in the annual CES exhibition. More and more automotive companies, such as BMW, Honda, Toyota, and Suzuki, are abandoning Detroit and rushing 3,000 kilometers south.

Continuing southward has become a new trend in the automotive industry since its inception over 140 years ago. From Stuttgart, where the inventor of the automobile, Mercedes-Benz, is located, to Nagoya, Japan, where the headquarters of the world's largest automaker, Toyota, is situated, most renowned automotive companies have successively emerged in Germany, Italy, France, Japan, and South Korea. The Big Three in Detroit – Ford, General Motors, and Chrysler – were born in the northernmost part of Michigan, Detroit. These great automotive cities are all north of the 30th parallel north – including China FAW, the eldest son of the People's Republic, which was also born in Changchun, one of the northernmost cities in China.

The birth of Tesla marked the beginning of a shift. In 2003, Tesla was born in Silicon Valley, California, and now has its headquarters in Austin, Texas, in the southern United States. Subsequently, new American automotive companies such as RIVIAN, Lucid, and Fisker all emerged in California. From the cold and dreary Detroit to the warm and sunny California, just like the aging Detroit Auto Show and the eternally youthful Las Vegas, there is a firm move southward.

New automobiles head south, and companies driving the electrification and intelligence of automobiles, such as Waymo and NVIDIA, have almost unanimously emerged in the south. Of course, Contemporary Amperex Technology Co. Limited (CATL) was born in Fujian, China, a beautiful southern city.

The history of the Chinese automotive industry also features a southern migration route map. From the champion 30 years ago, China FAW, to SAIC Motor Group 10 years ago, to BYD, which surpassed SAIC this year to top the Chinese market, the Chinese automotive industry has been following a clear path, initially moving east and then turning south.

The center of the American automotive industry has shifted south from Detroit to Las Vegas, and the new future of Lexus faces Shanghai. In Jinshan, the southernmost part of Shanghai, Toyota Motor Corporation ushers in a new era of heading south.

In the new automotive era, everything is beginning to change.

Global Restart of the Merger and Acquisition Era

On November 12, 2024, in Shenzhen, China FAW launched the "Mount Everest" plan and released the first model, Tiangong 08, under its Hongqi pure electric platform in this warm southern city.

Earlier, a rumor accompanied the first snowfall in Changchun and drifted to the warm city of Guangzhou: "Liu Changqing, assistant general manager of China FAW, will travel south to Guangzhou to take over as general manager of GAC Group." After GAC's performance suffered a rare decline in recent years, this rumor sparked much speculation. Although all parties involved have repeatedly clarified, rumors of possible capital integration between state-owned China FAW and GAC, which is in the eye of the storm of change, continue to emerge.

Official rumors and personnel appointments have always been nuanced. China FAW, located in Changchun, does have a driving force to move south. Especially with the slow progress of new energy and intelligence and the dilution of joint venture cooperation advantages, it is necessary to accelerate the pursuit of new energy and intelligence by leveraging the technological, talent, and supply chain advantages of the south.

Since 2015, both the then chairman Xu Ping and the subsequent chairman Xu Liuping have gradually moved south and deployed strategies to move beyond the confines of Changchun. FAW-Volkswagen's marketing center moved to Beijing for operations in 2019, FAW-Audi moved south to Hangzhou in 2022, FAW Besturn entered Jiangsu Yancheng in 2024, and rumors of Jetta moving south to Chengdu were rampant...

Does GAC have a need for active mergers and acquisitions? As an enterprise under the local State-owned Assets Supervision and Administration Commission, GAC's importance to Guangzhou and Guangdong is undeniable. In recent years, the impact on its joint venture sector has led to a sudden drop in GAC's performance last year, and GAC's two autonomous sectors, Aion and Trumpchi, also face strong competition from rivals. The capitalization process of GAC Aion has been hindered, and GAC, which is trying to grow bigger and stronger, faces a growth bottleneck in the short term.

Collaborating to face a more uncertain future and achieving win-win cooperation may be a better choice for both management teams and the central and local State-owned Assets Supervision and Administration Commissions. It is rumored that large state-owned automotive groups, including Dongfeng and SAIC, are each seeking suitable merger and acquisition partners to huddle together for warmth and face the storm of change. "Judging from the recently announced integration of Honda and Nissan, from China to the world, there is research on the possibility of deep cooperation at the capital level," Chairman Zhu Huarong said in his speech at the New Year gathering of Changan Automobile last year.

The last round of major consolidation in the Chinese automotive industry occurred 20 years ago, marked by China FAW's acquisition of Tianjin Automobile Group and SAIC's acquisition of Nanjing Automobile Group. Amidst the explosion of the automotive industry, some local enterprises struggled to keep up with the rapid pace of market upgrades and fell behind.

The current Chinese automotive industry is once again facing a cycle. As the revolution of electrification and intelligence enters deep waters, old enterprises that cannot keep up with the new round of industrial upgrades and some startups from a decade ago that cannot cope with the pressure of change are struggling. Meanwhile, powerful state-owned groups such as FAW, Dongfeng, and SAIC also need to graft market forces to quickly catch up with the wave of new automobiles, traverse the cycle, and move towards the next era. This naturally paves the way for large-scale capital consolidation.

While domestic consolidation is still brewing, some substantial international consolidations have already begun to take shape. In December 2024, amidst the year-end chill, Honda and Nissan officially announced their merger path to cope with the centennial changes in the automotive industry, which will set off a new wave of global transformation and consolidation.

In the third quarter of last year, after a dire financial report in the US market led to losses, there was an uproar at the board meeting at Nissan's Yokohama headquarters. Faced with the enthusiastic but sinister hand extended by Foxconn and Terry Gou, Nissan President Makoto Ukita looked around in perplexity. After a fierce internal struggle, he took the finance and R&D directors to the Honda headquarters in Aoyama, Tokyo, and knocked on the door of the equally anxious Honda President Toshihiro Mibe's office.

The rapid advent of electrification has left Honda, often self-deprecating with the joke "buy an engine, get a car free," abruptly facing the dilemma of having no engines to sell. Resistance to change is deeply ingrained in human nature. In a mere three years, sales in the Chinese market plummeted from a peak of over 1.8 million to less than 900,000. When Mibe opened the door to find Ukita handing him a rose, they exchanged a silent glance and immediately embraced, a gesture of solidarity amidst adversity.

Akio Toyoda sang high praise for the Nissan-Honda merger, stating, "It will have a positive impact on competition in Japan and globally!" He acknowledged that the rapid development of China's automotive industry poses a significant challenge to Japan's automotive sector during the transition to electrification and software, and collaboration seems like a prudent choice.

Volkswagen, which had bet heavily on pure electric vehicles, suddenly realized that the electrification trend was not proceeding along the path it had envisioned. This humiliation, coupled with Aryan pride, made them nostalgic for the decisive yet gentle era of their former chairman, Herbert Diess. Within three years, the Wolfsburg board of directors was stunned by their reckless decision to oust Diess.

Three decades ago, Nissan began its decline. In 1998, Renault acquired Nissan, marking a classic case of global acquisitions. Three decades later, Nissan faces setbacks in two key markets: the United States and China. In the US, Nissan missed the hybrid vehicle (HEV) opportunity; in China, Dongfeng Nissan's last successful model was the launch of the new generation Teana in late 2018. Since 2019, nearly all models, including the 14th-generation Sylphy, the 2021 three-cylinder X-Trail, the 2023 e-power X-Trail, the 2023 Ariya, and the new-generation Qashqai, have failed to gain traction.

The Honda-Nissan collaboration heralds a new cycle. In the previous cycle 30 years ago, Volvo was sold to Ford Motor Company, Daimler acquired Chrysler, and Jaguar Land Rover were successively acquired by Ford and India's Tata. This time, European automakers are expected to be the primary targets of acquisitions. Renault, Peugeot Citroen, and even Fiat, which have made little progress in electrification and intelligence, will struggle to navigate this industrial revolution safely.

In early January, Luca de Meo, CEO of Renault Group, led a team to China to unveil a research and development center with around 150 people in Shanghai. This team is dedicated to developing electric vehicles exclusively for the European market. Renault believes it must rely on China's capabilities to establish future competitiveness.

Everything aligns with a chilling prophecy: God has never favored humanity, and we must walk the entire journey alone. From Carlos Tavares' investment in Zero Run in 2022 to Renault's return to China, just as they rushed to China for joint ventures 20 years ago, European automakers are recalibrating their focus on the East.

Who is stealing the profits from cars?

"Where did the profits go?" From dealers to suppliers, from OEM manufacturers to CFOs of multinational companies, everyone wants to know: Where did the profits in the auto industry plummet in 2024?

Last November, German automaker Audi released its third-quarter financial report, revealing a 91% drop in operating profit to 106 million euros. Similarly, Toyota's third-quarter profit plummeted by more than half compared to the same period last year. Daimler, BMW, and Stellantis Group have all announced sharp declines in full-year earnings, and Nissan has even issued a full-year earnings warning. Except for Ford and General Motors, which rely heavily on the lucrative North American market and remain optimistic about profits, most multinational companies are facing a terrible fiscal year with significantly reduced profits.

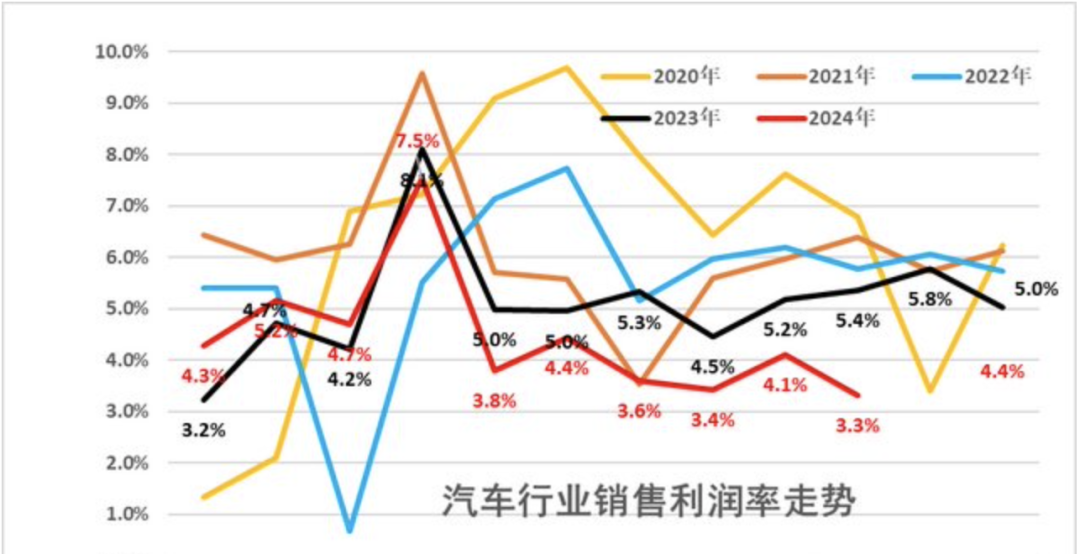

This is particularly evident in China. As of November 2024, the profit rate of China's auto industry was 3.3%, a year-on-year decrease of 35%. From January to November 2024, the profit rate of the auto industry was 4.4%, a year-on-year decrease of 7.3%, still lower than the average level of 6.1% for industrial enterprises. China's auto industry dominates global production and sales figures, but profits have long deviated from a reasonable level due to an increasingly competitive market, deep price wars, and declining consumption.

According to monitoring data from the China Automobile Dealers Association's "Market Pulse," price wars in the first ten months of last year led to a cumulative loss of nearly 200 billion yuan in new vehicle retail sales, and the loss ratio of dealers surged from about 50% in 2023 to 70%.

"In the era of electrification, the power battery industry takes away the main profits of the automotive supply chain; in the era of intelligence, high-end smart chip companies and software algorithm companies take away more than half of the profits. This will lead to a rapid decline in the profitability of traditional OEM manufacturers," predicted a 2023 report by Roland Berger Consulting, which has now become a reality.

This represents a profound restructuring of the auto industry's profit chain over the past 100 years. Previously, the profit distribution model in the auto industry was relatively stable, with industry profit margins fluctuating between 7% and 10%. However, the new automotive era has changed everything, and the profit distribution structure of the industry has begun to differentiate, with profits gradually shifting to power battery industries represented by CATL and smart solution providers like INVOY.

Financial reports show that CATL earned a profit of 44.121 billion yuan in 2023. In the first three quarters of 2024, CATL's net profit was 36.001 billion yuan, and it is expected to exceed 50 billion yuan for the full year. In terms of turnover, it has maintained a super-high level of gross profit margin of about 30% and net profit margin of about 15% in recent years.

This shift has sparked numerous complaints from auto industry giants. "We are all working for CATL!" In 2023 and 2024, including Chairman Zeng Qinghong of GAC Group and Chairman Zhu Huarong of Changan Automobile, have all publicly expressed ridicule and dissatisfaction with CATL's high profit margins on different occasions.

Compared to the auto industry's overall profit margin of 4.3%, the power battery industry is still enjoying the dividends of new energy vehicles. In the first three quarters of last year, profits in upstream industries such as lithium-ion battery manufacturing increased by 58.8%. Among the 30 power battery enterprises listed on the A-share market, 27 reported positive profits, and the net profit of six enterprises increased year-on-year.

The era of intelligent vehicles is driving profits to continue migrating. Services and supply chains represented by software OTA and intelligent hardware embedding are beginning to occupy an increasingly important position. Intelligent driving system solutions and intelligent chip manufacturers are drawing substantial profits, which is excellent news for both Huawei and NVIDIA.

Shenzhen INVOY Intelligent Technology Co., Ltd., spun off from Huawei's Intelligent Solutions BU, is currently a provider of Hongmeng Zhixing, AVITAR, and many other intelligent driving systems using Huawei's latest ADS 3.0. According to Thalys' financial report, in 2022 and 2023, INVOY lost 7.587 billion yuan and 5.597 billion yuan, respectively. However, with the rapid popularization of ADS 3.0, it turned a profit in the first half of last year, with operating revenue of 10.435 billion yuan and a net profit of 2.231 billion yuan from January to June. It is expected to earn a profit of about 5 billion yuan for the full year, with a net profit rate of over 20%, a stark contrast to the 4.3% profit rate of the entire auto industry.

In just four years, the profit distribution model of the auto industry will undergo tremendous changes. Traditional automakers, which once controlled the profit distribution of the supply chain through branding, are now undergoing significant transformations. Fields such as electronic and electrical architecture design, intelligent driving system integration, and the power battery industry have become the main profit earners, while profits in the manufacturing sector have been compressed to an extremely meager level.

Huawei's entry into the auto industry, whether through the Intelligent Selection mode or the Hi mode, does not involve the manufacturing sector. Instead, it chooses to use "Hongmeng Zhixing" as a channel and brand link, with AITO, Zunjie, Zhijie, and Xiangjie as brand difference categories, and INVOY as the intelligent driving solution, handing over the manufacturing process entirely to Thalys, Chery, BAIC, and JAC.

Taking Tesla, a winner from the previous cycle, as an example, software service subscriptions have become an important component of its revenue. In the third quarter of 2024, Tesla's revenue was 25.182 billion US dollars, slightly lower than the market expectation of 25.37 billion US dollars, but its net profit reached 2.167 billion US dollars, still far exceeding that of Toyota, the best among traditional automakers.

As AI begins to gradually become widespread, the next trend in the auto industry may be dominated by smart chip companies represented by NVIDIA. On November 21, NVIDIA released its financial report for the third quarter of fiscal year 2025. The report shows that NVIDIA's revenue in the third quarter was 35.1 billion US dollars, an increase of 94% year-on-year; net profit was 19.31 billion US dollars, an increase of 109% year-on-year. A technology giant with a net profit margin of over 55% is emerging.

Foxconn's parent company, Hon Hai Precision Industry Co., Ltd., is considering acquiring Nissan Motor Co., Ltd. It can be foreseen that Luxshare Precision is also replicating its involvement in the automotive manufacturing industry from the Apple supply chain.

Everything is still unnamed

"Our competitors are no longer BMW and Volkswagen but Geely, BYD, and Tesla." In early January, Jim Farley said in a video interview with American media that the electric vehicle revolution has profoundly changed the world, and Chinese brands have already achieved a leading position alongside Tesla in this field. The technological revolution in the automotive industry has not only profoundly transformed China's automotive industry but is also shaking up the unchanged global automotive industry landscape that has persisted for many years.

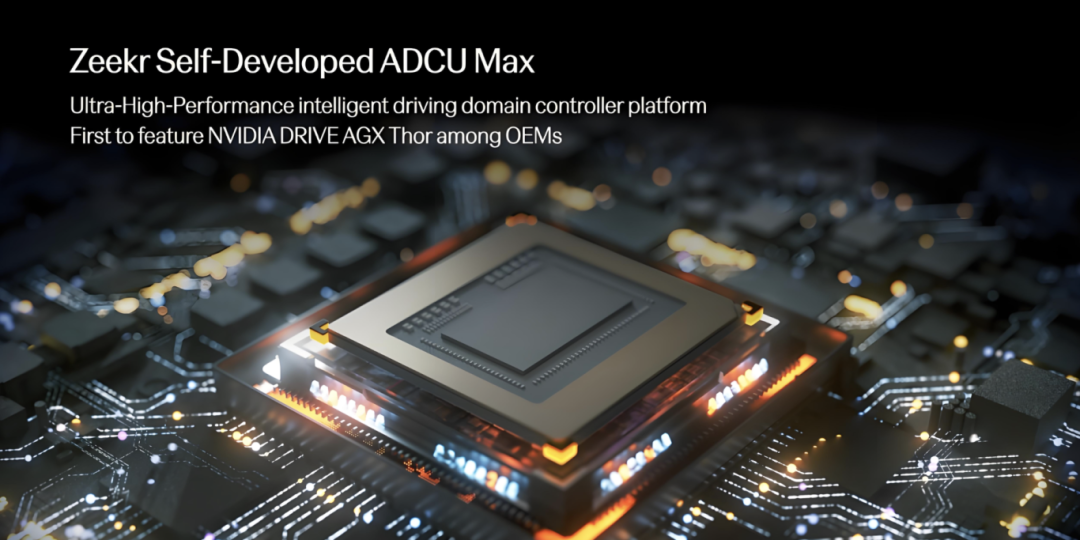

Toyota's partnership with NVIDIA is still based on the previous-generation Orin chip, while Zeekr has chosen to become the first OEM to equip the Thor chip. "With the latest cutting-edge technology from Qualcomm and NVIDIA, Zeekr is already among the global leading brands in the field of intelligent driving," said An Conghui, CEO of Zeekr Technology, who attended CES on January 7. As the world's first OEM to mass-produce the NVIDIA DRIVE AGX Thor intelligent driving domain controller platform, Zeekr will begin mass deliveries of its first mass-produced native autonomous driving vehicle, the Zeekr RT, in 2025. At this technology Olympics, Zeekr Technology has fully demonstrated the strength and ambition of Chinese technology enterprises in their international journey from multiple dimensions, including technology, ecology, and products.

"Everything is new, and everything is still unnamed!" BMW, impacted by Lixiang and Huawei in the Chinese market, is determined to catch up on intelligence as quickly as possible. BMW premiered its new-generation ultra-sensory intelligent cockpit at CES, featuring BMW's pioneering Panorama iDrive and the new-generation BMW Operating System X. Dr. Peter Weber, Member of the Board of Management of BMW AG responsible for Development, said that the control and operation concept of Panorama iDrive brings together BMW's pioneering achievements and technological leadership in the field of human-machine interaction over the past 25 years, providing users with a groundbreaking interactive experience. It will be applied to BMW's new-generation models first at the end of 2025.

However, the world is not always in sync. On January 21, President Trump announced the revocation of his predecessor Biden's "Green New Deal" and the cancellation of the 7,000-dollar electric vehicle subsidy upon taking office. He expects the United States to become a manufacturing country again and mentioned his vision for revitalizing the American auto industry. Trump said, "We will produce cars in the United States at a speed unimaginable just a few years ago."

In 2024, the United States sold over 3.2 million new energy vehicles, of which 1.9 million were hybrid models (including HEV and PHEV) and 1.3 million were pure electric vehicles. Sales of traditional gasoline vehicles fell below 80% for the first time. However, Trump's new policy will introduce uncertainty into the US electric vehicle market in 2025.

Trump's new policy unabashedly favors Detroit but also makes classic automakers like General Motors, Ford, and Chrysler increasingly content to stay in the US market, making it difficult for them to go global. Classics like the F-150, Cybertruck, Mustang, and Jeep have seen their market share compressed more in the US (including Canada and Australia), relying on policy protection and the market's preference for pickup trucks and large SUVs to extract incredible excess profits, stubbornly surviving in the nursery of history and populism with monopoly profits.

A noteworthy data point reveals that in the third quarter of 2024, the average selling price of new vehicles in the United States hit a record high of $47,542, equivalent to approximately 347,000 yuan. In contrast, during the first half of the same year, the average selling price of cars in China stood at 179,000 yuan. For instance, the retail price of the Honda Civic in the US approached 190,000 yuan, while its counterpart in China was priced at only 110,000 yuan, highlighting the benefits that Chinese car consumers reap from the country's low-cost manufacturing capabilities.

Despite the potential for trade protectionism to erect barriers, in the long run, the global transition towards renewable energy and green technologies, including solar panels and electric vehicles, is driving rapid demand growth. Given that there is no global overcapacity in these sectors, trade will inevitably continue in various forms. China, leveraging its natural manufacturing prowess, policy advantages, and a comprehensive economic structure, is poised to excel in mass production efficiency. Its manufacturing capacity surpasses the combined total of the next nine countries, significantly enhancing the efficiency of both China's and the global supply chain.

Intelligence represents the pinnacle of advancement, and China has emerged as the optimal location for foreign brands to establish localized supply chains and implement business models. China's vast pool of mass-verified technologies, process innovations, product advancements, talented engineers, and abundant resources has almost become a globally unique business model. This rationale underpins Toyota's decision to integrate the new-generation supply chain of Lexus in China and manufacture Lexus vehicles exclusively in Shanghai. Similarly, Audi's Changchun PPE factory exemplifies this trend, with SAIC-Audi focusing on Shanghai and leveraging the partnership with Huawei to propel AUDI's growth in China.

Zhu Huarong, the head of Changan Automobile, foresees a future where competition intensifies, leading to a pronounced Matthew Effect. He anticipates a coexistence of large groups and multiple brands, with a select few emerging victorious. Leveraging digital and intelligent technology, achieving sales of tens of millions of vehicles for a brand is no longer a distant dream; rather, it is becoming a tangible reality, marked by immense volumes and scales.

Unlike Detroit, which can comfortably remain within the US and enjoy regional prosperity, BMW, Toyota (from Germany and Japan respectively), and the three global automotive trusts in Korea are constrained by the limited capacity of their domestic markets. They must establish a global presence to cater to the diverse consumer needs across regions and age groups. As Franz Kafka eloquently put it, "With one hand, block the despair that fate overshadows; but at the same time, you must use the other hand to record everything you see in the ruins."

The rapid transformations in the Chinese market have indeed left those accustomed to persistence feeling despondent. The revolutionary sentiment that questions the inherent superiority of established players has enabled numerous newcomers to swiftly alter the landscape in China. In 2024, Hongmeng Zhixing delivered 445,000 new vehicles, ranking second in industry sales with an 89% target completion rate. Although it fell short of the 500,000-vehicle target, Hongmeng Zhixing has ambitiously set a sales goal of 1 million vehicles for 2025. This ambitious target, if achieved even at 80%, would see 800,000 Hongmeng Zhixing vehicles surpass BBA, the luxury brand that has dominated the Chinese market for three decades, emerging as a new symbol of Chinese pride.

Intelligent vehicles and AI technology are poised to become the focal points of the intense rivalry between China and the United States. Eric Schmidt, the former CEO of Google, expressed surprise in a December 2024 interview with The Washington Post, stating, "I thought our restrictions on chips would keep them out!" He noted that by the end of 2024, DeepSeek had officially released DeepSeek-v3, achieving the top ranking in open-source AI, rivaling top closed-source systems like OpenAI and Anthropic. Schmidt believes that even if the US wins the initial phase of the competition, China will ultimately prevail due to its faster application of this technology in mass-produced products.

While China still faces challenges in catching up with the US in basic technology and research systems (the journey from 0 to 1), it excels in the growth flywheel that propels innovation from 1 to 100. Schmidt has keenly observed this advantage, while Musk and Huang Renxun have unhesitatingly integrated Tesla and NVIDIA into China's flywheel effect.

The tech industry has reached a consensus that intelligent vehicles, humanoid robots, and low-altitude aircraft are the technological weapons that will shape the future. Currently, China stands out as the most dynamic and fertile ground for these advancements. It is time to usher in a radical transformation that redefines the world!