AI-Powered Glasses Stage a Spectacular Comeback | TrendsWave

![]() 12/09 2025

12/09 2025

![]() 631

631

By Lao Yu'er

"2025: The Dawn of China's AI Glasses Revolution"

In recent times, this sentiment has been echoing loudly through tech and financial media circles.

Fueled by such forecasts, tech titans like Xiaomi, Baidu, and Alibaba have rolled out a slew of AI glasses this year, rejuvenating the once-doubted concept of smart glasses and thrusting them back into the limelight of consumer electronics.

Moreover, this new "glasses race" has transcended traditional industry boundaries. A diverse array of players, including tech firms, automakers, mobile phone supply chains, and even pharmaceutical giants, are ramping up their investments.

Over the years, glasses have been continually reimagined by the times, yet they've struggled to gain widespread market acceptance. As the AR/VR bubble begins to deflate, the gradual maturation of AI technology is opening up fresh avenues and trends for glasses.

Whether they emerge as the next-generation computing platform or simply serve as auxiliary devices for specific scenarios, the "glasses craze" is undeniably underway. Behind these commercial opportunities lies a profound ethical dilemma: how can humans coexist harmoniously with technology?

This in-depth article from the TrendsWave content team delves into the heart of the matter. We welcome your attention across multiple platforms.

A Frenzied Rush

The surge in "AI glasses" is not without precedent.

Tracing its roots back to late 2023, Meta teamed up with Ray-Ban to launch the first-generation smart glasses, successfully propelling the concept from a niche geek toy into the mainstream consumer market's consciousness.

According to Wellsenn XR data, global AI glasses sales soared to 2.34 million units in 2024, with the third quarter alone witnessing a staggering 1.65 million units sold, marking a 370% year-over-year surge.

However, it's the Chinese market that has truly ignited this AI glasses frenzy.

IDC data reveals a robust demand for AI glasses in China, with shipments totaling 1.158 million units in the first half of the year. Full-year projections suggest shipments will exceed 2.75 million units, accounting for over 55% of the global market share.

CINNO Research data indicates that in the third quarter of 2025, the domestic consumer AR market continued its upward trajectory, with sales surpassing 129,000 units. Among them, all-in-one AR glasses (AI glasses with screens) witnessed exponential growth, with sales soaring by 355% year-over-year.

Throughout this journey, a diverse range of players, from tech giants to automakers, and from the mobile phone supply chain to pharmaceutical behemoths, have actively participated.

On the evening of December 3, Li Auto unveiled its Livis AI glasses, marking its foray into the AI glasses sector. Interestingly, in late 2024, Wang Xing, the founder of Meituan and an investor in Li Auto, vehemently opposed Li's proposal to develop AI glasses, causing the project to stall for several months. The fact that the project has now materialized underscores its significance in Li's strategic vision.

Li Auto is not alone in this endeavor.

A few days ago, at the end of November, Alibaba launched the Quark AI Glasses S1 and G1 series, comprising six models in total, reportedly selling over 7,000 units within two days.

Baidu's XiaoDu brand also officially released its AI glasses in November, with plans to launch them for sale within the year.

Xiaomi unveiled its first AI glasses in June this year. Almost simultaneously, Lens Technology announced the official rollout of its AI+AR glasses, Rokid Glasses, developed in collaboration with Rokid.

According to Luxshare Precision's 2024 annual report, its consumer electronics business encompasses AI glasses and AR/VR devices. In May of this year, Luxshare Precision was added as an "AI glasses" concept stock by iFinD.

Telecom operators are also vying for a piece of the pie. In early 2025, China Mobile planned to launch three high-end AI glasses models, while China Unicom introduced eSIM AI sports glasses. China Telecom unveiled the Tianyi AI smart glasses.

Even Renhe Pharmacy, an A-share listed company in the pharmaceutical manufacturing sector, stated on December 3 on an interactive platform that "the company is striving to expedite the official launch and sales of ULOOK glasses."

Startups such as Rokid, Thunderbird Innovation, and INMO have also rolled out multiple new products.

Furthermore, in December of this year, Huawei and Tencent are set to release AI glasses products; in January next year, Honor will unveil related new offerings; additionally, ByteDance may also be developing smart glasses.

Based on a rough compilation of publicly available information, over 40 new AI glasses products have been launched domestically this year.

Corporate enthusiasm is further fueled by national consumption policies.

On January 5, 2025, the National Development and Reform Commission and the Ministry of Finance jointly issued the "Notice on Implementing Large-Scale Equipment Updates and Consumer Goods Trade-In Policies with Enhanced Intensity and Scope in 2025," explicitly stating: "Implement purchase subsidies for digital products such as mobile phones."

Soon after, Shanghai incorporated AI glasses into the scope of consumer subsidies based on this policy. With the stage set, a fierce "battle of a hundred glasses" seems poised to erupt.

A New Vehicle

But why glasses? This seemingly ordinary everyday item has repeatedly become the new battleground for tech competitions.

The most intuitive reason is the vast user base.

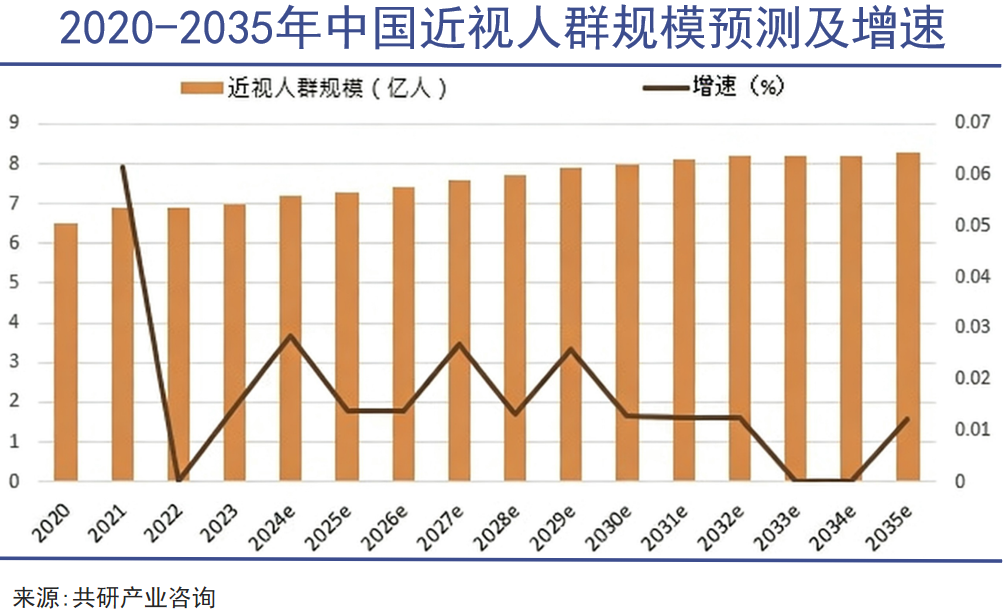

According to the "2024-2030 China Myopia Glasses Market Survey and Investment Prospect Analysis Report" by Gongyan Industrial Research Institute, China's population reached approximately 1.46 billion in 2023, peaking in number. Over the past two decades, influenced by factors such as excessive eye use, electronic screens, and genetics, the proportion of myopic individuals in China has been steadily rising alongside population growth.

The report predicted in 2023 that nearly 50% of China's population is myopic, with around 700 million people requiring myopia glasses, and this number is expected to continue growing over time.

This means AI glasses are targeting a massive, pre-existing population accustomed to wearing glasses, resulting in relatively low market education costs.

A deeper driving force lies in the different strategic significances that various industries attribute to AI glasses.

For internet companies, AI glasses may serve as a high-quality vehicle for collecting "physical world data."

Nowadays, internet companies have amassed a wealth of text, image, and video data online. However, data collection from the real physical world has been less successful. Whoever can continuously acquire images, sounds, and objects encountered by people in real-world scenarios may be able to train AI models that better understand the physical world, achieving next-generation technological breakthroughs.

This can be considered a must-win arena for tech giants. AI glasses worn throughout the day act as countless mobile data collection terminals, continuously inputting real-world visual and auditory information into AI systems.

For hardware and software tech companies, they have been striving to find the next "iPhone" - the next physical gateway to the internet beyond mobile phone terminals. Whether it was smart speakers or smartwatches, they have all been targets attempted by major players.

Now, glasses appear to be a more suitable gateway. With advancements in new materials, display technologies, battery technologies, and AI chips, glasses-shaped devices can undertake more tasks such as communication, information acquisition, and lightweight interactions, reducing people's reliance on mobile phones.

This is also one of the reasons why mobile phone manufacturers and their supply chain enterprises are getting involved. For automakers, AI glasses can serve as a crucial extension of the automotive ecosystem, further upgrading their intelligence. For instance, Li Auto's AI glasses enable remote "vehicle control," such as opening electric sliding doors, pre-activating in-car air conditioning, and seat heating.

Of course, some companies choose to start with more practical pain points. On December 4, Hangzhou Tongxing Technology unveiled China's first AI glasses for the visually impaired. Designed based on models like Tongyi Qianwen's Qwen-VL, this product offers features such as obstacle avoidance during travel, object and text recognition, and a voice assistant, demonstrating the practical value of AI glasses in specific scenarios.

Cross-industry players like Renhe Pharmacy are attempting to find a niche in the "neural training function" segment. However, the technological maturity and market acceptance of such products remain to be seen, with companies more motivated by marketing and brand extension considerations.

The resurgence of AI glasses seems to have brought back memories of the VR/AR glasses era.

Concerns Abound

Back then, Zuckerberg attempted to shield human eyes with VR glasses, painting a virtual world filled with boundless business opportunities, prompting global tech giants to follow suit. In China alone, over 200 VR startups secured financing in 2016, totaling 2.5 billion yuan.

However, during the actual product rollout, defects such as discomfort caused by heavy devices, poor content due to high development costs, and insufficient commercialization scenarios due to single technology quickly led to the decline of the VR market.

Several years later, ByteDance acquired and invested in China's VR company Pico, spending a total of approximately 20 billion yuan. Yet, after just over two years, the project underwent significant adjustments, with nearly half of the workforce facing layoffs or reassignments.

Apple also staked its brand reputation on MR glasses with the Apple Vision, but the market response has been lukewarm since its launch. According to plans, Apple will also introduce AR glasses, the Apple Glass, next year.

Looking further back, the once-red-hot Storm Group went from promoting VR glasses as its main product upon returning to the A-share market to eventual bankruptcy in just a few years. This year, netizens discovered a large quantity of its hardware flooding onto Xianyu, with brand-new products originally priced at 249 yuan now selling for just 19.9 yuan.

Given these past precedents, we can see that AI glasses still face numerous daunting challenges.

The first hurdle is practicality. From the current functionalities demonstrated by AI glasses, there are aspects that outperform mobile phone terminals, with simultaneous translation being the most representative example, offering high information timeliness and hands-free operation. Such advantages are also evident in scenarios like music listening and navigation.

However, in actual use, these scenarios are not highly frequent. Most functionalities showcased by AI glasses can essentially be achieved by mobile phones. Conversely, many functionalities of mobile phones are unlikely to be replicated by AI glasses in the short term. AI glasses may serve as a novelty for specific, low-frequency scenarios but remain severely inadequate for meeting daily essential needs.

The second major issue is the significant deficiency in product experience. Current AI glasses products generally face an "impossible trinity": performance (computing power and display), lightweight design (wearing comfort), and battery life are difficult to balance simultaneously.

In September 2025, during the Meta Connect conference, Meta CEO Mark Zuckerberg encountered consecutive malfunctions while demonstrating the latest Ray-Ban smart glasses, leading to an awkward situation which Zuckerberg attributed to "poor network."

Zuckerberg is a staunch advocate for smart glasses products.

According to industry media XR Vision statistics, the current return rate for AI glasses on platforms like JD.com and Tmall is approximately 30%, while on Douyin, it reaches as high as 40%-50%. Behind these high return rates lies the disparity between user expectations and real-world experiences.

The third pressing concern is privacy, a "Damocles' Sword" hanging over the AI glasses industry.

This is not a new issue - as early as 2012, Google's launch of Google Glass sparked widespread controversy over privacy concerns regarding photography in public places, ultimately leading to the project's temporary suspension in 2015.

Now, with the entry of smart glasses featuring higher-resolution cameras and more powerful AI recognition capabilities, privacy worries have only intensified. The absence of legal and ethical frameworks may subject the entire industry to stringent policy restrictions due to individual abuse incidents.

Moreover, human health and social ethics cast a persistent shadow over smart glasses products.

The potential impact of long-term electronic device wear on vision and hearing remains uncertain, with a lack of long-term research data specifically targeting smart glasses.

More importantly, if AI glasses achieve widespread adoption, they may "invade" human visual perception even more than mobile phones - after all, glasses sit right before our eyes, covering nearly our entire field of vision. Could this technology exacerbate the disconnect between the real and virtual worlds? Will the immersive virtual world depicted in the movie Ready Player One become a reality? Should humans primarily inhabit the physical or digital world?

These questions transcend technological discussions and touch upon choices regarding the direction of civilizational development.