Who is the most profitable enterprise in the reform of state-owned enterprises in Shenzhen?

![]() 10/28 2024

10/28 2024

![]() 731

731

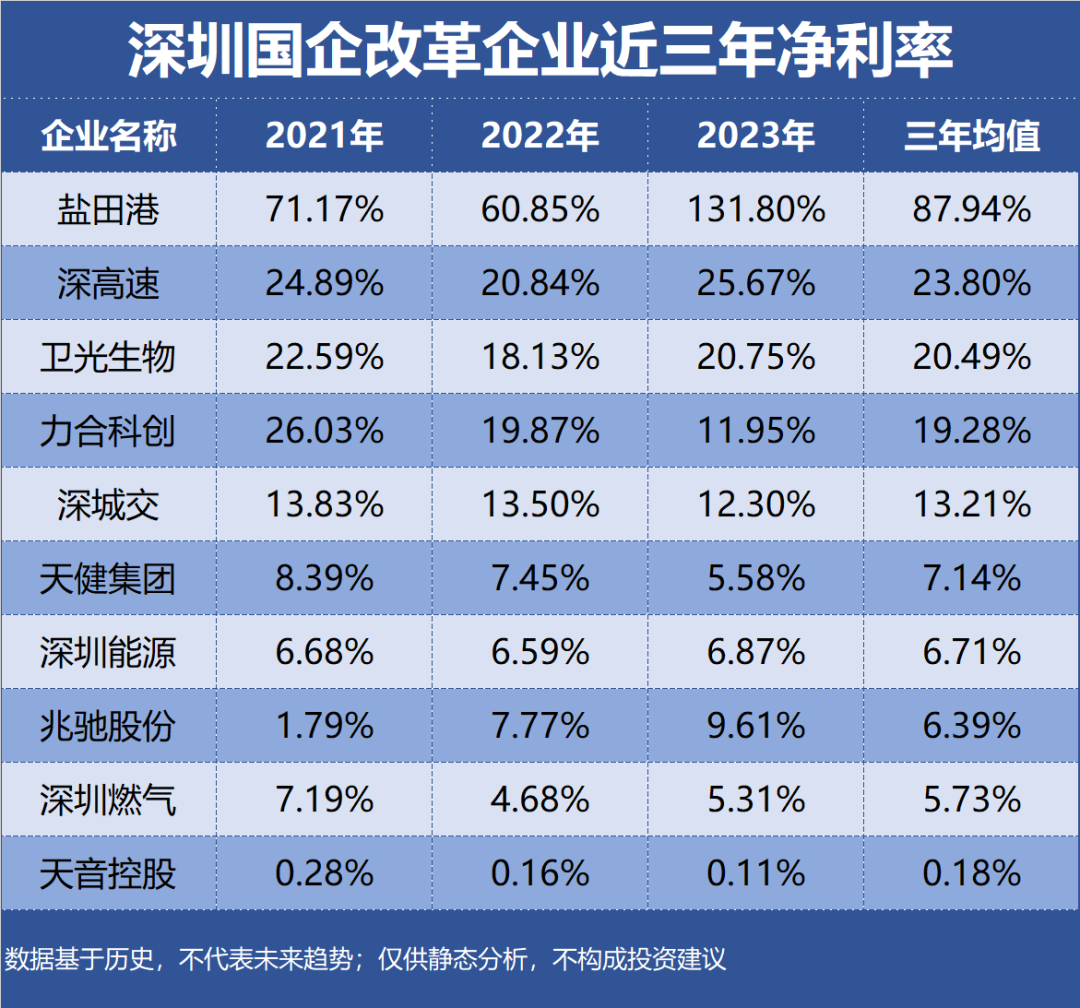

The state-owned enterprise reform in Shenzhen mainly involves listed companies under the Shenzhen State-owned Assets Supervision and Administration Commission. Profitability is typically measured by the amount and level of corporate earnings over a certain period. Analyzing profitability involves an in-depth examination of a company's profit margins. This article, part of the series on corporate value, focuses on [Profitability], selecting 31 state-owned enterprise reform companies in Shenzhen as research samples. Evaluation indicators include return on equity, gross margin, net profit margin, etc. The data is based on historical figures and does not represent future trends; it is intended for static analysis only and does not constitute investment advice.

Top 10 most profitable enterprises in Shenzhen's state-owned enterprise reform:

10th: Leaguer Sci-Tech Industrial Segment: Cosmetics Manufacturing and Others Profitability: ROE 7.09%, Gross Margin 30.38%, Net Profit Margin 19.28% Performance Forecast: ROE has declined consecutively for the past three years to 4.70%, with the latest forecast average at 4.50% Main Product: New materials are the primary source of revenue, accounting for 66.82% of total revenue with a gross margin of 17.71% Company Highlights: Leaguer Sci-Tech's main business includes new material R&D and production, innovation base platform services, technological innovation operation services, and investment incubation services. It is one of the earlier scientific and technological innovation service institutions in China.

9th: Shenzhen Energy Industrial Segment: Thermal Power Profitability: ROE 5.08%, Gross Margin 19.79%, Net Profit Margin 6.71% Performance Forecast: ROE has declined consecutively for the past three years to 4.52%, with the latest forecast average at 5.76% Main Product: Electricity from coal is the primary source of revenue, accounting for 25.77% of total revenue with a gross margin of 9.13% Company Highlights: Shenzhen Energy's main business includes the development, production, purchase, and sale of various conventional and renewable energy sources, as well as urban solid waste treatment, urban gas supply, and wastewater treatment. The company was the first in China to complete ultra-low emission retrofits for all coal-fired power units.

8th: Tianjian Group Industrial Segment: Residential Development Profitability: ROE 15.79%, Gross Margin 18.23%, Net Profit Margin 7.14% Performance Forecast: ROE has fluctuated between 12% and 18% over the past three years, with the latest forecast average at 5.59% Main Product: Construction is the primary source of revenue, accounting for 77.07% of total revenue with a gross margin of 5.64% Company Highlights: Tianjian Group's business encompasses urban construction, comprehensive development, and urban services. It is a state-controlled listed company in Shenzhen and a core enterprise under the Shenzhen Special Economic Zone Construction Engineering Group.

7th: Yantian Port Industrial Segment: Port Operations Profitability: ROE 6.26%, Gross Margin 33.93%, Net Profit Margin 87.94% Performance Forecast: ROE has fluctuated between 4% and 9% over the past three years, with the latest forecast average at 7.30% Main Product: Port cargo handling and transportation is the primary source of revenue, accounting for 62.07% of total revenue with a gross margin of 14.42% Company Highlights: Yantian Port's main business includes the development and operation of terminals; cargo handling and transportation; construction and operation of supporting transportation facilities; and construction and operation of supporting warehousing and industrial facilities.

6th: Shenzhen Urban Transport Planning & Design Institute (SUTPDI) Industrial Segment: Engineering Consulting Services Profitability: ROE 12.58%, Gross Margin 37.09%, Net Profit Margin 13.21% Performance Forecast: ROE has declined consecutively for the past three years to 7.53%, with the latest forecast average at 7.49% Main Product: Big data software and smart transportation are the primary sources of revenue, accounting for 55.22% of total revenue with a gross margin of 28.84% Company Highlights: SUTPDI provides customers with globally leading digital urban transportation solutions and operational services. It is China's first state-controlled listed company specializing in comprehensive urban transportation solutions.

5th: Tianyin Holding Industrial Segment: Professional Chain Stores Profitability: ROE 5.15%, Gross Margin 3.23%, Net Profit Margin 0.18% Performance Forecast: ROE has declined consecutively for the past three years to 3.09%, with the latest forecast average at 5.50% Main Product: Communication product sales are the primary source of revenue, accounting for 71.89% of total revenue with a gross margin of 2.36% Company Highlights: Tianyin Holding is a leading comprehensive service provider for smart terminals across all channels in China, with smart terminal sales as its core business.

4th: Shenzhen Expressway Industrial Segment: Expressway Operations Profitability: ROE 11.39%, Gross Margin 34.36%, Net Profit Margin 23.80% Performance Forecast: ROE has fluctuated between 9% and 13% over the past three years, with the latest forecast average at 9.85% Main Product: Toll fees are the primary source of revenue, accounting for 64.78% of total revenue with a gross margin of 50.46% Company Highlights: Shenzhen Expressway is primarily engaged in the investment, construction, and management of toll roads and environmental protection businesses. It is Shenzhen's first dual-listed company on both the Hong Kong and Shanghai stock exchanges and is state-controlled.

3rd: Shenzhen Gas Industrial Segment: Gas Profitability: ROE 10.48%, Gross Margin 16.64%, Net Profit Margin 5.73% Performance Forecast: ROE has fluctuated between 9% and 12% over the past three years, with the latest forecast average at 10.57% Main Product: Pipeline gas is the primary source of revenue, accounting for 58.17% of total revenue with a gross margin of 12.42% Company Highlights: Shenzhen Gas's main business includes urban gas, gas resources (upstream resources), integrated energy, and smart services. It is a state-controlled listed company in Shenzhen with a dual focus on "gas + clean energy."

2nd: Weiguang Biotech Industrial Segment: Blood Products Profitability: ROE 10.03%, Gross Margin 39.42%, Net Profit Margin 20.49% Performance Forecast: ROE has fluctuated between 6% and 13% over the past three years, with the latest forecast average at 10.93% Main Product: Human serum albumin is the primary source of revenue, accounting for 37.79% of total revenue with a gross margin of 37.33% Company Highlights: Weiguang Biotech is primarily engaged in the production, sales, and R&D of biological products. It is the only blood product manufacturer in Shenzhen and a state-controlled listed company in Guangming District.

1st: Zotye Auto Industrial Segment: Color TVs Profitability: ROE 7.59%, Gross Margin 17.22%, Net Profit Margin 6.39% Performance Forecast: ROE has increased consecutively for the past three years to 11.18%, with the latest forecast average at 13.20% Main Product: Multimedia audio-visual products and operational services are the primary sources of revenue, accounting for 72.86% of total revenue with a gross margin of 12.52% Company Highlights: Zotye Auto's main business includes smart displays, smart home networking, and the full LED industry chain, covering lighting, backlighting, and direct-view displays.

ROE, Gross Margin, and Net Profit Margin of the Top 10 Most Profitable Enterprises in Shenzhen's State-Owned Enterprise Reform Over the Past Three Years: